Chicago Illinois Employee Stock Purchase Plan is an employee benefit offered by American Annuity Group, a leading financial services company based in Chicago, Illinois. This plan allows eligible employees to purchase company stock at a discounted price, enabling them to invest in the company's success and potentially grow their wealth. The Chicago Illinois Employee Stock Purchase Plan is designed to promote employee ownership, aligning the interests of the employees with the long-term goals and performance of American Annuity Group. By participating in the plan, employees have the opportunity to invest in the company they work for, fostering a sense of ownership and building a stronger bond between the employee and the organization. There are several types of Chicago Illinois Employee Stock Purchase Plans offered by American Annuity Group, Inc. These include: 1. Standard Stock Purchase Plans: This type of plan enables eligible employees to purchase company stock at a discounted price. The discount may vary depending on the plan, but it is typically a percentage off the fair market value of the stock. This allows employees to buy shares at a lower cost, potentially gaining value as the stock price increases over time. 2. Qualified Employee Stock Purchase Plans (ESPN): These plans are designed to meet certain Internal Revenue Service (IRS) requirements and offer additional tax advantages to employees. Qualified ESPN provide employees with even more favorable terms and potential tax benefits. For example, contributions to a qualified ESPN may be excluded from an employee's taxable income, reducing their overall tax liability. 3. Non-Qualified Employee Stock Purchase Plans: These plans do not meet certain IRS requirements and are not eligible for the same tax advantages as qualified plans. However, they still offer employees the opportunity to purchase company stock at a discounted price. The Chicago Illinois Employee Stock Purchase Plan of American Annuity Group, Inc. aims to incentivize and reward employees for their dedication and commitment to the company's success. It not only serves as an attractive employee benefit but also encourages a culture of ownership and fosters an increased sense of loyalty among employees. By participating in the plan, employees have the potential to share in the company's financial growth, making it a valuable tool for wealth accumulation and retirement planning.

Chicago Illinois Employee Stock Purchase Plan of American Annuity Group, Inc.

Description

How to fill out Chicago Illinois Employee Stock Purchase Plan Of American Annuity Group, Inc.?

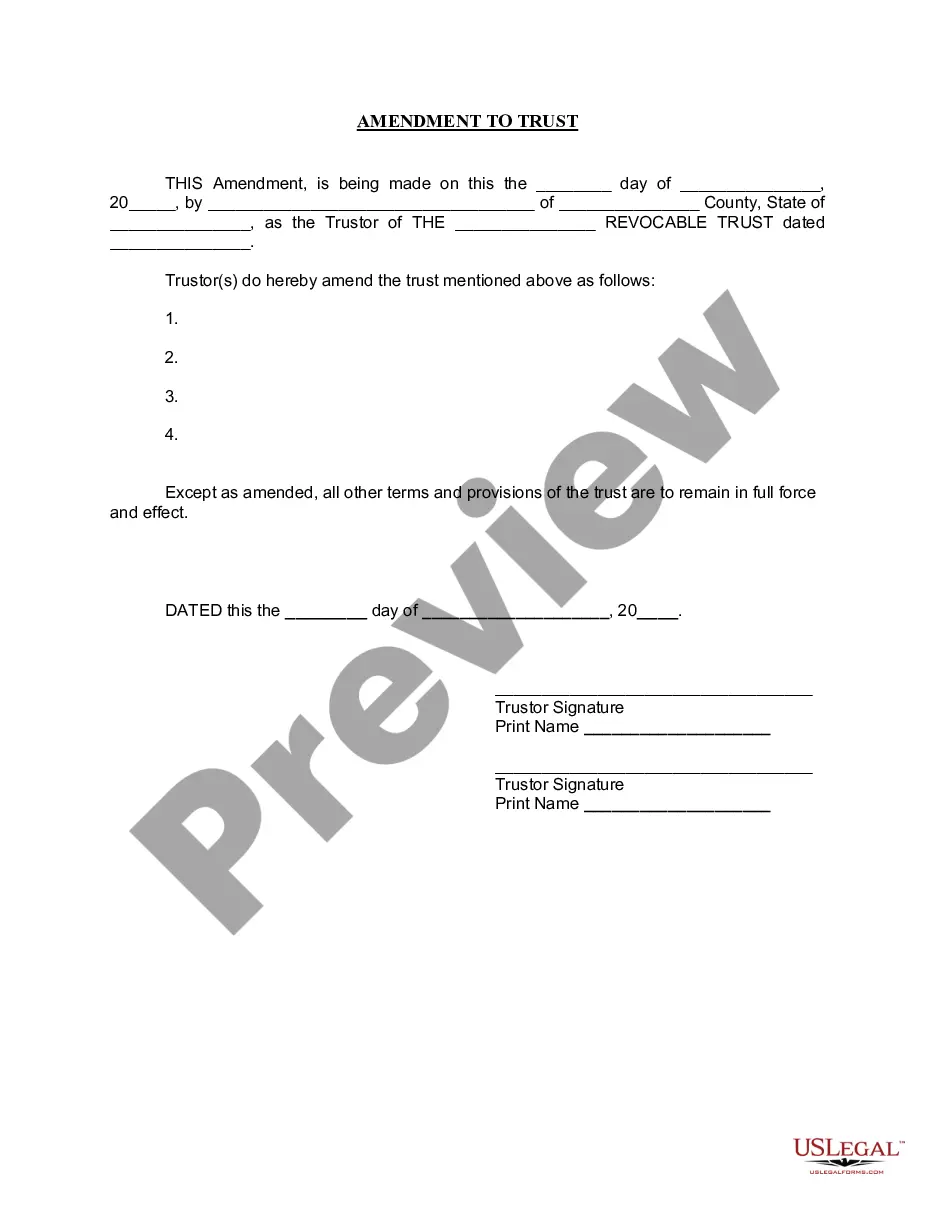

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Chicago Employee Stock Purchase Plan of American Annuity Group, Inc., with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to document completion simple.

Here's how you can find and download Chicago Employee Stock Purchase Plan of American Annuity Group, Inc..

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the related forms or start the search over to locate the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Chicago Employee Stock Purchase Plan of American Annuity Group, Inc..

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Chicago Employee Stock Purchase Plan of American Annuity Group, Inc., log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you have to cope with an extremely difficult case, we recommend using the services of an attorney to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-compliant paperwork with ease!