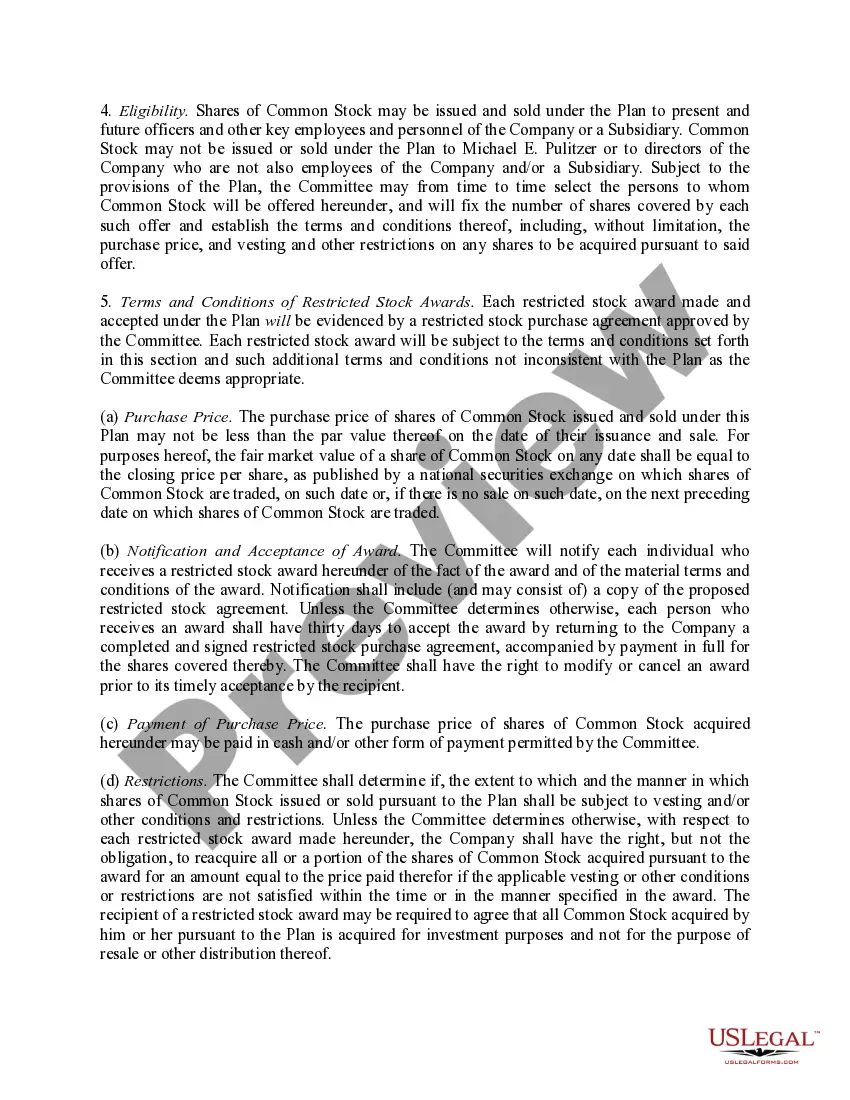

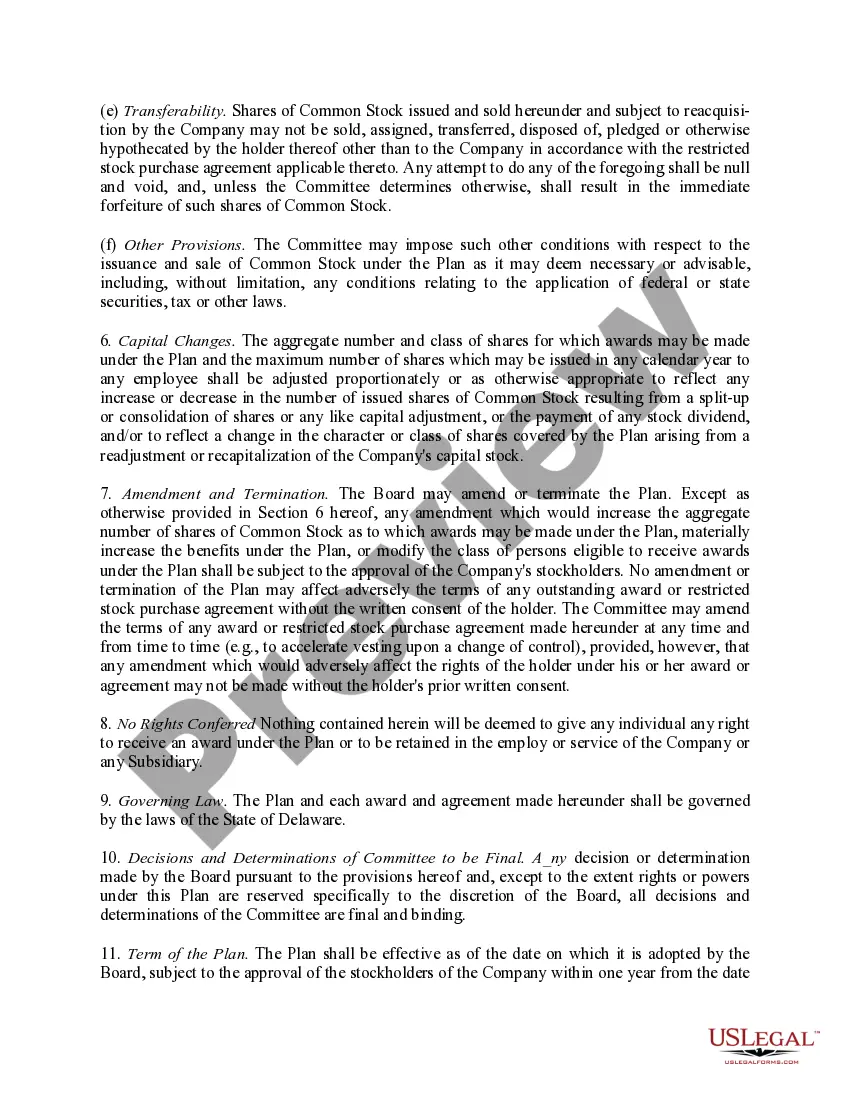

Lima Arizona Key Employees' Restricted Stock Purchase Plans for Pulitzer Publishing Co. are company-specific programs designed to incentivize and reward key employees by offering them the opportunity to purchase restricted stock. These plans are aimed at promoting the long-term commitment and loyalty of talented individuals who play a vital role in the success of Pulitzer Publishing Co. The Lima Arizona Key Employees' Restricted Stock Purchase Plans at Pulitzer Publishing Co. are created to align the interests of the employees with those of the company, fostering a sense of ownership and motivating key individuals to drive the organization towards sustainable growth. These plans are typically implemented with specific terms and conditions, ensuring that they are targeted exclusively towards deserving employees who meet the eligibility criteria. Through the Lima Arizona Key Employees' Restricted Stock Purchase Plans, participants are granted the exclusive right to purchase a predetermined number of company stocks at a discounted price or with certain additional benefits. The stocks are "restricted" in the sense that certain restrictions, such as a vesting period or performance-based milestones, may apply. The specific types of Lima Arizona Key Employees' Restricted Stock Purchase Plans offered by Pulitzer Publishing Co. can vary. Here are a few possible variations: 1. Performance-Based Plans: These plans tie the purchase of restricted stock to predefined performance goals and objectives. Key employees must meet or exceed these targets to be eligible for the purchase of the restricted stock. 2. Time-Based Vesting Plans: Under these plans, eligible employees acquire ownership rights to the restricted stock over a specific period, known as the vesting period. These stocks may be purchased at a discount or at market price during the vesting period. 3. Profit-Sharing Plans: In Profit-Sharing Plans, participants purchase the restricted stock using a portion of the company's profits. The plan may be based on the achievement of specific profit targets or distributed across all eligible employees. 4. Stock Options Plans: Though not strictly considered "restricted stock purchase plans," stock options provide key employees with the right to purchase company stocks at a predetermined price, known as the exercise price. Stock options can serve as an alternative or additional component to restricted stock plans. In summary, the Lima Arizona Key Employees' Restricted Stock Purchase Plans at Pulitzer Publishing Co. represent a valuable tool for incentivizing and rewarding key employees. The plans are designed with various terms, including performance-based milestones and time-based vesting, to reinforce the commitment and dedication of these individuals. By aligning the interests of the employees with the overall success of the company, these plans contribute to the long-term growth and prosperity of Pulitzer Publishing Co.

Pima Arizona Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co.

Description

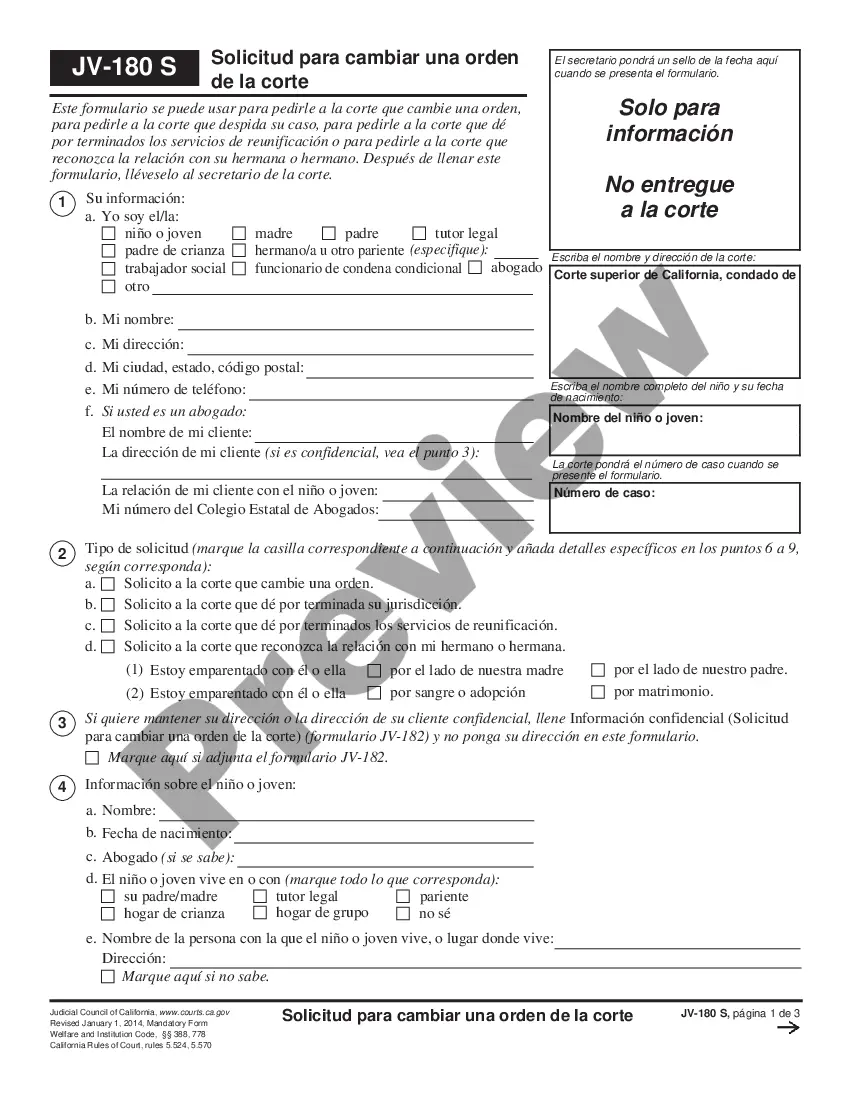

How to fill out Pima Arizona Key Employees' Restricted Stock Purchase Plan For Pulitzer Publishing Co.?

If you need to get a trustworthy legal paperwork supplier to obtain the Pima Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co., look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to find and execute different papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply type to search or browse Pima Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co., either by a keyword or by the state/county the form is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Pima Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co. template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes this experience less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate contract, or complete the Pima Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co. - all from the comfort of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

An ESPP allows you to purchase company stock at a discounted price, often between 5-15% off the fair market value. For example, if the fair market value on the applicable date is $10 per share, and your plan offers a 15% discount, you can purchase those shares for $8.50 per share.

To get a favorable tax treatment, you have to hold the shares purchased under a Section 423 plan at least one year after the purchase date, and two years after the grant date. Q. How am I taxed in my ESPP? A.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

An ESPP with a generous discount and a lookback provision is a no-brainer. Just like the employer match to your 401(k) contributions, ESPP discounts are essentially free money. If you can afford it, contribute the maximum and sell the stock as soon as possible.

An employee stock purchase plan, (ESPP) is a type of broad-based stock plan that allows employees to use after-tax payroll deductions to acquire their company's stock, usually at a discount of up to 15%.

What happens if I buy shares through an ESPP and then leave my company? The shares that you've purchased are yours to keep, regardless of whether you continue working for your company or the circumstances around your departure.

An ESOP is a qualified defined contribution retirement plan, so employees don't purchase shares with their own money. An ESPP, on the other hand, is a plan that allows employees to use their own money to buy company shares at a discount.

#11 How much should I put in an employee stock purchase plan? You can contribute 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. The more disposable income you have, the more you can afford to put in an employee stock purchase plan.

Under ESOPs, employees are given an option to purchase shares on the spot at a discounted price. The company may specify the lock-in period for the shares issued pursuant to the exercise of the option. Shares issued under an ESPS shall be locked in for a minimum period of one year from the date of allotment.