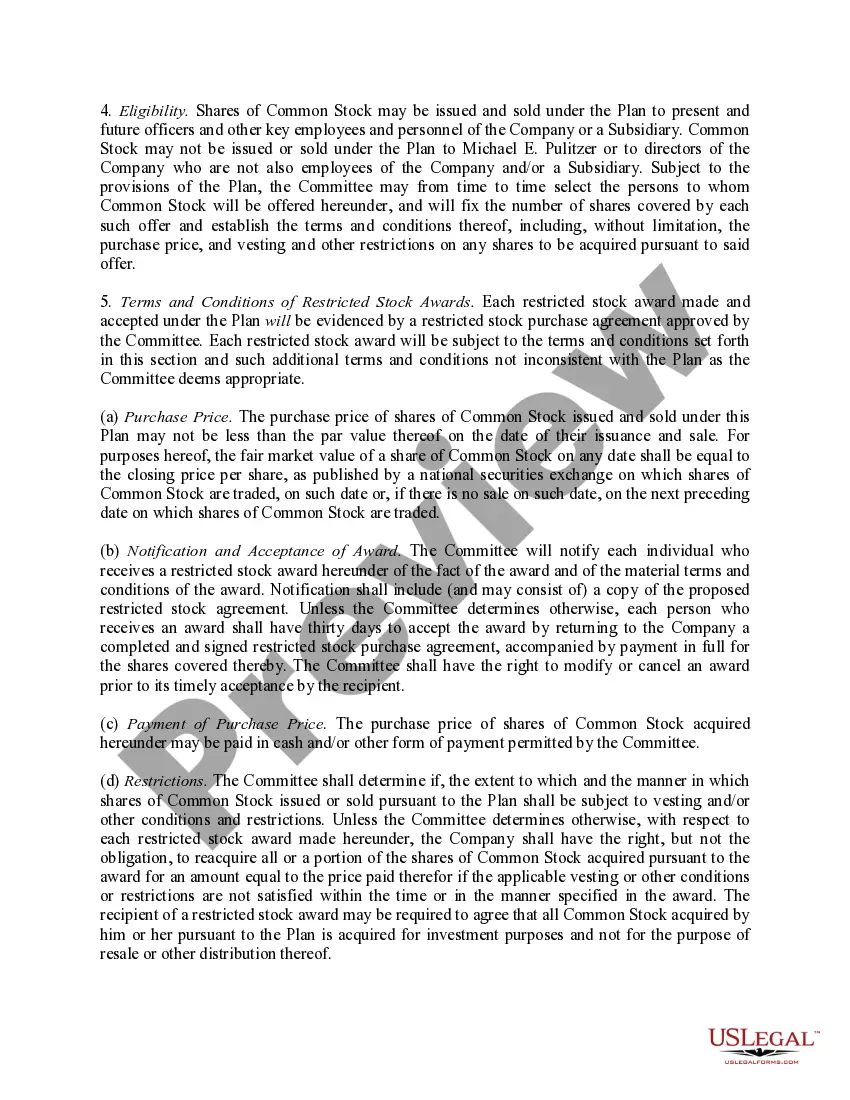

The San Diego California Key Employees' Restricted Stock Purchase Plan is a specialized program designed for key employees of Pulitzer Publishing Co., a renowned company based in San Diego, California. This plan offers selected employees the opportunity to purchase restricted stock at a designated price within a specified time frame, allowing them to invest in the company's shares and align their interests with the long-term success of Pulitzer Publishing Co. The primary goal of this plan is to attract, motivate, and retain talented key employees who are integral to the company's growth and performance. By providing this incentive, Pulitzer Publishing Co. aims to foster a sense of ownership and loyalty among its key employees, ultimately strengthening the company's overall performance and shareholder value. The San Diego California Key Employees' Restricted Stock Purchase Plan operates on a set of key terms and conditions. These include a restricted stock purchase period during which eligible employees can buy shares at a predetermined price, which is typically lower than the market price. The plan may also include a vesting period, during which the purchased shares are subject to certain restrictions on transfer or sale. The specific types or variations of the San Diego California Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co. may differ based on the eligibility criteria, purchase price, vesting schedules, and other relevant provisions. These variations cater to the diverse needs and goals of different key employees within the organization. Some potential types or distinctions within this plan might include: 1. Standard Restricted Stock Purchase Plan: This plan may entail a typical vesting schedule where the restricted stock purchased by key employees gradually becomes fully transferable over a predetermined period, usually subject to specific milestones or continued employment. 2. Performance-Based Restricted Stock Purchase Plan: Under this type of plan, the eligibility for the unrestricted transferability of purchased shares depends on certain performance metrics, such as achieving financial targets or meeting specific growth objectives. This plan allows Pulitzer Publishing Co. to reward and reinforce exceptional performance by key employees. 3. Tiered Restricted Stock Purchase Plan: This plan may involve multiple tiers or levels based on the employee's position, seniority, or other factors. Each tier may have different purchase price discounts, vesting periods, or other customized provisions tailored to the specific needs and circumstances of the respective employees. Overall, the San Diego California Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co. serves as an effective tool to incentivize and reward key employees, fostering their long-term commitment, and aligning their interests with the company's success. These plans can help cultivate a culture of ownership and partnership, ensuring a motivated workforce that contributes to the growth and prosperity of Pulitzer Publishing Co.

San Diego California Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co.

Description

How to fill out San Diego California Key Employees' Restricted Stock Purchase Plan For Pulitzer Publishing Co.?

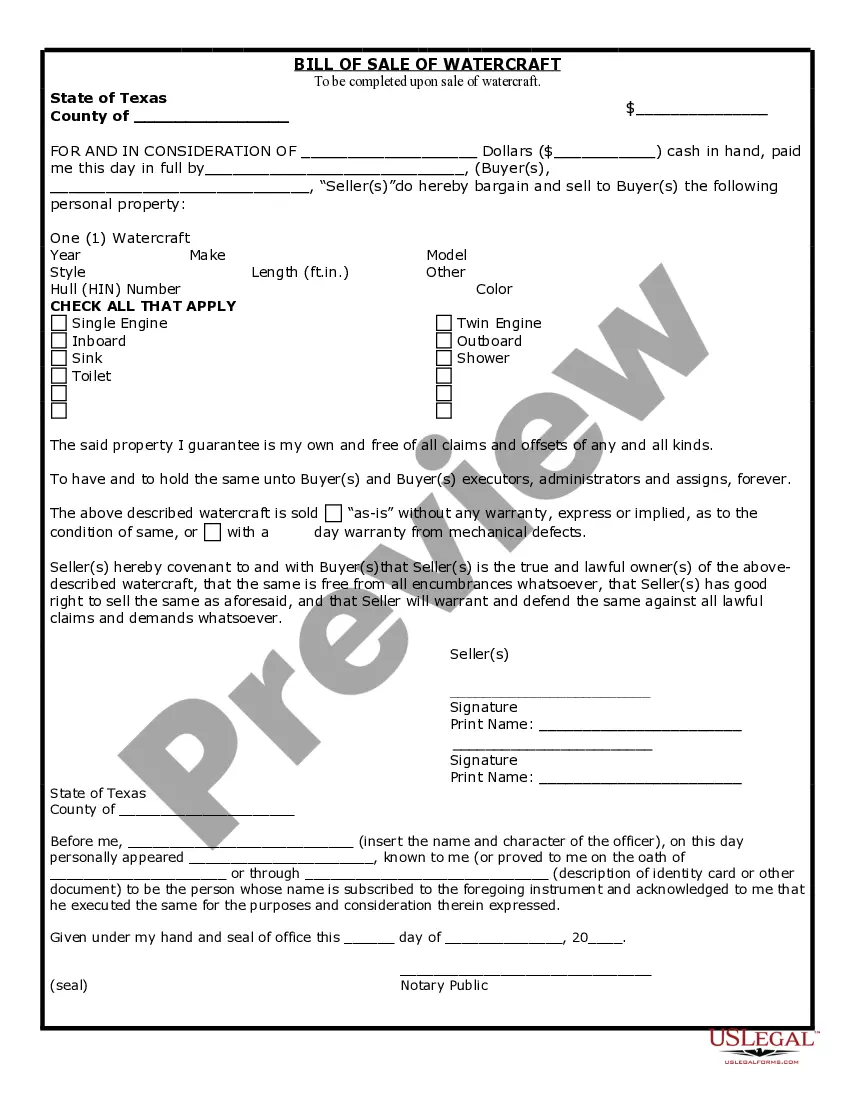

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the San Diego Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co., it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the current version of the San Diego Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co., you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Diego Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co.:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your San Diego Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co. and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

RSUs are generally subject to a vesting schedule, meaning the stock does not fully belong to the employee until such a time it is vested. During the vesting period, the stock cannot be sold. Once vested, the stock is given a Fair Market Value and is considered taxable compensation to the employee.

You may not sell, assign, pledge, encumber, or otherwise transfer any interest in the Restricted Shares until the dates set forth in the Vesting Schedule set forth below, at which point the Restricted Shares will be referred to as ?Vested.? A Restricted Share shall not be subject to execution, attachment or similar

Once they are vested, RSUs can be sold or kept like any other shares of company stock. Unlike stock options or warrants, RSUs always have some value based on the underlying shares. For tax purposes, the entire value of vested RSUs must be included as ordinary income in the year of vesting.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

If you want to remove the restrictive legend, you should contact the company that issued the securities?or the transfer agent for the company's securities?to ask about the procedures for removing a legend. If you have a broker, you may want to ask your broker to help you.

Unlike stock options, RSUs do not have an ?exercise price.? This means that employees with RSUs, upon vesting, will automatically receive normal shares of company stock at a defined fair market value (FMV) without paying a dime to exercise.

You can gift vested RSUs because you own the company stock outright. Financial gifts are tax-deductible only if the recipient is a qualified charitable organization. Be aware of gift tax issues. You can gift up to $15,000 in 2021 to an individual without gift tax consequences (?annual exclusion gift?).

RSUs are allowed, by law, to be granted to employees and non-employees alike. This means they can be used for contractors and outside directors. From an individual income and tax perspective they are also similar to RSUs given to employees.

Restricted stock units (RSUs) are company shares issued through the vesting stock plans. Employers give them to full-time employees or independent contractors for reaching certain milestones or staying with the company for a certain period of time.

While stock options are the most common form of equity compensation in smaller private companies, RSUs have become the most common type of equity award for public and large private companies. Facebook pioneered the use of RSUs as a private company to allow it to avoid having to register as a public company earlier.