The Harris Texas Approval of Company Employee Stock Purchase Plan is a program implemented by Harris Texas, a reputed company based in Texas. This plan provides an opportunity for employees of the company to purchase company stock at a discounted price, typically through after-tax payroll deductions. Under the Harris Texas Approval of Company Employee Stock Purchase Plan, eligible employees can contribute a portion of their salary to this plan, which is used to purchase company stock at regular intervals, such as quarterly or semi-annually. The plan is designed to encourage employees to become stakeholders in the company's success, aligning their interests with those of the company and fostering a sense of ownership. One of the key benefits of this plan is the discounted purchase price offered to employees. The discount may vary, but it is typically a percentage off the fair market value of the company stock. This discounted rate makes it attractive for employees to participate in the plan, as they have the potential to buy company stock at a lower price than what is available in the public market. Another advantage of the Harris Texas Approval of Company Employee Stock Purchase Plan is its long-term investment potential. By participating in the plan and accumulating shares over time, employees can potentially benefit from any increase in the company's stock price. As the stock market tends to generate higher returns over the long run, this plan provides an opportunity for employees to build wealth and share in the company's growth. Additionally, the Harris Texas Approval of Company Employee Stock Purchase Plan may offer certain tax advantages. While individual tax situations may vary, there might be tax benefits associated with this plan, such as the potential for capital gains tax deferral until the stock is sold. While there is no specific information indicating different types of the Harris Texas Approval of Company Employee Stock Purchase Plan, it is worth noting that companies may tailor their employee stock purchase plans to meet specific needs or preferences. This may involve variations in the discount percentage, holding periods, or other plan features. In summary, the Harris Texas Approval of Company Employee Stock Purchase Plan is a program that enables employees of Harris Texas to purchase company stock at a discounted price, thereby fostering employee ownership and aligning their interests with the success of the company. This plan offers potential long-term investment benefits, potential tax advantages, and an opportunity for employees to accumulate wealth through stock ownership.

Harris Texas Approval of Company Employee Stock Purchase Plan

Description

How to fill out Harris Texas Approval Of Company Employee Stock Purchase Plan?

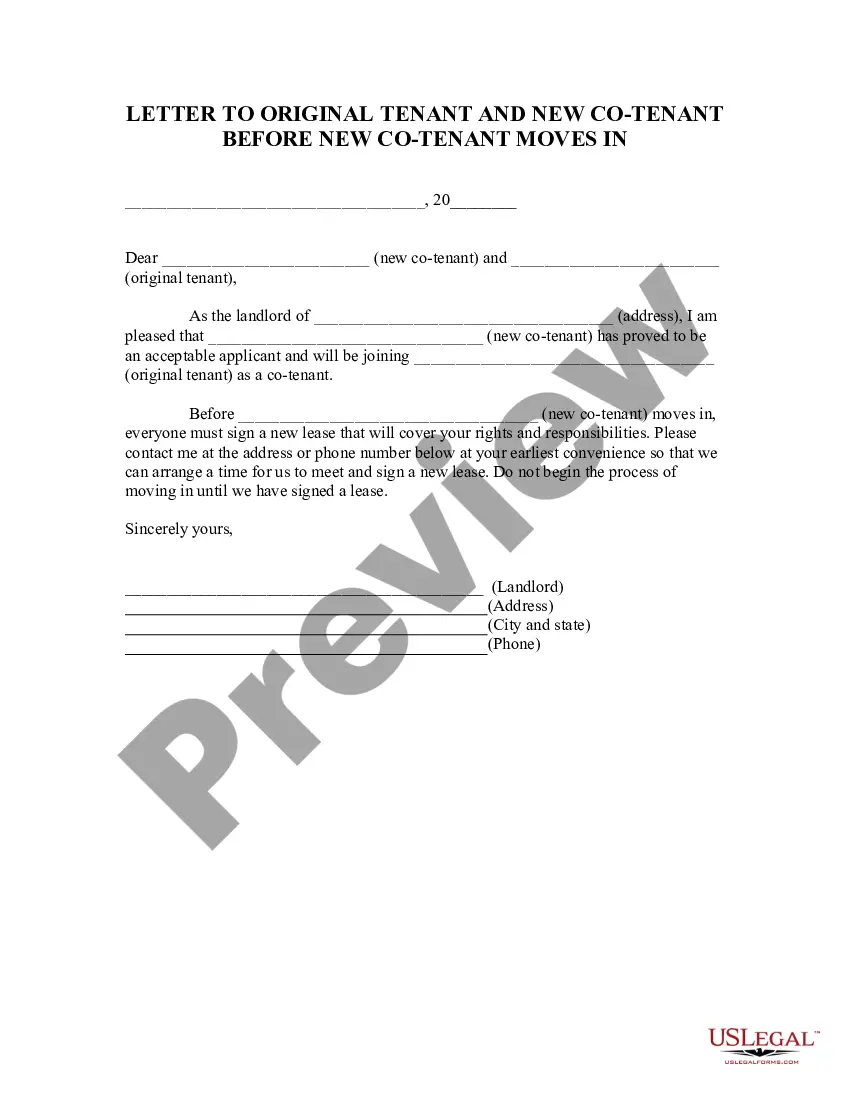

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Harris Approval of Company Employee Stock Purchase Plan is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the Harris Approval of Company Employee Stock Purchase Plan. Follow the guidelines below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Approval of Company Employee Stock Purchase Plan in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Investing in an ESPP can be a good idea, but it should complement your financial goals. These goals can be either long-term or short-term objectives for your overall financial health. Depending on when you buy and sell your shares, your ESPP could fit well into both.

Create an ownership culture in your company An ESPP is the easiest and often the most cost-effective way for employees to purchase shares in the company. When employees are also owners, they have a greater stake in the success of the company, which can be a powerful motivator and reduce turnover.

You can usually purchase ESPP plan stock worth 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. If you participate, your employer will deduct your contribution directly from your paycheck.

Stock plans are generally available to all employees and allow them to purchase shares at a reduced price. The purchase of company stock is made via payroll deductions.

You can usually purchase ESPP plan stock worth 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. If you participate, your employer will deduct your contribution directly from your paycheck. Your employer will then purchase the company stock for you, typically at the end of a 6-month period.

You will continue to own stock purchased for you during your employment, but your eligibility for participation in the plan ends. Any funds withheld from your salary but not used to purchase shares before the end of your employment will be returned to you, normally without interest, within a reasonable period.

A. A qualified 423 employee stock purchase plan allows employees under U.S. tax law to purchase stock at a discount from fair market value without any taxes owed on the discount at the time of purchase.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

ESPPs have traditionally been associated first and foremost with public companies. But the tide has turned in recent years and more than ever, larger private companies are embracing this type of equity compensation program.

To be eligible for a Section 423 ESPP, you must be an employee from the start of the offering until at least three months before the purchase date (12 months for termination because of disability). However, most companies end participation when you terminate employment.