Dallas Texas Employee Stock Purchase Plan is a beneficial program offered by employers based in Dallas, Texas, which allows employees to purchase company stocks at a discounted rate. This program encourages employee ownership and can be a valuable asset to employees looking to build wealth and participate in the company's success. Through the Dallas Texas Employee Stock Purchase Plan, employees have the opportunity to buy company stocks directly from their paycheck, usually on a quarterly or annual basis. The plan is typically offered as a voluntary benefit, allowing employees to decide whether they want to participate or not. One of the key advantages of the Dallas Texas Employee Stock Purchase Plan is the discounted price at which employees can purchase stocks. This discounted rate is often at a percentage below the market price of the company's stock, making it an attractive investment option for employees. The discount percentage can vary depending on the employer and the terms of the plan. Another benefit of the Dallas Texas Employee Stock Purchase Plan is the potential for capital appreciation. If the company's stock price increases over time, employees can sell their shares at a profit. This can be a great way for employees to build wealth and generate additional income outside their regular salary. It is important to note that there might be different types of Dallas Texas Employee Stock Purchase Plans offered by employers. Some variations may include: 1. Qualified Stock Purchase Plan: This type of plan is eligible for favorable tax treatment under the Internal Revenue Code, where employees may be able to receive certain tax advantages when participating in the plan. 2. Non-Qualified Stock Purchase Plan: This plan does not meet the requirements for favorable tax treatment and may have different rules and regulations compared to qualified plans. 3. Employee Stock Ownership Plan (ESOP): This type of plan is typically offered by closely held companies and allows employees to acquire ownership in the company gradually. Sops can provide employees with additional retirement benefits and can have specific tax advantages as well. Overall, the Dallas Texas Employee Stock Purchase Plan is a valuable opportunity for employees in Dallas, Texas to invest in their company's stock and potentially benefit from its growth. It is important for individuals to review the specific details and terms of the plan offered by their employer to fully understand the benefits and any potential risks associated with participation.

Dallas Texas Employee Stock Purchase Plan

Description

How to fill out Dallas Texas Employee Stock Purchase Plan?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the Dallas Employee Stock Purchase Plan.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Dallas Employee Stock Purchase Plan will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Dallas Employee Stock Purchase Plan:

- Ensure you have opened the correct page with your localised form.

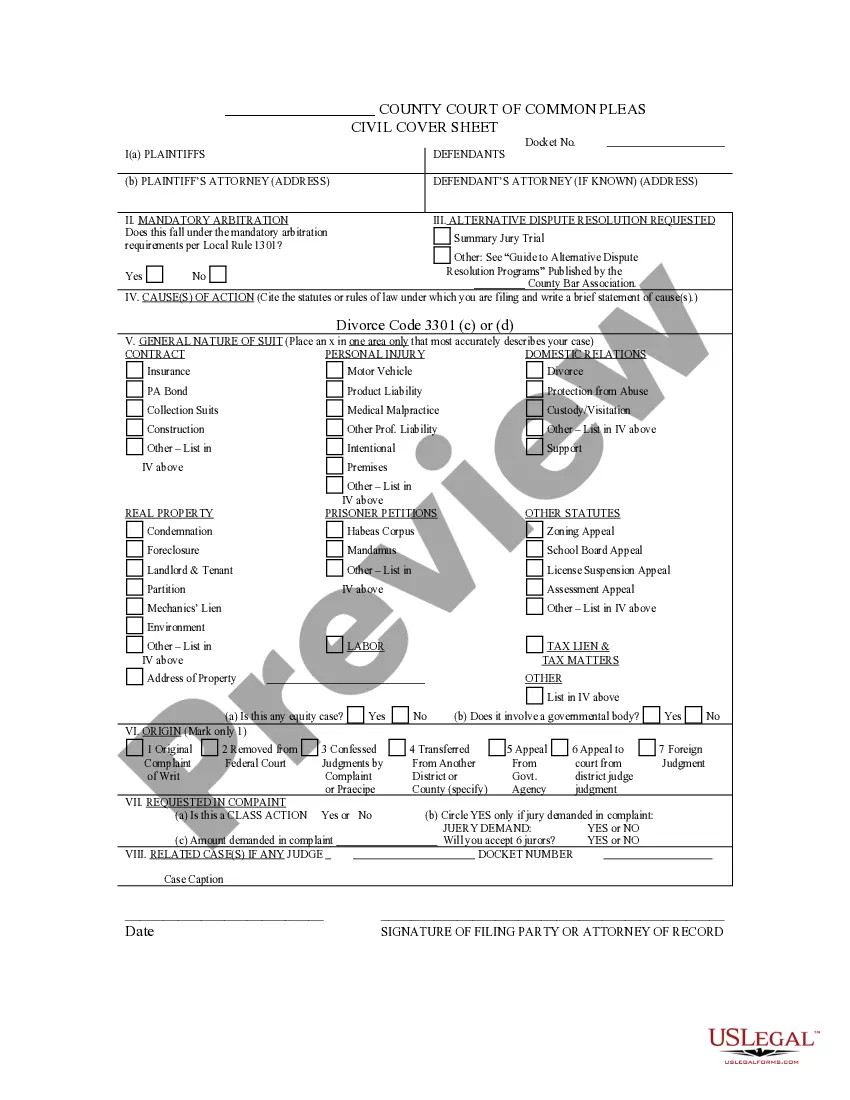

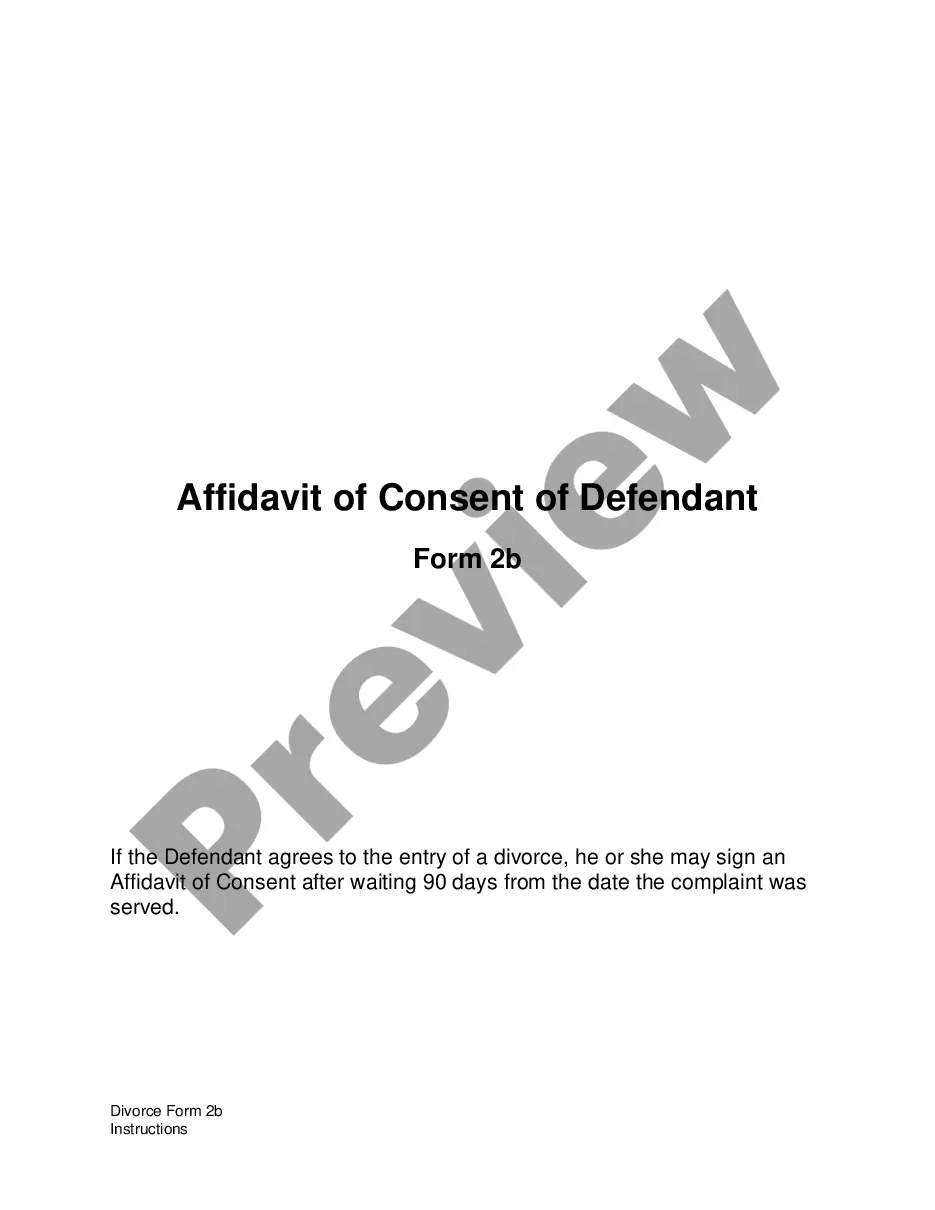

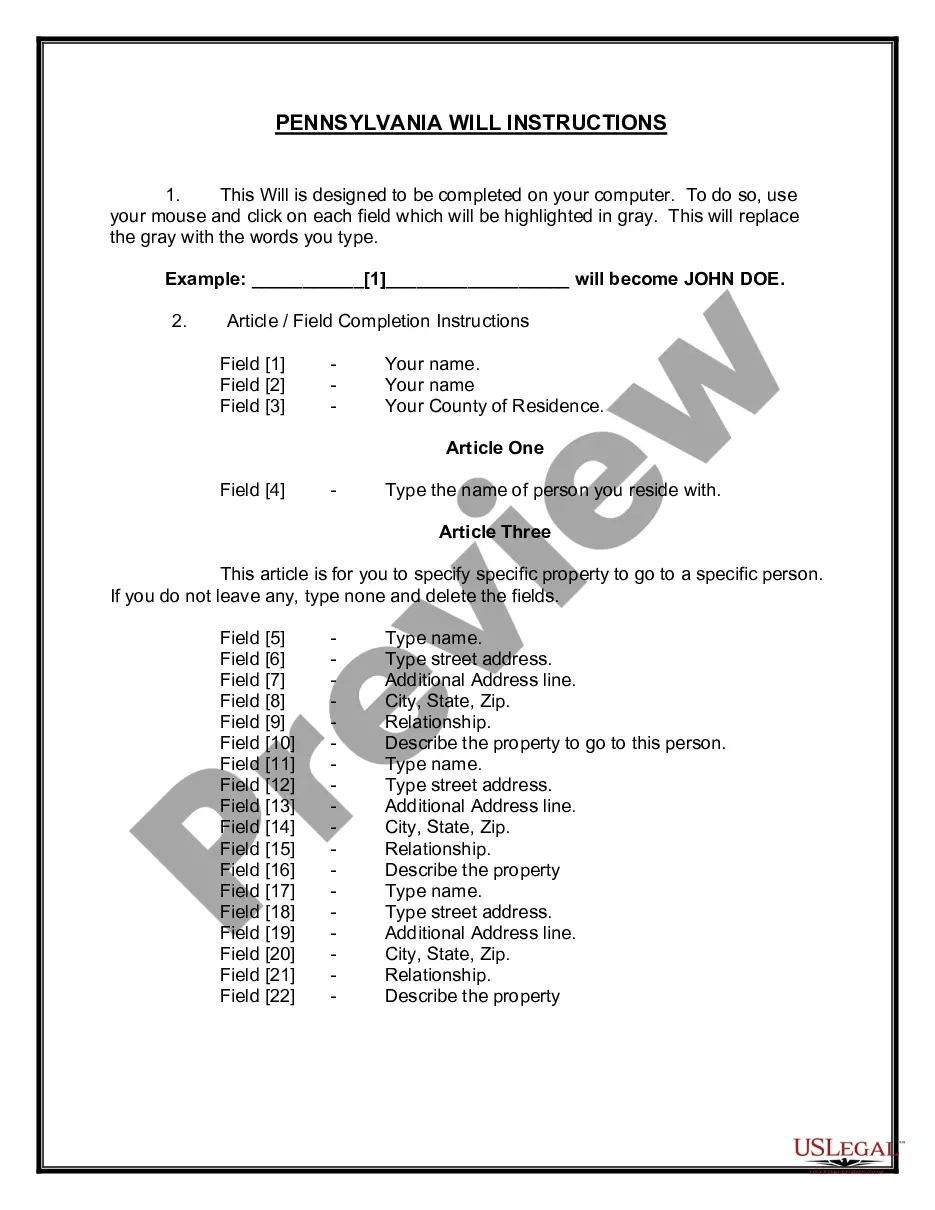

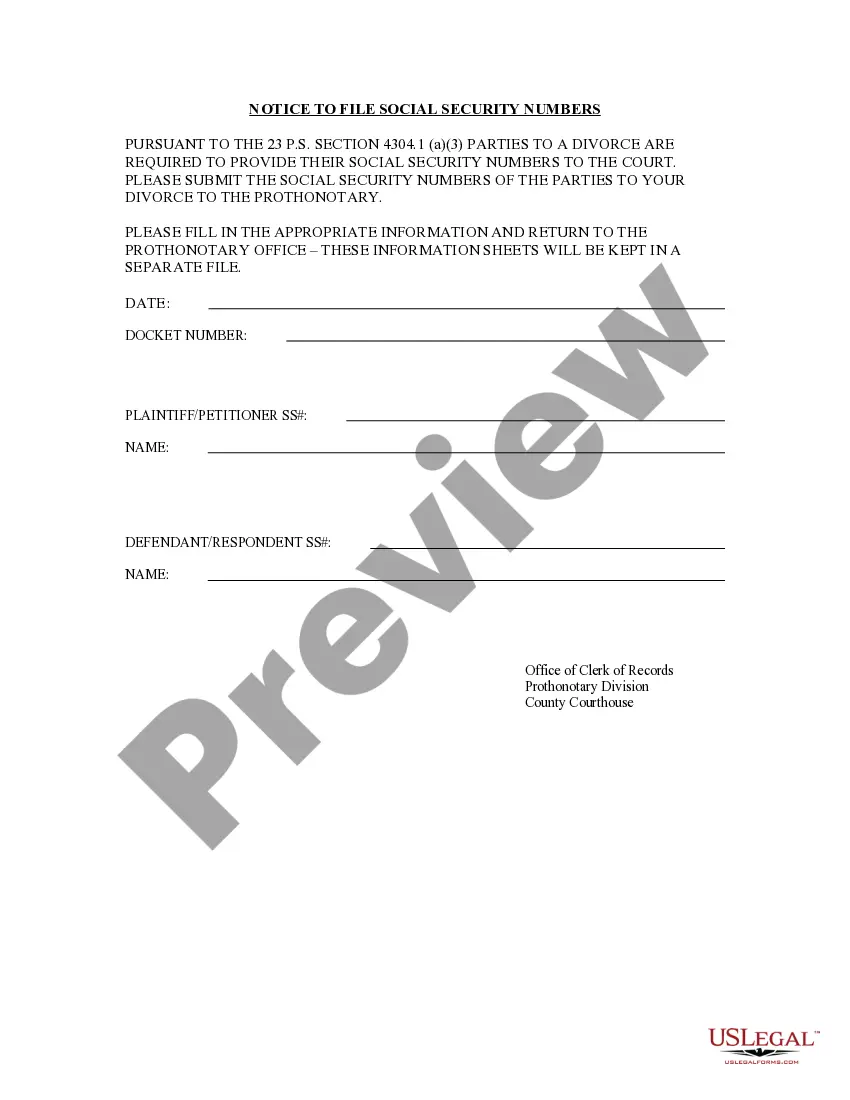

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Dallas Employee Stock Purchase Plan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!