Franklin Ohio Employee Stock Purchase Plan, also known as Foes pp, is a company-sponsored program allowing employees of Franklin Ohio in the United States to purchase company stock at a discounted price. With the aim of encouraging employee ownership and fostering loyalty, this employee benefit offers a convenient way for employees to invest in the company they work for. The Franklin Ohio Employee Stock Purchase Plan provides eligible employees with the opportunity to contribute a portion of their salary, typically through automatic payroll deductions, towards the purchase of Franklin Ohio stock. The contributions accumulate over a specified period, usually a six-month or one-year offering period. At the end of the specified period, employees are given the option to use the accumulated funds to purchase Franklin Ohio shares at a discount, usually at a predetermined price or a percentage below the current market value. There may be variations or types of Franklin Ohio Employee Stock Purchase Plans based on different structures or offerings provided by the employer. These variations might include: 1. Standard Employee Stock Purchase Plan: This type of ESPN offers a straightforward approach where eligible employees participate by setting aside a percentage of their salary regularly to purchase company stock at a discounted price. 2. Qualified Employee Stock Purchase Plan (ESPN): This plan meets specific IRS requirements and provides additional tax advantages to participants. With a ESPN, employees may be eligible for preferential tax treatment on the gains realized from selling the purchased shares, potentially resulting in tax savings. 3. Non-Qualified Employee Stock Purchase Plan (ESPN): This plan, unlike Less, does not meet certain IRS requirements and, as a result, does not offer the same tax advantages. However, Nests still provide employees with the opportunity to purchase company stock at a discounted price. Overall, the Franklin Ohio Employee Stock Purchase Plan offers employees an attractive way to become shareholders and take part in the company's success. By offering discounted stock options and various plan types, Franklin Ohio aims to incentivize employee participation and foster a sense of ownership and commitment among its workforce. Check with the company's HR department or employee benefits portal for specific details on the Franklin Ohio Employee Stock Purchase Plan offerings and eligibility requirements.

Franklin Ohio Employee Stock Purchase Plan

Description

How to fill out Franklin Ohio Employee Stock Purchase Plan?

If you need to get a reliable legal document supplier to get the Franklin Employee Stock Purchase Plan, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to get and complete various papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply select to look for or browse Franklin Employee Stock Purchase Plan, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

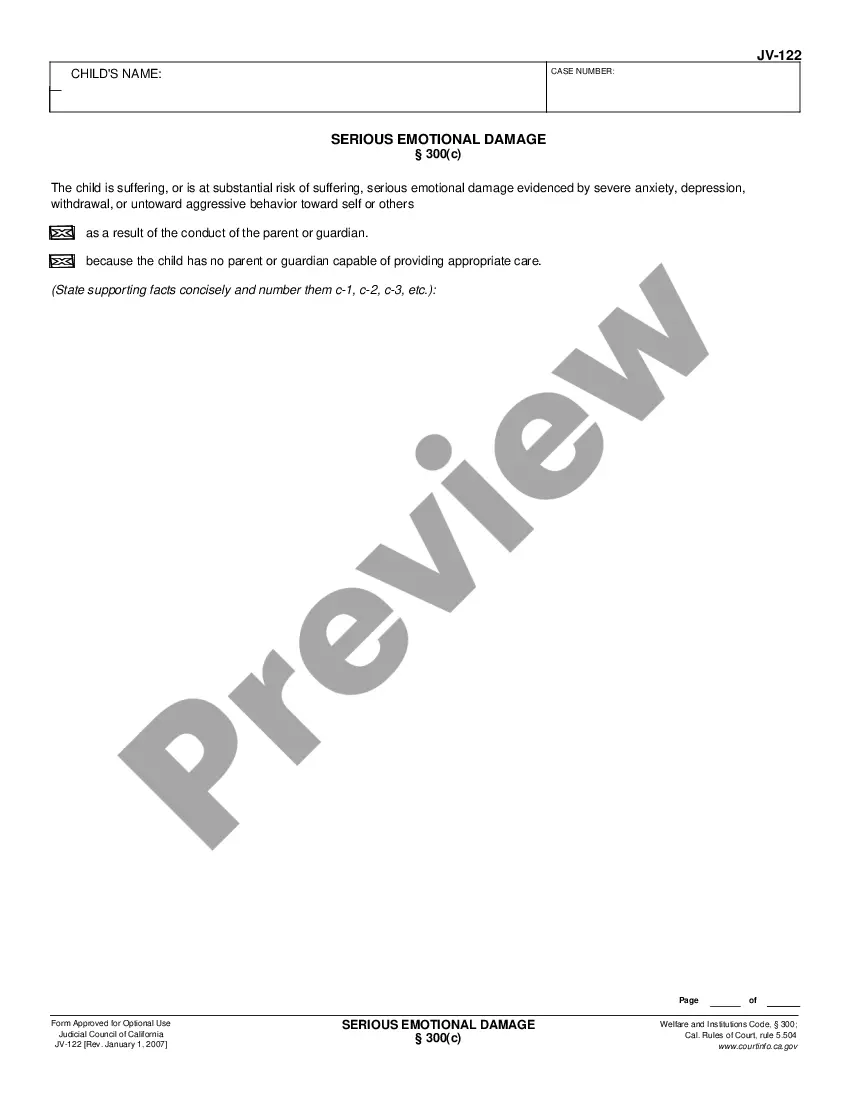

Don't have an account? It's simple to get started! Simply locate the Franklin Employee Stock Purchase Plan template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less pricey and more reasonably priced. Set up your first company, organize your advance care planning, create a real estate contract, or complete the Franklin Employee Stock Purchase Plan - all from the convenience of your sofa.

Sign up for US Legal Forms now!