Travis Texas Employee Stock Purchase Plan (ESPN) is a company-sponsored program that allows eligible employees of Travis Texas Corporation to purchase company stock at a discounted price. It provides employees with an opportunity to invest in their company's stock and potentially participate in its future growth. ESPN are commonly used by companies to attract and retain employees by offering them an ownership stake in the company. Travis Texas offers different types of ESPN to cater to the diverse needs of its workforce. These may include: 1. Basic ESPN: This is the standard plan offered to employees, which allows them to purchase company stock at a discount. Typically, employees can contribute a certain percentage of their salary to buy stock on a regular basis, usually through payroll deductions. 2. Look back ESPN: In this type of plan, employees have the advantage of purchasing company stock at a discounted price based on the lower price between the offering date and the purchase date. It allows employees to maximize their discount and potential gains. 3. Qualified ESPN: A qualified ESPN provides certain tax advantages to the participants. The contributions made by employees to purchase company stock may be tax-deductible or offer tax-deferred benefits, subject to specific regulations and conditions defined by the tax authorities. 4. Non-Qualified ESPN: Unlike qualified ESPN, non-qualified ESPN do not offer the same tax advantages. Employees participating in this plan may have to pay taxes on the difference between the purchase price and the fair market value of the shares at the time of purchase. Travis Texas Employee Stock Purchase Plan typically has a set holding period for the purchased shares, which may range from a few months to a few years. During this period, employees may not be able to sell or transfer the acquired shares, ensuring that they are encouraged to hold on to the stock and align their interests with the company's long-term success. Participating in the Travis Texas Employee Stock Purchase Plan can be a great way for employees to build wealth, diversify their investment portfolio, and potentially benefit from the growth of the company they work for. It is important for employees to understand the terms, conditions, and potential risks associated with the plan before making investment decisions.

Travis Texas Employee Stock Purchase Plan

Description

How to fill out Travis Texas Employee Stock Purchase Plan?

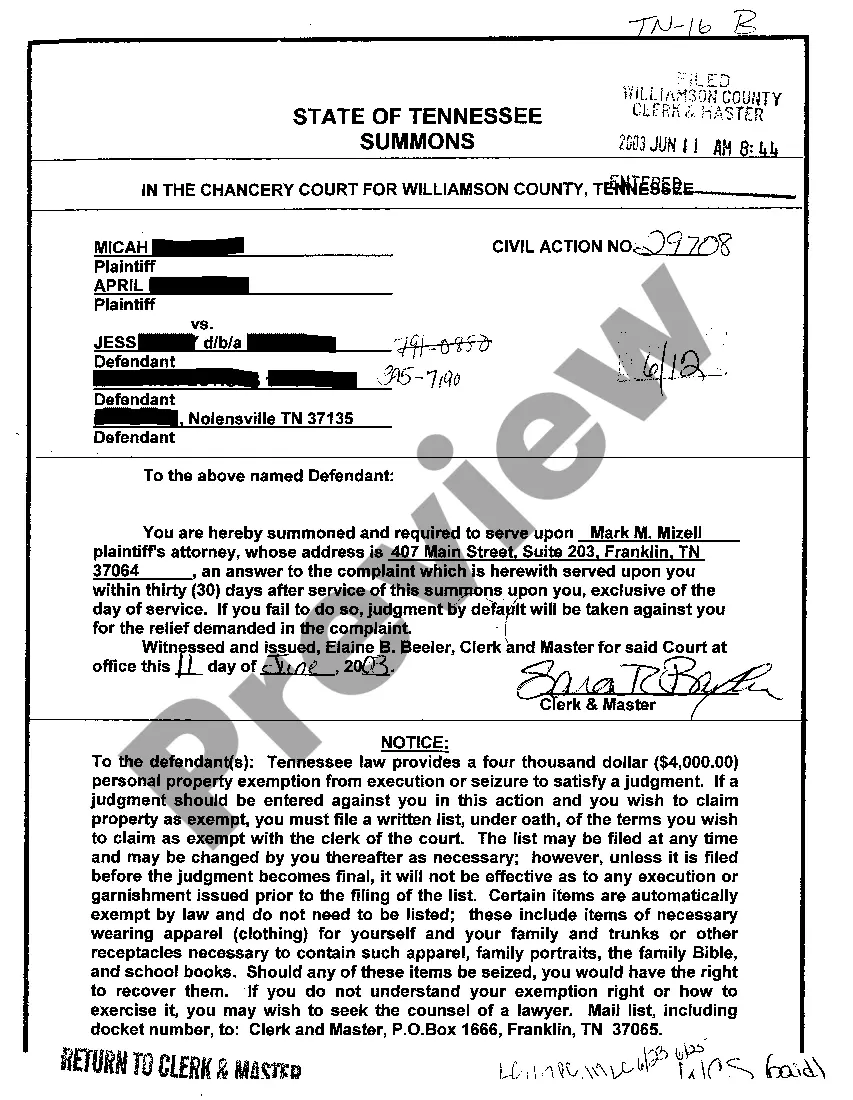

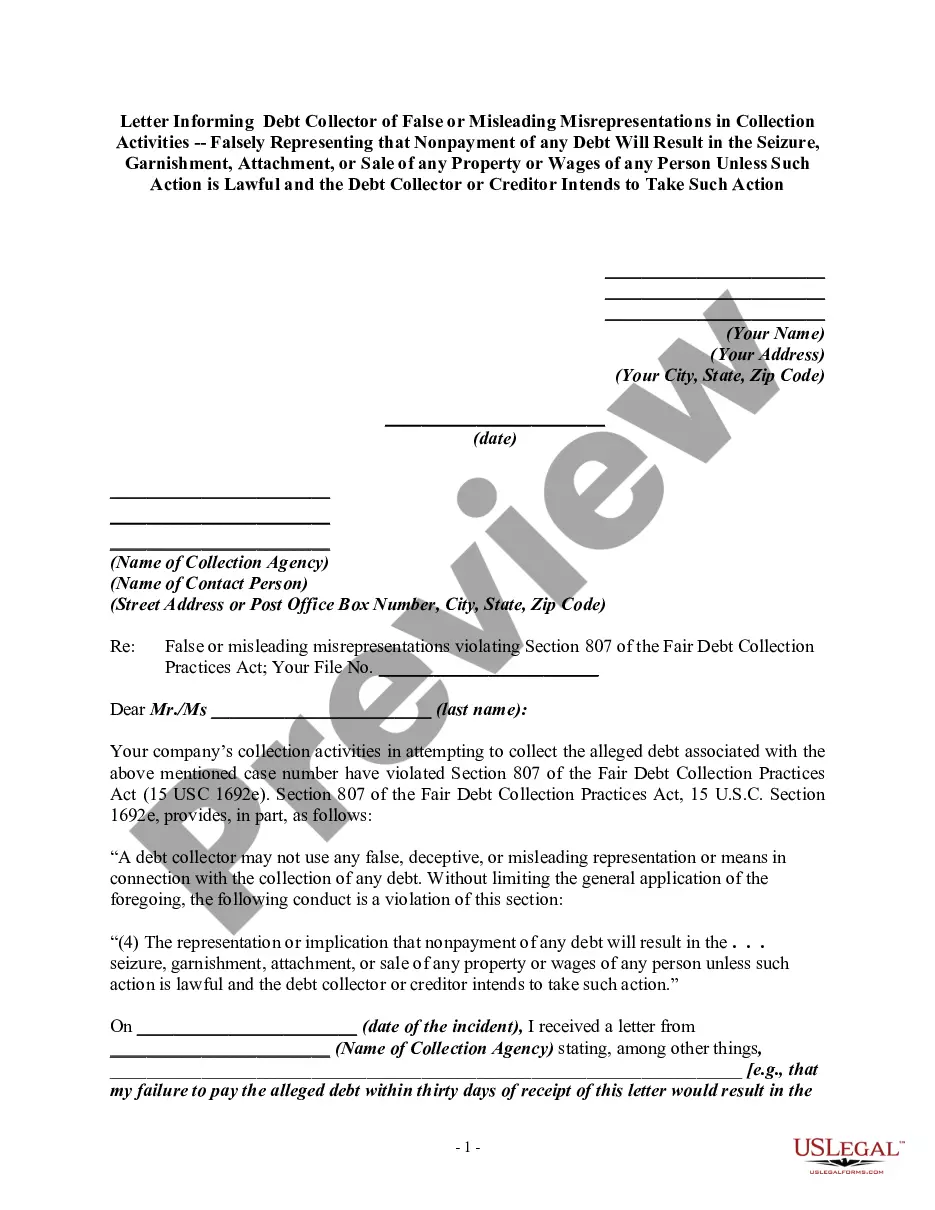

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, finding a Travis Employee Stock Purchase Plan suiting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Apart from the Travis Employee Stock Purchase Plan, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Travis Employee Stock Purchase Plan:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Travis Employee Stock Purchase Plan.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

This is one of those things that surprises people it's possible to lose money on an ESPP. You're buying shares of stock, and the value of ESPP shares can go up or down very quickly. A 15% drop in price can eliminate the value from participating in the plan in the first place.

An ESPP allows you to purchase company stock at a discounted price, often between 5-15% off the fair market value. For example, if the fair market value on the applicable date is $10 per share, and your plan offers a 15% discount, you can purchase those shares for $8.50 per share.

An employee stock purchase plan (ESPP) is a benefit that allows people to buy stock in the company they work for at a discounted price. Large companies or public corporations sometimes offer these plans, and they use the sum of their total employee contributions to make a large investment in the company.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

Six companies have ESOPs, and four of these are majority employee-owned (Publix, Burns & McDonnell, West Monroe Partners, and W.L. Gore & Associates). A table with the employee ownership companies only is below. For the complete list and details on each company, see the Fortune or Great Place to Work sites.

An ESOP is a qualified defined contribution retirement plan, so employees don't purchase shares with their own money. An ESPP, on the other hand, is a plan that allows employees to use their own money to buy company shares at a discount.

When you buy stock under an employee stock purchase plan (ESPP), the income isn't taxable at the time you buy it. You'll recognize the income and pay tax on it when you sell the stock. When you sell the stock, the income can be either ordinary or capital gain.

More than 80% of tech companies offer an employee stock purchase plan (ESPP). Of the plans we've seen (and we've seen a lot of them), Adobe's ESPP is top-notch and may even be the best in the industry.