The Maricopa Arizona Amended and Restated Employee Stock Purchase Plan is a comprehensive and beneficial program designed to provide employees of Maricopa Arizona with the opportunity to purchase company stock at a discounted rate. This plan is a crucial aspect of Maricopa Arizona's overall compensation package, enabling employees to become shareholders and align their financial interests with the company's success. Under this employee stock purchase plan, eligible employees are given the chance to regularly contribute a portion of their salary towards purchasing Maricopa Arizona common stock. These contributions can be made through automatic payroll deductions, making it convenient and effortless for employees to participate. The plan offers a discount on the purchase price of the stock, allowing employees to acquire shares at a more favorable rate than the prevailing market price. One significant advantage of the Maricopa Arizona Amended and Restated Employee Stock Purchase Plan is its tax-friendly nature. The contributions made by employees are deducted from their taxable income, reducing their overall tax liability. This further enhances the appeal of the plan and encourages employees to take advantage of this opportunity to build their wealth and foster a sense of ownership in the company. It's worth noting that there may be different types or variations of the Maricopa Arizona Amended and Restated Employee Stock Purchase Plan, tailored to suit the unique needs of the employees or based on specific circumstances. These variations may include: 1. Standard Employee Stock Purchase Plan: This is the foundation of the program and offers employees the chance to purchase company stock at discounted rates through regular payroll deductions. 2. Executive Stock Purchase Plan: This variant may be exclusive to executives or higher-level employees, providing them with additional benefits such as larger discounts or the ability to purchase more shares. 3. Restricted Stock Purchase Plan: This type of plan might be implemented for certain employees who are subject to specific restrictions, such as a vesting schedule or conditions related to the company's performance. 4. Option Stock Purchase Plan: This plan can grant eligible employees the opportunity to purchase stock options, giving them the right to buy shares at a predetermined price in the future. It's important for employees to carefully review the details, terms, and eligibility criteria of their specific Maricopa Arizona Amended and Restated Employee Stock Purchase Plan to fully understand the benefits and potential implications. Employees are encouraged to consult with the HR department or plan administrators for in-depth information and guidance regarding their participation in the plan.

Maricopa Arizona Amended and Restated Employee Stock Purchase Plan

Description

How to fill out Maricopa Arizona Amended And Restated Employee Stock Purchase Plan?

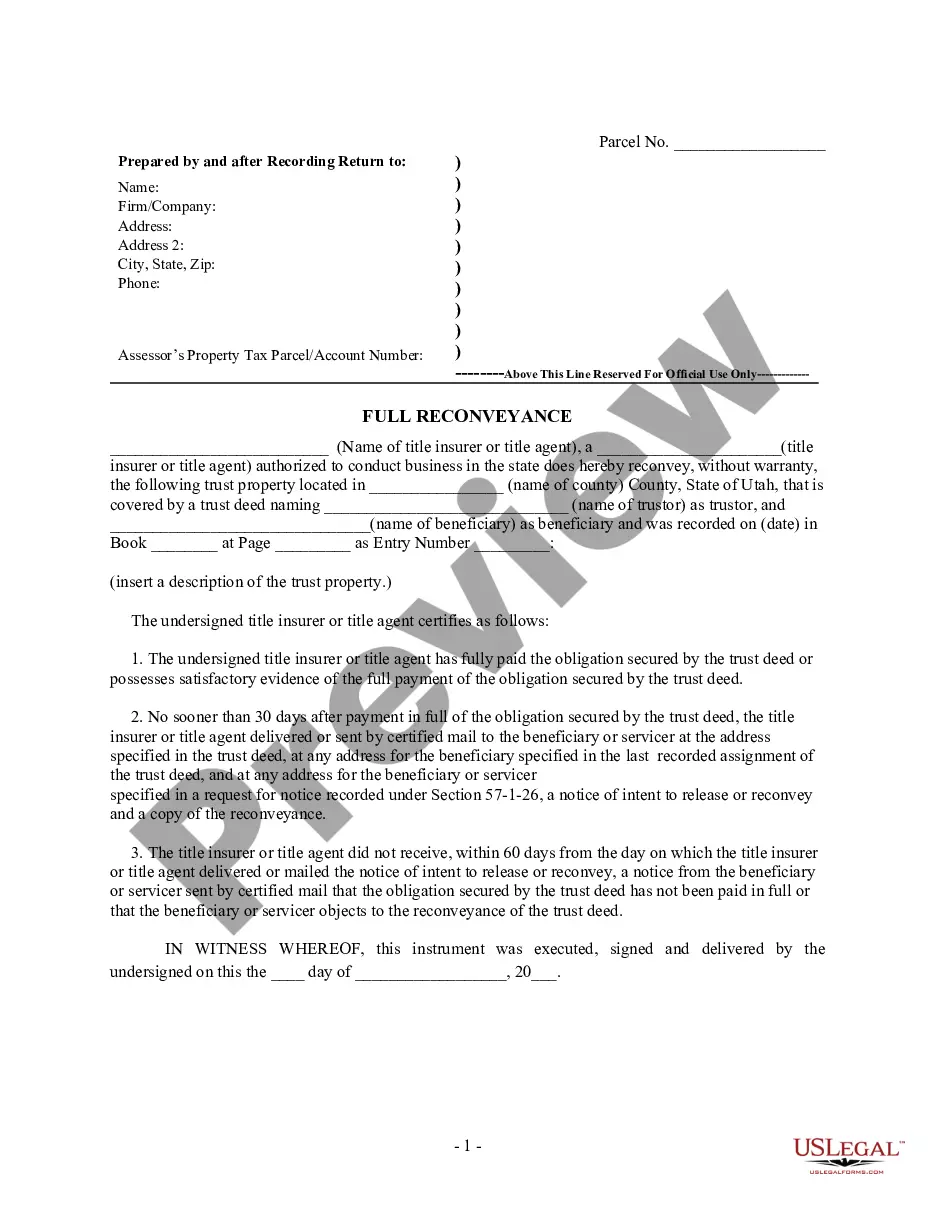

Draftwing paperwork, like Maricopa Amended and Restated Employee Stock Purchase Plan, to take care of your legal matters is a tough and time-consumming process. Many situations require an attorney’s participation, which also makes this task expensive. However, you can get your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for various scenarios and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Maricopa Amended and Restated Employee Stock Purchase Plan form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Maricopa Amended and Restated Employee Stock Purchase Plan:

- Make sure that your template is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Maricopa Amended and Restated Employee Stock Purchase Plan isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin using our website and get the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!