The Salt Lake Utah Amended and Restated Employee Stock Purchase Plan is a comprehensive program that allows employees of a specific company or organization located in Salt Lake City, Utah, to purchase company stocks at a discounted price. This plan aims to provide employees with an opportunity to acquire ownership in the company they work for, fostering a sense of loyalty, commitment, and motivation. The Salt Lake Utah Amended and Restated Employee Stock Purchase Plan is designed to benefit employees by offering them an exclusive platform to invest in their employer's stock, ultimately allowing them to share in the company's success. This stock purchase plan typically features several key components, including eligibility requirements, contribution limits, purchase periods, and discounted stock prices. Employees who meet the eligibility criteria and choose to participate in the Salt Lake Utah Amended and Restated Employee Stock Purchase Plan can contribute a portion of their pre-tax income towards purchasing company stock. These contributions are usually accumulated over a predetermined purchase period, which may vary based on the specific plan. The accumulated funds are then used to buy the company's stocks at a discounted price, typically lower than the prevailing market rate. The Salt Lake Utah Amended and Restated Employee Stock Purchase Plan may also offer different types or variations, such as: 1. Standard Employee Stock Purchase Plan: This is the most common type of plan, allowing eligible employees to contribute a percentage of their salary towards purchasing company stock. 2. Direct Stock Purchase Plan (DSP): In addition to the standard plan, some companies may offer a DSP that allows employees to purchase company stocks directly from the issuer, bypassing brokerage firms. This plan often features lower fees and is ideal for employees looking to acquire stock directly from the company. 3. Section 423 Qualified Plan: This type of plan complies with the requirements outlined in Section 423 of the Internal Revenue Code. It offers additional tax advantages to participants, such as the ability to purchase company stock using funds accumulated from after-tax payroll deductions. 4. Non-Qualified Stock Purchase Plan: Unlike qualified plans, non-qualified plans do not adhere to Section 423 requirements. They offer greater flexibility to employers in designing the plan's provisions, but participants may not enjoy the same tax advantages as in qualified plans. Participating in the Salt Lake Utah Amended and Restated Employee Stock Purchase Plan can be a beneficial financial decision for employees in Salt Lake City. It allows them to invest in their company, potentially accumulate wealth through stock appreciation, and align their financial interests with the success of the organization. This plan fosters employee engagement and can be an essential part of the overall compensation and benefits package offered by companies in Salt Lake City, Utah.

Salt Lake Utah Amended and Restated Employee Stock Purchase Plan

Description

How to fill out Salt Lake Utah Amended And Restated Employee Stock Purchase Plan?

Preparing papers for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Salt Lake Amended and Restated Employee Stock Purchase Plan without professional assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Salt Lake Amended and Restated Employee Stock Purchase Plan on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Salt Lake Amended and Restated Employee Stock Purchase Plan:

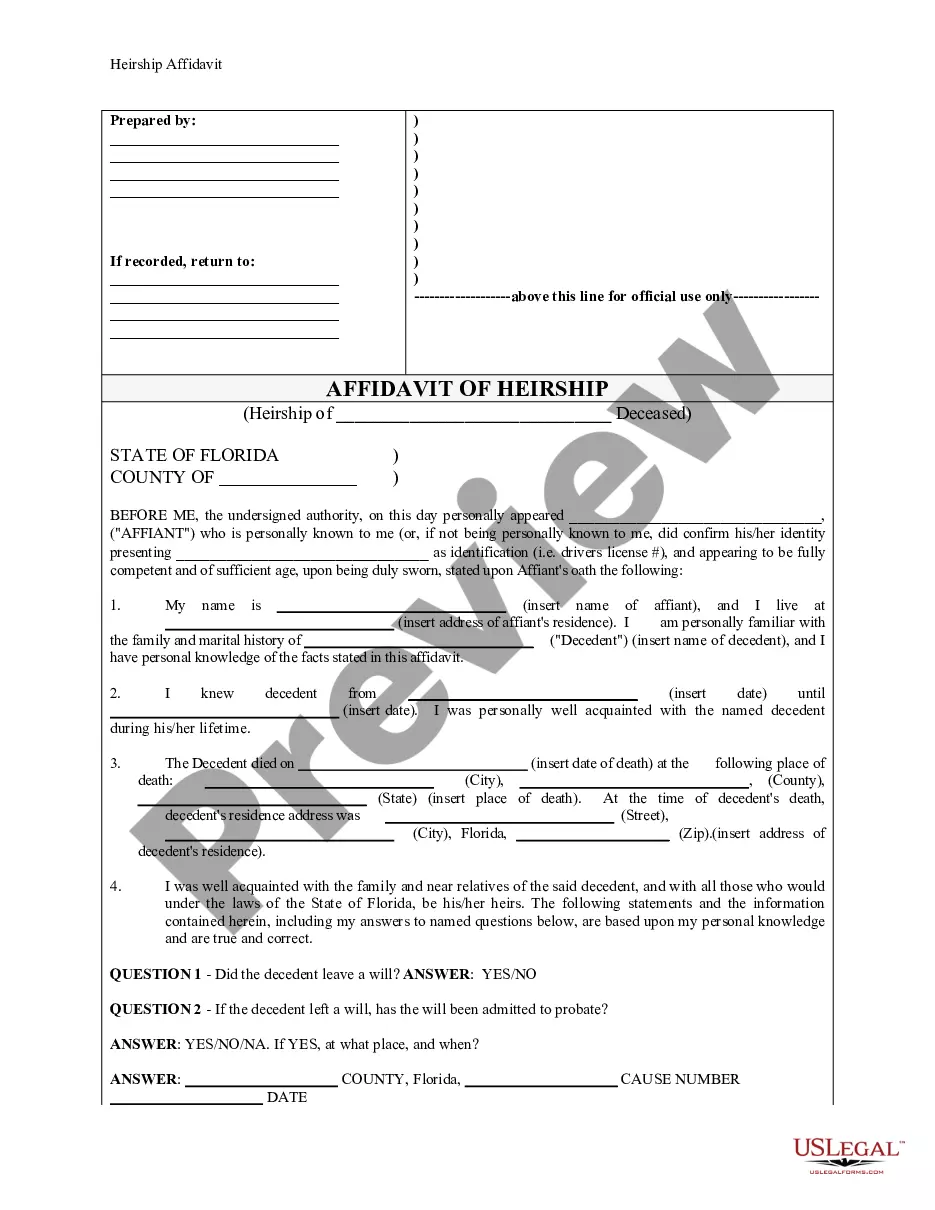

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!