Title: Harris Texas Proposal to Amend Stock Purchase Plan: Enhancing Employee Benefits and Ownership Introduction: The Harris Texas Proposal to amend the stock purchase plan seeks to introduce crucial changes to optimize the benefits and opportunities for employees within the organization. By enhancing the stock purchase plan, employees can participate more actively in the company's success while fostering a sense of ownership and loyalty. This detailed description explores the key aspects of the proposed amendments and identifies potential types within the Harris Texas Proposal. 1. Expanded Employee Eligibility: The proposed amendment aims to broaden the eligibility criteria for the stock purchase plan, allowing more employees to participate actively. This expansion may encompass various subtypes, such as: a) Full-Time Employees: All full-time employees, regardless of their position within the organization, will be eligible to participate in the stock purchase plan. b) Part-Time Employees: The proposal may extend eligibility to part-time employees, granting them an opportunity to become stockholders and avail related benefits. c) Contractual Employees: The amendment may include provisions enabling contractual employees meeting specific criteria to participate in the plan. 2. Increased Discount or Matched Contributions: The Harris Texas Proposal may suggest an enhanced discount or matched contribution scheme to entice employees to acquire company stocks. The types of amendments in this category could include: a) Expanded Discount Percentage: Increasing the discount percentage offered to employees for purchasing company stocks beyond the current rate. b) Enhanced Matching Contributions: A proposal to match a higher percentage of employees' contributions up to a certain limit, thereby encouraging them to invest in the stock purchase plan. 3. Empowering Employee Stockholders: The proposed amendments could strive to empower stock holding employees by providing them additional benefits and rights. These types might include: a) Voting Rights: Given to employees who hold company stocks, empowering them to participate actively in corporate decision-making processes. b) Dividend Entitlement: Ensuring that employees who obtain company stocks are entitled to dividend payments, further aligning their interests with the organization. c) Stock Conversion Options: The proposal may include provisions allowing stockholders to convert their shares into other forms of company equity, such as non-voting shares or preferred stock. 4. Education and Communication Initiatives: To ensure employees understand and make the most of the amended stock purchase plan, the proposal may focus on enhancing education and communication channels. This category of amendments could include: a) Financial Literacy Programs: Introducing education initiatives to educate employees about stock market basics, investment strategies, and long-term financial planning. b) Transparent Communication: Establishing regular company-wide updates, newsletters, or dedicated channels to communicate the benefits and progress of the stock purchase plan effectively. Conclusion: The Harris Texas Proposal to amend the stock purchase plan aims to create a more inclusive and employee-centered system. By expanding eligibility, enhancing benefits, and empowering employees, the proposal seeks to foster a stronger sense of ownership and loyalty among the workforce. The various types discussed above highlight the potential variations within this comprehensive proposal, ultimately leading to a more prosperous and engaged workforce.

Harris Texas Proposal to amend stock purchase plan

Description

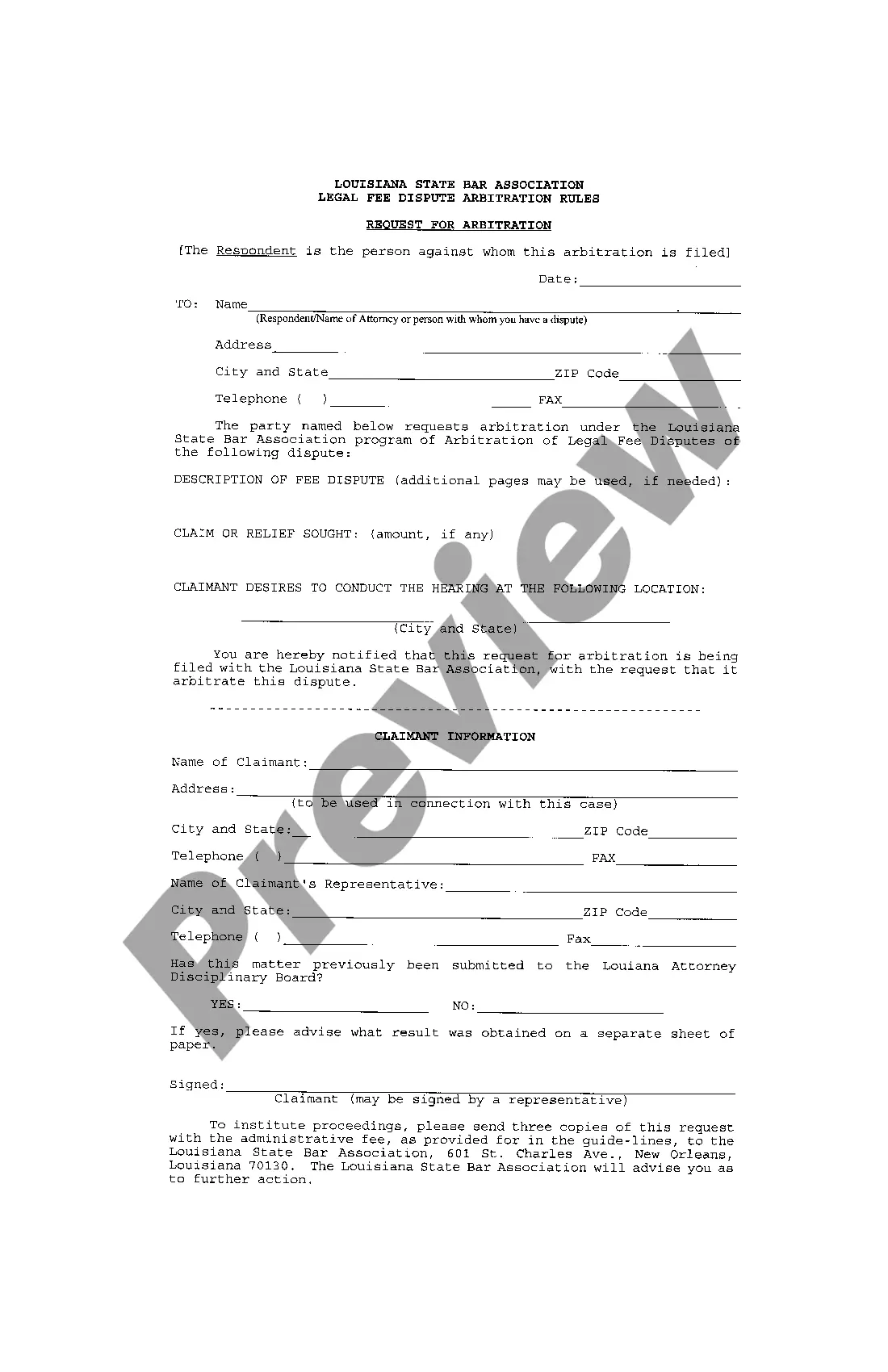

How to fill out Harris Texas Proposal To Amend Stock Purchase Plan?

Drafting papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Harris Proposal to amend stock purchase plan without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Harris Proposal to amend stock purchase plan on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Harris Proposal to amend stock purchase plan:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

You're free to do as you please with the shares after they're transferred into your name. You can sell, trade, exchange, transfer, or donate them. But disposing of ESPP shares triggers tax consequences that depend on three factors: how long you've owned the stock, the selling price, and how many shares are sold.

Under Rule 10b5-1, directors and other major insiders in the company?large shareholders, officers, and others who have access to MNPI?can establish a written plan that details when they can buy or sell shares at a predetermined time on a scheduled basis.

You may be surprised to learn that it is possible to commit crimes on accident. Some people unintentionally engage in white collar criminal acts, specifically insider trading, making it increasingly important to address what insider trading is and how to best prevent an accidental accusation.

Insider trading is the trading of a company's securities by individuals with access to confidential or material non-public information about the company. Taking advantage of this privileged access is considered a breach of the individual's fiduciary duty.

When you leave, your stock options will often expire within 90 days of leaving the company. If you don't exercise your options, you could lose them. Here's what you need to know about stock options and what you should do with them when leaving a job.

After Rule 10b5-1 was enacted, the SEC staff publicly took the position that canceling a planned trade made under the safe harbor does not constitute insider trading, even if the person was aware of the inside information when canceling the trade.

Can a Rule 10b5-1 plan be terminated? It is not advisable for the trader to terminate a Rule 10b5-1 plan except under unusual circumstances. Termination of a plan, by itself, is not a violation of Rule 10b-5 because the termination does not occur in connection with the sale or purchase of securities.

NQSOs can be transferred during your lifetime to family members, trusts for your benefit, or charities, provided the employer's plan allows for such transfers. A gift of NQSOs is complete only when the employee stock option is vested.

Yes, it is possible to transfer stocks and other investments from one brokerage account to another. There are many reasons that you might want to do this. For example, you might have started a new job that uses a different company for its retirement accounts.

The sender or the person gifting the stock can transfer ownership of all, or a portion, of their stock holdings for a particular company. Many brokers also offer the ability to transfer shares as a gift periodically.