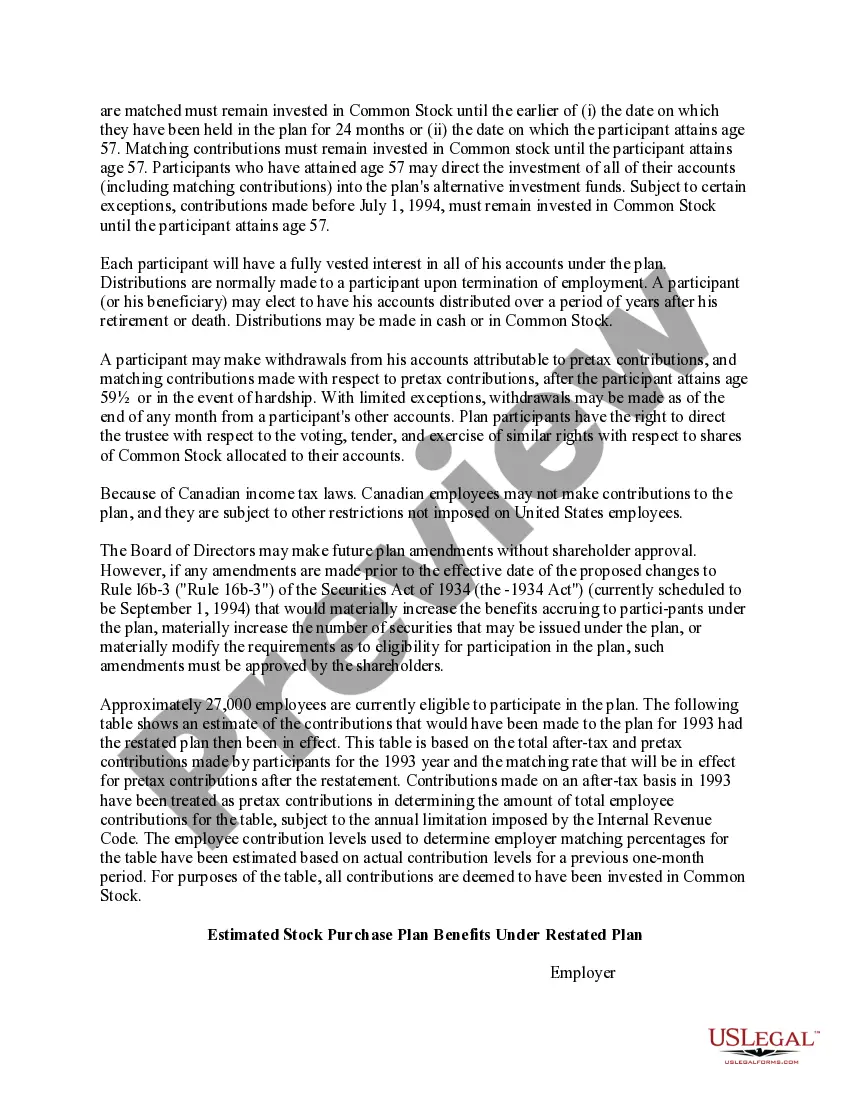

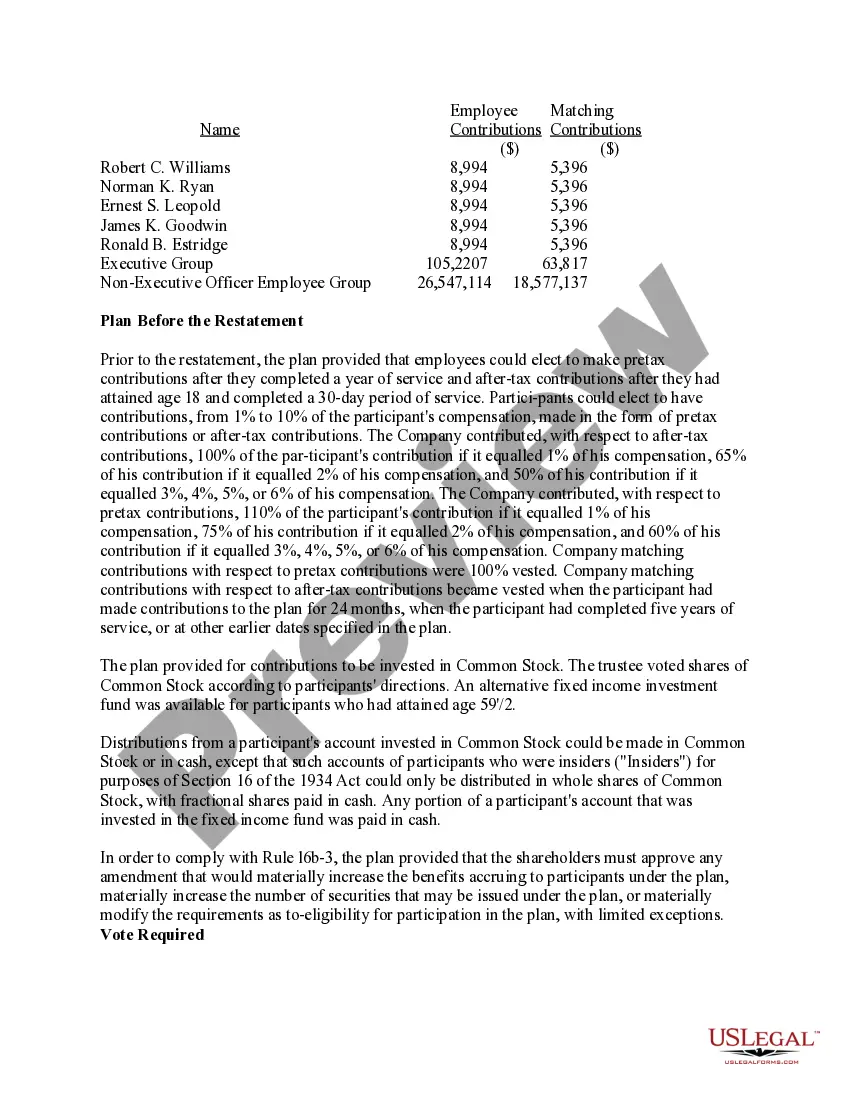

Orange California Proposal to amend stock purchase plan

Description

How to fill out Orange California Proposal To Amend Stock Purchase Plan?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Orange Proposal to amend stock purchase plan without professional help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Orange Proposal to amend stock purchase plan on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Orange Proposal to amend stock purchase plan:

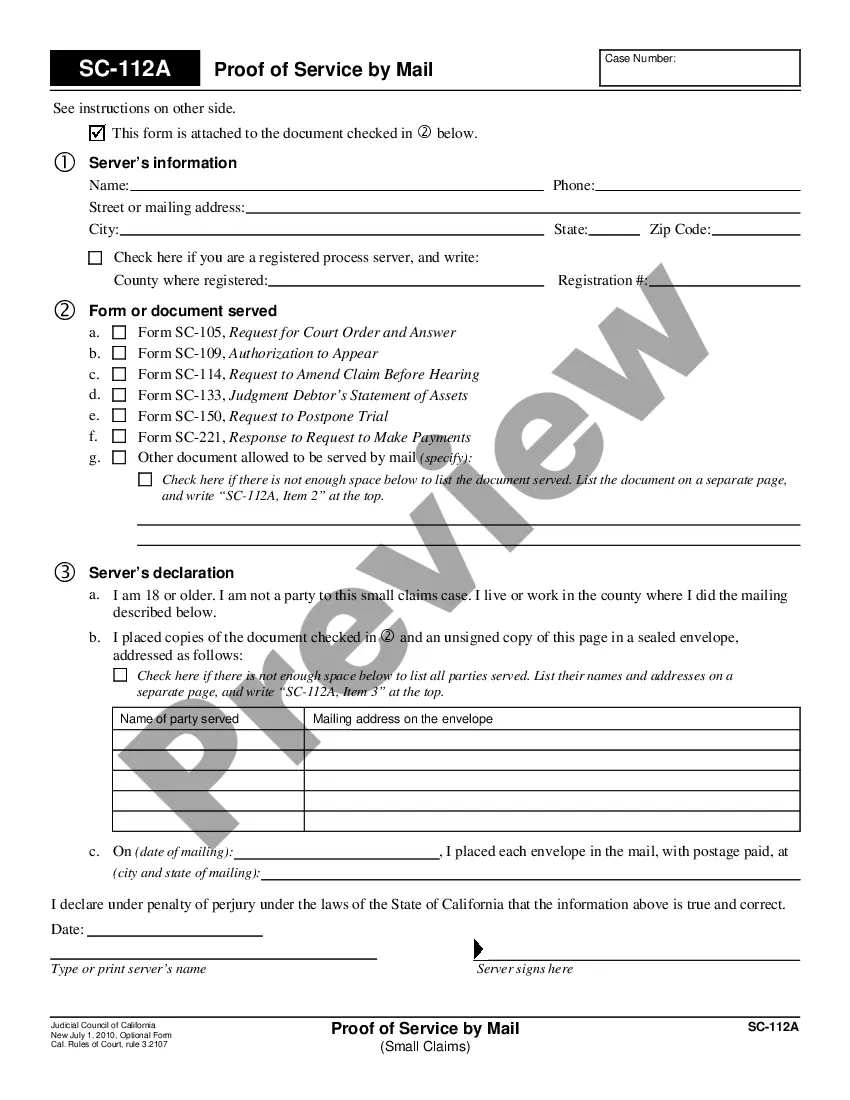

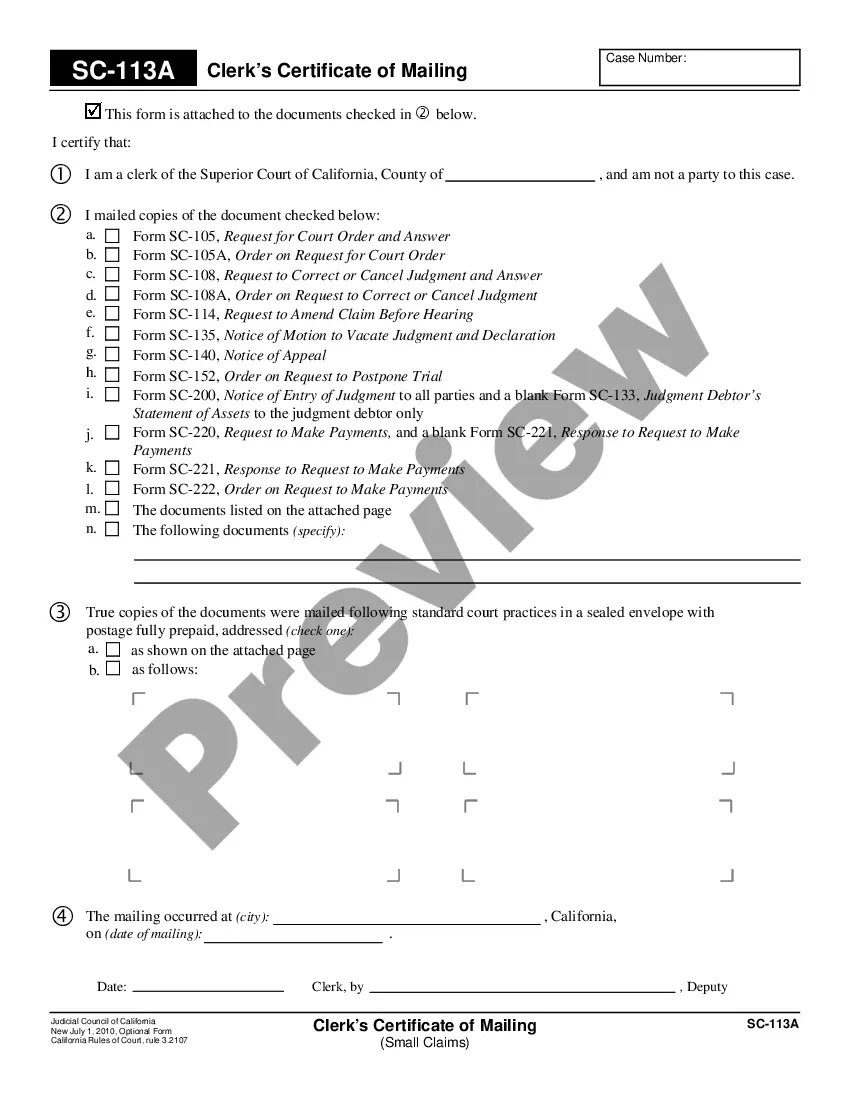

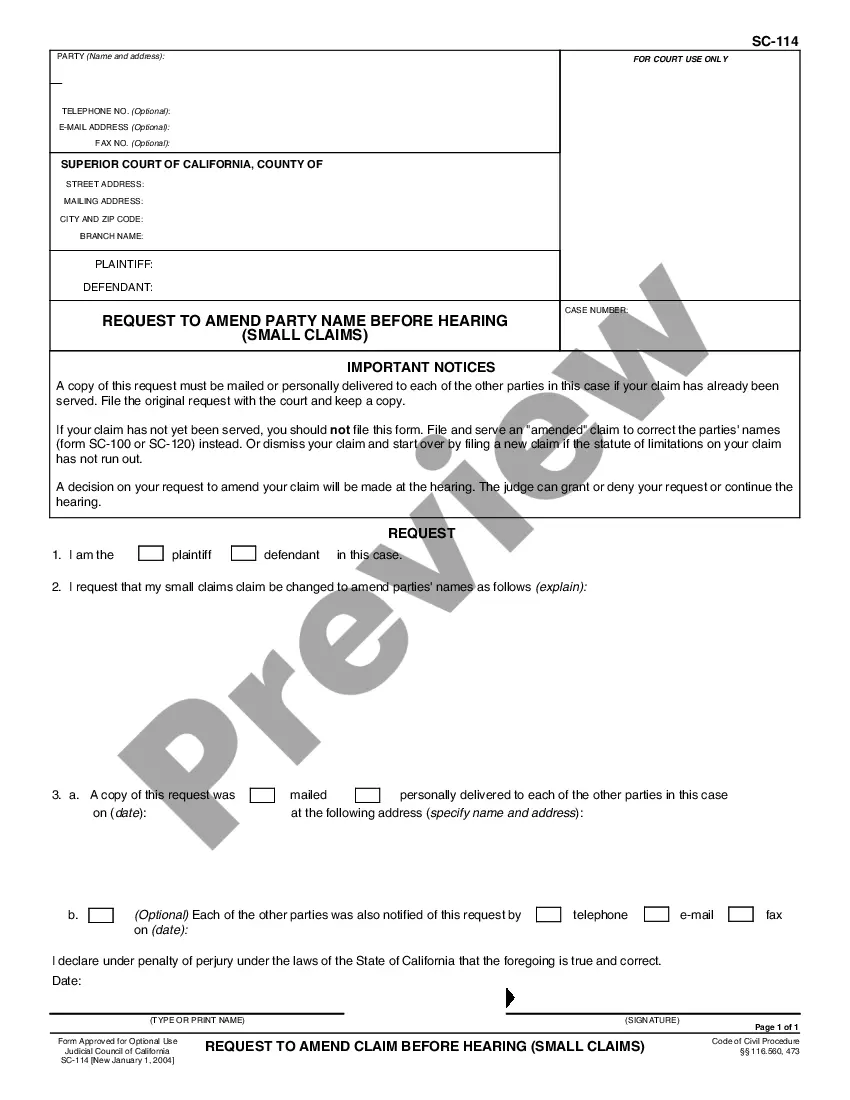

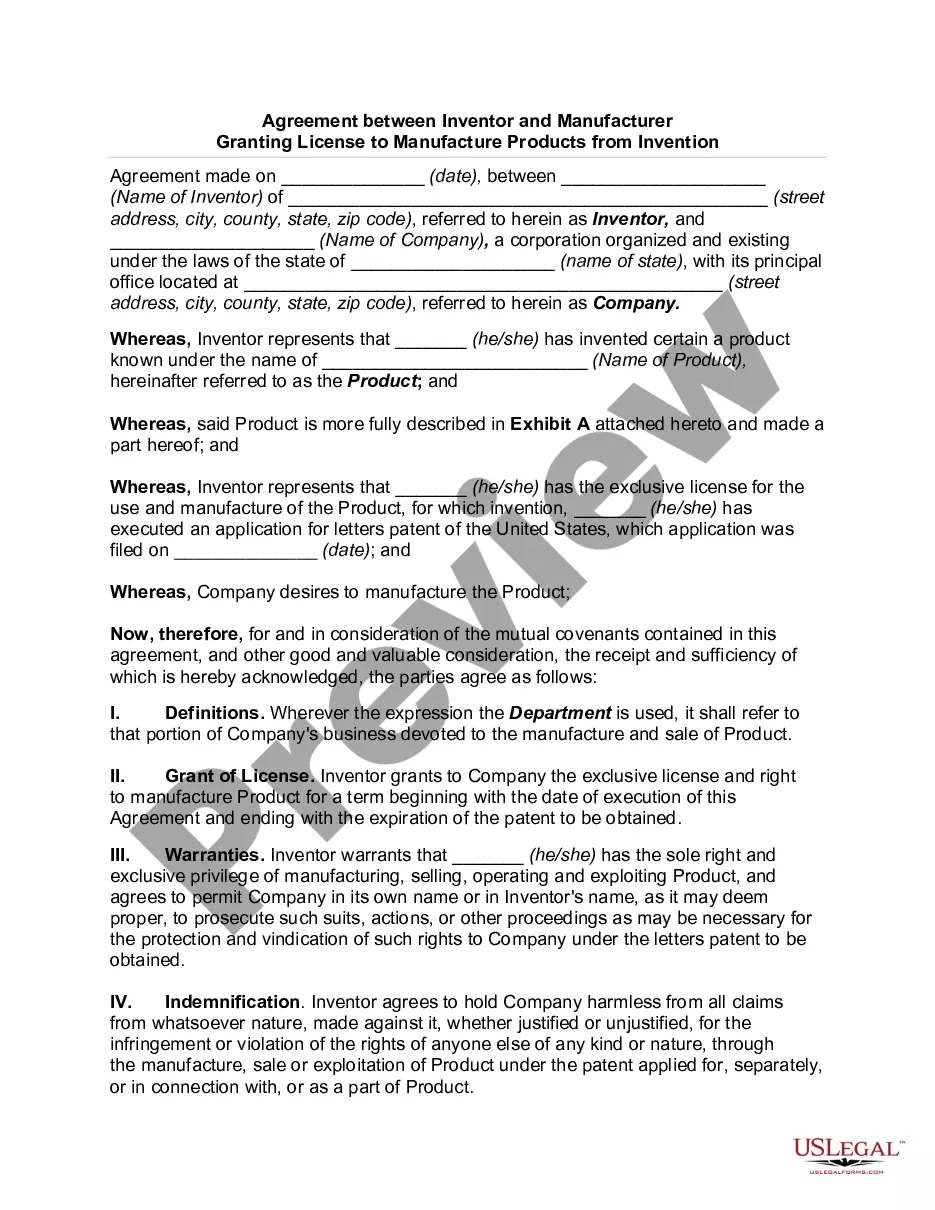

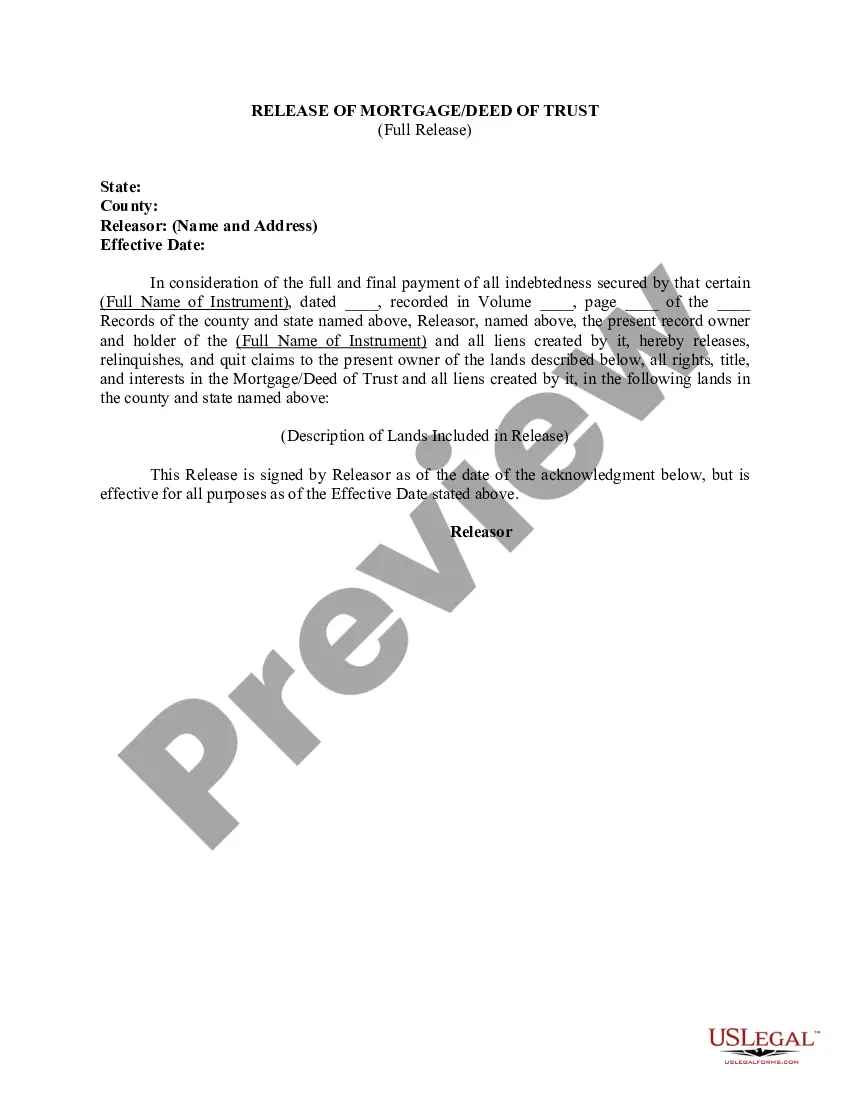

- Examine the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

Paying tax twice on the discount. With ESPPs, the purchase discount is reported to the IRS on Form W-2 and is included in your income in the year of sale. Thus, when you sell the shares, do not make the purchase price your cost basis when you complete Form 8949 to report the sale.

An ESPP allows you to purchase company stock at a discounted price, often between 5-15% off the fair market value. For example, if the fair market value on the applicable date is $10 per share, and your plan offers a 15% discount, you can purchase those shares for $8.50 per share.

To get a favorable tax treatment, you have to hold the shares purchased under a Section 423 plan at least one year after the purchase date, and two years after the grant date. Q. How am I taxed in my ESPP? A.

In a nutshell: Owning company shares is a HUGE benefit, especially when you manage those shares to their greatest advantage. As a general recommendation, we suggest selling 80% to 90% of your ESPP shares immediately after purchase and using the proceeds to improve your financial situation in other ways.

You may withdraw from the ESPP by notifying Fidelity and completing a withdrawal election. When you withdraw, all of the contributions accumulated in your account will be returned to you as soon as administratively possible and you will not be able to make any further contributions during that offering period.

Original cost basis is the acquisition cost you paid for an investment, plus commissions and any fees. Adjusted cost basis is the original cost basis plus any adjustments due to the following: ? Stock plan and ESPP transactions. ? Corporate actions. ? Wash sales.

IRS Form 3922 Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c) is for informational purposes only and is not entered into your return. You will need this information when you sell the stock, so the form should be kept for your records.

They can only report the unadjusted basis ? what the employee actually paid. To avoid double taxation, the employee must use Form 8949. The information needed to make this adjustment will probably be in supplemental materials that come with your 1099-B.

An ESPP allows you to purchase company stock at a discounted price, often between 5-15% off the fair market value. For example, if the fair market value on the applicable date is $10 per share, and your plan offers a 15% discount, you can purchase those shares for $8.50 per share.

If you have to make an AMT adjustment, increase the basis in the stock by the AMT adjustment. Doing this ensures when the stock is sold in the future, the taxable gain for AMT purposes is limited, which means you don't pay tax twice on the same amount.