Cook Illinois is a well-known transportation company based in Illinois. They provide various services such as school bus transportation, charter services, and shuttle services. As part of their business operations, Cook Illinois offers a Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers. This agreement outlines the terms and conditions for purchasing restricted stock within Cook Illinois. The Cook Illinois Sample Restricted Stock Purchase Agreement is a legally binding document that establishes the rights and obligations of Intermark, Inc. and the purchasers. It ensures that the purchasers have a clear understanding of their investment in Cook Illinois and protects their interests. This agreement is crucial in providing transparency and clarity on the stock purchasing process. There are different types of Cook Illinois Sample Restricted Stock Purchase Agreements available between Intermark, Inc. and Purchasers. Some common examples include: 1. Initial Public Offering (IPO) Restricted Stock Purchase Agreement: This type of agreement is executed when Cook Illinois goes public and offers its stock to the public for the first time. It outlines the conditions and restrictions associated with purchasing restricted stock during the IPO process. 2. Private Placement Restricted Stock Purchase Agreement: In certain cases, Cook Illinois may offer restricted stock to a select group of investors through a private placement. This agreement specifies the terms and conditions for purchasing restricted stock in this private offering, including any limitations or requirements imposed by Cook Illinois. 3. Secondary Market Restricted Stock Purchase Agreement: Sometimes, existing stockholders or employees of Cook Illinois may sell their restricted stock to other interested parties. This agreement governs the terms and conditions of such secondary market transactions, ensuring a smooth and regulated process for purchasing restricted stock. Regardless of the specific type, Cook Illinois Sample Restricted Stock Purchase Agreements between Intermark, Inc. and Purchasers outline important details such as the number of shares being purchased, the purchase price, any vesting provisions, transfer restrictions, and other relevant terms and conditions. Investors and purchasers should carefully review the specific agreement that applies to their situation to understand their rights, obligations, and restrictions associated with purchasing restricted stock in Cook Illinois. It is always recommended seeking legal advice to ensure compliance with all applicable laws and regulations.

Cook Illinois Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers

Description

How to fill out Cook Illinois Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Cook Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Cook Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers from the My Forms tab.

For new users, it's necessary to make some more steps to get the Cook Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers:

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Common Stock Agreement means an agreement executed by a Common Stockholder and the Company as contemplated by Section 5, below, which imposes on the shares of Common Stock held by the Common Stockholder such restrictions as the Board or Committee deem appropriate.

Once an asset purchase is complete, the assets and liabilities that have been purchased are moved to the new entity and the old entity (and any assets or liabilities it still owns) must be wound down. In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.

RSUs provide an incentive for employees to stay with a company for the long term and help it perform well so that their shares increase in value.

A Restricted Stock Agreement places a limit on a stockholder's ability to sell stock on the open market. 0Imagine a company is worth $20 million and the company wants to issue new employee a 1% stock interest in the company.

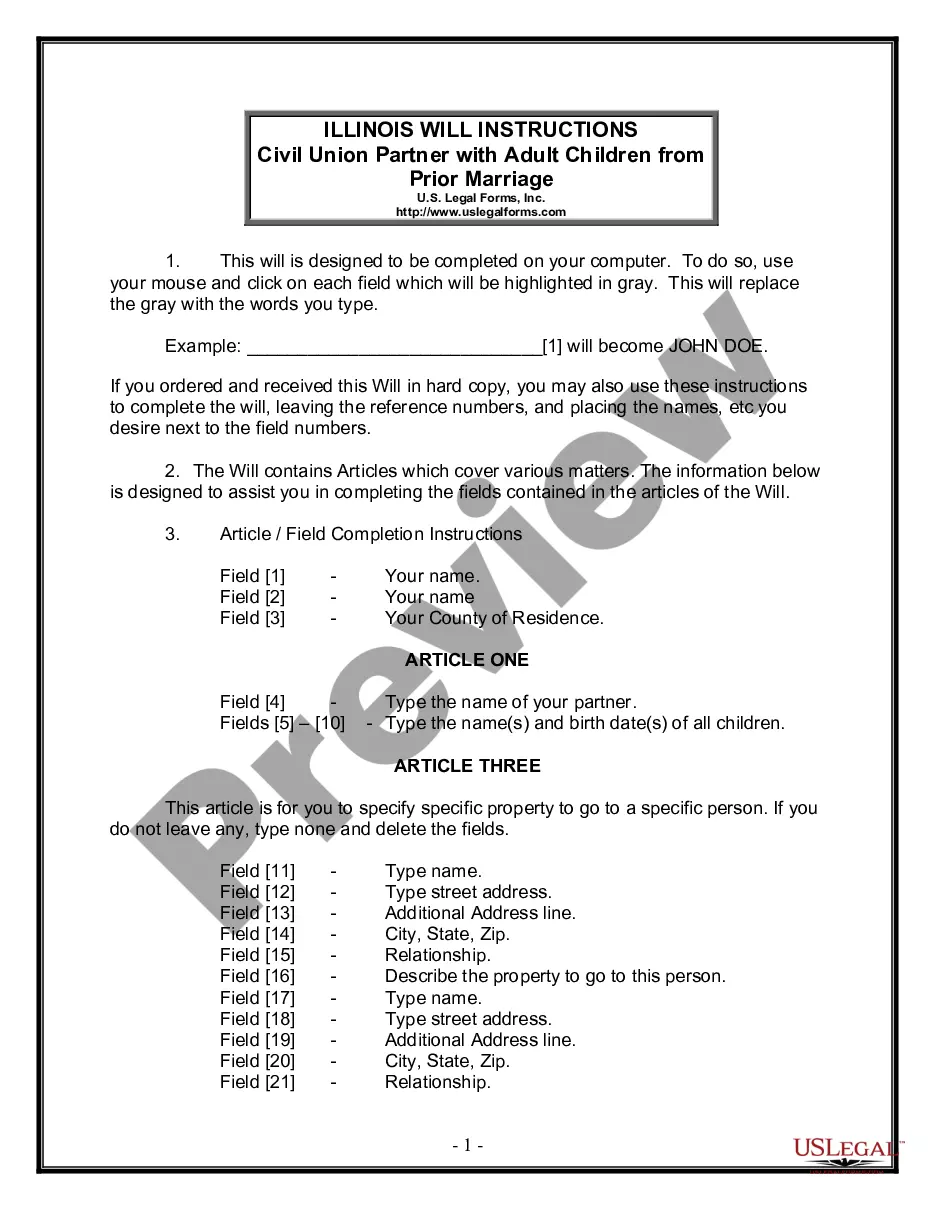

Stock Purchase Agreement: Everything You Need to Know Name of company. Purchaser's name. Par value of shares. Number of shares being sold. When/where the transaction takes place. Representations and warranties made by purchaser and seller. Potential employee issues, such as bonuses and benefits.

Restricted stock refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates, such as executives and directors. Restricted stock is non-transferable and must be traded in compliance with special Securities and Exchange Commission (SEC) regulations.

A stock and asset purchase agreement is a contract between the buyer and seller of a business. It outlines the terms, conditions, and details regarding the sale of shares or ownership interest in an existing company.

The advantages of restricted stock bonus/purchase plans are (1) the employee can make the §83(b) election; (2) the employee is generally entitled to capital gain treatment on sale of vested stock; and (3) the Company gets a wage deduction without paying cash wages.

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.