San Diego, California is a vibrant coastal city located in the southern part of the state. Known for its remarkable beaches, pleasant climate, and a wide range of attractions, San Diego offers residents and visitors an array of experiences. The San Diego, California Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers is a legally binding contract that outlines the terms and conditions of purchasing restricted stock from Intermark, Inc. The agreement sets forth the rights, responsibilities, and restrictions of both Intermark, Inc. as the issuer of the restricted stock, and the Purchasers who are acquiring the stock. Some key elements covered in the agreement include: 1. Identity and Parties: The agreement clearly identifies Intermark, Inc. as the issuing company and provides details of the purchasers involved. 2. Stock Details: It entails a comprehensive description of the restricted stock being purchased, including the class, number of shares, and any relevant restrictions or limitations. 3. Purchase Price and Consideration: The agreement outlines the purchase price of the stock and the payment terms agreed upon by Intermark, Inc. and the purchasers. 4. Transfer Restrictions: It lays out any restrictions on transferring the stock, including lock-up periods, preemptive rights, or any other limitations as deemed necessary. 5. Representations and Warranties: Both parties provide assurances regarding their authority to enter into the agreement, the accuracy of the information provided, and compliance with any applicable laws or regulations. 6. Termination: The circumstances under which the agreement may be terminated by either party are specified, along with the consequences of termination. 7. Governing Law and Jurisdiction: The agreement determines the governing law and jurisdiction that will apply in case of any disputes or controversies. While there might not be different types of San Diego California Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers, the agreement itself can be customized based on the specific needs and requirements of the parties involved.

San Diego California Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers

Description

How to fill out San Diego California Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, finding a San Diego Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. In addition to the San Diego Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your San Diego Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers:

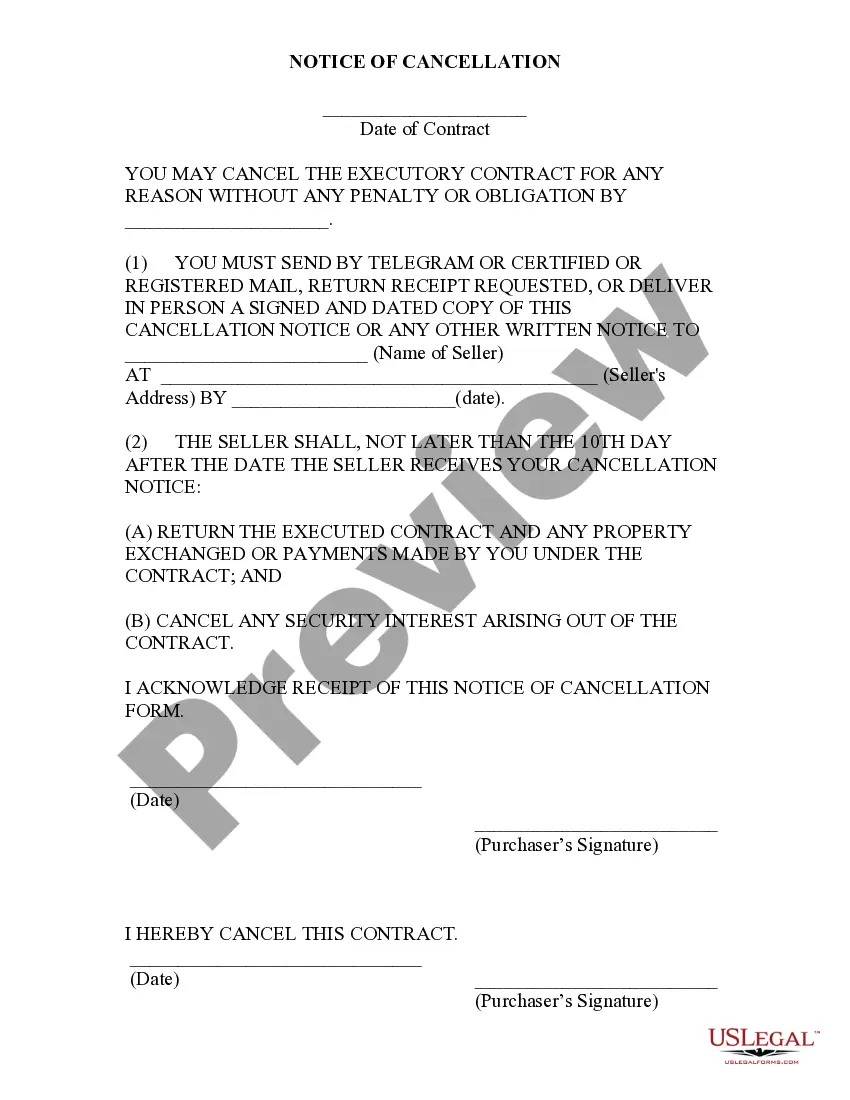

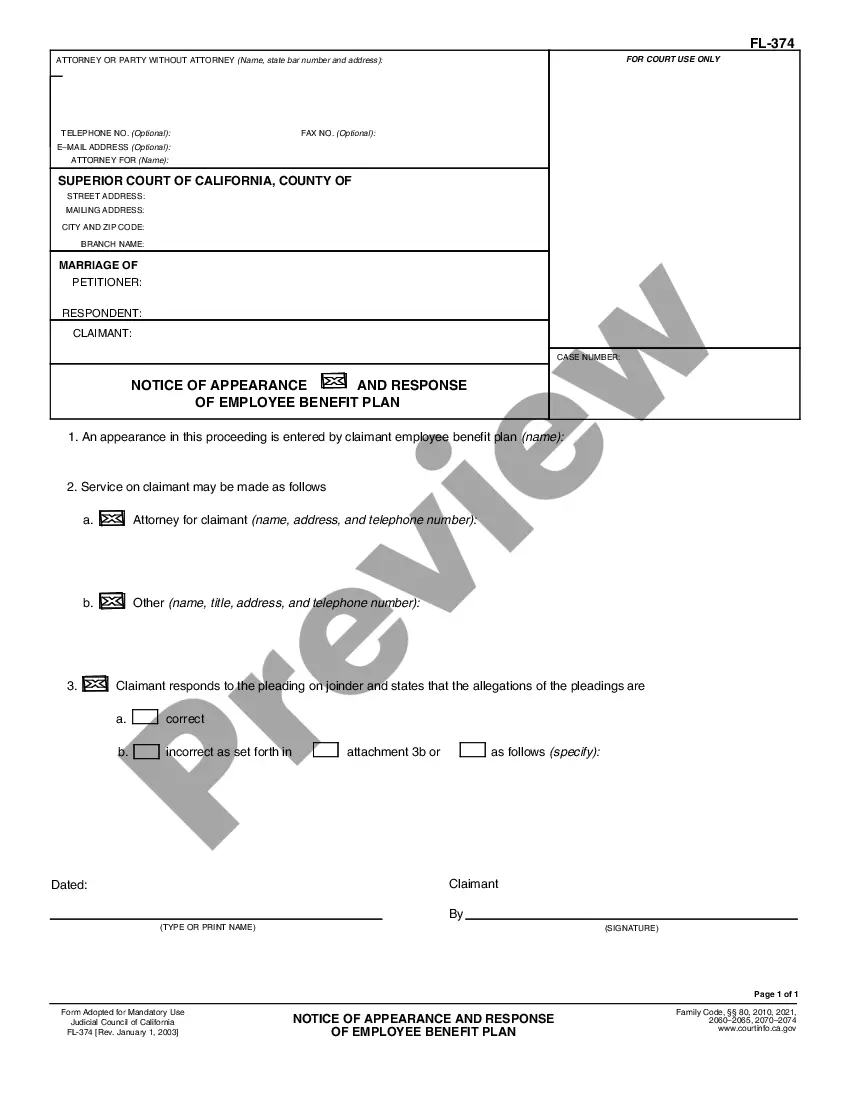

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the San Diego Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Stock Purchase Agreement: Everything You Need to Know Name of company. Purchaser's name. Par value of shares. Number of shares being sold. When/where the transaction takes place. Representations and warranties made by purchaser and seller. Potential employee issues, such as bonuses and benefits.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Stock purchase agreements are important because they put the terms of a sale into writing. This can prevent misunderstandings that may end up in the courtroom. The agreement also allows the seller to show and explain that they are the owner of the stock being sold.

Stock Purchase Agreement Name of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder.

A founder stock purchase agreement is an agreement that documents ownership of a company in its beginning stages. This legal contract is not mandatory but is beneficial to establish a shareholder's stake in the company and determine the terms and conditions of that ownership.

Restricted Stock Purchase Agreement means a written agreement between the Company and the Optionee evidencing the terms and restrictions applying to stock purchased under a Stock Purchase Right. The Restricted Stock Purchase Agreement is subject to the terms and conditions of the Plan and the Notice of Grant.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

Founders use restricted stock to ensure that each of the other founders continues to contribute to the corporation. Imagine, for instance, that a corporation's stock is split between five founders.

A securities purchase agreement sets out the terms for the purchase of company-issued securities by one or more investors making a minority investment in the company (see Practice Note, Minority Investments: Overview).