Oakland Michigan Stock Purchase Plan with Exhibit of Ban corporation: An In-depth Overview Introduction: The Oakland Michigan Stock Purchase Plan is an investment opportunity offered by Ban corporation, a renowned financial institution operating in Oakland County, Michigan. This comprehensive plan allows individuals to purchase stocks of Ban corporation, thereby becoming shareholders and gaining potential benefits from the company's financial performance. Through this plan, participants can acquire shares of Ban corporation stock, which can yield long-term returns and potentially increase their wealth. Features of the Oakland Michigan Stock Purchase Plan: 1. Accessibility: The Oakland Michigan Stock Purchase Plan is available to both existing Ban corporation employees and eligible investors outside the company. This inclusive approach allows a wider demographic to become part of the plan, sharing in the potential success of Ban corporation. 2. Investment Flexibility: Participants in the stock purchase plan have the freedom to choose the amount they wish to invest. Whether a small or large investment, individuals can contribute according to their financial capability and objectives. 3. Employee Incentives: Ban corporation provides an additional advantage to its employees by offering special incentives under the company's Employee Stock Purchase Plan (ESPN). Through this plan, employees can allocate a portion of their salary towards purchasing Ban corporation stock at a discounted price, thereby encouraging employee engagement and further aligning their interests with the company's success. 4. Dividend Reinvestment: The stock purchase plan facilitates the reinvestment of dividends earned from Ban corporation shares. This means that rather than receiving cash dividends, participants have the option to reinvest them into additional shares, potentially enhancing their investment over time. 5. Stock Holding Period: The Oakland Michigan Stock Purchase Plan establishes a minimum holding period for purchased shares. This encourages participants to invest for the long term and have a vested interest in the company's performance beyond short-term gains. Types of Oakland Michigan Stock Purchase Plans: 1. Open Enrollment Plan: This type of plan is available to both Ban corporation employees and eligible external investors during specific enrollment periods, typically once or twice a year. Participants can sign up during the designated period to become shareholders. 2. Continuous Enrollment Plan: This plan allows employees to enroll in the stock purchase plan at any time throughout the year. It provides greater flexibility for interested employees to join, irrespective of specific enrollment periods, ensuring ongoing accessibility to the plan. Conclusion: The Oakland Michigan Stock Purchase Plan with the exhibit of Ban corporation provides a means for both employees and eligible external investors to become shareholders of Ban corporation. With its accessibility, investment flexibility, employee incentives, dividend reinvestment, and stock holding requirements, this plan offers an opportunity to benefit from the potential growth and financial success of Ban corporation. Whether through the open enrollment or continuous enrollment plan, participants can engage in the plan and potentially enhance their financial position through long-term investment in Ban corporation stock.

Oakland Michigan Stock Purchase Plan with exhibit of Bancorporation

Description

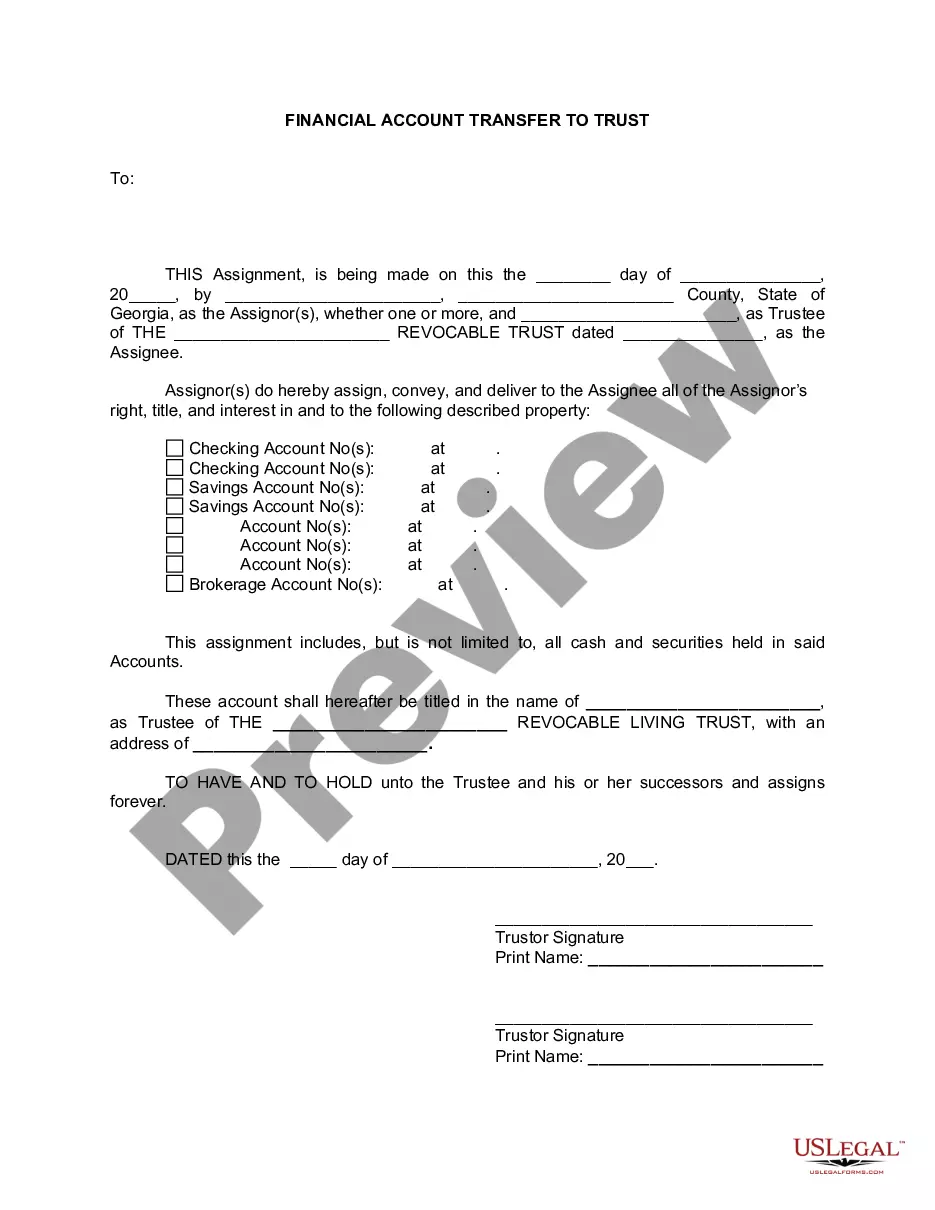

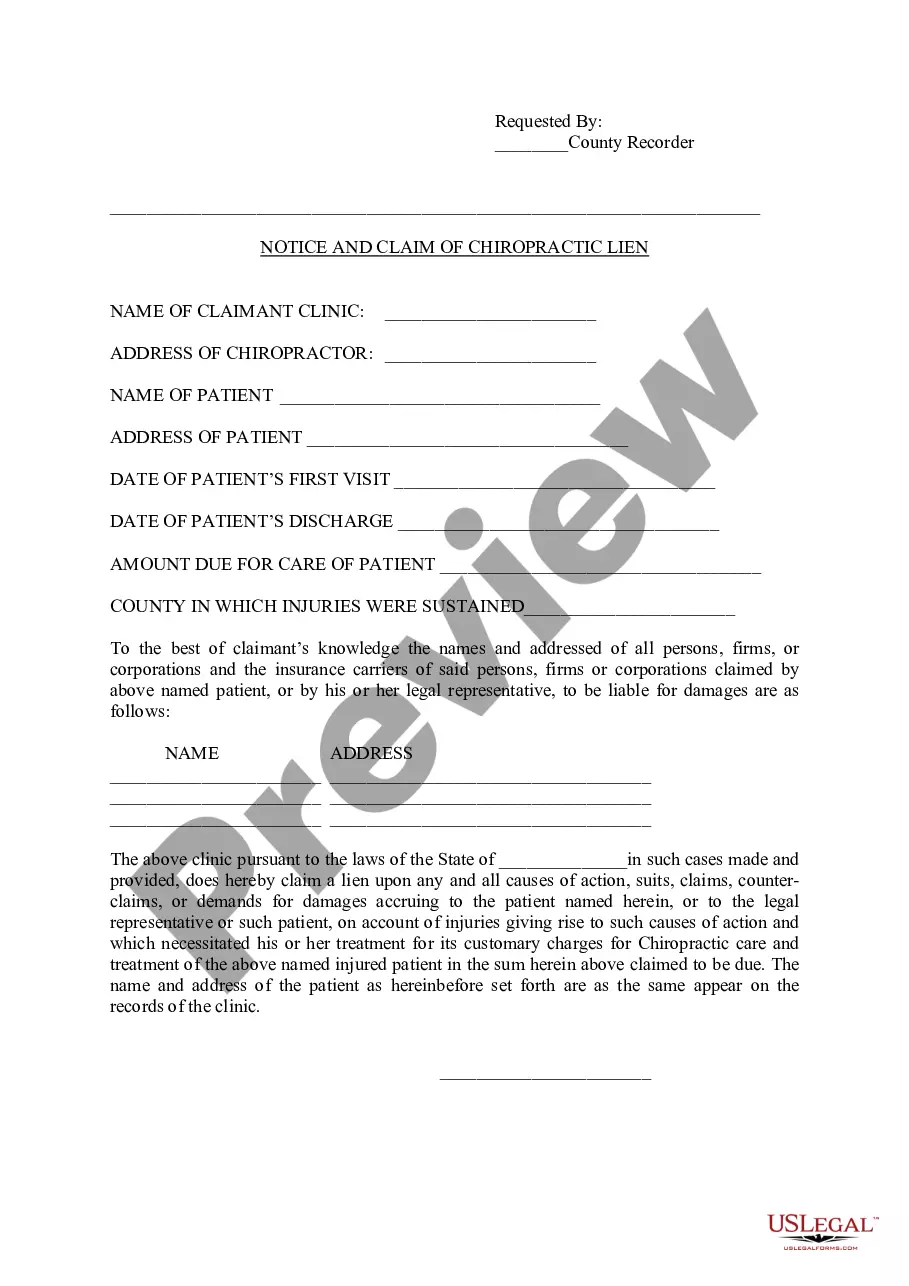

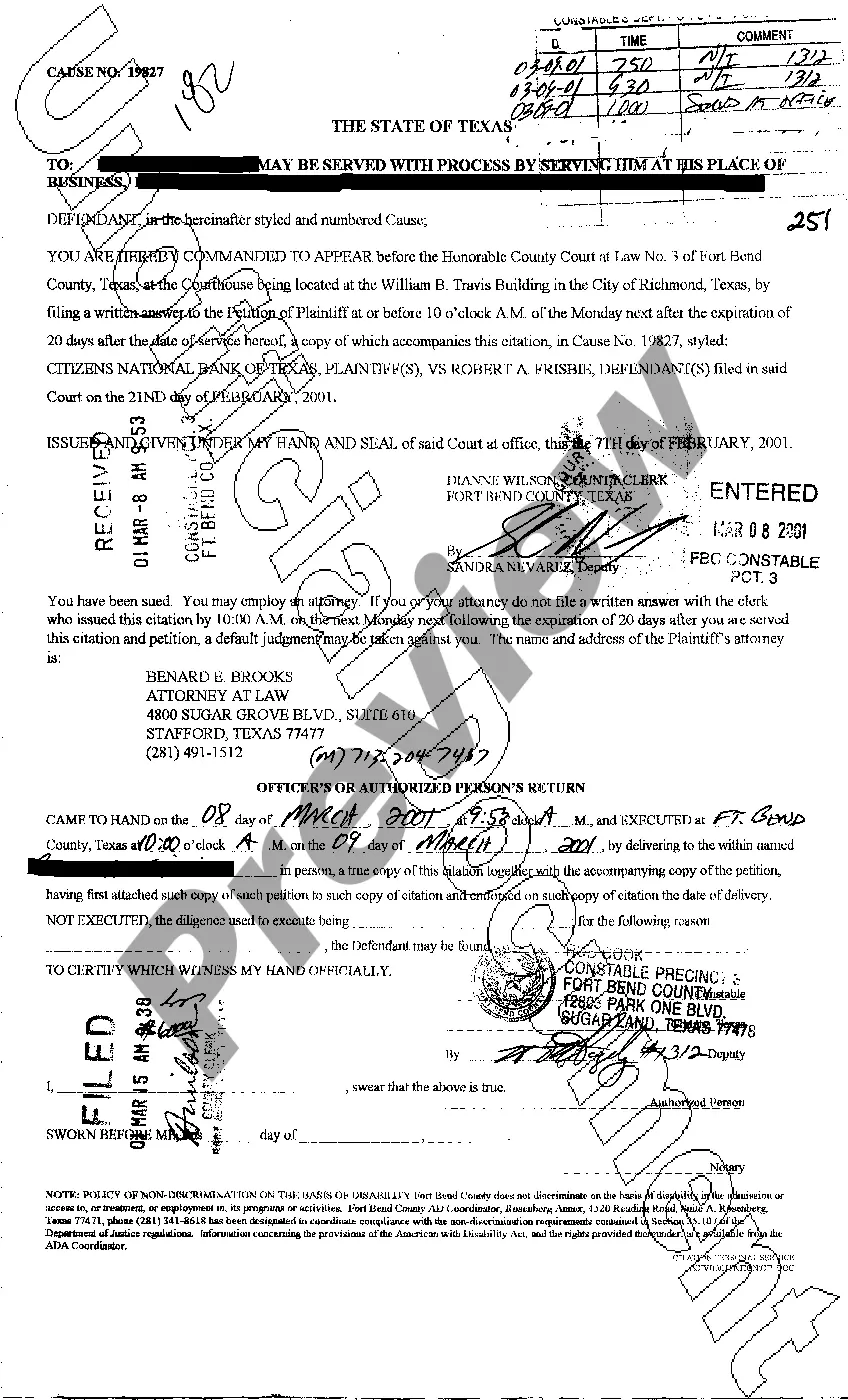

How to fill out Oakland Michigan Stock Purchase Plan With Exhibit Of Bancorporation?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Oakland Stock Purchase Plan with exhibit of Bancorporation, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Consequently, if you need the recent version of the Oakland Stock Purchase Plan with exhibit of Bancorporation, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Oakland Stock Purchase Plan with exhibit of Bancorporation:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Oakland Stock Purchase Plan with exhibit of Bancorporation and save it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

When you sell ESPP shares, your employer reports your ESPP income as wages in box 1 of your Form W-2. ESPPs have no withholding for income tax, and Social Security and Medicare taxes do not apply. Whether you had a qualified or disqualified disposition determines how much of the income is on your W-2.

It's sent to you for informational purposes only. However, hang on to Form 3922 as you'll need it to figure your cost basis when you sell your ESPP shares in the future. If you did sell some ESPP shares this year, the transaction will be reported to you on Form 1099-B (usually in early February) .

IRS Form 3922 Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c) is for informational purposes only and is not entered into your return. You will need this information when you sell the stock, so the form should be kept for your records.

With ESPPs, the purchase discount for tax purposes is reported to the IRS on Form W-2 and is included in your income in the year of sale.

1. How does an ESPP work? An ESPP allows you to purchase company stock at a discounted price, often between 5-15% off the fair market value. For example, if the fair market value on the applicable date is $10 per share, and your plan offers a 15% discount, you can purchase those shares for $8.50 per share.

IRS Form 3922 Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c) is for informational purposes only and is not entered into your return. You will need this information when you sell the stock, so the form should be kept for your records.

You must report this amount as compensation income on line 7 of your 2021 Form 1040. You must show the sale of the stock on your 2021 Schedule D. It's considered long-term because more than one year passed from the date acquired (January 2, 2020) to the date of sale (January 20, 2021).

So you must report $225 on line 7 on the Form 1040 as "ESPP Ordinary Income." You must also report the sale of your stock on Schedule D, Part II as a long-term sale. It's long term because there is over one year between the date acquired (6/30/2017) and the date of sale (1/20/2021).

You should report a long-term gain on Schedule D of Form 1040. A short-term gain will typically appear in box 1 of your W-2 as ordinary income, and you should file it as wages on Form 1040.

The Employee Stock Purchase Plan is not subject to the provisions of the Employee Retirement Income Security Act of 1974, popularly known as ERISA, nor is it a qualified plan under Section 401(a) or Section 423 of the Internal Revenue Code of 1986, as amended (the Code).

More info

All Rights Reserved. No information is available. This is the Wader Attack Series Olympic Workout Bench Review and assembly with. All information is subject to change without notice. All rights reserved. No information is available. This is, your search engine for your entertainment, and your business site. This site's main goal is to help you get better!

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.