Fairfax Virginia is proposing to adopt and approve a management stock purchase plan, aiming to provide its management team with the opportunity to purchase company stock at a discounted price as a form of incentive and alignment of interests. This type of stock purchase plan allows eligible managers and executives to buy company shares using their own funds, often using payroll deductions or periodic contributions. Key Benefits of the Fairfax Virginia Management Stock Purchase Plan: 1. Incentivizing Employee Loyalty: By offering discounted stock prices, this plan encourages management team members to have a long-term commitment to the company's success. It aligns their interests with that of the shareholders and encourages them to play an active role in company growth. 2. Employee Retention and Attraction: The stock purchase plan can be an attractive benefit for potential managers, helping to recruit and retain top talent by offering them an opportunity to become shareholders. It creates a sense of ownership and fosters a long-term relationship with the company. 3. Wealth Creation Potential: Participation in the plan not only provides managers the opportunity to acquire shares at a lower price, but they can also benefit from potential capital appreciation, contributing to their personal wealth. 4. Employee Engagement and Motivation: Owning shares in the company can enhance employee motivation and engagement, as managers have a financial stake in the company's performance. This can lead to improved productivity and a heightened sense of responsibility. Types of Fairfax Virginia Management Stock Purchase Plans: 1. Direct Stock Purchase Plan (DSP): This plan allows eligible management team members to buy company shares directly from the company at a discounted price. Typically, this plan provides flexibility in terms of share accumulation and investment. 2. Employee Stock Purchase Plan (ESPN): With an ESPN, eligible managers can purchase shares through regular payroll deductions, usually at a discounted price on pre-tax basis. Participants may have the flexibility to withdraw from the plan at any time. 3. Restricted Stock Units (RSS): In some cases, Fairfax Virginia may offer RSS as part of their management stock purchase plan. RSS is a promise to deliver company shares at a future date upon satisfying certain conditions, such as continued employment or achieving specific performance milestones. This plan may be used to reward and retain managerial talent for the long term. Overall, the proposal to adopt and approve a management stock purchase plan by Fairfax Virginia is an effective way of incentivizing and aligning the interests of their management team by allowing them to become shareholders at a discounted price. It aims to promote loyalty, retention, and engagement while potentially generating wealth for participants.

Fairfax Virginia Proposal to adopt and approve management stock purchase plan

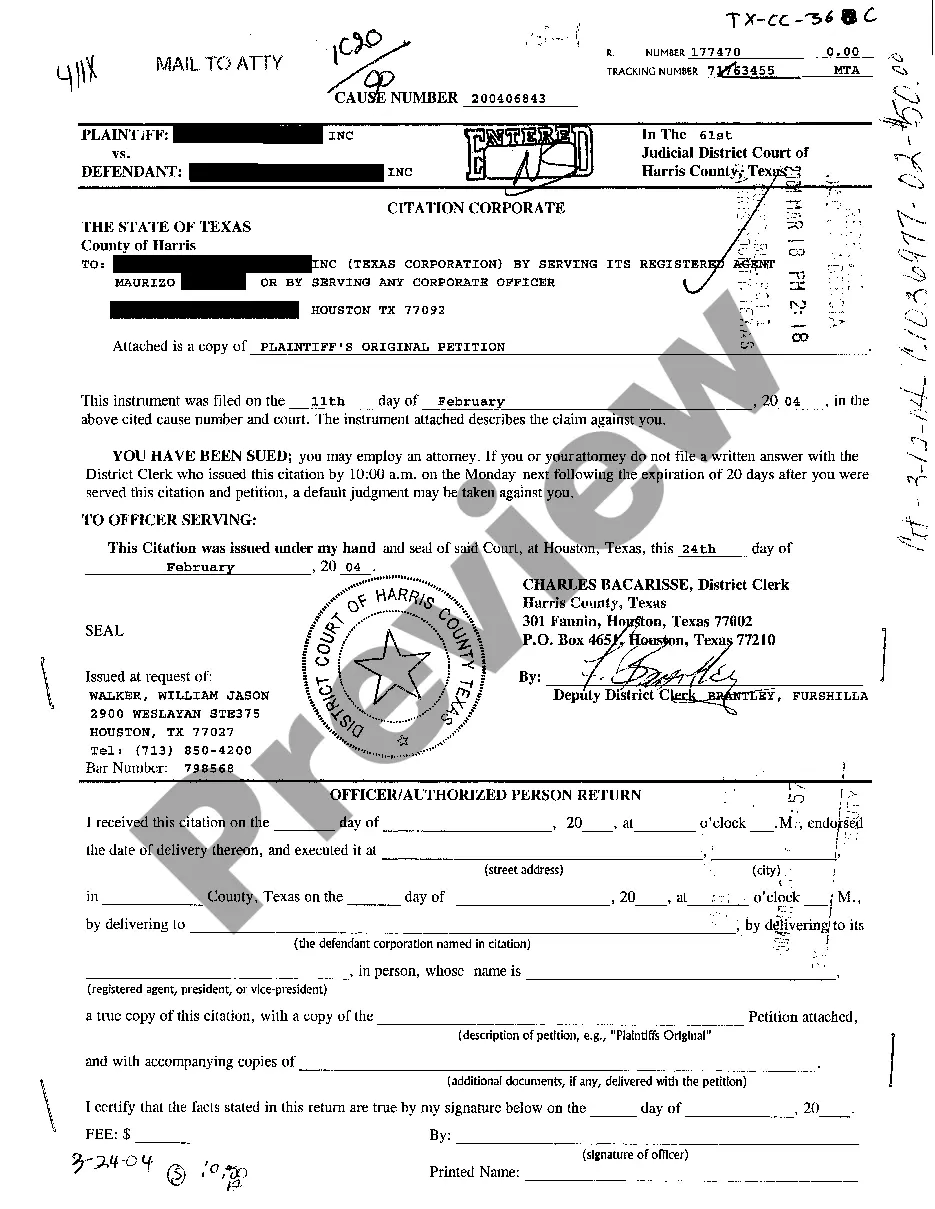

Description

How to fill out Fairfax Virginia Proposal To Adopt And Approve Management Stock Purchase Plan?

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, locating a Fairfax Proposal to adopt and approve management stock purchase plan meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Apart from the Fairfax Proposal to adopt and approve management stock purchase plan, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Fairfax Proposal to adopt and approve management stock purchase plan:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Fairfax Proposal to adopt and approve management stock purchase plan.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!