Oakland, Michigan Proposal to Adopt and Approve Management Stock Purchase Plan The Oakland, Michigan Proposal to adopt and approve a management stock purchase plan aims to provide a mechanism for key employees and executives to acquire company stock, thus aligning their interests with those of the shareholders. This plan allows eligible individuals within the management team to purchase company shares at a discounted price, encouraging loyalty, motivation, and a sense of ownership. The proposal seeks to implement a stock purchase program that includes various types of plans to cater to different management levels and objectives. Some proposed types of stock purchase plans include: 1. Executive Stock Purchase Plan (ESPN): This plan is designed specifically for top-level executives and allows them to purchase company stock at a predetermined price. The ESPN offers a substantial discount to incentivize executives to invest in the company's stock and believe in its long-term growth potential. 2. Management Stock Option Plan: This plan offers eligible management members the opportunity to purchase company stock at a predetermined strike price within a specified time frame. Stock options provide the flexibility to either exercise the option or wait for favorable market conditions to maximize their investment. 3. Restricted Stock Unit (RSU) Plan: Under this plan, select management employees can receive a grant of company stock, subject to certain vesting conditions. RSS offer individuals the right to receive the company's shares at a future date, typically tied to their continued employment or achievement of specific performance goals. 4. Employee Stock Purchase Plan (ESPN): As part of this comprehensive proposal, an ESPN may also be included to allow all eligible employees, both management and non-management, to purchase company shares at a discounted rate, enhancing overall employee engagement and fostering a culture of ownership within the organization. The proposed adoption of these management stock purchase plans in Oakland, Michigan is aimed at attracting and retaining top talent, motivating employees to contribute to the company's success, and fostering a long-term perspective among management members. By providing opportunities for stock ownership, the proposal seeks to align the interests of management with those of the shareholders, promoting positive financial outcomes for all stakeholders involved. Overall, the Oakland, Michigan Proposal to adopt and approve management stock purchase plans establishes a framework to incentivize management employees with ownership opportunities, thus encouraging loyalty, dedication, and collaboration towards achieving the company's growth objectives.

Oakland Michigan Proposal to adopt and approve management stock purchase plan

Description

How to fill out Oakland Michigan Proposal To Adopt And Approve Management Stock Purchase Plan?

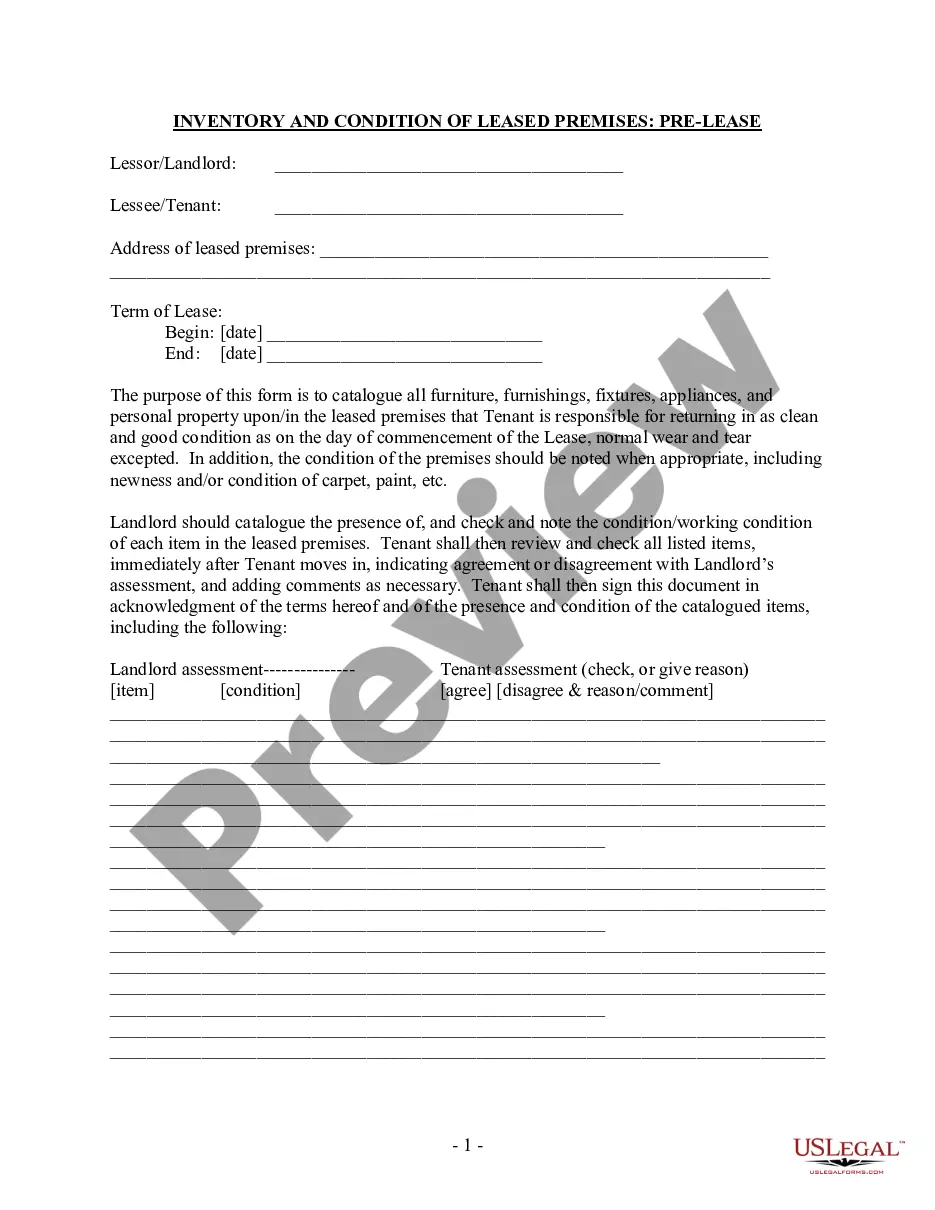

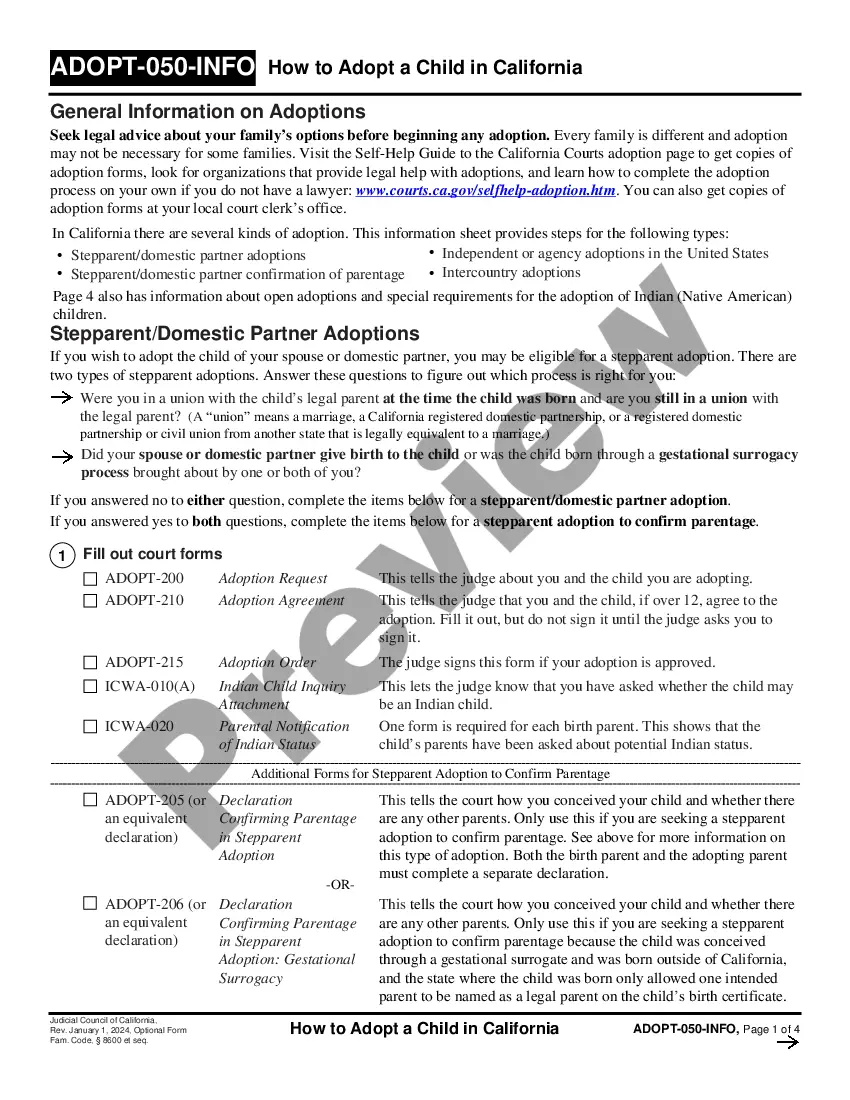

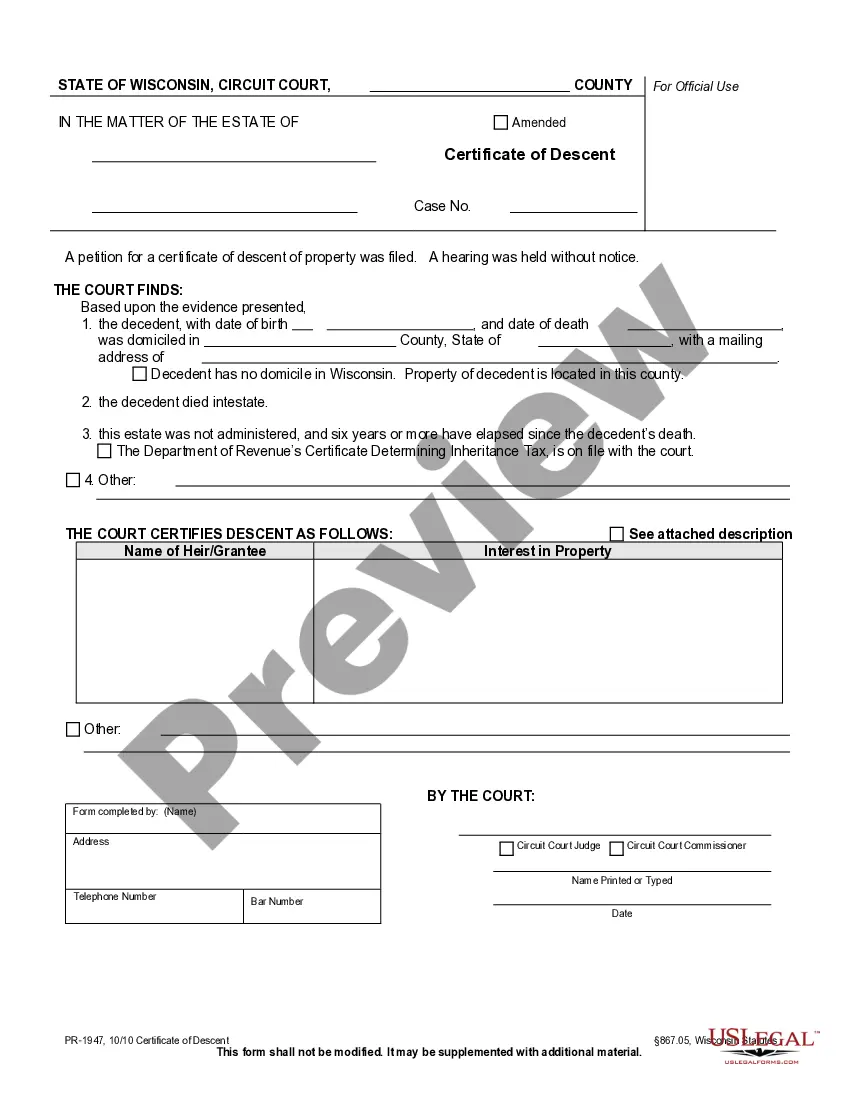

Preparing documents for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Oakland Proposal to adopt and approve management stock purchase plan without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Oakland Proposal to adopt and approve management stock purchase plan by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Oakland Proposal to adopt and approve management stock purchase plan:

- Examine the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

Most commonly, we see people use the ESPP sale proceeds to create an emergency fund, pay off debt, use toward the downpayment on a mortgage, or simply reinvest in other places. The idea is to use those proceeds from selling ESPP shares immediately to further other important long-term financial goals.

You can sell your ESPP plan stock immediately to lock in your profit from the discount. If you hold the company stock for at least a year and sell it for more than two years after the offering date, you pay lower taxes.

An ESOP will probably cost $80,000 to $250,000 to set up and run the first year and, for most companies with fewer than a few hundred employees, $20,000 to $30,000 annually.

Setting Up Your Employee Stock Option Plan Your company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

ESOPs are costly to set up ($80,000 to a few hundred thousand dollars), but less costly than the sale of the company to another buyer. Their ongoing costs are not a significant factor for the large majority of companies.

Steps to Setting Up an ESOP (1) Determine Whether Other Owners Are Amenable.(2) Conduct a Feasibility Study.(3) Conduct a Valuation.(4) Hire an ESOP Attorney.(5) Obtain Funding for the Plan.(6) Establish a Process to Operate the Plan.

How does a withdrawal work in an ESPP? With most employee stock purchase plans, you can withdraw from your plan at any time before the purchase. Withdrawals are made on Fidelity.com or through a representative. However, you should refer to your plan documents to determine your plan's rules governing withdrawals.

When you purchase ESPP shares, you don't owe any taxes. But when you sell the stock, the discount you received on the price is considered additional compensation, so the government will tax it.

You must report this amount as compensation income on line 7 of your 2021 Form 1040. You must show the sale of the stock on your 2021 Schedule D. It's considered long-term because more than one year passed from the date acquired (January 2, 2020) to the date of sale (January 20, 2021).

More info

A total of six federal courts and one state court are listed below and the locations of their offices are found at. The San Francisco–Oakland Bay Bridge, located on California's Golden Gate Bridge, is the world's longest cantilever bridge, spanning over the San Francisco Bay. California's first state court system was established here, in 1855. In addition, the U.S. court system in San Francisco is a court for both civil and criminal issues, based within the state of California. A criminal court for criminal matters is located in San Francisco. U.S. District Court San Francisco, located at, has jurisdiction over the Eastern District of California, Southern District of California, Northern District of California, Central District of California, Western District of California, Eastern Pennsylvania District of Pennsylvania, Southern District of New York, and U.S. District of Minnesota. Additionally, the Western District of North Dakota has jurisdiction over Dakota County.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.