Tarrant Texas Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer

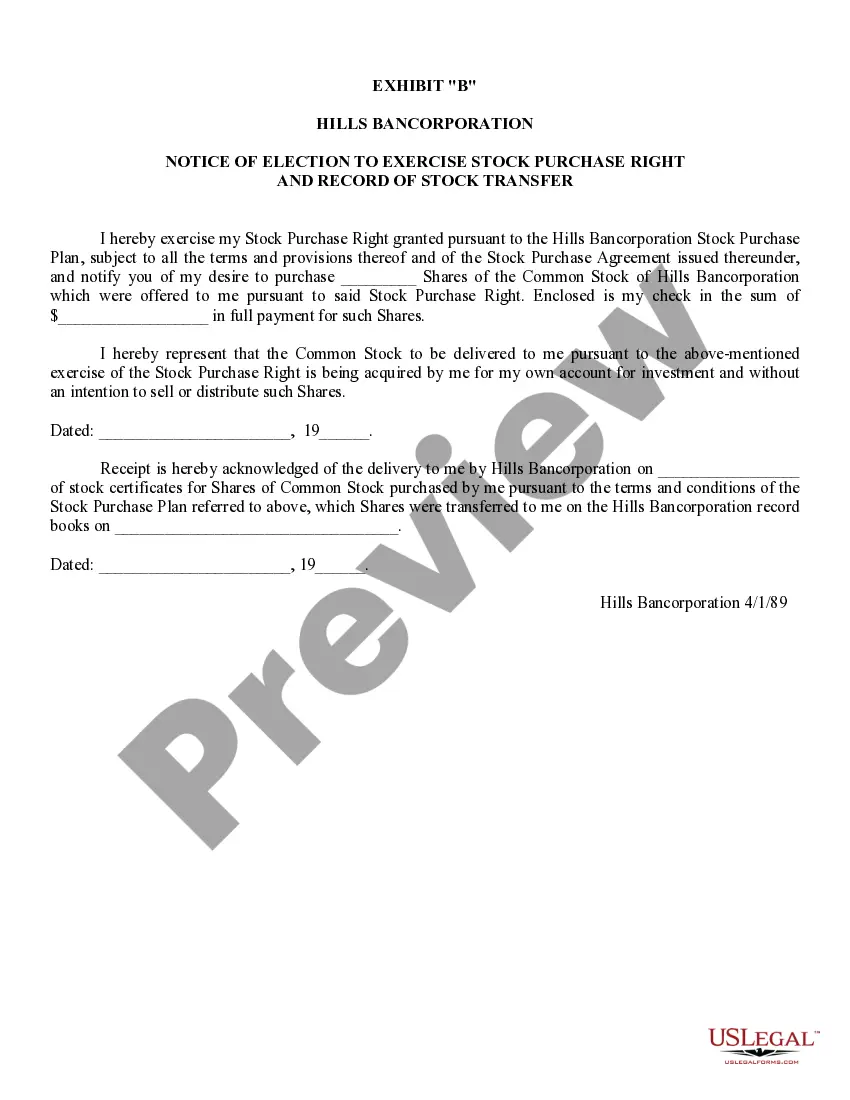

Description

How to fill out Notice Of Election To Exercise Stock Purchase Right And Record Of Stock Transfer?

Legislation and statutes in every domain differ across the nation.

If you're not a lawyer, it's simple to become confused by a variety of standards when it comes to creating legal documents.

To prevent expensive legal fees when drafting the Tarrant Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer, you require a validated template appropriate for your area.

That's the easiest and most economical method to acquire current templates for any legal purposes. Find them all in just a few clicks and maintain your documents in order with the US Legal Forms!

- That's when utilizing the US Legal Forms platform proves to be beneficial.

- US Legal Forms is a reliable online repository of over 85,000 state-specific legal templates.

- It's a superb option for professionals and individuals seeking DIY templates for various personal and business needs.

- All forms can be reused multiple times: once you buy a template, it stays available in your account for future access.

- Hence, when you possess an account with an active subscription, you can simply Log In and retrieve the Tarrant Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer from the My documents section.

- For first-time users, a few additional steps are needed to acquire the Tarrant Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer.

- Examine the webpage content to ensure you have located the correct sample.

- Utilize the Preview option or review the form description if it is provided.

Form popularity

FAQ

Exercising a stock option means purchasing the issuer's common stock at the price set by the option (grant price), regardless of the stock's price at the time you exercise the option.

Form 3921 is an informational report, similar to 1099s, that lets the IRS know that certain individuals/entities received compensation. This makes it easier for the IRS to hold people accountable to the income that they report on their personal/entity income tax return.

You can file form 3921 either by mail or online. If you are required to file 250 or more 3921s, you must file online.

Stock Options It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation. Box 3: Social Security wages (up to the income ceiling)

3921 is an informational form only. It is generally not entered on your tax return unless you then sold the stock, or if you could be subject to alternative minimum tax (AMT). When you receive form 3921, this means that your employer transferred stock to you because you exercised an incentive stock option (ISO).

You have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or loss. However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income.

You'll pay capital gains tax on any increase between the stock price when you sell and the stock price when you exercised. In this example, you'd pay capital gains tax on $5 per share (the $10 sale price minus $5, which was the price of the stock when you exercised).

With nonqualified stock options, for employees the spread at exercise is reported to the IRS on Form W-2 For nonemployees, it is reported on Form 1099-MISC (starting with the 2020 tax year, it will be reported on Form 1099-NEC ). It is included in your income for the year of exercise.

Open market options When you buy an open-market option, you're not responsible for reporting any information on your tax return. However, when you sell an optionor the stock you acquired by exercising the optionyou must report the profit or loss on Schedule D of your Form 1040.