Clark Nevada Management Stock Purchase Plan is a program offered by Clark Nevada Management Inc. that allows eligible employees to purchase company stock at discounted rates. This stock purchase plan is designed to provide employees with an opportunity to invest in the company's growth and potentially benefit from the success of their employer. The Clark Nevada Management Stock Purchase Plan aims to attract and retain talented employees by providing them with an ownership stake in the company. It offers several advantages to eligible employees, such as the ability to purchase stock at a discount, typically below the market price. This discount allows employees to increase their potential returns when the stock price appreciates. The plan operates through payroll deductions, where employees can contribute a specified percentage of their salary towards the purchase of company stock. These deductions are made on an after-tax basis and are accumulated until there is enough to make a stock purchase. The purchased shares are then held in a brokerage account on behalf of the employee. One of the key features of the Clark Nevada Management Stock Purchase Plan is the flexibility it offers to employees. Participants can choose to contribute a fixed percentage of their salary or a specific dollar amount towards stock purchases. This flexibility allows employees to tailor their investment to their own financial goals and risk tolerance. Another type of stock purchase plan offered by Clark Nevada Management is the Employee Stock Ownership Plan (ESOP). An ESOP is a qualified retirement plan that invests primarily in the company's stock. It allows employees to become partial owners of the company and participate in its growth and success. The Clark Nevada Management Stock Purchase Plan and ESOP provide employees with an opportunity to build wealth through stock ownership. By participating in these plans, employees can potentially benefit from the company's performance and have a personal stake in its success. In summary, the Clark Nevada Management Stock Purchase Plan is a program that enables eligible employees to purchase company stock at discounted rates. It offers advantages such as a lower purchase price and flexibility in contribution amounts. Additionally, the company also offers an ESOP, which focuses on retirement planning and allows employees to become partial owners of the company.

Clark Nevada Management Stock Purchase Plan

Description

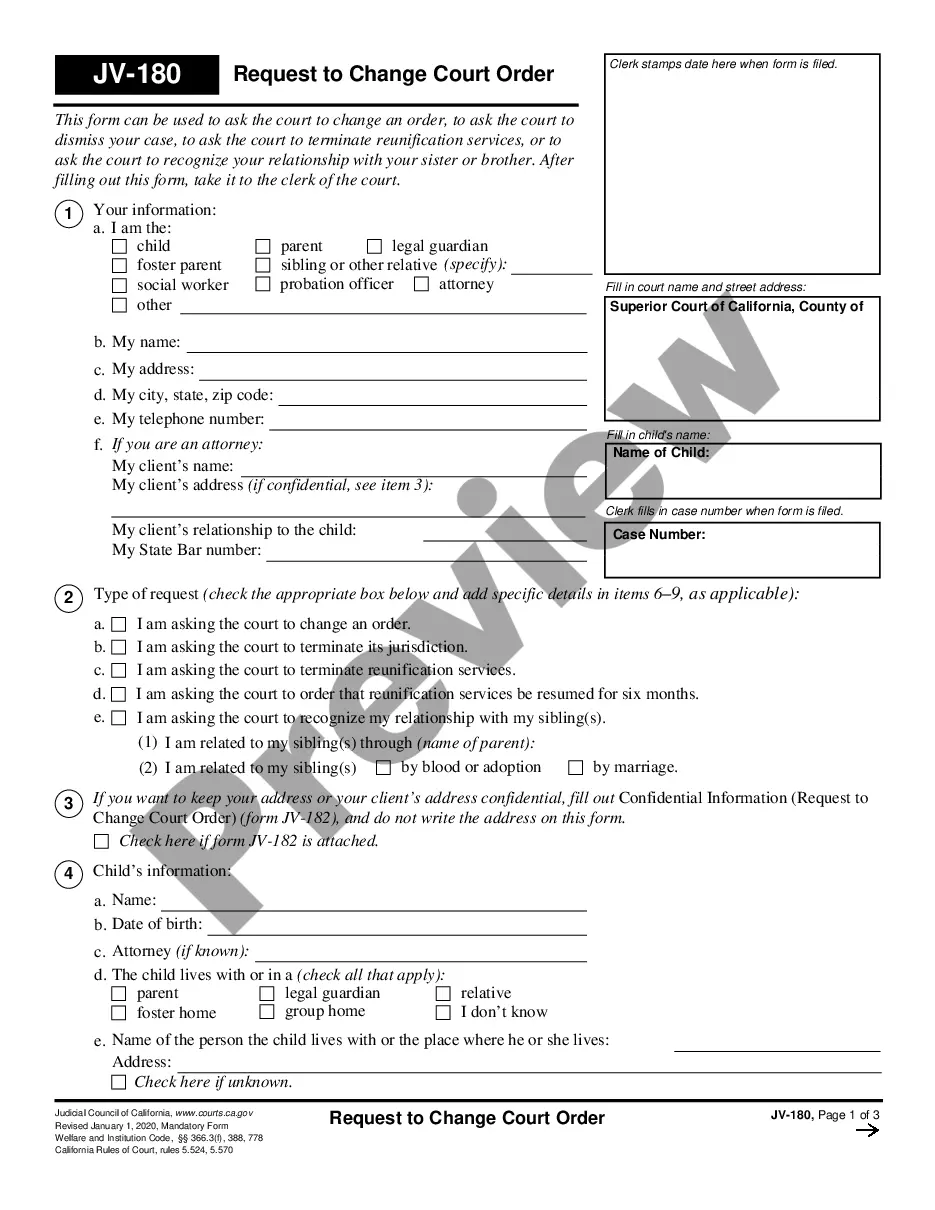

How to fill out Clark Nevada Management Stock Purchase Plan?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life sphere, locating a Clark Management Stock Purchase Plan suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Clark Management Stock Purchase Plan, here you can get any specific form to run your business or individual affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Clark Management Stock Purchase Plan:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Clark Management Stock Purchase Plan.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Investing in an ESPP can be a good idea, but it should complement your financial goals. These goals can be either long-term or short-term objectives for your overall financial health. Depending on when you buy and sell your shares, your ESPP could fit well into both.

Your contributions into the plan will be directly pulled from payroll at each pay period and accumulate in your ESPP account. At the end of the period, on the purchase date, the money will be used to purchase shares of your company stock at a discount to their market value.

These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

An ESPP allows you to purchase company stock at a discounted price, often between 5-15% off the fair market value. For example, if the fair market value on the applicable date is $10 per share, and your plan offers a 15% discount, you can purchase those shares for $8.50 per share.

An employee stock purchase plan (ESPP) is a benefit that allows people to buy stock in the company they work for at a discounted price. Large companies or public corporations sometimes offer these plans, and they use the sum of their total employee contributions to make a large investment in the company.

With most employee stock purchase plans, you can withdraw from your plan at any time before the purchase.

Can you lose money on an ESPP? This is one of those things that surprises people it's possible to lose money on an ESPP. You're buying shares of stock, and the value of ESPP shares can go up or down very quickly. A 15% drop in price can eliminate the value from participating in the plan in the first place.

#11 How much should I put in an employee stock purchase plan? You can contribute 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. The more disposable income you have, the more you can afford to put in an employee stock purchase plan.