Clark Nevada Approval of Employee Stock Ownership Plan of Franklin Co. is a regulatory process that involves the review and authorization of an employee stock ownership plan (ESOP) proposed by Franklin Co. It is essential to understand the key elements, benefits, and procedures of this plan before seeking Clark Nevada approval. An ESOP is a qualified retirement plan designed to provide employees with ownership interests in the company they work for. This plan allows employees to acquire shares of company stock over time, either through direct purchase or as a benefit from the company. The Clark Nevada Approval process ensures that the ESOP meets all legal requirements and safeguards the interests of both employees and the company. The Approval of Employee Stock Ownership Plan of Franklin Co. by Clark Nevada involves an in-depth analysis of various factors. These include the structure of the proposed plan, the valuation of the company, the impact on employees' retirement benefits, and compliance with relevant laws and regulations. One type of Clark Nevada Approval of Employee Stock Ownership Plan of Franklin Co. is the initial submission process. Upon initial submission, Franklin Co. presents a comprehensive plan documentation to Clark Nevada, including details such as the purpose of the ESOP, eligibility criteria for employee participation, contributions, vesting schedule, and distribution rules. Additionally, the plan should demonstrate how stock value will be appraised fairly and independently. Another type of approval is the review and evaluation process. Clark Nevada closely examines the ESOP proposal to ensure its compliance with the Employee Retirement Income Security Act (ERICA), the Internal Revenue Code, and other relevant regulations. They assess the adequacy of the plan's provisions for meeting employees' retirement needs, evaluating the long-term sustainability of the ESOP, and ensuring the plan operates in the best interest of the employees. A critical aspect of Clark Nevada Approval is determining the market value of the employer's stock. Independent appraisers evaluate the worth of the company, taking into account its financial performance, growth potential, industry trends, and other pertinent factors. This valuation is essential in establishing fair and accurate stock prices for employee acquisitions. After thorough evaluation, Clark Nevada may grant the Approval of Employee Stock Ownership Plan of Franklin Co. if the proposed ESOP meets all legal requirements and financial standards. This approval is crucial as it allows Franklin Co. to implement the ESOP, providing employees with the opportunity to participate in the company's future growth and success. Overall, the Clark Nevada Approval of Employee Stock Ownership Plan of Franklin Co. ensures a fair and transparent process for establishing an ESOP that benefits both the company and its employees. It upholds legal compliance, protects the interests of workers, and promotes long-term financial security. By encouraging employee stock ownership, Franklin Co. can create a motivated and engaged workforce, fostering loyalty, and driving productivity.

Clark Nevada Approval of Employee Stock Ownership Plan of Franklin Co.

Description

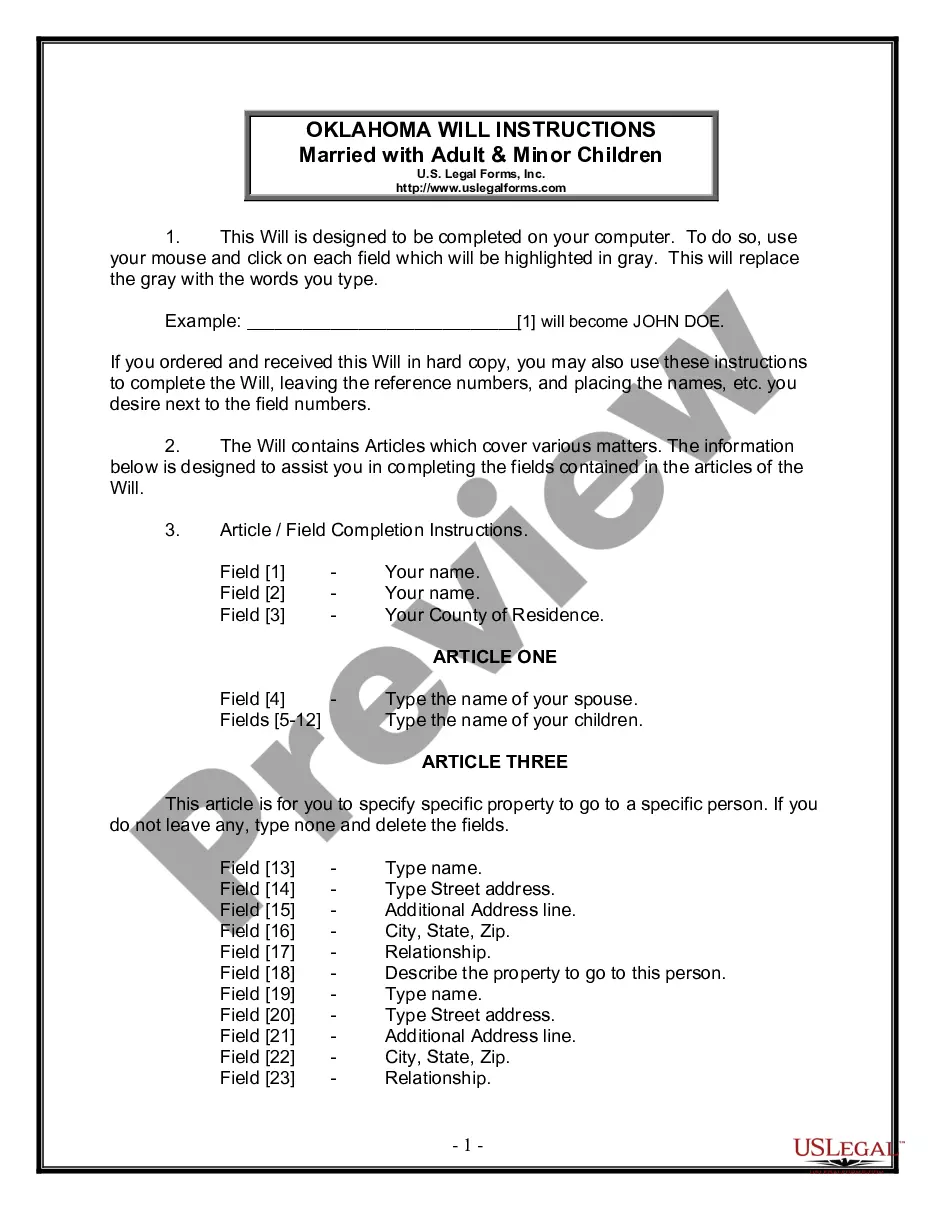

How to fill out Clark Nevada Approval Of Employee Stock Ownership Plan Of Franklin Co.?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Clark Approval of Employee Stock Ownership Plan of Franklin Co., it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Consequently, if you need the current version of the Clark Approval of Employee Stock Ownership Plan of Franklin Co., you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Clark Approval of Employee Stock Ownership Plan of Franklin Co.:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Clark Approval of Employee Stock Ownership Plan of Franklin Co. and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!