Cook Illinois Approval of Employee Stock Ownership Plan of Franklin Co. Cook Illinois, a leading provider of transportation services based in Illinois, has recently announced the approval of an Employee Stock Ownership Plan (ESOP) for Franklin Co. This move signifies Cook Illinois' commitment to enhancing employee engagement, retention, and long-term company growth. The Employee Stock Ownership Plan is a unique and innovative program designed to provide ownership opportunities to employees of Franklin Co., a subsidiary of Cook Illinois. Through this plan, employees will have the opportunity to acquire company stock, which they can hold until retirement or leave the company. This ownership stake will not only provide financial benefits but also foster a sense of loyalty, motivation, and commitment among the employees. The Cook Illinois Approval of Employee Stock Ownership Plan of Franklin Co. aims to drive the company's success by aligning the interests of its employees with the overall objectives of the organization. By making employees actual owners, Cook Illinois seeks to create a culture of shared responsibility and accountability, further enhancing the company's performance and competitive advantage. Under the Cook Illinois Approval of Employee Stock Ownership Plan of Franklin Co., employees will have the opportunity to contribute a portion of their salaries towards purchasing company stock. These contributions will be tax-deductible and allow employees to build a significant ownership stake over time. The stock will be held in a trust on behalf of the employees, with the value of the stock reflecting the company's overall performance. Furthermore, the Cook Illinois Approval of Employee Stock Ownership Plan of Franklin Co. offers several notable advantages for both employees and the company. Firstly, it provides a retirement benefit, allowing employees to accumulate considerable wealth over their career while offering tax advantages compared to traditional retirement plans. Secondly, it incentivizes employees to improve their performance and contribute to the long-term success of the company, as their efforts directly impact the value of their stock ownership. It is worth mentioning that the Cook Illinois Approval of Employee Stock Ownership Plan of Franklin Co. comes in different types tailored to meet the specific needs and goals of different employees. These may include eligibility-based distinctions, varying vesting schedules, and contribution options. This flexibility allows employees at different stages of their careers to participate in the program and reap the associated benefits. In summary, the Cook Illinois Approval of Employee Stock Ownership Plan of Franklin Co. demonstrates the company's commitment to fostering employee engagement, loyalty, and long-term growth. By providing employees with the opportunity to own a stake in the company's success, Cook Illinois aims to align their interests and create a sense of shared responsibility and commitment. This innovative program offers numerous benefits for employees and the business, including tax advantages, retirement benefits, and enhanced performance.

Cook Illinois Approval of Employee Stock Ownership Plan of Franklin Co.

Description

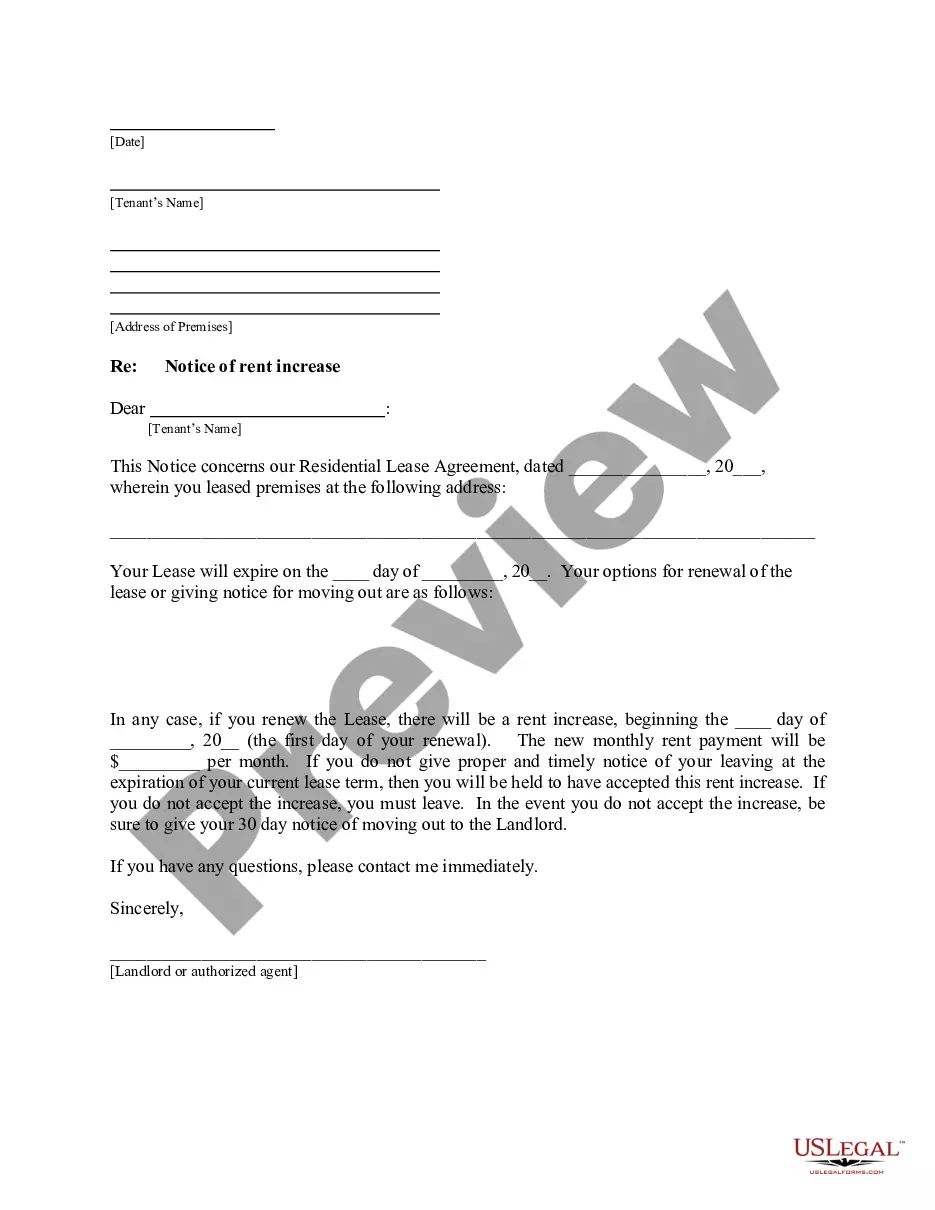

How to fill out Cook Illinois Approval Of Employee Stock Ownership Plan Of Franklin Co.?

If you need to get a reliable legal document supplier to find the Cook Approval of Employee Stock Ownership Plan of Franklin Co., look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it easy to locate and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to look for or browse Cook Approval of Employee Stock Ownership Plan of Franklin Co., either by a keyword or by the state/county the document is intended for. After locating needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Cook Approval of Employee Stock Ownership Plan of Franklin Co. template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less expensive and more affordable. Set up your first business, organize your advance care planning, create a real estate agreement, or execute the Cook Approval of Employee Stock Ownership Plan of Franklin Co. - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

To make a withdrawal or borrow money, contact your plan administrator at the phone number listed on your ESOP statements. You'll typically have to fill out certain forms and will receive a 1099 tax statement at the end of the year.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Hence, the entire value is in the hand of the employee at the time of the vesting. RSUs typically vest over a 1-4 year period. If Raj possesses vested RSUs or restricted stocks, he will continue to have ownership of his shares even after leaving the company as they are already vested and converted into stocks.

Request the distribution forms from the ESOP company. These forms will transfer the shares from the control of the ESOP to you. You will need to fill out the forms completely and sign them. Sell the shares using your broker or online brokerage house if you wish to transfer the vested stock to cash.

The average employee in an ESOP company has accumulated $134,000 from his or her stake in the business, according to a 2018 Rutgers University study. This is 29 percent more than the average 401(k) balance of $103,866 reported by Vanguard the same year.

An employee stock ownership plan (ESOP) gives workers ownership interest in the company. An ESOP is usually formed to allow employees the opportunity to buy stock in a closely held company to facilitate succession planning.

Research by the Department of Labor shows that ESOPs not only have higher rates of return than 401(k) plans and are also less volatile. ESOPs lay people off less often than non-ESOP companies. ESOPs cover more employees, especially younger and lower income employees, than 401(k) plans.

ESOP Withdrawal Age Requirement According to the ESOP withdrawal rules, employees can generally begin taking distributions from the ESOP from the minimum age of 200b59.5 years200b. However, from the age of 200b55200b, some employees can start taking distributions, especially if terminated.

An ESOP can allow cash distributions, however, as long as the employee has the right to demand that benefits be paid in employer stock. Distributions of dividends from employer stock held inside an ESOP are not subject to the early distribution tax, no matter when you receive the dividend.