The Bexar Texas Employee Stock Ownership Plan (ESOP) of Franklin Savings Bank is a comprehensive and attractive retirement benefit program offered to employees of the bank. Highly regarded in the financial industry, the Bexar Texas ESOP allows employees to become partial owners of the bank, providing them with a unique opportunity to build wealth and derive financial benefits through stock ownership. The Bexar Texas ESOP of Franklin Savings Bank operates by allocating shares of the bank's stock to eligible employees based on their respective years of service, compensation levels, or a combination of both. These shares are held in a trust on behalf of the employees until they become eligible to receive them. The trust is managed by a designated trustee, ensuring the safekeeping and integrity of the shares. One key advantage of the Bexar Texas ESOP is that it offers eligible employees a tax-advantaged retirement savings plan. Contributions made to the ESOP are tax-deductible for the bank, while employees are not taxed on their allocated shares until they withdraw funds from the plan upon retirement or other specified events. This tax deferral enables employees to potentially accumulate more wealth in a tax-efficient manner. Another noteworthy feature of the Bexar Texas ESOP is its alignment of employee and company interests. As employees become shareholders, they gain a vested interest in the bank's performance and profitability. This fosters a sense of ownership and motivation among employees, as their hard work and dedication directly contribute to the bank's success. Moreover, the Bexar Texas ESOP nurtures a strong company culture, promoting teamwork, loyalty, and long-term commitment. The Bexar Texas Employee Stock Ownership Plan of Franklin Savings Bank offers several types of plans tailored to employees' needs and preferences. These plans may include: 1. Traditional ESOP: This plan allocates shares to employees as retirement benefits, allowing them to participate in the growth and success of the bank over time. It typically follows a vesting schedule to ensure employees remain with the company for a specific period to fully benefit from their allocated shares. 2. ESOP Plus: This plan incorporates additional company contributions, such as profit-sharing or matching contributions, to enhance employees' retirement savings. It provides an extra incentive for employees to contribute to the ESOP, maximizing their potential wealth accumulation. 3. ESOP Roth Option: This plan allows employees to make after-tax contributions to the ESOP, offering the potential for tax-free withdrawals upon retirement. The Roth option can be an attractive choice for employees seeking tax diversification and flexibility in retirement distributions. In summary, the Bexar Texas Employee Stock Ownership Plan of Franklin Savings Bank is a robust and personalized retirement benefit program that grants employees the opportunity to become plan shareholders. Through tax advantages, alignment of interests, and various plan options, employees can enjoy the financial rewards of ownership and build a secure future.

Bexar Texas Employee Stock Ownership Plan of Franklin Savings Bank - Detailed

Description

How to fill out Bexar Texas Employee Stock Ownership Plan Of Franklin Savings Bank - Detailed?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Bexar Employee Stock Ownership Plan of Franklin Savings Bank - Detailed, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the latest version of the Bexar Employee Stock Ownership Plan of Franklin Savings Bank - Detailed, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Bexar Employee Stock Ownership Plan of Franklin Savings Bank - Detailed:

- Glance through the page and verify there is a sample for your area.

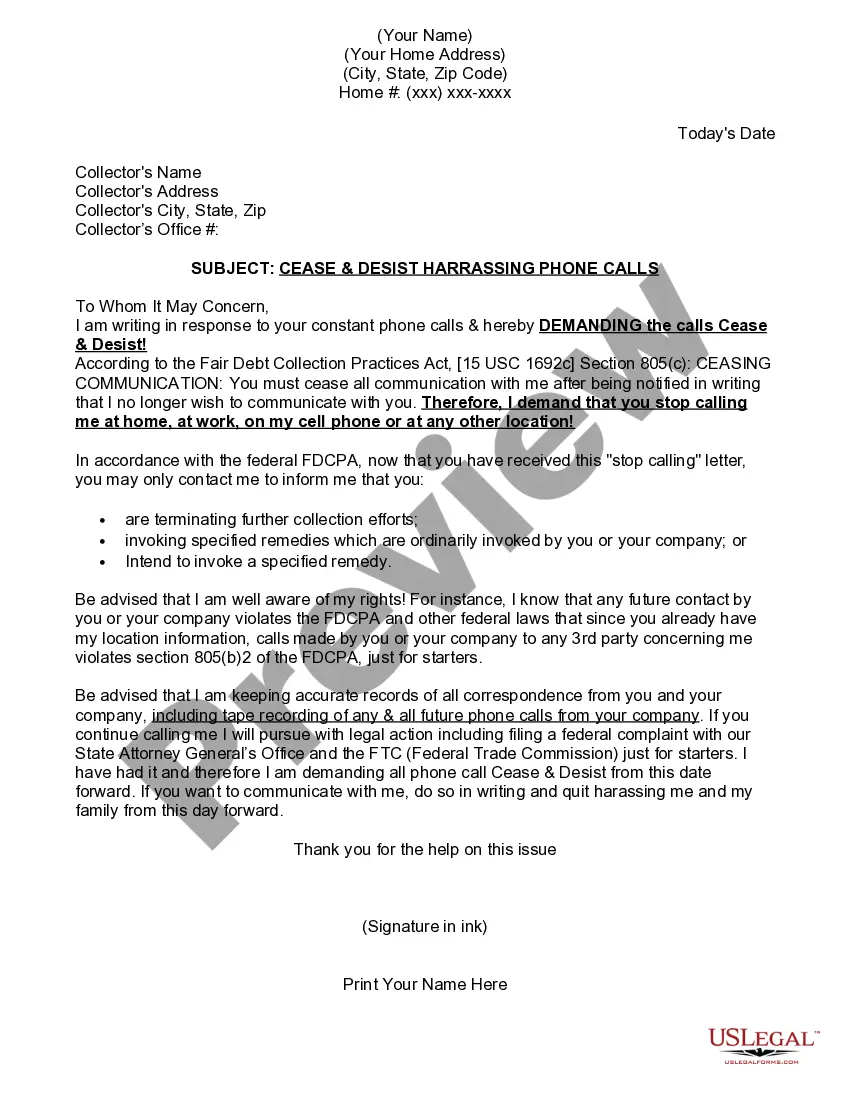

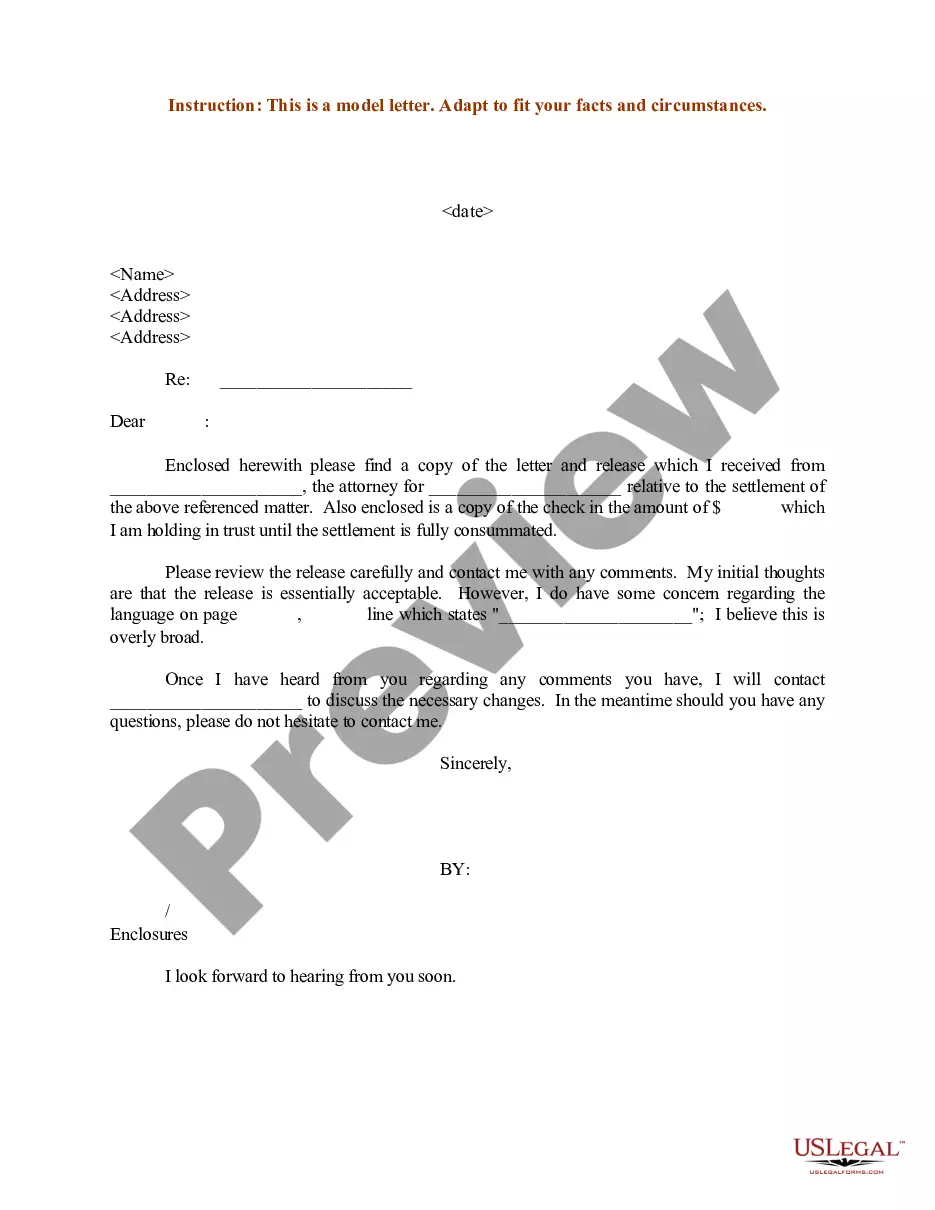

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Bexar Employee Stock Ownership Plan of Franklin Savings Bank - Detailed and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!