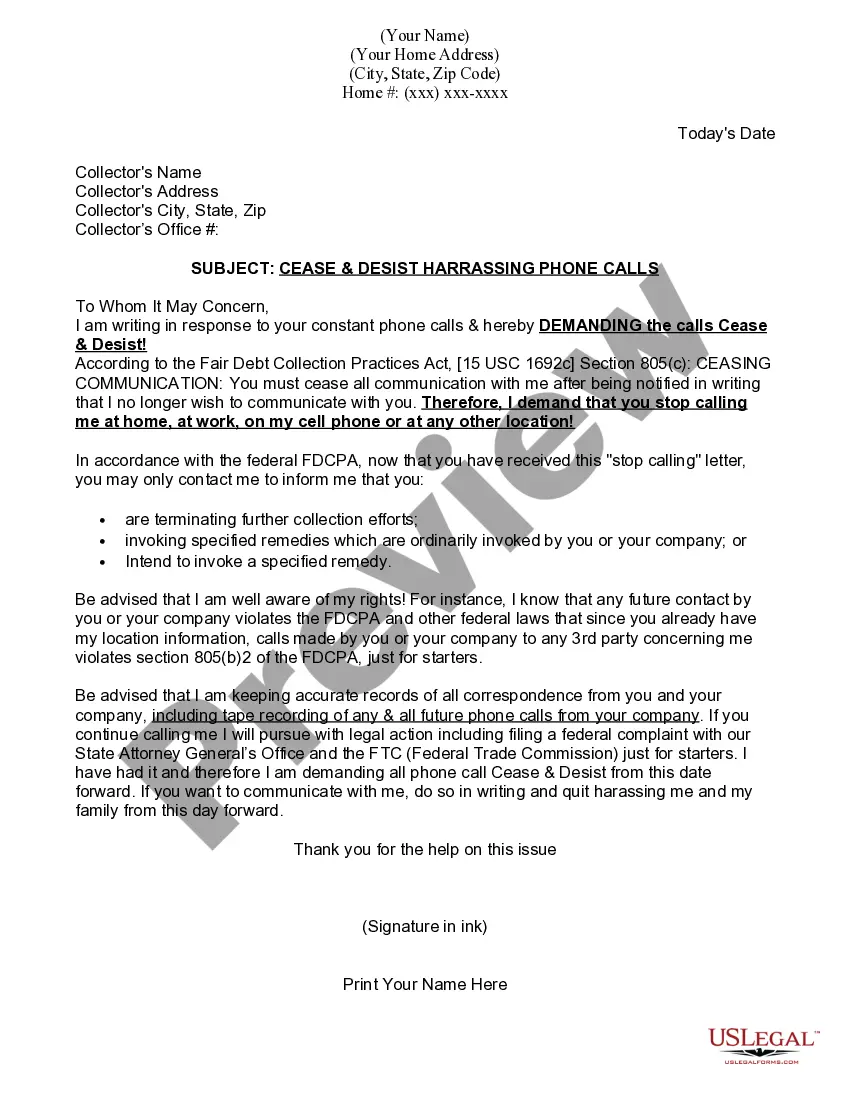

The Bexar Texas Employee Stock Ownership Trust Agreement is a legally binding document that outlines the terms and conditions of an employee stock ownership plan (ESOP) in Bexar County, Texas. This agreement serves as a crucial component of a company's ESOP as it documents the responsibilities, rights, and obligations of both the company and the employees participating in the trust. The Bexar Texas Employee Stock Ownership Trust Agreement typically begins by defining the purpose of the trust and its objectives. It outlines how the trust will be funded, whether through cash contributions by the company or by purchasing shares in the company. The agreement provides details about the method of determining the share price, how the shares will be allocated to employees, and the vesting schedule. There can be different types of Bexar Texas Employee Stock Ownership Trust Agreements depending on the specific needs and goals of the company. Some common types include: 1. Basic ESOP Trust Agreement: This is the most fundamental type of agreement that establishes the core parameters and guidelines of the employee stock ownership plan. It typically addresses the distribution of shares, eligibility criteria, and the overall trust administration process. 2. Leveraged ESOP Trust Agreement: A leveraged ESOP involves the use of borrowed funds to purchase company shares, which are then allocated to employees' accounts. This type of trust agreement will include provisions related to debt repayment, interest rates, and the allocation of voting rights. 3. Defined Contribution ESOP Trust Agreement: In a defined contribution ESOP, the employer's contributions are determined based on a fixed formula or percentage. The trust agreement for this type of ESOP will outline how employer contributions are determined, how employee accounts are managed, and the rules for distributing retirement benefits. 4. Vesting ESOP Trust Agreement: A vesting ESOP establishes a specific timeline or schedule for employees to become fully entitled to their allocated shares. The trust agreement will specify the vesting schedule, which may be based on years of service or other criteria, as well as the consequences for early termination or retirement. It is important for companies in Bexar County, Texas, to carefully craft their Employee Stock Ownership Trust Agreements to ensure compliance with state and federal laws governing Sops. Consulting with legal professionals and financial advisors specializing in employee ownership plans can help businesses develop a customized trust agreement that best meets their objectives and safeguards the interests of both the company and its employees.

Bexar Texas Employee Stock Ownership Trust Agreement

Description

How to fill out Bexar Texas Employee Stock Ownership Trust Agreement?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Bexar Employee Stock Ownership Trust Agreement, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Bexar Employee Stock Ownership Trust Agreement from the My Forms tab.

For new users, it's necessary to make some more steps to get the Bexar Employee Stock Ownership Trust Agreement:

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!