Kings New York Employee Stock Ownership Trust Agreement, also known as ESOP Agreement, is a legal document that outlines the terms and conditions of a stock ownership plan offered by Kings New York, a reputed company in the state of New York. This agreement is designed to create an employee stock ownership trust, which is a mechanism for employees to acquire ownership in the company through the purchase of company stocks. The Kings New York Employee Stock Ownership Trust Agreement plays a vital role in granting employees the opportunity to become shareholders and align their interests with those of the company. By participating in the ESOP, employees are given a stake in the company’s success, fostering a sense of ownership, loyalty, and motivation. This agreement outlines the processes and procedures for the establishment, operation, and termination of the Employee Stock Ownership Trust. It describes the eligibility criteria for employees to participate in the ESOP, the contribution limits for both the employer and employees, and the vesting schedule for the stocks acquired through the plan. The Kings New York Employee Stock Ownership Trust Agreement also covers the valuation of the company's stocks, which is crucial for determining the fair value of the shares allocated to employees. It defines the method and frequency of valuation, ensuring transparency and fairness in the process. In addition to the standard Kings New York Employee Stock Ownership Trust Agreement, there may be variations or specific types of agreements tailored to meet different objectives and circumstances. Some of these types include: 1. Leveraged ESOP Agreement: This agreement allows the ESOP to borrow funds to facilitate the purchase of company stocks, expanding employee ownership with borrowed capital. 2. Non-Leveraged ESOP Agreement: In contrast to the leveraged ESOP, this agreement does not involve borrowing funds. The shares are acquired solely through employer contributions or purchases from existing shareholders. 3. Qualified Stock Bonus Plan (SOP) Agreement: This type of agreement combines the benefits of an Employee Stock Ownership Plan (ESOP) with a profit-sharing component. It allows the company to distribute shares or cash bonuses, based on the achievement of certain financial goals, to eligible employees. Overall, the Kings New York Employee Stock Ownership Trust Agreement is a crucial legal document that outlines the rules, rights, and responsibilities of both the company and its employees in the realm of stock ownership. By fostering employee participation and engagement, this agreement empowers the workforce while strengthening the company's financial stability and long-term success.

Kings New York Employee Stock Ownership Trust Agreement

Description

How to fill out Kings New York Employee Stock Ownership Trust Agreement?

Preparing papers for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Kings Employee Stock Ownership Trust Agreement without professional assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Kings Employee Stock Ownership Trust Agreement by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Kings Employee Stock Ownership Trust Agreement:

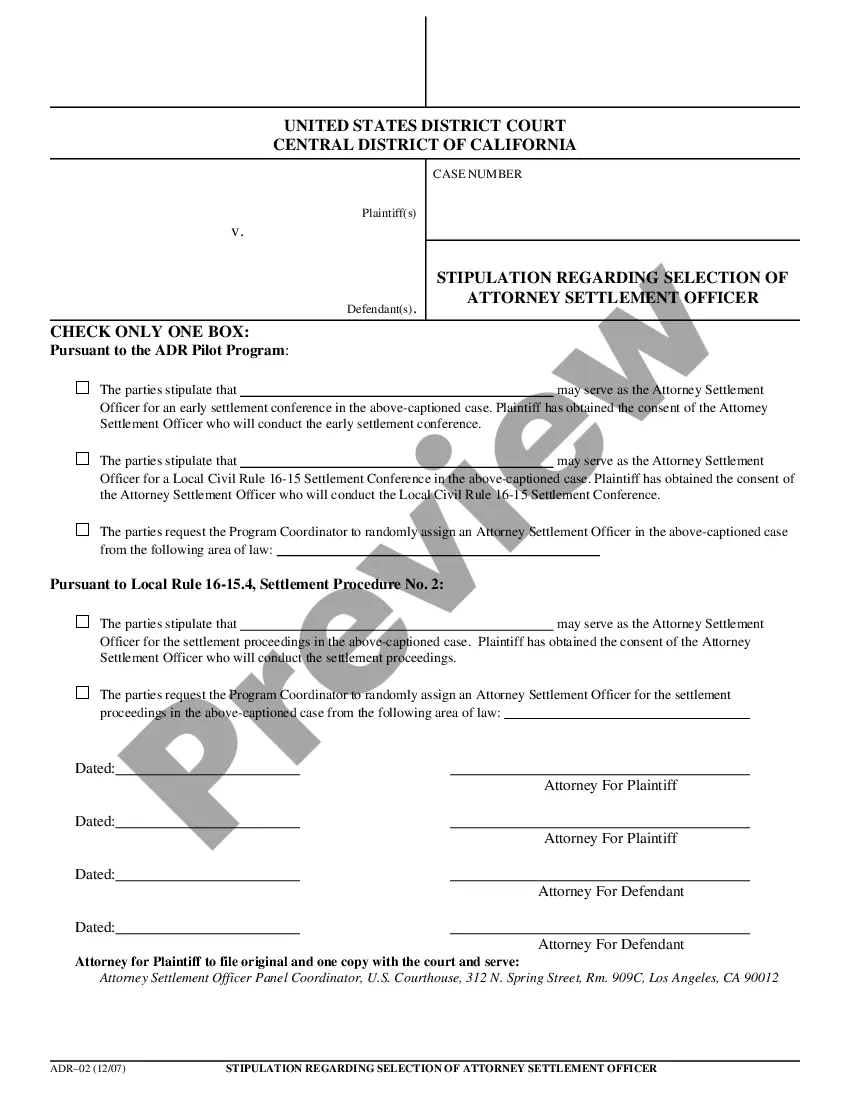

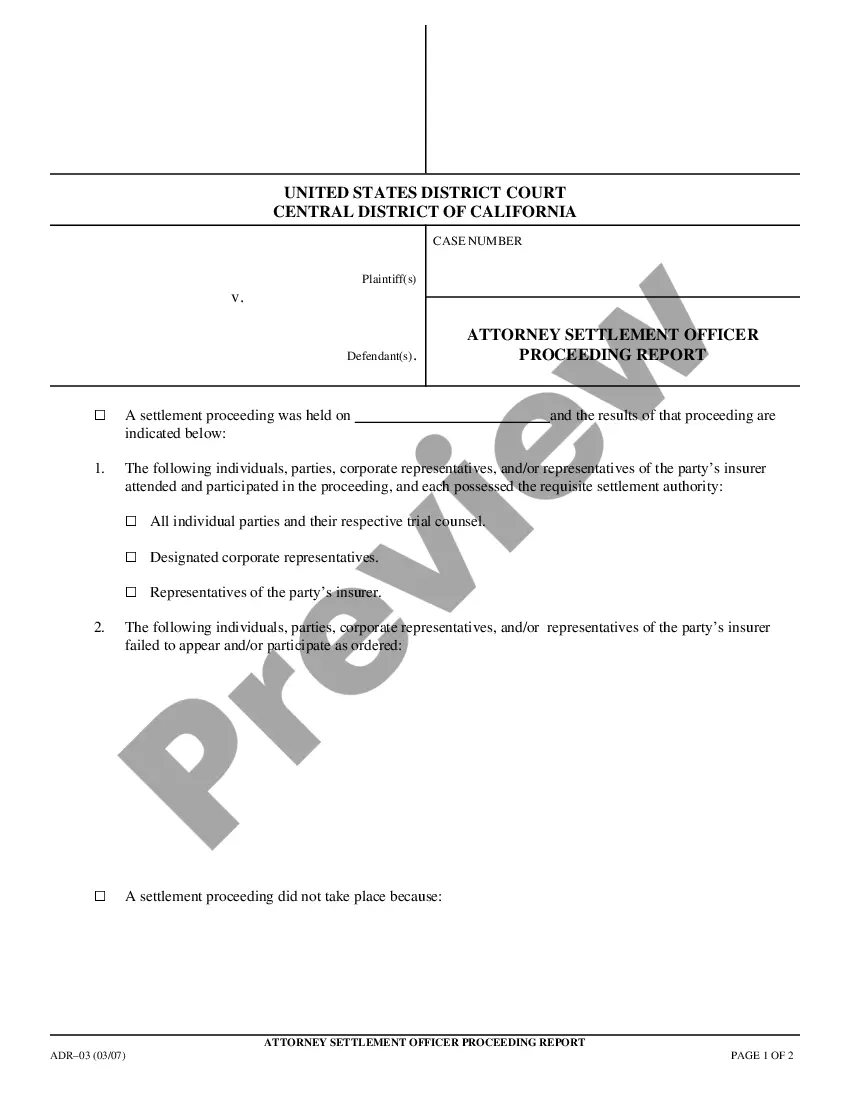

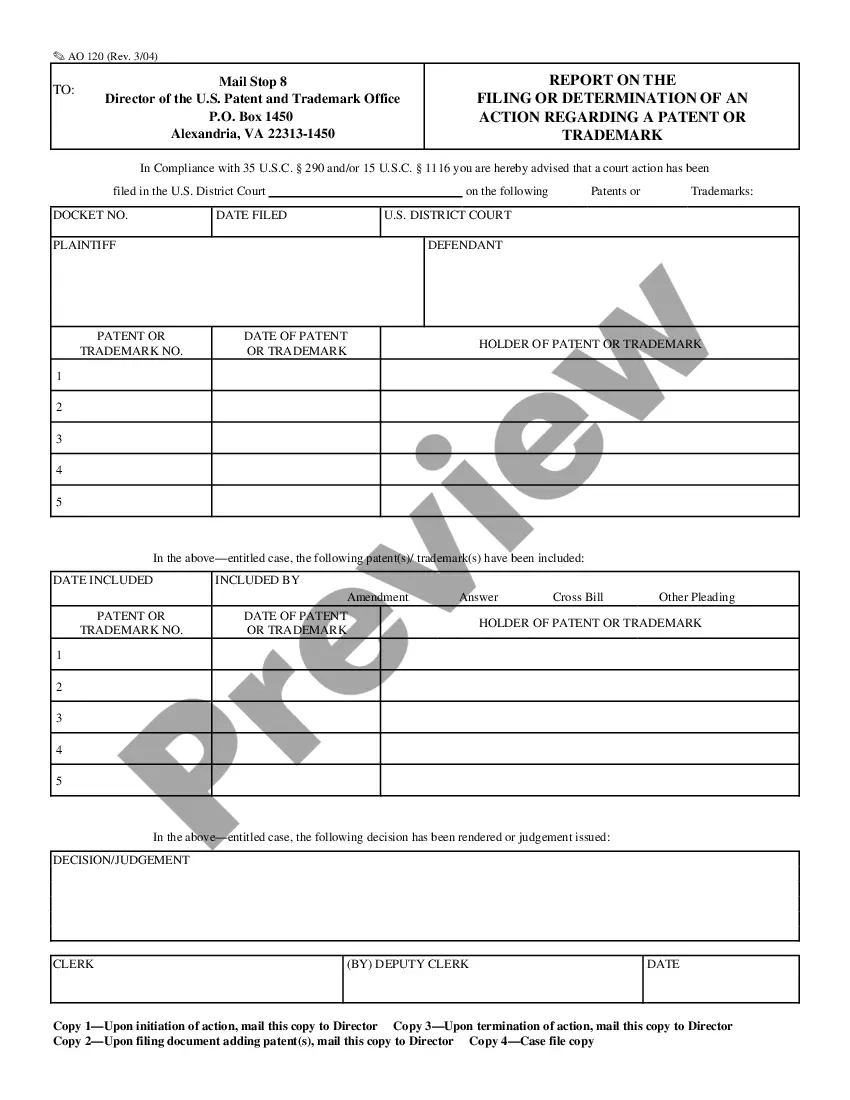

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a few clicks!