Montgomery Maryland Employee Stock Ownership Plan (ESOP) of First American Health Concepts, Inc. is a unique retirement benefit program offered by the company to its employees in Montgomery County, Maryland. An ESOP is a type of employee benefit plan that provides employees with an ownership interest in the company through the allocation of company stock. First American Health Concepts, Inc. is a leading healthcare company that is headquartered in Montgomery County, Maryland. This company offers various types of Sops to its employees, providing them with the opportunity to have a financial stake in the success of the organization. The Montgomery Maryland ESOP of First American Health Concepts, Inc. allows eligible employees to become partial owners of the company by granting them shares of company stock. These shares are allocated based on various factors such as an employee's salary, years of service, and job performance. The ESOP functions as a retirement savings plan, providing employees with a long-term investment in the company. As the company's value grows, so does the value of the employees' stock holdings. This incentivizes employees to contribute to the success of the company, as their financial well-being is directly tied to it. In addition to providing employees with a financial stake in the company, the Montgomery Maryland ESOP offers numerous tax advantages. Contributions made by the company to the ESOP are tax-deductible, and employees are not taxed on the value of the stock until they leave the company and receive their distributions. Through the Montgomery Maryland ESOP, employees of First American Health Concepts, Inc. have the opportunity to build retirement savings and benefit from the growth and success of the company. This is a valuable employee benefit that encourages loyalty, productivity, and a sense of ownership among the workforce. Keywords: Montgomery Maryland, Employee Stock Ownership Plan, ESOP, First American Health Concepts, retirement benefit, employee benefit plan, ownership interest, company stock, financial stake, long-term investment, tax advantages, retirement savings, loyalty, productivity, workforce.

Montgomery Maryland Employee Stock Ownership Plan of First American Health Concepts, Inc.

Description

How to fill out Montgomery Maryland Employee Stock Ownership Plan Of First American Health Concepts, Inc.?

Drafting papers for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Montgomery Employee Stock Ownership Plan of First American Health Concepts, Inc. without expert help.

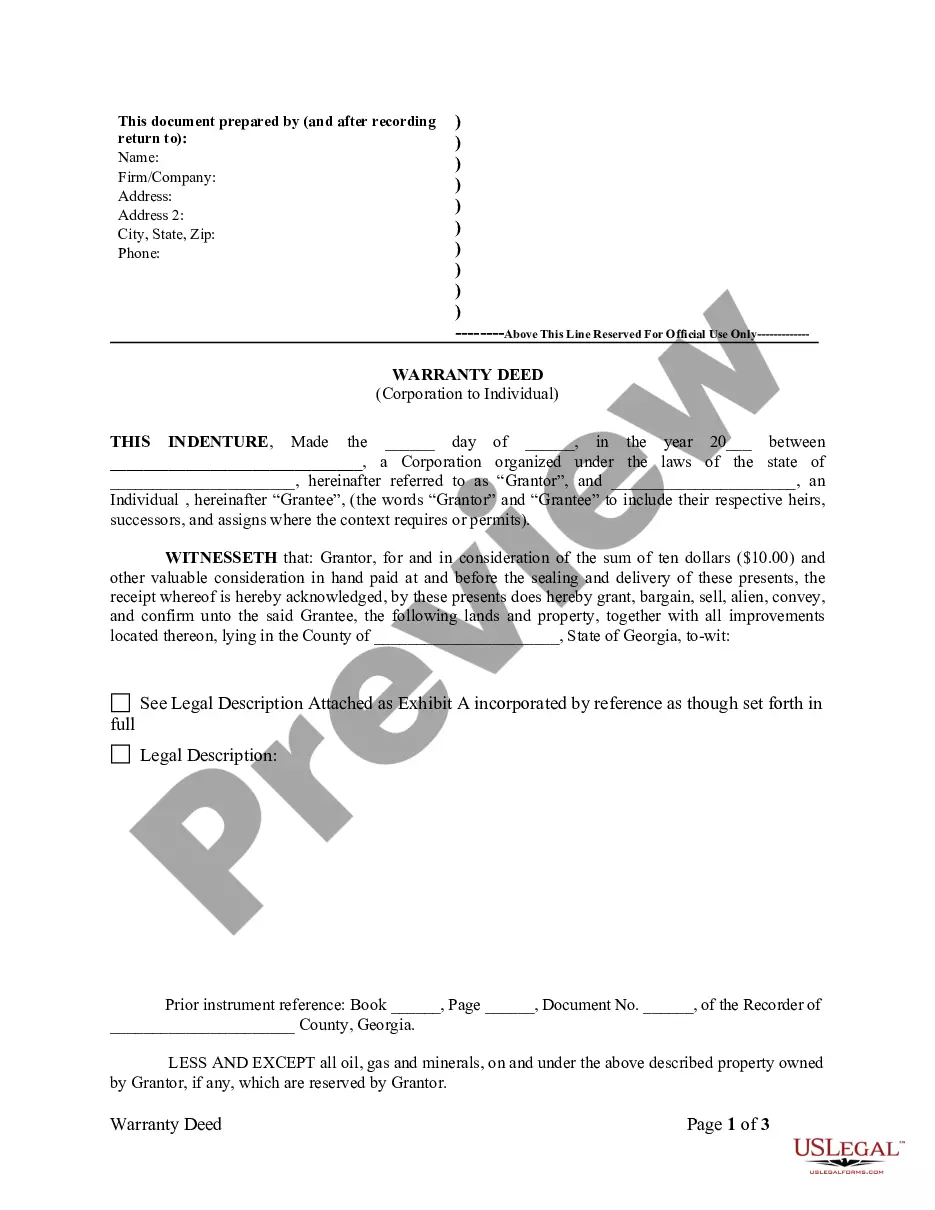

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Montgomery Employee Stock Ownership Plan of First American Health Concepts, Inc. on your own, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guide below to get the Montgomery Employee Stock Ownership Plan of First American Health Concepts, Inc.:

- Examine the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

The company can make your distribution in stock, cash, or both. Many ESOP participants leave with an account that has both stock and cash in it. The cash will be paid out in cash. The share portion may be cashed in, so you will get cash for the shares as well.

Distributions from the ESOP After Employment Terminates ESOP benefits are mainly paid to participants after their employment with the company terminates, whether because of retirement or other reasons.

An ESOP is a qualified defined contribution retirement plan, so employees don't purchase shares with their own money. An ESPP, on the other hand, is a plan that allows employees to use their own money to buy company shares at a discount.

Ownership. An ESOP is intended to provide benefits after an employee retires, while an ESPP offers immediate rewards. ESPP participants own the stock immediately. ESOP participants own stock purchased with their own contributions but employer-purchased shares vest over a scheduled period.

Under ESOS, employees are given an option to purchase shares at a later date, i.e. after the vesting period. Under ESOPs, employees are given an option to purchase shares on the spot at a discounted price. The company may specify the lock-in period for the shares issued pursuant to the exercise of the option.

Distributions from ESOPs may be rolled over into an IRA or 401(k) plan. Additionally, an ESOP may be diversified after an ESOP participant has reached 55 years old and has participated in the plan for 10 years minimum.

Research by the Department of Labor shows that ESOPs not only have higher rates of return than 401(k) plans and are also less volatile. ESOPs lay people off less often than non-ESOP companies. ESOPs cover more employees, especially younger and lower income employees, than 401(k) plans.

Like other qualified retirement plans, ESOP distributions received by employees under age 59-½ (or, in the case of terminating employment, under age 55) are considered early withdrawals, so they are subject to normal applicable taxes, plus an additional 10% excise tax.

The company can make your distribution in stock, cash, or both. Many ESOP participants leave with an account that has both stock and cash in it. The cash will be paid out in cash. The share portion may be cashed in, so you will get cash for the shares as well.

Request the distribution forms from the ESOP company. These forms will transfer the shares from the control of the ESOP to you. You will need to fill out the forms completely and sign them. Sell the shares using your broker or online brokerage house if you wish to transfer the vested stock to cash.