Hennepin County, located in the state of Minnesota, has adopted an incentive compensation plan to attract and retain top talent within its organizations. This detailed description will explore the various aspects of the Hennepin Minnesota Adoption of Incentive Compensation Plan, highlighting its significance and potential types. Key aspects of the Hennepin Minnesota Adoption of Incentive Compensation Plan: 1. Goal-oriented Approach: The incentive compensation plan in Hennepin County aims to motivate employees by tying their pay to the achievement of specific goals. This ensures a focus on performance and encourages individual and team excellence. 2. Customization: The plan allows for customization to meet the unique needs of different departments or positions within Hennepin County. It can include performance-based bonuses, profit-sharing arrangements, or other incentives based on predetermined criteria. 3. Transparent Evaluation Criteria: The plan provides clear and transparent evaluation criteria, ensuring that employees understand the goals they need to achieve in order to earn incentives. This fosters a sense of fairness, clarity, and accountability among employees. 4. Talent Attraction and Retention: The adoption of an incentive compensation plan helps Hennepin County attract and retain highly skilled professionals who are motivated by performance-based rewards. It acts as a competitive advantage in attracting talent in a competitive job market. 5. Performance Management: By aligning compensation with performance, the plan promotes a culture of continuous improvement and high-quality service delivery. Employees are driven to excel and contribute positively to the organization's success. Different types of Hennepin Minnesota Adoption of Incentive Compensation Plans: 1. Merit-Based Plan: This type of plan rewards employees based on their individual performance against predefined objectives. It focuses on recognizing and incentivizing exceptional performance and individual contributions. 2. Profit-Sharing Plan: In this type of plan, employees receive a portion of the organization's profits based on a predetermined formula. It encourages employees to work collectively toward the financial success of the organization. 3. Team-Based Plan: This plan rewards employees based on the performance of their team or department as a whole. It encourages collaboration, teamwork, and collective success rather than individual achievements. 4. Sales Incentive Plan: Particularly relevant for sales teams, this plan motivates employees to achieve and exceed sales targets. It often includes commissions or bonuses based on sales revenue or customer acquisitions. 5. Long-Term Incentive Plan: This type of plan provides incentives that are linked to long-term organizational goals, such as increased market share or sustained profitability. It reinforces loyalty and commitment among employees. In summary, the Hennepin Minnesota Adoption of Incentive Compensation Plan is an essential tool for attracting and retaining talent, promoting performance-based rewards, and fostering a culture of excellence within Hennepin County organizations. By adopting various types of plans, such as merit-based, profit-sharing, team-based, sales incentive, and long-term incentive plans, the county can effectively motivate and reward employees based on their individual and collective contributions.

Hennepin Minnesota Adoption of incentive compensation plan

Description

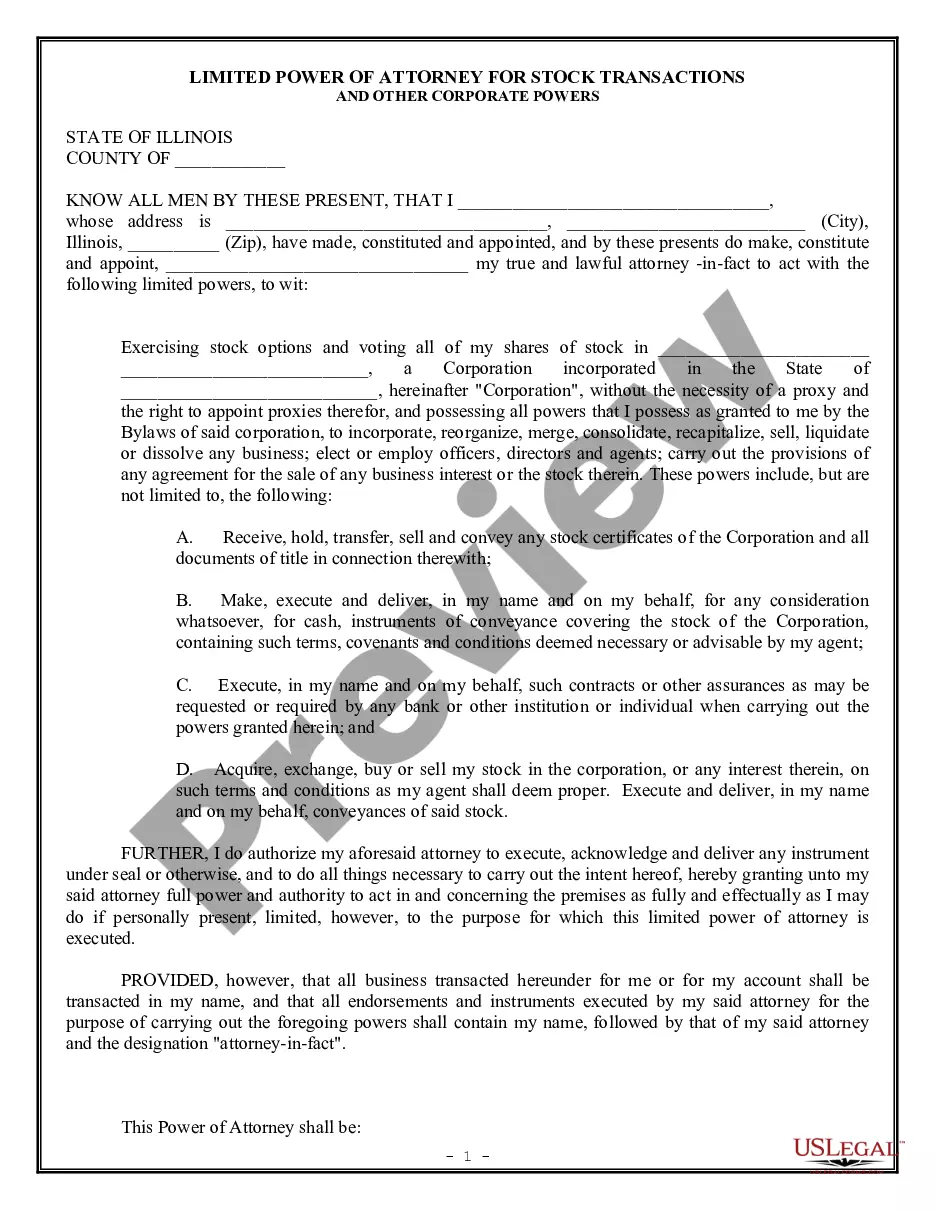

How to fill out Hennepin Minnesota Adoption Of Incentive Compensation Plan?

Are you looking to quickly create a legally-binding Hennepin Adoption of incentive compensation plan or probably any other form to take control of your own or business matters? You can select one of the two options: contact a legal advisor to draft a valid document for you or create it entirely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get professionally written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific form templates, including Hennepin Adoption of incentive compensation plan and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- To start with, carefully verify if the Hennepin Adoption of incentive compensation plan is adapted to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Hennepin Adoption of incentive compensation plan template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the paperwork we provide are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Send it to: Minnesota Property Tax Refund St. Paul, MN 55145-0020.

You can file up to 1 year late. To claim your 2021 refund, you have until August 15, 2023 to file.

Can I file my M1PR (Minnesota Property Tax Refund) through TurboTax? Yes, you can file your M1PR when you prepare your Minnesota taxes in TurboTax. We'll make sure you qualify, calculate your Minnesota property tax refund, and fill out an M1PR form, which can be e-filed.

File your 2021 Minnesota Homestead Credit and Renter's Property Tax Refund return (Form M1PR) using eFile xpress! Most calculations are automatically performed for you. liminate errors before submitting your return. Receive confirmation that your return was accepted.

To file a Form M1PR in the TurboTax online program, go to: Across the top, select State Taxes. On screen, Status of your state returns, under Minnesota, click on Start or Continue or Edit. Follow the step-by-step interview questions. On screen, Minnesota Credits, select Continue to proceed,

Complete and send us Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund. If you are filing as a renter, include any Certificates of Rent Paid (CRPs) you received. See the Form M1PR instructions for filing details. Use our Where's My Refund?

Can I e-file the M1PR form? Yes, after completing the M1PR within the account, you can go to the E-file section of the account and electronically file the M1PR separately or with your other forms.

File your 2021 Minnesota Homestead Credit and Renter's Property Tax Refund return (Form M1PR) using eFile xpress! Most calculations are automatically performed for you. liminate errors before submitting your return. Receive confirmation that your return was accepted.

2021 M1NC, Federal Adjustments. Page 1. 2021 Schedule M1NC, Federal Adjustments. Minnesota has not adopted certain federal law changes enacted after December 31, 2018, that affect federal adjusted gross income for tax year 2021. This schedule allows for any necessary adjustments required to file a state tax return.