Collin, Texas Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan: Collin, Texas is a vibrant city located in the northeastern part of the state. Known for its strong economy and thriving business community, Collin attracts both residents and entrepreneurs looking for opportunities. In line with promoting employee benefits and incentivizing directors, proposals have been put forth to approve a comprehensive Employees' Stock Deferral Plan and Directors' Stock Deferral Plan in Collin, Texas. The Employees' Stock Deferral Plan aims to provide eligible employees with the option to defer a portion of their compensation in the form of company stocks. This plan enables employees to accumulate stocks over time, offering long-term investment opportunities and potential growth. By participating in such a plan, employees can align their financial interests with the company's success, fostering a sense of ownership and engagement. On the other hand, the Directors' Stock Deferral Plan specifically targets board members and directors. This plan seeks to offer an additional incentive for these key decision-makers by allowing them to defer a portion of their compensation as company stocks. By tying their compensation to the company's performance, directors are further motivated to make strategic decisions that drive growth, shareholder value, and long-term success. The proposals for both plans include comprehensive details outlining the eligibility criteria, deferral options, vesting schedules, and liquidity provisions. These plans are designed to align the interests of employees and directors with the company's long-term goals while facilitating personal financial growth. Employees' Stock Deferral Plan — Key Features: 1. Eligibility: Full-time, part-time, and eligible contract employees. 2. Deferral Options: Flexible options allowing a percentage of compensation to be deferred as stocks. 3. Vesting Schedule: Specifies the timeline and conditions under which the stocks become the employee's property. 4. Liquidity Provisions: Outlines opportunities to access or sell stocks based on specified events or trigger points. 5. Reporting and Compliance: Ensures transparency, compliance with regulatory guidelines, and regular monitoring. Directors' Stock Deferral Plan — Key Features: 1. Eligibility: Board members, appointed directors, and executive leaders. 2. Deferral Options: Tailored options allowing directors to defer a portion of their compensation as stocks. 3. Vesting Schedule: Specifies vesting periods and conditions for the stocks to become fully owned by the director. 4. Liquidity Provisions: Outlines opportunities for directors to sell or access their stocks based on predefined events. 5. Reporting and Compliance: Ensures transparency, compliance with regulatory requirements, and board oversight. These proposals aim to empower employees and directors by offering them a stake in the company's success while fostering a long-term commitment to growth. By approving these plans, Collin, Texas seeks to reinforce its reputation as a business-friendly city where both employees and directors can benefit from their contributions and dedication. [Copy of Employees' Stock Deferral Plan and Directors' Stock Deferral Plan available upon request.] Note: The specific names or types of Collin, Texas Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan may vary based on the unique structures and requirements of each organization operating in the Collin area.

Collin Texas Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans

Description

How to fill out Collin Texas Proposals To Approve Employees' Stock Deferral Plan And Directors' Stock Deferral Plan With Copy Of Plans?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Collin Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Collin Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Collin Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans:

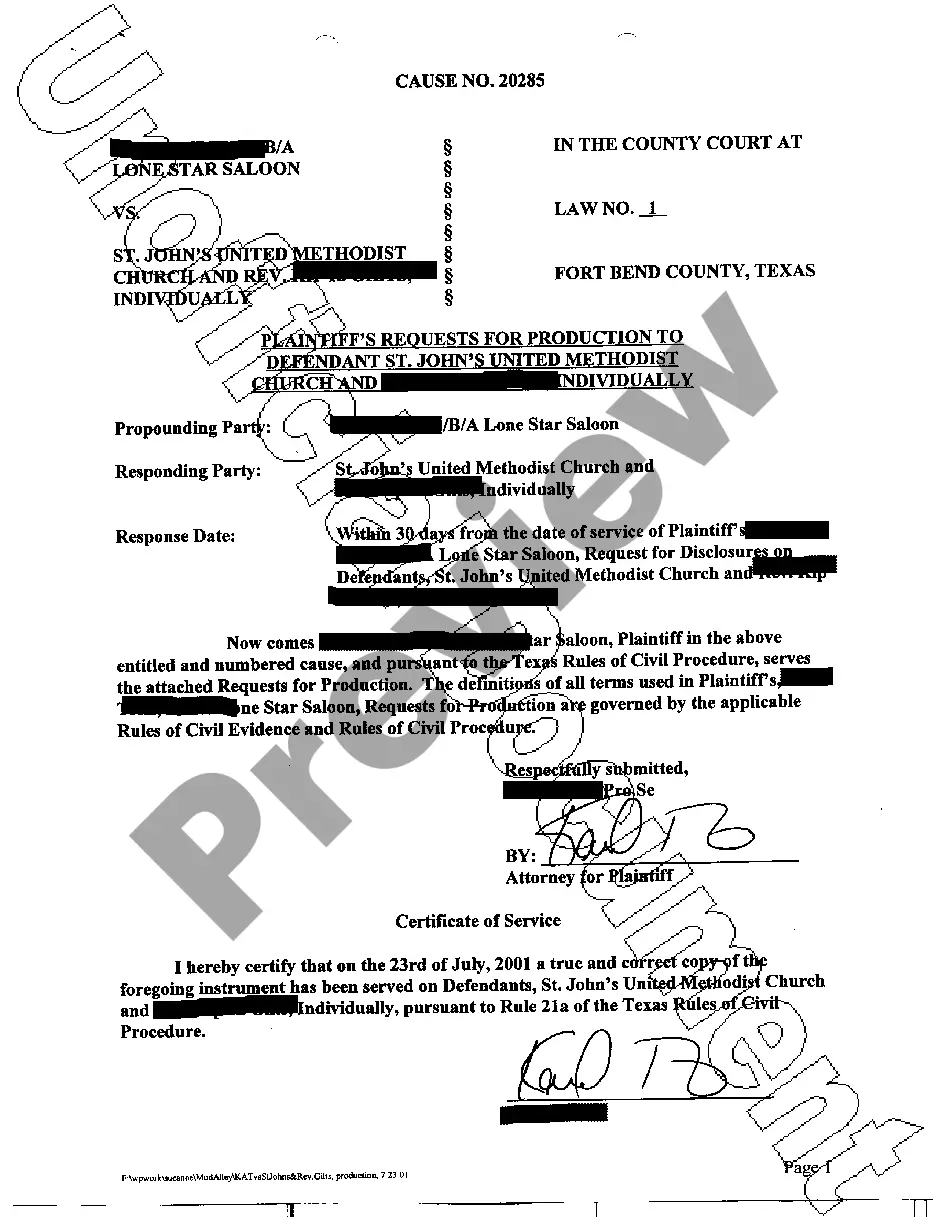

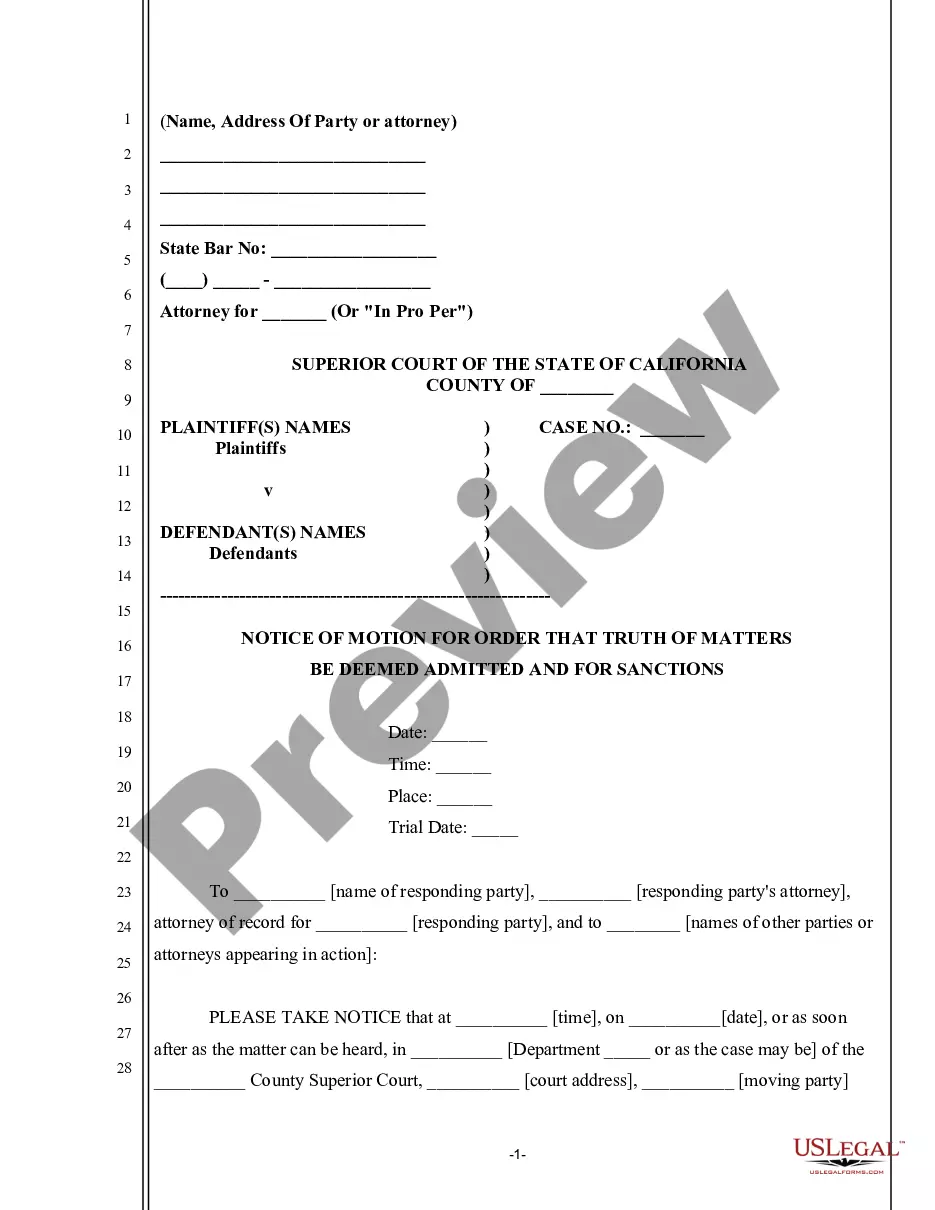

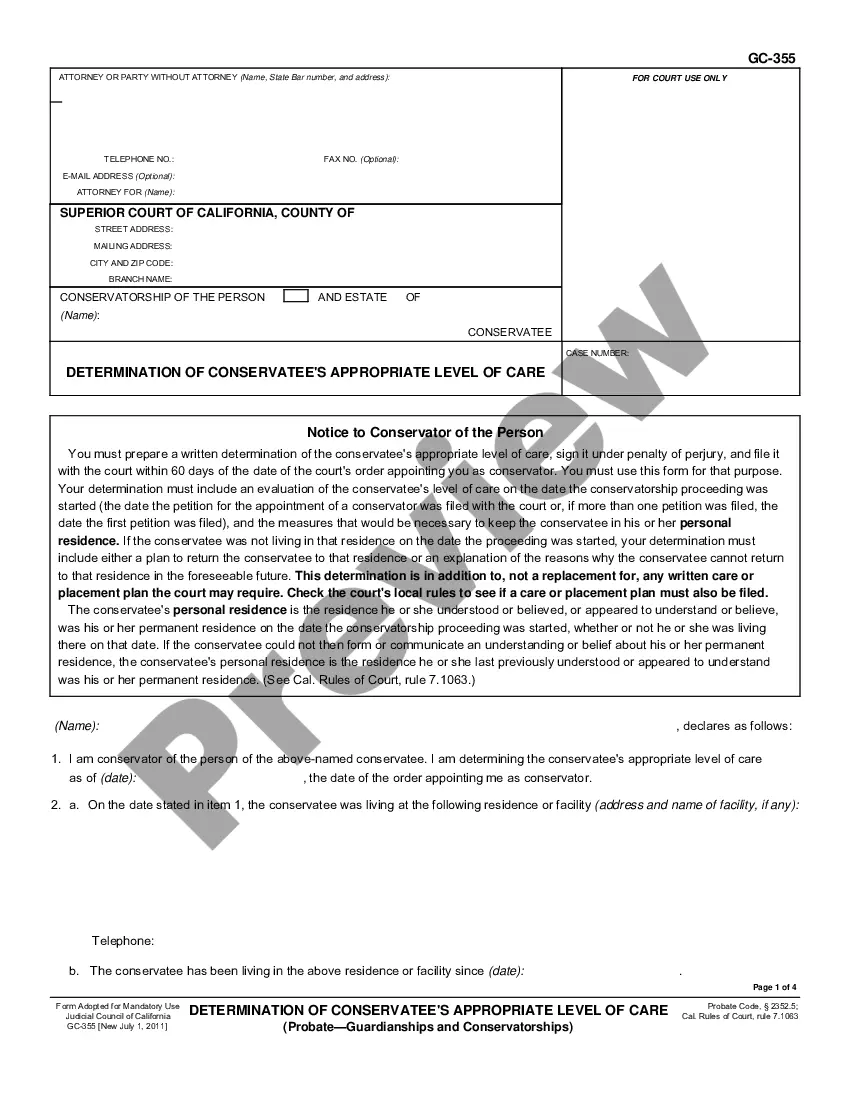

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Record the journal entry upon disbursement of cash to the employee. In 2020, the deferred compensation plan matures and the employee is paid. The journal entry is simple. Debit Deferred Compensation Liability for $100,000 (this will zero out the account balance), and credit Cash for $100,000.

The W-2 has several boxes. Box 1 lists the compensation paid to you from the deferred compensation plan. Boxes 2, 3 and 4 list the amount of federal, Social Security wages and Social Security taxes withheld from the compensation.

Unlike a 401k with contributions housed in a trust and protected from the employer's (and the employee's) creditors, a deferred compensation plan (generally) offers no such protections. Instead, the employee only has a claim under the plan for the deferred compensation.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

On the company balance sheet, the accounting for deferred compensation appears on the left or assets side as salaries expense, and on the right or liabilities side as salaries payable.

Deferred compensation is typically not considered earned, taxable income until you receive the deferred payment in a future tax year.

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.

A deferred compensation plan allows employees to place income into a retirement account where it sits untaxed until they withdraw the funds. After withdrawal, the funds become subject to taxes, although this is usually much less if payment is deferred until retirement.

Deferred compensation can be broadly classified into Qualified Deferred Compensation and Non-Qualified Deferred Compensation. Since the compensation is paid at a later date, the amount deferred for payment is not included while computing tax. Therefore, it reduces the amount of taxable income in the current year.

NQDC plans allow corporate executives to defer a much larger portion of their compensation, and to defer taxes on the money until the deferral is paid. You should consider contributing to a corporate NQDC plan only if you are maxing out your qualified plan options, such as a 401(k).