Maricopa, Arizona is a vibrant city located in Pinal County, known for its picturesque scenery, rich history, and thriving community. As a forward-thinking city, Maricopa has implemented various proposals to enhance the benefits offered to its employees and directors through stock deferral plans. Two notable proposals are the Employees' Stock Deferral Plan and the Directors' Stock Deferral Plan. The Employees' Stock Deferral Plan in Maricopa, Arizona, aims to provide eligible employees with an opportunity to defer a portion of their stock compensation. This plan allows employees to invest a specified percentage of their stock grants into a tax-deferred account, offering them flexibility in managing their financial goals and planning for the future. By deferring a portion of their stock, employees can potentially maximize their long-term savings and take advantage of potential tax benefits. On the other hand, the Directors' Stock Deferral Plan in Maricopa, Arizona, exclusively targets company directors. Designed to align the interests of directors with the success of the organization, this plan enables directors to defer a portion of their stock-based compensation. This deferred amount can be invested or reinvested, providing directors with potential growth opportunities and financial security in the long run. By deferring their stock, directors can further demonstrate their commitment to the company's success and align their interests with shareholders. Both the Employees' Stock Deferral Plan and Directors' Stock Deferral Plan in Maricopa, Arizona, are carefully crafted to empower eligible participants and offer them valuable financial planning tools. The plans are designed to provide flexibility, tax advantages, and potential investment growth opportunities, allowing employees and directors alike to take control of their financial futures. To gain a deeper understanding of the Maricopa Arizona Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan, it is recommended to review and analyze the copy of the plans. The plans' documentation will include detailed information, guidelines, and eligibility criteria, ensuring that participants have a comprehensive understanding of the benefits, restrictions, and procedures associated with the stock deferral plans. By approving these proposals, Maricopa, Arizona, demonstrates its commitment to attracting and retaining top talent, while also fostering a collaborative environment between employees, directors, and shareholders. These innovative plans reflect the city's progressive approach towards employee benefit programs and its dedication to offering valuable financial incentives to drive growth and success within the community. In conclusion, Maricopa, Arizona, offers its employees and directors two significant stock deferral plans — the Employees' Stock Deferral Plan and Directors' Stock Deferral Plan. These plans provide eligible participants with the opportunity to defer a portion of their stock-based compensation into tax-deferred accounts and potentially benefit from investment growth. By approving these proposals, Maricopa showcases its dedication to supporting the financial well-being of its employees and directors, fostering a successful and thriving community.

Maricopa Arizona Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans

Description

How to fill out Maricopa Arizona Proposals To Approve Employees' Stock Deferral Plan And Directors' Stock Deferral Plan With Copy Of Plans?

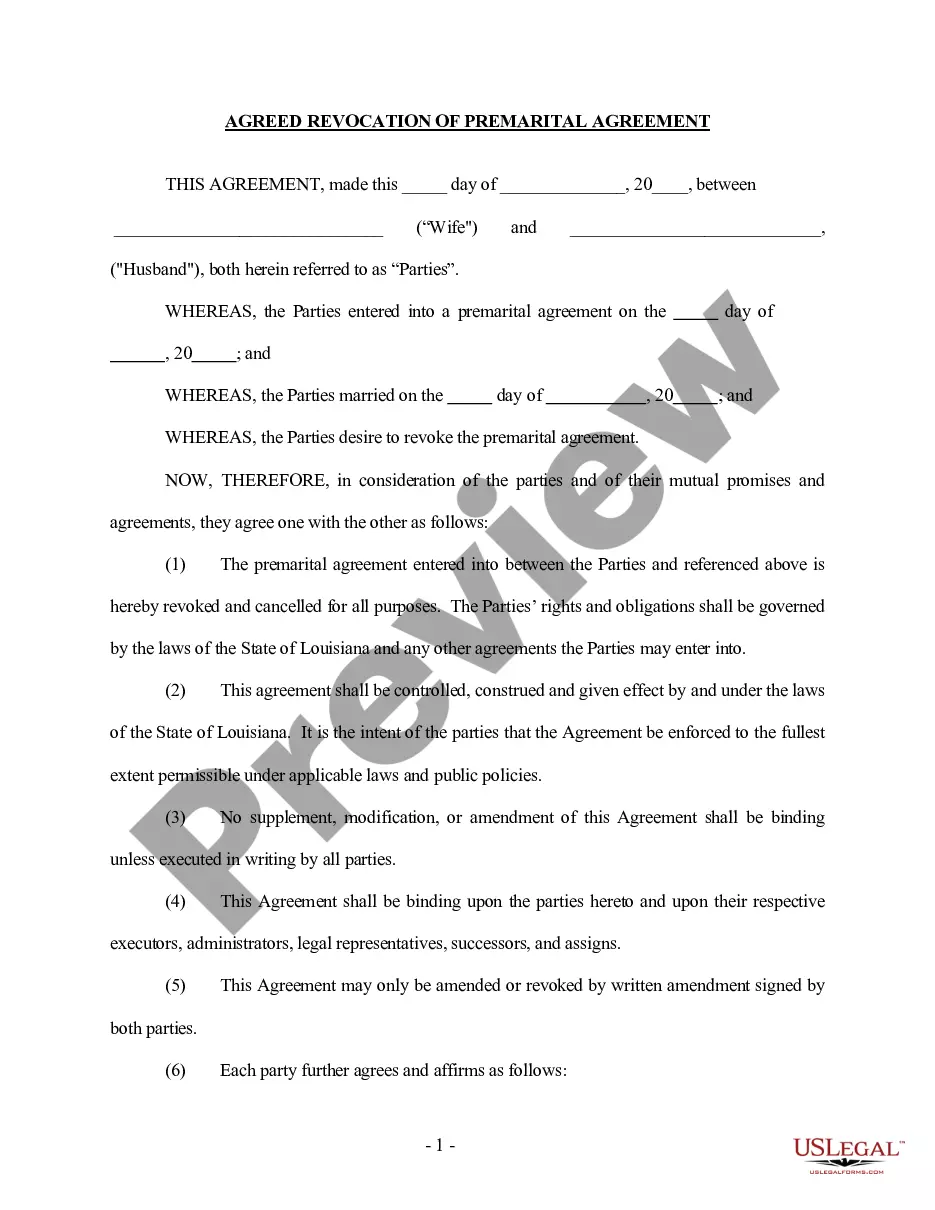

Are you looking to quickly draft a legally-binding Maricopa Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans or probably any other form to manage your own or corporate matters? You can go with two options: hire a legal advisor to write a valid paper for you or draft it completely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant form templates, including Maricopa Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans and form packages. We offer templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra troubles.

- To start with, carefully verify if the Maricopa Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans is adapted to your state's or county's laws.

- If the document includes a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were looking for by using the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Maricopa Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to find and download legal forms if you use our services. Additionally, the templates we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!