The Fairfax Virginia Employees' Stock Deferral Plan is a retirement benefit program offered by Nor west Corp. to its employees based in Fairfax, Virginia. This plan allows eligible employees to defer a portion of their compensation in the form of Nor west Corp. stock, which is then set aside for their future retirement. The Employees' Stock Deferral Plan provides employees with a unique opportunity to invest in the success of Nor west Corp. and potentially benefit from the company's growth over time. By deferring a portion of their salary, participants have the ability to accumulate shares of Nor west Corp. stock, which may appreciate in value over the long term. Through this plan, employees are given the flexibility to choose the percentage of their compensation they wish to defer, allowing them to align their retirement savings strategy with their individual financial goals. By deferring a portion of their salary and investing in Nor west Corp. stock, employees can access potential tax advantages and contribute towards their financial well-being in retirement. It is important to note that there may be different variations or types of the Fairfax Virginia Employees' Stock Deferral Plan for Nor west Corp., adapted to meet the diverse needs of employees. These variations may include options such as: 1. Traditional Stock Deferral Plan: This type of plan allows employees to defer a portion of their compensation as Nor west Corp. stock on a pretax basis. The deferred stock is held in a separate account and grows tax-deferred until retirement. 2. Restricted Stock Unit (RSU) Deferral Plan: In this plan, employees have the option to defer receiving the shares granted through restricted stock units and instead have them placed in a deferred stock account. The value of the RSS is then deferred and potentially grows over time. 3. Performance Award Deferral Plan: This type of plan enables employees to defer a portion of their performance-based awards, such as stock options, performance shares, or bonuses. The deferred awards are held as Nor west Corp. stock and can appreciate, potentially enhancing the employee's retirement savings. The Fairfax Virginia Employees' Stock Deferral Plan for Nor west Corp. offers employees an opportunity to invest in their future financial security through the deferred acquisition of Nor west Corp. stock. By deferring a portion of their compensation, employees can potentially accumulate wealth over time while enjoying the benefits of tax-deferred growth.

Fairfax Virginia Employees' Stock Deferral Plan for Norwest Corp.

Description

How to fill out Fairfax Virginia Employees' Stock Deferral Plan For Norwest Corp.?

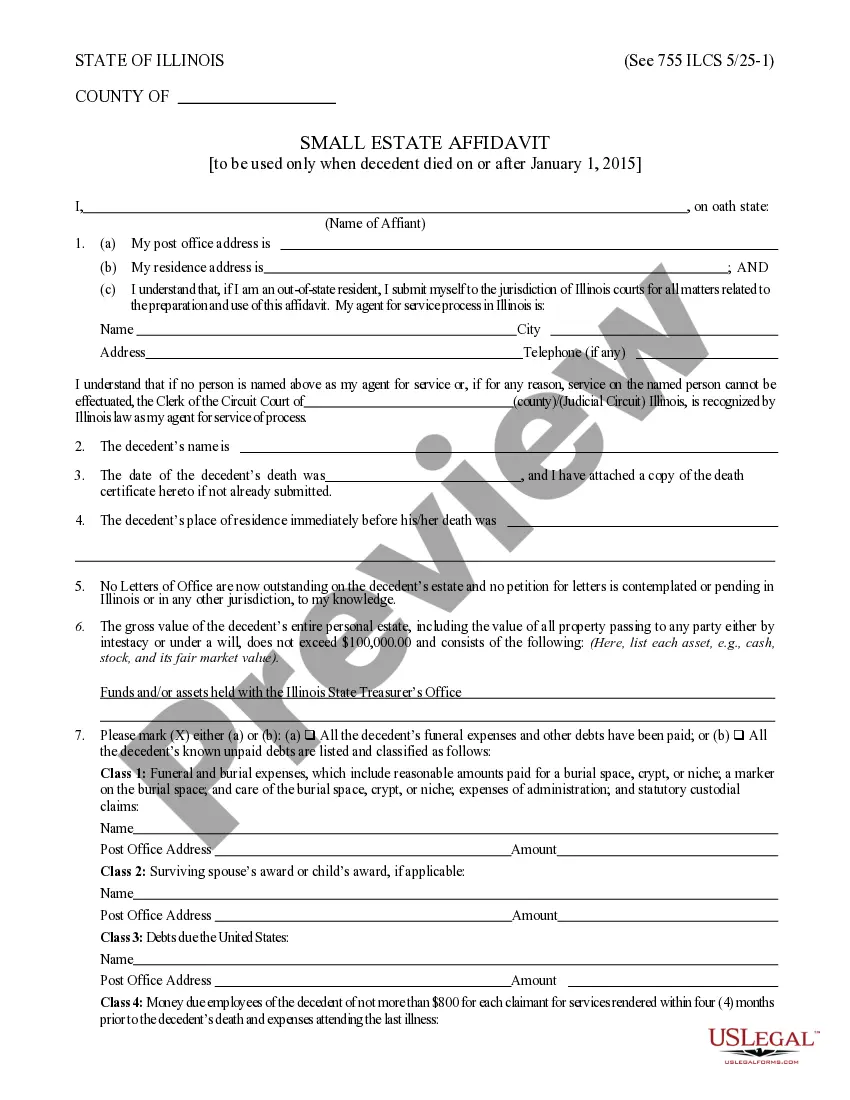

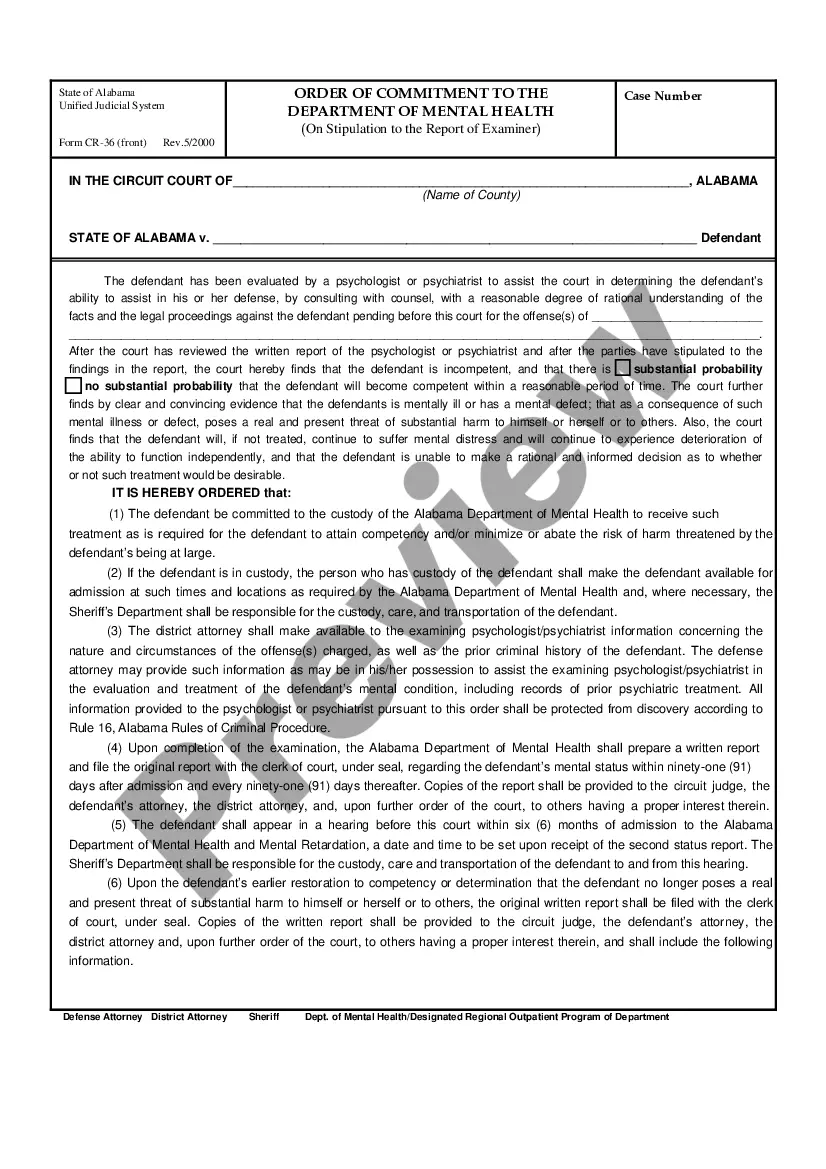

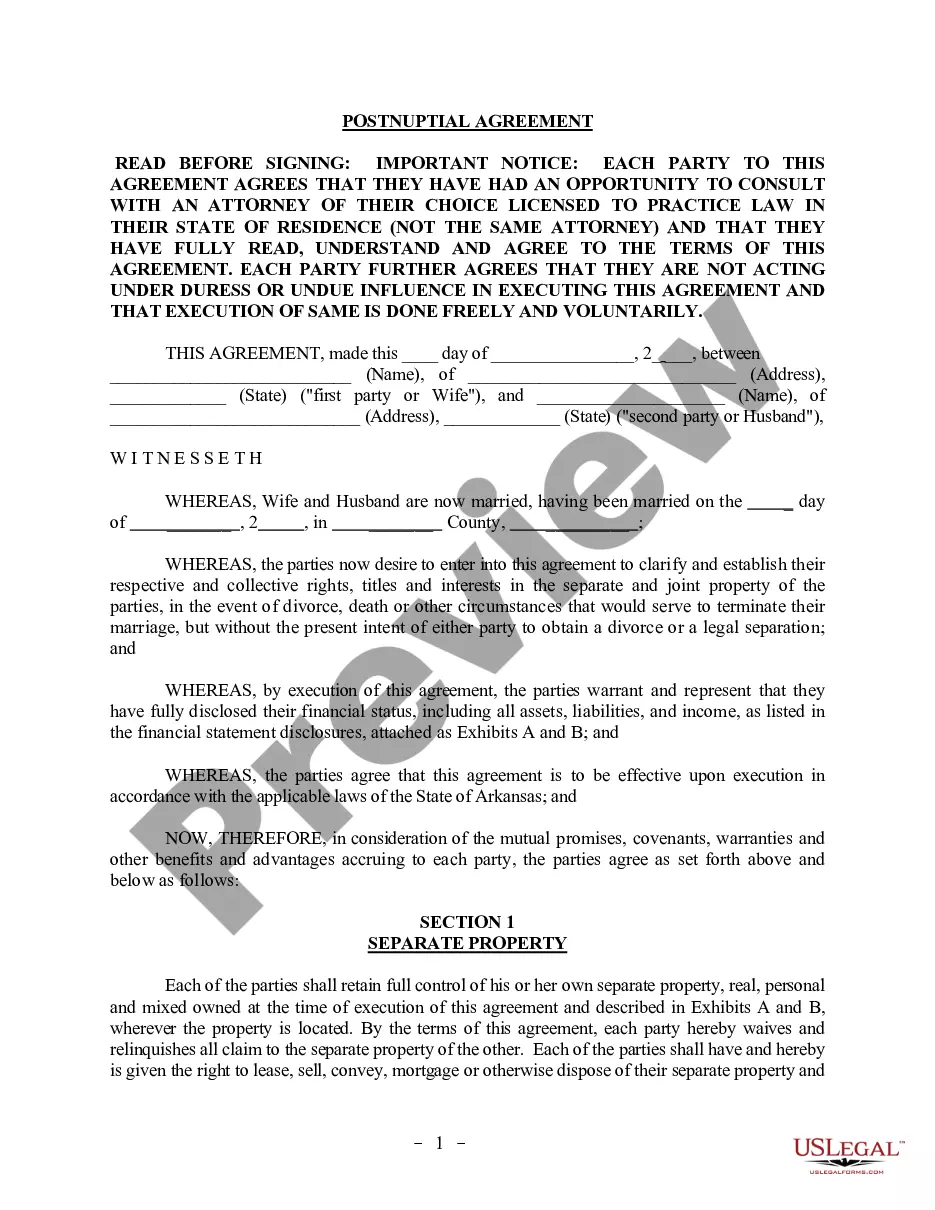

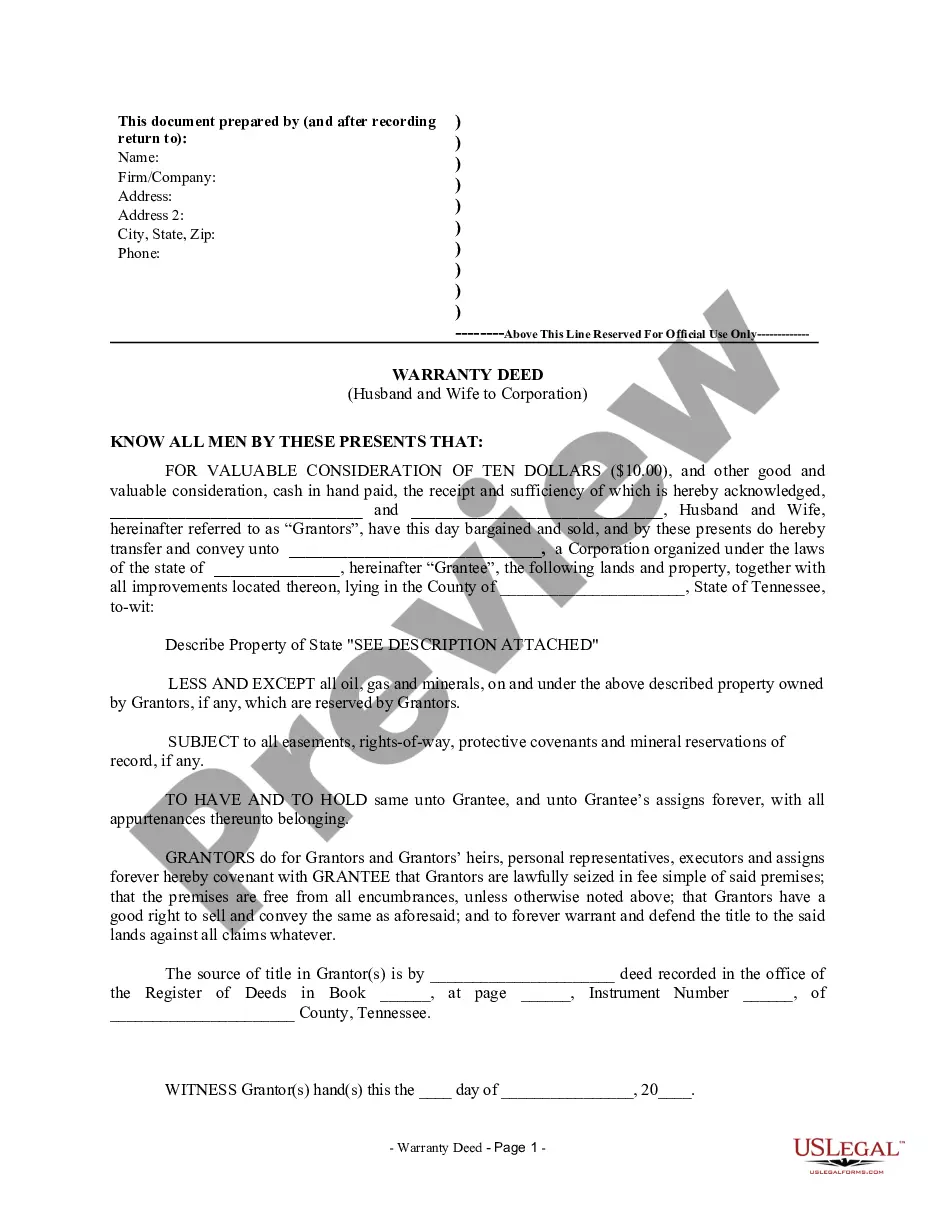

Do you need to quickly create a legally-binding Fairfax Employees' Stock Deferral Plan for Norwest Corp. or probably any other document to take control of your own or business affairs? You can go with two options: contact a legal advisor to draft a valid document for you or create it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you receive neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-specific document templates, including Fairfax Employees' Stock Deferral Plan for Norwest Corp. and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, carefully verify if the Fairfax Employees' Stock Deferral Plan for Norwest Corp. is adapted to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Fairfax Employees' Stock Deferral Plan for Norwest Corp. template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the templates we offer are updated by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!