The Kings New York Employees' Stock Deferral Plan for Nor west Corp. is a financial program designed to provide an opportunity for eligible employees of Kings New York to defer a portion of their compensation in the form of company stock. This plan allows employees to invest in Nor west Corp. stocks and defer the tax consequences of the stocks are distributed or sold. By participating in this plan, employees can benefit from the potential appreciation of Nor west Corp. stocks over time. The plan offers a tax-efficient way to save for retirement or other financial goals by deferring taxable income and instead receiving company stocks. There are different types or options available within the Kings New York Employees' Stock Deferral Plan: 1. Stock Deferral Option: This option allows eligible employees to defer a predetermined percentage of their compensation in the form of Nor west Corp. stocks. Employees can choose the percentage they want to defer and contribute to their stock account. The deferred stock will be subject to vesting requirements determined by the company. 2. Deferred Compensation Matching Option: This option provides additional benefits to employees who choose to defer a portion of their compensation in Nor west Corp. stocks. The company may offer a matching contribution based on the amount the employee defers, encouraging further participation and long-term savings. 3. Vesting Schedule: The plan may also include a vesting schedule, which determines when employees have full ownership of the deferred stocks. The vesting schedule is typically based on the employee's length of service with Kings New York and incentivizes long-term commitment to the company. 4. Distribution Options: Upon retirement, separation from service, or a specified event, employees can start accessing their deferred stock account. The plan may offer various distribution options, including lump-sum distributions, installment payments, or periodic withdrawals. Employees can choose the most suitable option based on their financial needs and goals. It is important for employees considering participation in the Kings New York Employees' Stock Deferral Plan to consult with a financial advisor or tax professional to fully understand the implications and advantages of the program. By taking advantage of this plan, employees can align their financial interests with the success of Nor west Corp. while also enjoying potential tax benefits and long-term growth opportunities.

Kings New York Employees' Stock Deferral Plan for Norwest Corp.

Description

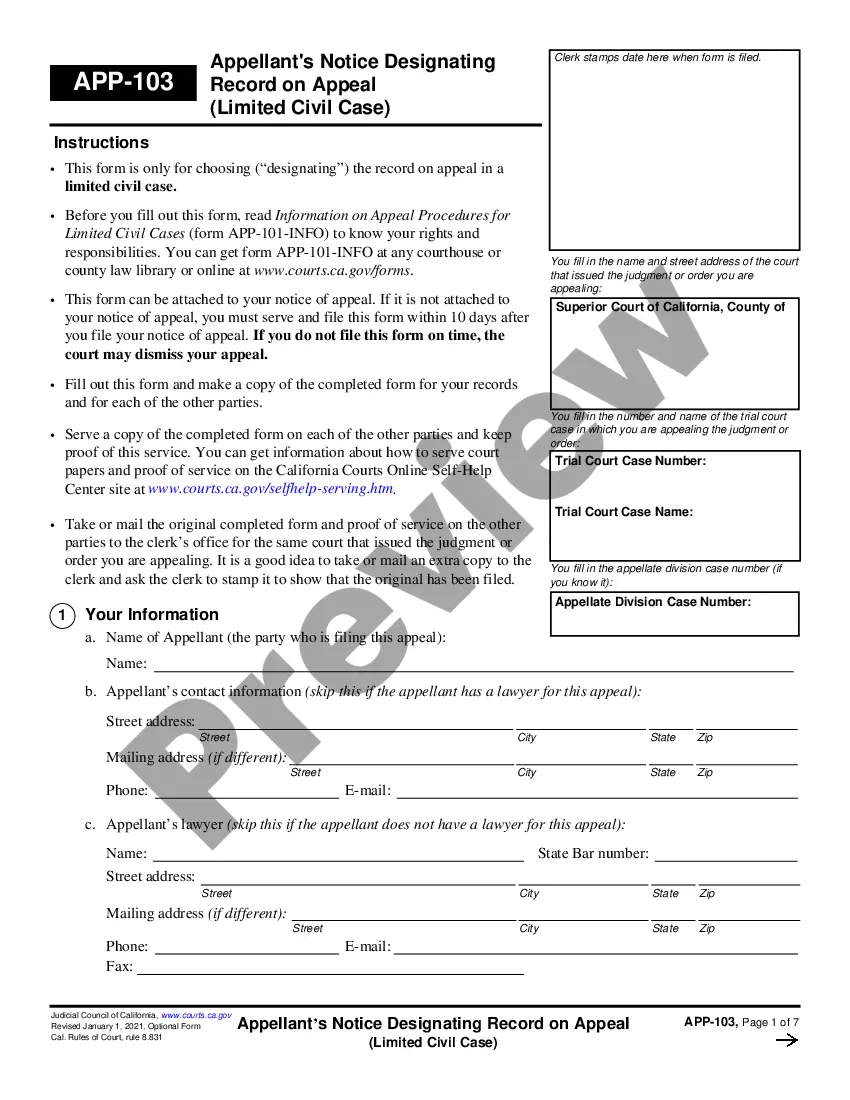

How to fill out Kings New York Employees' Stock Deferral Plan For Norwest Corp.?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Kings Employees' Stock Deferral Plan for Norwest Corp. suiting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Kings Employees' Stock Deferral Plan for Norwest Corp., here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Kings Employees' Stock Deferral Plan for Norwest Corp.:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Kings Employees' Stock Deferral Plan for Norwest Corp..

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Bonus Deferral Election means an election filed by an eligible employee or Participant pursuant to which the Participant elects to defer receipt of a specified amount of his Bonus Compensation for a Fiscal Year and to have such amount contributed to the Plan as a Deferral Contribution.

Deferred compensation plans are best suited for high-income earners who want to put away funds for retirement. Like 401(k) plans or IRAs, the money in these plans grows tax-deferred and the contributions can be deducted from taxable income in the current period.

Typically, Fidelity says, you and your employer agree on when withdrawals can start. It may be five years, 10 years or not until you reach retirement. If you retire early, get fired or quit for another job before the due date, your employ gets to claw back some of that compensation as a penalty.

Typically, Fidelity says, you and your employer agree on when withdrawals can start. It may be five years, 10 years or not until you reach retirement. If you retire early, get fired or quit for another job before the due date, your employ gets to claw back some of that compensation as a penalty.

Record the journal entry upon disbursement of cash to the employee. In 2020, the deferred compensation plan matures and the employee is paid. The journal entry is simple. Debit Deferred Compensation Liability for $100,000 (this will zero out the account balance), and credit Cash for $100,000.

An executive deferred compensation plan allows employers to defer a part of their executives' income so that they will pay taxes on it later when they start withdrawing from it.

Deferred compensationwhen offered as an investment account or a stock optionhas the potential to increase capital gains over time. Rather than simply receiving the amount that was initially deferred, a 401(k) and other deferred compensation plans can increase in value before retirement.

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Deferred compensation plans don't have required minimum distributions, either. Based upon your plan options, generally, you may choose 1 of 2 ways to receive your deferred compensation: as a lump-sum payment or in installments.

More info

Employee Savings (as of 01/01/00) (7.9) 0.1 Equity-based plans (7.4) 2.5 In a defined contribution plan — (7.1) 2.1 Deferred compensation (7.3) 1.7 Total employee savings (10.9) 2.5 Notes 1: As part of the consolidation, ECAC has committed to the City of San Francisco to assume the obligations of the former ECAC Retirement Benefit Plan with regard to the plan participants who retired between November 1, 2000, and October 31, 2001, or the plan to which ECAC and ECAC Financial received vested assets equal to 3.5% of the participant's average monthly benefit. Note 2: ECAC Retirement Benefits. ECAC Retirement Benefits Plan for Active Employees and their Survivors ECAC Retirement Benefit Plan Eligibility Requirements for All Employees Under the Plan, ECAC Retirement Benefits are payable to eligible active employees and their survivors who qualify for ECAC's Retirement Benefits Plan (see Benefits for Retiring Employees).

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.