Phoenix Arizona Employees' Stock Deferral Plan for Norwest Corp.

Description

How to fill out Employees' Stock Deferral Plan For Norwest Corp.?

Creating documentation for business or personal purposes is always a significant responsibility.

When forming a contract, a public service application, or a power of attorney, it is crucial to take into account all federal and state laws and regulations of the specific area.

Nonetheless, small counties and even municipalities also have legislative rules that you must consider.

The remarkable aspect of the US Legal Forms library is that all the documents you've ever purchased are never lost - you can access them in your profile under the My documents tab at any time. Join the platform and swiftly acquire verified legal forms for any application with just a few clicks!

- All these factors make it stressful and time-intensive to produce the Phoenix Employees' Stock Deferral Plan for Norwest Corp. without expert assistance.

- It's simple to avoid spending money on attorneys for drafting your documents and create a legally sound Phoenix Employees' Stock Deferral Plan for Norwest Corp. independently, using the US Legal Forms online library.

- It is the best web-based collection of state-specific legal documents that are professionally validated, ensuring their authenticity when selecting a template for your county.

- Previously subscribed users just need to Log In to their accounts to retrieve the necessary form.

- If you do not yet have a subscription, follow the step-by-step guide below to secure the Phoenix Employees' Stock Deferral Plan for Norwest Corp.

- Browse the page you've opened and confirm if it contains the template you require.

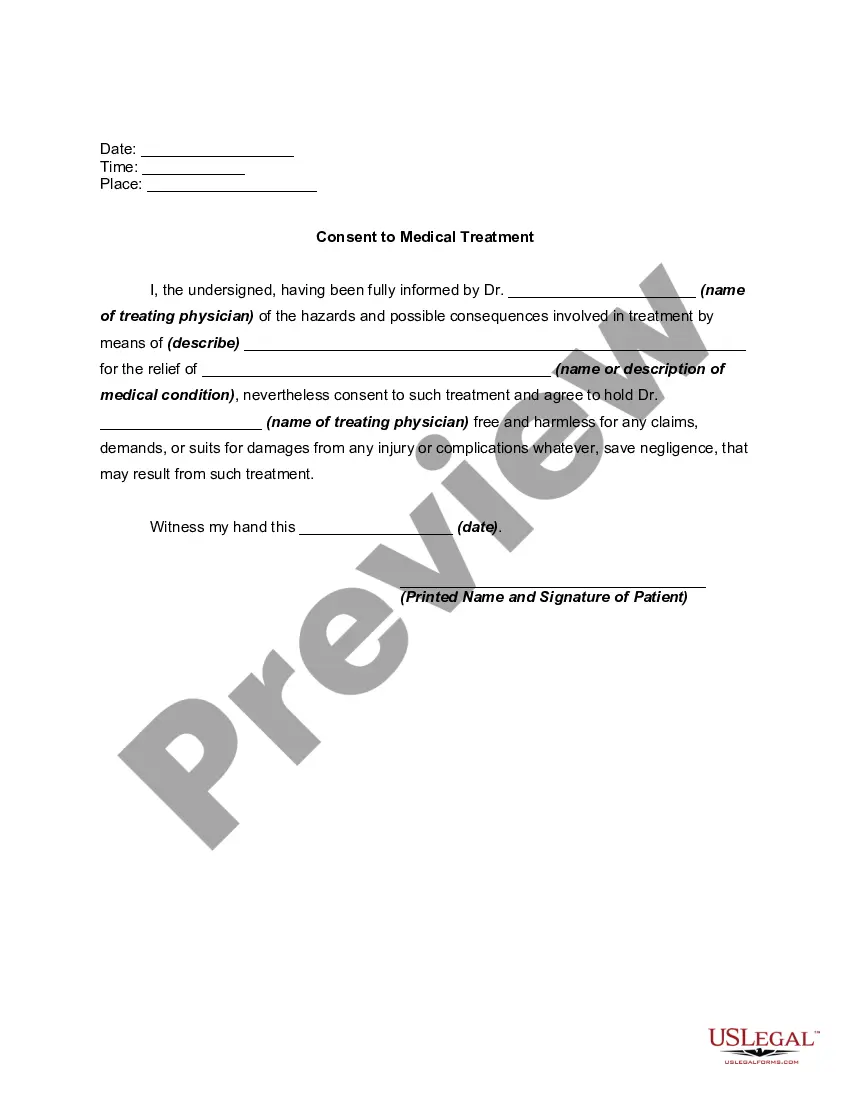

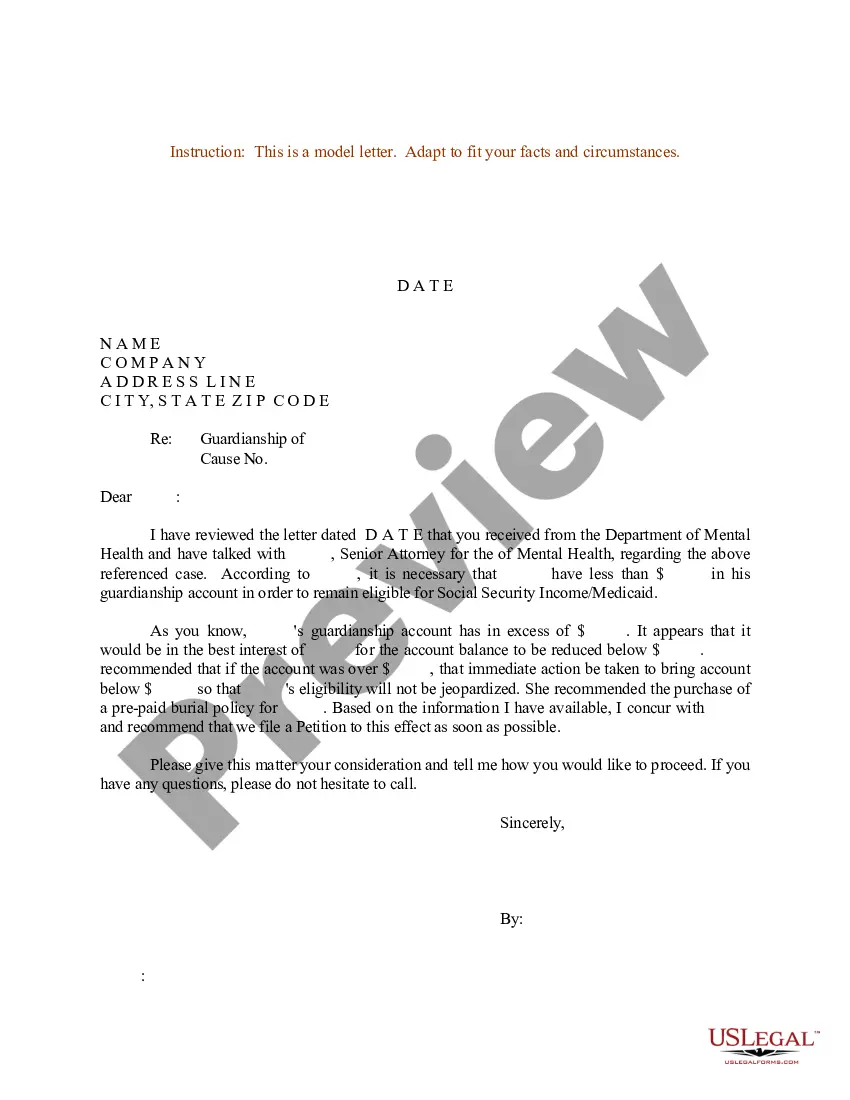

- To check, utilize the form description and preview if these features are available.

Form popularity

FAQ

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including 457(b) plans) is $20,500 in 2022 ($19,500 in 2020 and in 2021; $19,000 in 2019).

How deferred compensation is taxed. Generally speaking, the tax treatment of deferred compensation is simple: Employees pay taxes on the money when they receive it, not necessarily when they earn it.

Contribute a Set Percentage One easy way to increase your retirement savings is to contribute a percentage of your income to your Deferred Compensation Plan (DCP) account. Consider saving between 7% and 10% of your salary.

Deferred compensation is often considered better than a 401(k) for high-paid executives looking to reduce their tax burden. As well, contribution limits on deferred compensation plans can be much higher than 401(k) limits.

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.

Your Contributions One easy way to increase your retirement savings is to contribute a percentage of your income to your Deferred Compensation Plan (DCP) account. Consider saving between 7% and 10% of your salary.

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.