The Cook Illinois Directors' Stock Deferral Plan for Nor west Corp. is a comprehensive program designed to provide directors with flexibility in managing their compensation and maximizing their long-term investment potential. This plan allows directors of Cook Illinois, a subsidiary of Nor west Corp., to defer a portion of their compensation and invest it in Nor west Corp.'s stock. By participating in this plan, directors can choose to defer a percentage of their annual retainer and meeting fees, which are typically paid in cash. Instead of receiving cash payments immediately, directors have the option to allocate a specific number of shares of Nor west Corp.'s stock in lieu of cash payments. This deferral allows directors to benefit from potential future appreciation of Nor west Corp.'s stock value. The Cook Illinois Directors' Stock Deferral Plan provides directors with various options for investment allocation. Directors can choose to allocate their deferred stock to a fixed number of shares or to a dollar amount, depending on their individual investment strategy. This flexibility allows directors to tailor their investment to suit their specific financial goals and preferences. Moreover, directors also have the option to reinvest their dividends on the deferred stock into additional shares of Nor west Corp.'s stock. This reinvestment feature further enhances their potential investment growth. Additionally, the Cook Illinois Directors' Stock Deferral Plan offers directors the opportunity to diversify their investment portfolios. Directors can elect to allocate a portion of their deferred stock to a diversified investment fund, which allows for exposure to a wider range of investment options. Overall, the Cook Illinois Directors' Stock Deferral Plan for Nor west Corp. provides directors with valuable options to defer compensation and invest in Nor west Corp.'s stock, ultimately aligning their interests with the long-term success of the company. This plan empowers directors to manage their compensation and investment strategies in a way that suits their individual financial objectives and risk tolerance. Different types or variations of the Cook Illinois Directors' Stock Deferral Plan may exist depending on the specific provisions outlined by Nor west Corp. These variations could include different deferral percentages, investment allocation options, dividend reinvestment terms, and diversification alternatives. The plan may also have specific guidelines and restrictions, such as minimum and maximum deferral amounts, eligibility requirements, and vesting schedules. It is essential for directors to carefully review the plan's details to fully understand the benefits and conditions associated with their participation.

Cook Illinois Directors' Stock Deferral Plan for Norwest Corp.

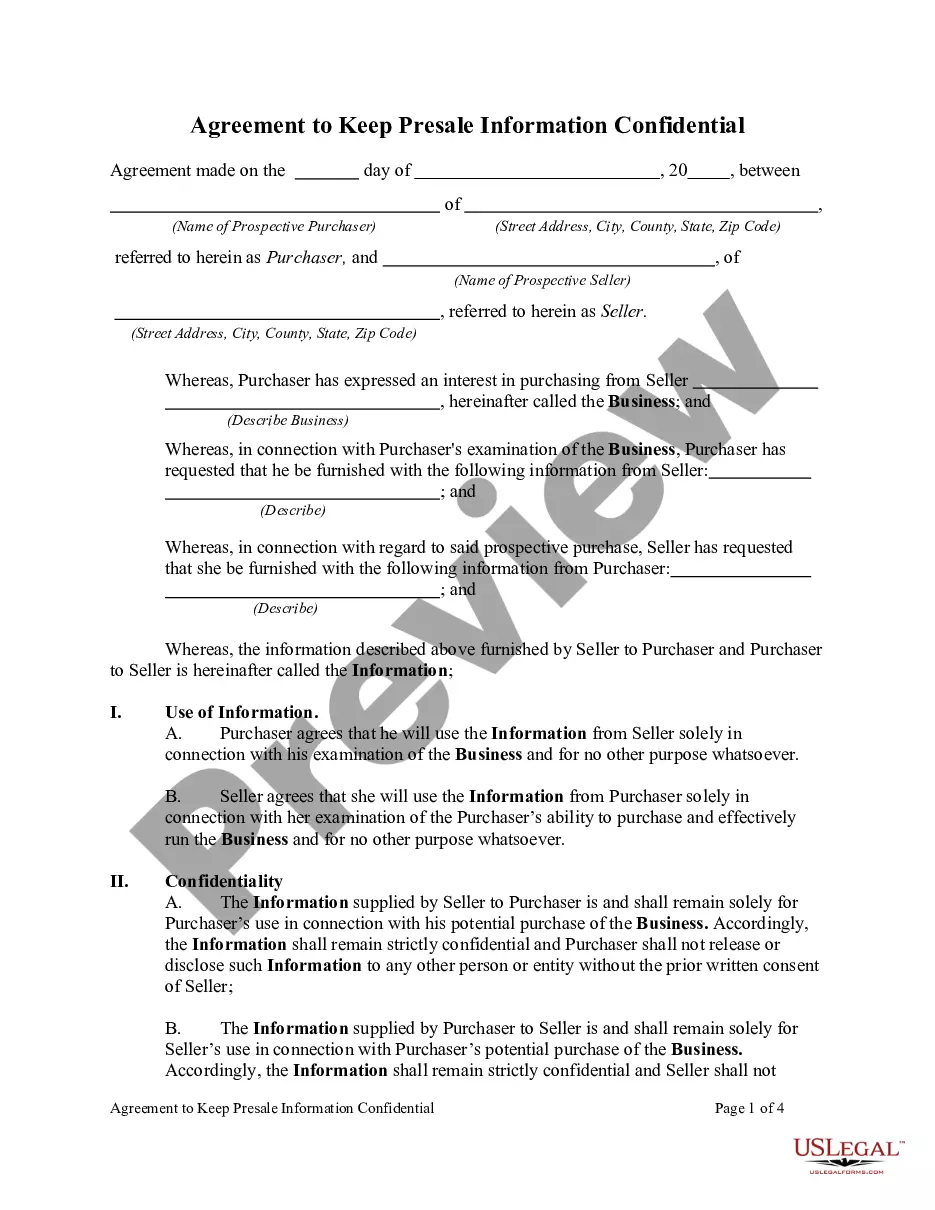

Description

How to fill out Cook Illinois Directors' Stock Deferral Plan For Norwest Corp.?

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cook Directors' Stock Deferral Plan for Norwest Corp., it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the recent version of the Cook Directors' Stock Deferral Plan for Norwest Corp., you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cook Directors' Stock Deferral Plan for Norwest Corp.:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Cook Directors' Stock Deferral Plan for Norwest Corp. and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

The Principal® Deferred Comp - Incentive Bonus plan is a deferred compensation plan that allows employers to make discretionary company contributions to participants, while helping meet organizational goals.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

Generally speaking, the tax treatment of deferred compensation is simple: Employees pay taxes on the money when they receive it, not necessarily when they earn it. For example, say your employer provides you $80,000 a year in salary and $20,000 a year in deferred compensation.

Deferred compensationwhen offered as an investment account or a stock optionhas the potential to increase capital gains over time. Rather than simply receiving the amount that was initially deferred, a 401(k) and other deferred compensation plans can increase in value before retirement.

On the company balance sheet, the accounting for deferred compensation appears on the left or assets side as salaries expense, and on the right or liabilities side as salaries payable.

Is deferred compensation considered earned income? Deferred compensation is typically not considered earned, taxable income until you receive the deferred payment in a future tax year. The use of Roth 401(k)s as deferred compensation, for example, is an exception, requiring you to pay taxes on income when it is earned.

Typically, Fidelity says, you and your employer agree on when withdrawals can start. It may be five years, 10 years or not until you reach retirement. If you retire early, get fired or quit for another job before the due date, your employ gets to claw back some of that compensation as a penalty.

A deferred compensation plan allows employees to place income into a retirement account where it sits untaxed until they withdraw the funds. After withdrawal, the funds become subject to taxes, although this is usually much less if payment is deferred until retirement.

Record the journal entry upon disbursement of cash to the employee. In 2020, the deferred compensation plan matures and the employee is paid. The journal entry is simple. Debit Deferred Compensation Liability for $100,000 (this will zero out the account balance), and credit Cash for $100,000.

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.