The Fairfax Virginia Directors' Stock Deferral Plan for Nor west Corp. is a comprehensive program designed to allow directors of Nor west Corp., a financial services company, to conveniently defer receipt of their annual stock compensation. This plan provides an attractive opportunity for directors to efficiently manage their personal financial assets, ensuring flexibility and long-term benefits. By participating in this program, directors are able to defer taxes on their stock compensation until a later date, potentially maximizing their returns and minimizing their immediate tax burdens. The Fairfax Virginia Directors' Stock Deferral Plan for Nor west Corp. offers various options to suit the preferences and goals of individual directors. These options are designed to allow directors to make informed decisions regarding the timing of their stock compensation distributions. The plan may include features such as: 1. Deferred Cash Option: Directors have the ability to choose to receive their stock compensation in the form of deferred cash payments. This option provides directors with the flexibility to manage their personal finances according to their specific needs, such as paying for education expenses, funding retirement plans, or making major purchases. 2. Deferred Stock Option: Directors may elect to defer receipt of their stock compensation, allowing it to be converted into shares of Nor west Corp. stock. This option allows directors to potentially benefit from increases in Nor west Corp.'s stock price, thereby aligning their interests with the company's long-term success. 3. Investment Options: The plan may offer a variety of investment choices to directors who participate in the stock deferral program. These options could include a range of investment vehicles, such as diversified portfolios, mutual funds, or fixed-income instruments. Directors can customize their investment strategies based on their risk tolerance and financial objectives. 4. Vesting and Distribution: The Fairfax Virginia Directors' Stock Deferral Plan for Nor west Corp. typically includes vesting schedules that determine when the deferred stock options or cash payments become available to directors. This ensures a fair distribution of compensation over time, aligning with the company's corporate governance principles. It is important for directors to thoroughly review the terms and conditions of the Fairfax Virginia Directors' Stock Deferral Plan for Nor west Corp. to make well-informed decisions regarding their stock compensation. The plan is structured to comply with relevant laws and regulations, ensuring that directors receive the full benefits of participating in this program while maintaining transparency and fairness. In summary, the Fairfax Virginia Directors' Stock Deferral Plan for Nor west Corp. offers directors the opportunity to defer their stock compensation, providing them with a range of options and flexibility in managing their personal finances. This program enables directors to align their interests with the long-term success of Nor west Corp. while maximizing their returns and optimizing tax efficiency.

Fairfax Virginia Directors' Stock Deferral Plan for Norwest Corp.

Description

How to fill out Fairfax Virginia Directors' Stock Deferral Plan For Norwest Corp.?

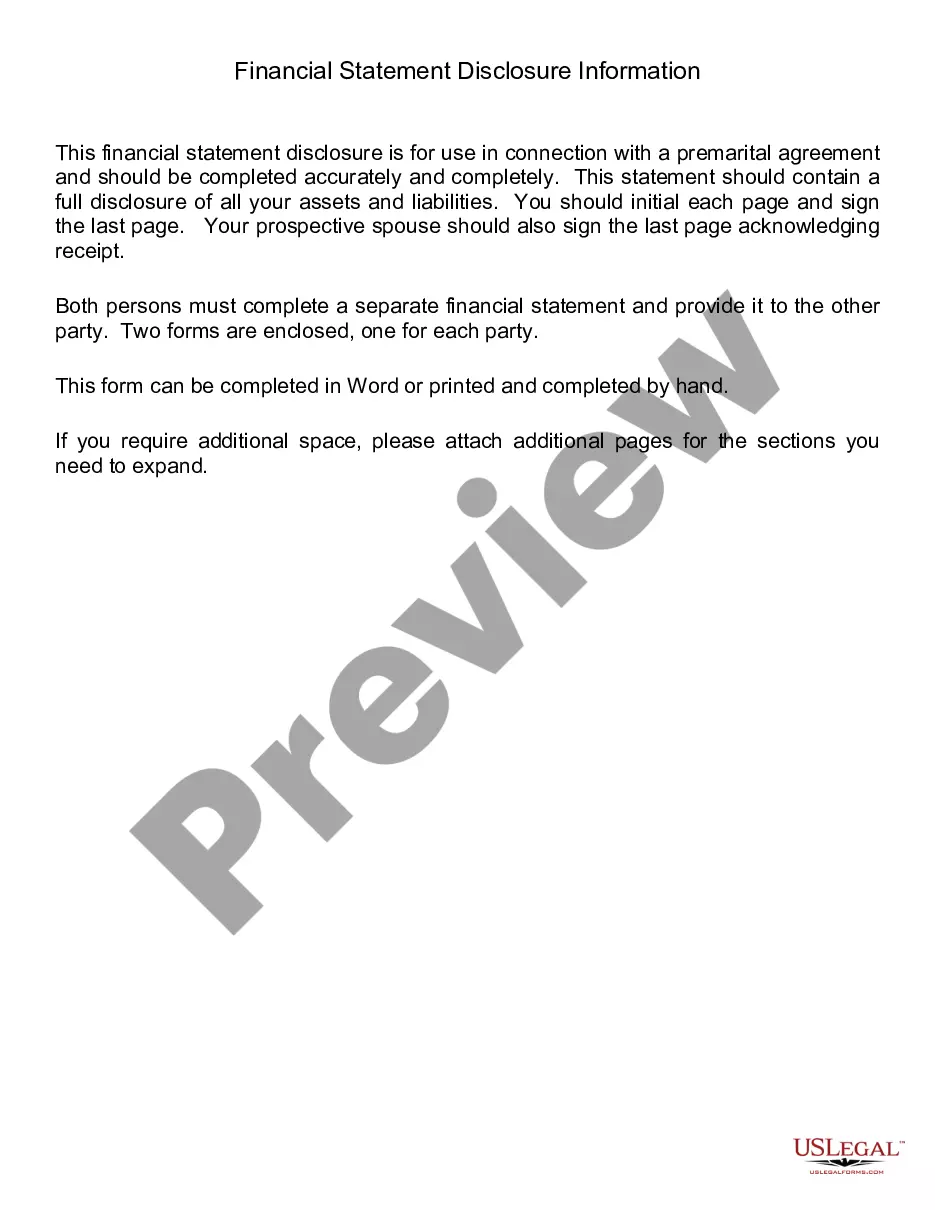

If you need to get a reliable legal paperwork provider to find the Fairfax Directors' Stock Deferral Plan for Norwest Corp., look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to find and execute different documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply select to look for or browse Fairfax Directors' Stock Deferral Plan for Norwest Corp., either by a keyword or by the state/county the document is created for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Fairfax Directors' Stock Deferral Plan for Norwest Corp. template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Fairfax Directors' Stock Deferral Plan for Norwest Corp. - all from the comfort of your home.

Join US Legal Forms now!