The Travis Texas Directors' Stock Deferral Plan is a comprehensive financial benefit offered by Nor west Corp. to its esteemed board members. This plan enables directors to defer receiving shares of stock from the company until a later predetermined date, providing flexibility to manage their financial interests effectively. Directors who choose to participate in this plan can defer the receipt of their stock compensation and potentially realize significant tax advantages. Under the Travis Texas Directors' Stock Deferral Plan, eligible board members can choose to defer a certain percentage or all of their earned stock or cash-based compensation. By opting for deferral, directors gain greater control over their income and tax obligations. Instead of receiving immediate payment, the deferred compensation is set aside and invested according to the directors' personalized investment allocations. The Nor west Corp. Travis Texas Directors' Stock Deferral Plan offers several options for how the deferred compensation can be invested. Directors can allocate funds into a variety of investment vehicles, such as mutual funds, stocks, bonds, or fixed-income funds, allowing them to tailor their investment strategy based on their financial goals and risk tolerance. One of the notable advantages of this plan is the potential tax benefits it offers. By deferring the receipt of their stock compensation, directors can potentially defer tax payments on their earnings until distribution occurs in the future, which may result in significant tax savings. Moreover, the deferred compensation can grow tax-deferred until it is distributed to the directors, allowing for potential investment gains over time. It is important to note that the Travis Texas Directors' Stock Deferral Plan may have different variations or types based on the specific needs and requirements of Nor west Corp. board members. The company may offer different investment options or additional features depending on the director's level, tenure, or specific compensation arrangements. This tailored approach ensures that directors can make the most appropriate decisions regarding the deferral of their stock compensation and investment strategy. In summary, the Travis Texas Directors' Stock Deferral Plan provided by Nor west Corp. offers an excellent opportunity for board members to defer the receipt of their stock compensation and manage their financial interests effectively. The plan allows directors to invest their deferred compensation according to their preferences, potentially realizing tax benefits and allowing for growth over time.

Travis Texas Directors' Stock Deferral Plan for Norwest Corp.

Description

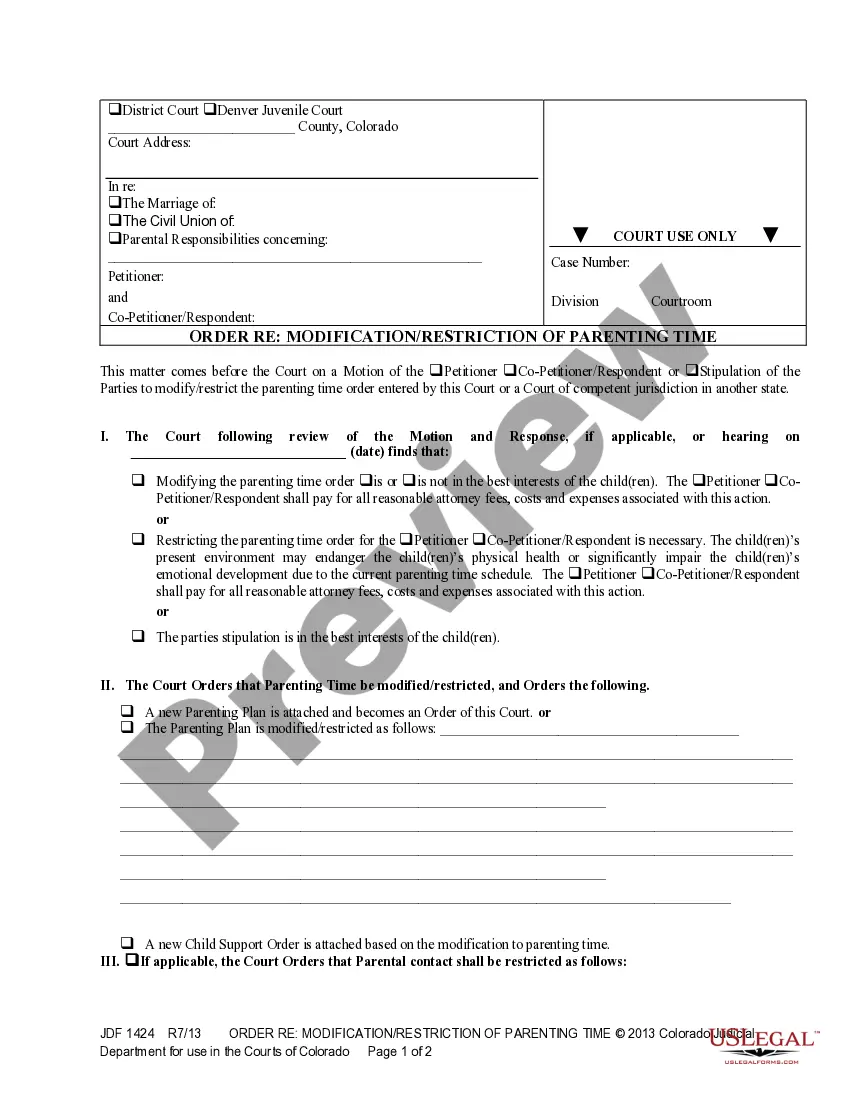

How to fill out Travis Texas Directors' Stock Deferral Plan For Norwest Corp.?

Drafting paperwork for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Travis Directors' Stock Deferral Plan for Norwest Corp. without professional assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Travis Directors' Stock Deferral Plan for Norwest Corp. by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Travis Directors' Stock Deferral Plan for Norwest Corp.:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!