The Wake North Carolina Directors' Stock Deferral Plan for Nor west Corp. is a comprehensive program designed to provide Nor west Corp. directors hailing from Wake North Carolina with opportunities to defer receiving their stock compensation. This plan allows directors to delay the receipt of stock awards, which is particularly beneficial for tax planning purposes and aligns the interests of directors with those of the company. Participants of the Wake North Carolina Directors' Stock Deferral Plan have the flexibility to choose the amount of their stock compensation to be deferred and the timing of its distribution. By choosing to defer receiving stock awards, directors can potentially reduce their tax liability in the current year, particularly if they are subject to high-income brackets. The Wake North Carolina Directors' Stock Deferral Plan offers several types of deferral options to suit the individual needs and preferences of directors. These options may include: 1. Deferred Compensation Account: Directors can opt to have their stock compensation deferred into a dedicated account, which earns a competitive rate of return over time. The funds in the account can be invested in various investment options, allowing suitable growth potential for the deferred compensation. 2. Stock Unit Deferral: Alternatively, directors can defer receiving actual stock and instead opt for stock units, which are essentially hypothetical shares that track the value of Nor west Corp. stock. The value of the stock units will fluctuate based on the performance of the company's stock, providing an opportunity for potential growth. 3. Combination Deferral: Directors may also choose a combination of deferral options, allocating a portion of their stock compensation to a deferred compensation account and another portion to stock units. This allows for diversification and potentially mitigates any risk associated with either option. Overall, the Wake North Carolina Directors' Stock Deferral Plan for Nor west Corp. offers directors from Wake North Carolina the flexibility, convenience, and tax advantages of deferring their stock compensation. By providing various deferral options, the plan ensures that directors can customize their approach to meet their individual financial goals and circumstances, while remaining aligned with the company's long-term success.

Wake North Carolina Directors' Stock Deferral Plan for Norwest Corp.

Description

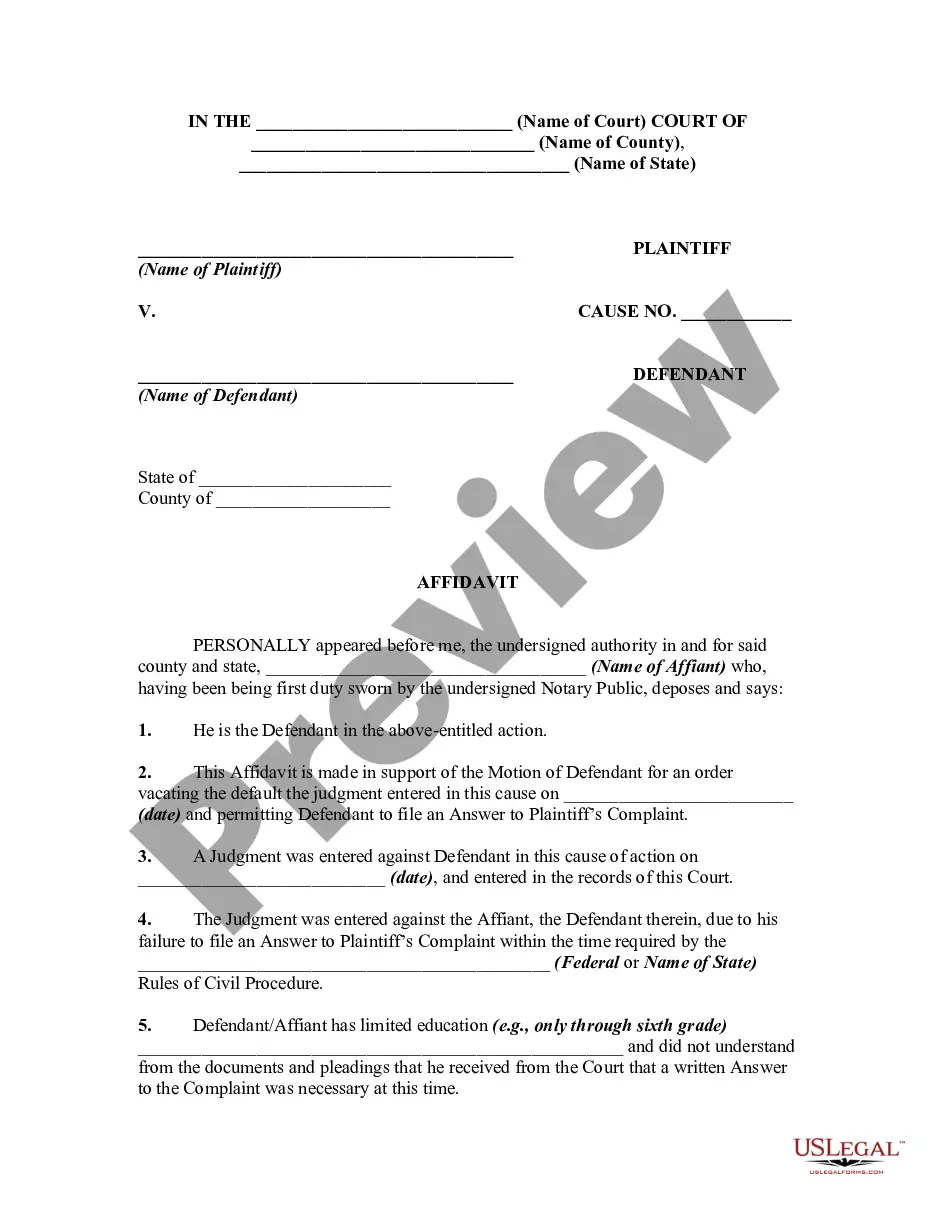

How to fill out Wake North Carolina Directors' Stock Deferral Plan For Norwest Corp.?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Wake Directors' Stock Deferral Plan for Norwest Corp., it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Consequently, if you need the recent version of the Wake Directors' Stock Deferral Plan for Norwest Corp., you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Wake Directors' Stock Deferral Plan for Norwest Corp.:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Wake Directors' Stock Deferral Plan for Norwest Corp. and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

You can't defer more than $10,000 to either plan (for example, $12,000 to the 401(k) plan and $8,000 to the SIMPLE IRA plan) because your deferrals to each employer's plan can't exceed 100% of your compensation from that employer.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

An executive deferred compensation plan allows employers to defer a part of their executives' income so that they will pay taxes on it later when they start withdrawing from it.

An employer will offer the opportunity for you to defer a portion of your compensation for a number of years, and doing so defers taxes on any earnings until you take a withdrawal. Examples include pensions, retirement plans, and stock options.

Deferred compensation plans can be a great savings vehicle, especially for employees who are maximizing their 401(k) contributions and have additional savings for investment, but they also come with lots of strings attached.

Typically, Fidelity says, you and your employer agree on when withdrawals can start. It may be five years, 10 years or not until you reach retirement. If you retire early, get fired or quit for another job before the due date, your employ gets to claw back some of that compensation as a penalty.

An executive deferred compensation plan gives the employer a way of putting off a guaranteed supplemental amount of the executive's earnings for a later date, normally after retirement. Most NQDCs also include the provision of paying benefits early, such as when the executive becomes disabled or dies prematurely.

Unlike a 401k with contributions housed in a trust and protected from the employer's (and the employee's) creditors, a deferred compensation plan (generally) offers no such protections. Instead, the employee only has a claim under the plan for the deferred compensation.

Deferred compensationwhen offered as an investment account or a stock optionhas the potential to increase capital gains over time. Rather than simply receiving the amount that was initially deferred, a 401(k) and other deferred compensation plans can increase in value before retirement.

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.