Houston Texas Approval of Deferred Compensation Investment Account Plan is a comprehensive retirement plan designed to provide financial security for employees in the Houston, Texas area. This plan allows participants to defer a portion of their compensation and invest it into various investment options. With the approval from Houston city officials, this plan offers significant advantages and benefits to eligible employees. The Houston Texas Approval of Deferred Compensation Investment Account Plan offers flexibility and control over investment choices. Participants can select from a range of investment options tailored to their risk tolerance and financial goals. These options may include stocks, bonds, mutual funds, and other assets. By diversifying their investments, participants can potentially enhance their returns and build a substantial retirement nest egg. One type of Houston Texas Approval of Deferred Compensation Investment Account Plan is the 401(k) plan. This plan allows employees to contribute a portion of their salary on a pre-tax basis, reducing their current taxable income. Contributions grow tax-free until withdrawal during retirement. Additionally, employers may match a portion of the employee's contributions, further boosting retirement savings. Another type of plan available to employees is the 457 plan. This plan is specifically designed for government and public sector employees. It allows participants to defer a portion of their compensation and invest it similarly as the 401(k) plan. The key difference is that the 457 plan does not impose penalties for early withdrawals before the age of 59 ½, making it a flexible option for those looking for more immediate access to their funds. The Houston Texas Approval of Deferred Compensation Investment Account Plan also provides tax advantages. Contributions to these plans are tax-deferred, meaning participants will only pay taxes on the money when they withdraw it during retirement. This can potentially decrease their taxable income during their working years, allowing for additional savings. Additionally, investment gains within the account grow on a tax-deferred basis, potentially increasing the overall account balance over time. It's important to note that each type of account plan may have unique features, eligibility requirements, and specific rules. Participants should carefully review the plan documents and consult with a financial advisor to understand the options available to them and make informed investment decisions that align with their individual financial goals. In conclusion, the Houston Texas Approval of Deferred Compensation Investment Account Plan is a valuable retirement savings option for employees in Houston, Texas. With multiple investment options, tax advantages, and potential employer contributions, this plan offers a strong foundation for building a secure financial future. Whether through a 401(k) or 457 plans, participants can take advantage of the flexibility, tax benefits, and potential growth opportunities provided by these investment accounts.

Houston Texas Approval of deferred compensation investment account plan

Description

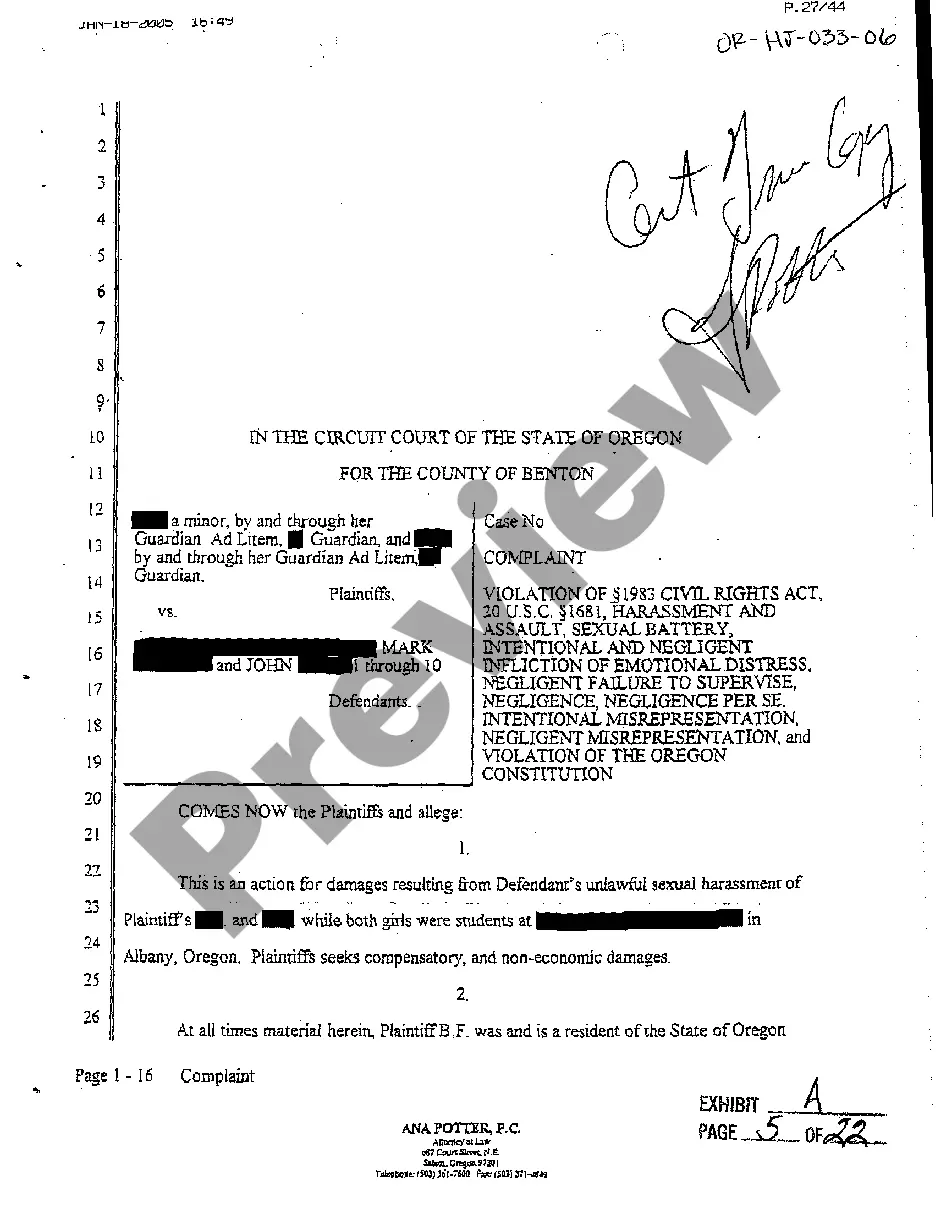

How to fill out Houston Texas Approval Of Deferred Compensation Investment Account Plan?

Creating documents, like Houston Approval of deferred compensation investment account plan, to take care of your legal matters is a challenging and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for different cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Houston Approval of deferred compensation investment account plan template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Houston Approval of deferred compensation investment account plan:

- Make sure that your template is compliant with your state/county since the rules for creating legal documents may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Houston Approval of deferred compensation investment account plan isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start utilizing our service and download the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

You can take the distribution in a lump sum or regular installments, paying tax when you receive the income. You can also arrange to withdraw some of it when you anticipate a need, such as paying for your kids' college tuition. While the IRS has few restrictions, your employer will probably have their own rules.

Deferred compensation plans come in two types ? qualified and non-qualified. Qualified retirement plans such as 401(k), 403(b) and 457 plans, are offered to all employees and are taxed when the contribution is made to the account.

Qualified deferred compensation plans are pension plans governed by the Employee Retirement Income Security Act (ERISA), a key set of federal regulations for retirement plans. They include 401(k) plans and 403(b) plans.

Attainment of age 59½, regardless of your employment status.

Generally, your deferred compensation (commonly referred to as elective contributions) isn't subject to income tax withholding at the time of deferral, and you don't report it as wages on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors, because it isn't included in box 1 wages

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

You can take the distribution in a lump sum or regular installments, paying tax when you receive the income. You can also arrange to withdraw some of it when you anticipate a need, such as paying for your kids' college tuition. While the IRS has few restrictions, your employer will probably have their own rules.

An eligible deferred compensation plan under IRC Section 457(b) is an agreement or arrangement (which may be an individual employment agreement) under which the payment of compensation is deferred (whether by salary reduction or by nonelective employer contribution).

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

ERISA can cover both defined-benefit and defined-contribution plans offered by employers. Common types of employer-sponsored retirement accounts that fall under ERISA include 401(k) plans, pensions, deferred-compensation plans, and profit-sharing plans.