Los Angeles California Approval of Deferred Compensation Investment Account Plan A deferred compensation investment account plan is a type of retirement savings option that allows employees to defer a portion of their current income to be received at a later date, usually during retirement. The approval of such plans in Los Angeles, California ensures that employees have the opportunity to take advantage of tax advantages and long-term investment growth. These investment account plans typically provide employees with the ability to contribute a percentage of their earnings before taxes are deducted, thereby reducing their current taxable income. This tax deferral allows individuals to potentially lower their current tax burden while allowing their investments to grow over time. In Los Angeles, California, the approval of deferred compensation investment account plans is beneficial for both employees and employers. Employers have the opportunity to attract and retain talented individuals by offering this retirement savings option. Additionally, employers may provide matching contributions or other incentives to promote participation in these plans. There are different types of deferred compensation investment account plans available in Los Angeles, each with its own unique features: 1. 401(k) Plans: A 401(k) plan is a popular type of deferred compensation investment account plan that allows employees to contribute a portion of their wages to a retirement account. Employers may also match a percentage of the employee's contributions, thereby augmenting the growth potential of the account. 2. 403(b) Plans: Similar to 401(k) plans, a 403(b) plan is designed for employees of certain tax-exempt organizations and public schools. These plans also offer tax advantages and investment opportunities to help individuals save for retirement. 3. Deferred Compensation Plans: Some employers offer deferred compensation plans that allow highly compensated employees to defer a portion of their compensation in addition to what they contribute to other retirement plans. These plans often have special rules and restrictions. 4. Simple IRA: A Simple IRA is another option available for small businesses with fewer than 100 employees. It provides an easy and cost-effective way for employers to offer retirement benefits, allowing employees to contribute a portion of their salary on a tax-deferred basis. Overall, the approval of deferred compensation investment account plans in Los Angeles, California is crucial in providing employees with a tax-advantaged retirement savings option. These plans enable individuals to build financial security for their future while encouraging long-term investment growth. Employers that offer these plans demonstrate their commitment to their employees' well-being and help foster a positive work environment.

Los Angeles California Approval of deferred compensation investment account plan

Description

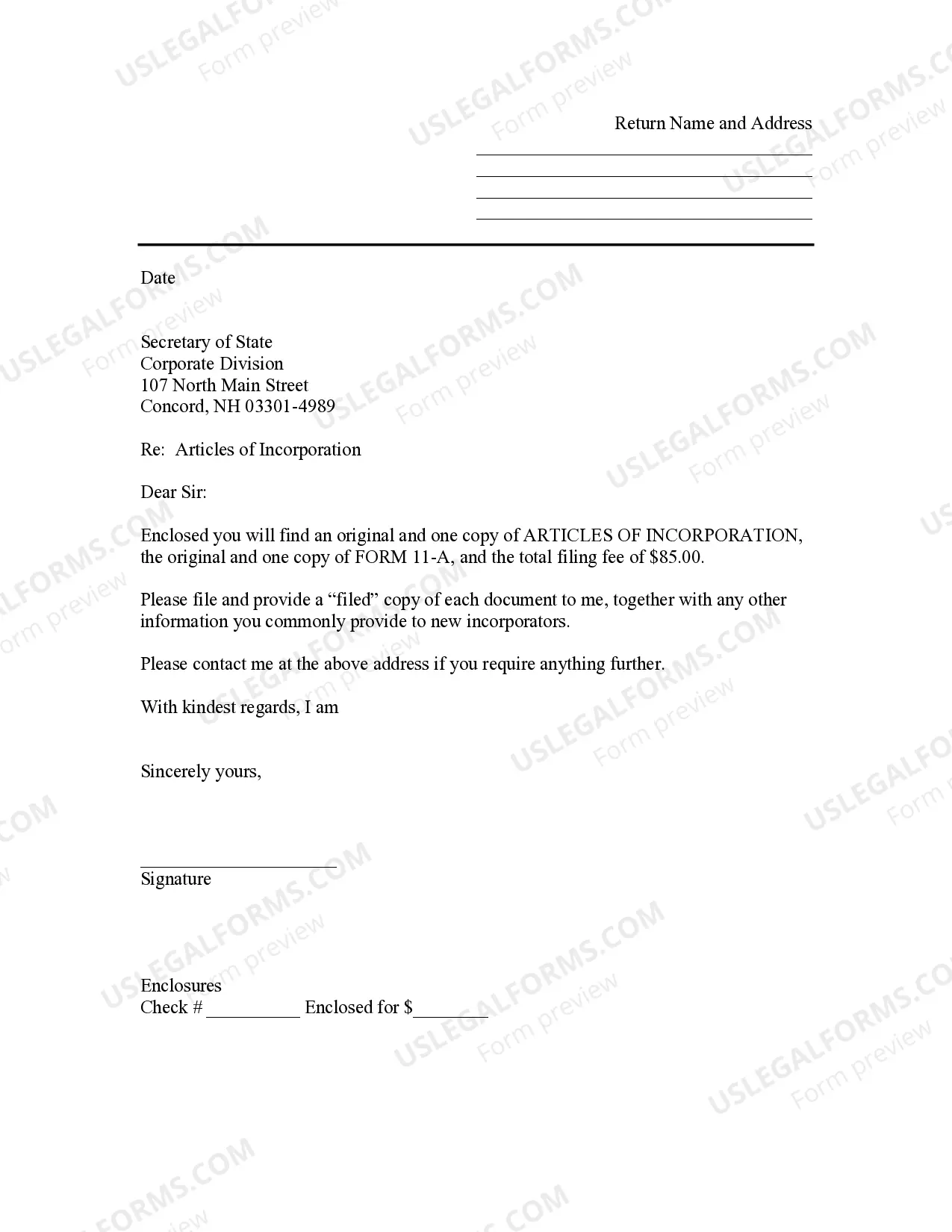

How to fill out Los Angeles California Approval Of Deferred Compensation Investment Account Plan?

Draftwing documents, like Los Angeles Approval of deferred compensation investment account plan, to take care of your legal affairs is a tough and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for a variety of cases and life circumstances. We ensure each document is compliant with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Los Angeles Approval of deferred compensation investment account plan template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Los Angeles Approval of deferred compensation investment account plan:

- Make sure that your template is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Los Angeles Approval of deferred compensation investment account plan isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our website and get the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to find and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!