San Antonio, Texas, Approval of Deferred Compensation Investment Account Plan: The San Antonio, Texas, Approval of Deferred Compensation Investment Account Plan is a comprehensive and flexible retirement benefit offered to employees of the San Antonio government or related organizations. This plan allows eligible employees to set aside a portion of their income on a pre-tax basis, with the funds invested in various investment options. The Approval of Deferred Compensation Investment Account Plan in San Antonio, Texas, provides employees with the opportunity to save for their retirement while enjoying potential tax advantages. By deferring a portion of their compensation, employees can reduce their current taxable income and allow those funds to grow tax-deferred until retirement. There are different types of Approval of Deferred Compensation Investment Account Plans available in San Antonio, Texas, each tailored to meet the diverse needs of employees. These plans include: 1. Traditional Deferred Compensation Plan: This plan allows employees to defer a fixed amount or a percentage of their income to be invested in a range of options such as mutual funds, stocks, bonds, or stable value funds. The contributions and investment earnings are tax-deferred until withdrawal, typically at retirement. 2. Roth Deferred Compensation Plan: This plan, similar to a Roth IRA, allows employees to contribute after-tax dollars, meaning they won't be taxed when withdrawn during retirement. With a Roth Deferred Compensation Plan, employees can potentially enjoy tax-free growth on their investments. 3. Hybrid Deferred Compensation Plan: This plan offers a combination of both traditional and Roth options, allowing employees to contribute to both accounts within their approved limits. This approach provides more control over future tax obligations by diversifying retirement savings taxable and tax-free sources. To enroll in the San Antonio, Texas, Approval of Deferred Compensation Investment Account Plan, eligible employees must carefully review the plan's details, investment options, and contribution limits. They can consult with financial advisors or plan administrators to make informed decisions based on their individual financial goals and risk tolerance. Overall, the San Antonio, Texas, Approval of Deferred Compensation Investment Account Plan is designed to provide employees with a powerful tool for securing their financial future. By taking advantage of this plan, employees can accumulate substantial retirement savings while benefiting from potential tax advantages, making the most out of their hard-earned income.

San Antonio Texas Approval of deferred compensation investment account plan

Description

How to fill out San Antonio Texas Approval Of Deferred Compensation Investment Account Plan?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life situation, locating a San Antonio Approval of deferred compensation investment account plan suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Apart from the San Antonio Approval of deferred compensation investment account plan, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your San Antonio Approval of deferred compensation investment account plan:

- Examine the content of the page you’re on.

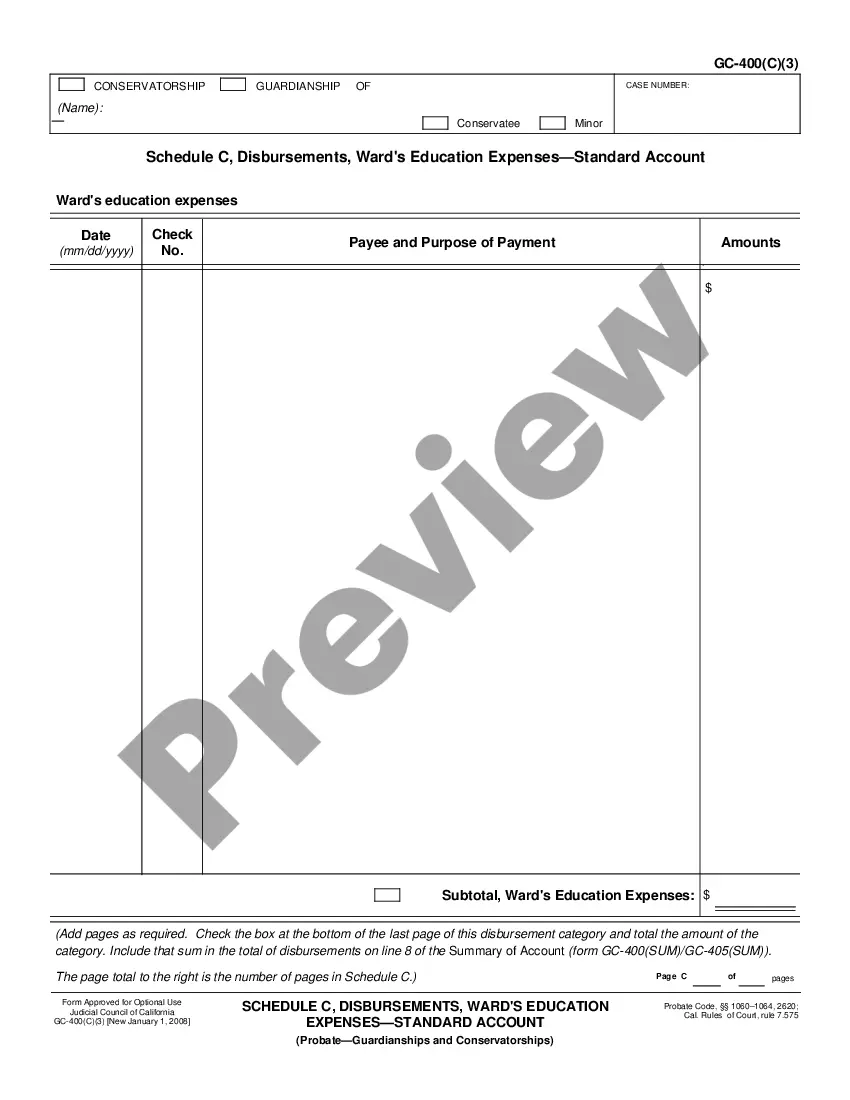

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Antonio Approval of deferred compensation investment account plan.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!