San Diego California, known for its sunny weather and stunning beaches, is a city situated on the west coast of the United States. This affluent city boasts a diverse economy and a high standard of living, attracting businesses and individuals alike. One significant aspect of the financial landscape in San Diego is the approval of deferred compensation investment account plans. A San Diego California approval of deferred compensation investment account plan refers to a program that allows employees to set aside a portion of their income for retirement or other long-term financial goals. These plans are typically offered by employers as a way to incentivize and retain talented individuals. The funds contributed are invested, providing potential growth opportunities over time. There are different types of San Diego California approval of deferred compensation investment account plans, each tailored to suit varying needs and preferences. Some common types include: 1. 401(k) plans: These are employer-sponsored retirement accounts that allow employees to contribute a portion of their salary on a pre-tax basis. The funds in a 401(k) plan are typically invested in a selection of mutual funds, giving participants the opportunity to grow their savings over time. 2. 403(b) plans: Similar to 401(k) plans, 403(b) plans are designed for employees of certain tax-exempt organizations, such as schools and nonprofits. These plans operate on a tax-deferred basis, enabling employees to save for retirement while enjoying potential tax advantages. 3. 457 plans: Primarily offered to state and local government employees, 457 plans are another form of deferred compensation investment account plans. These plans allow participants to contribute a portion of their income on a pre-tax or after-tax basis, offering flexibility in saving for retirement or other long-term financial goals. 4. Employee Stock Ownership Plans (Sops): Sops are unique deferred compensation investment account plans that provide employees with company stock as a form of ownership. These plans aim to align the interests of employees with the success of the company, potentially generating wealth for participants as the stock value increases. By offering these various types of San Diego California approval of deferred compensation investment account plans, employers provide their employees with opportunities to secure their financial future. Whether it be through 401(k) plans, 403(b) plans, 457 plans, or Sops, San Diego residents have access to a range of options to grow their wealth and plan for retirement.

Mydcplan Login

Description

How to fill out San Diego California Approval Of Deferred Compensation Investment Account Plan?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Diego Approval of deferred compensation investment account plan, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the San Diego Approval of deferred compensation investment account plan from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the San Diego Approval of deferred compensation investment account plan:

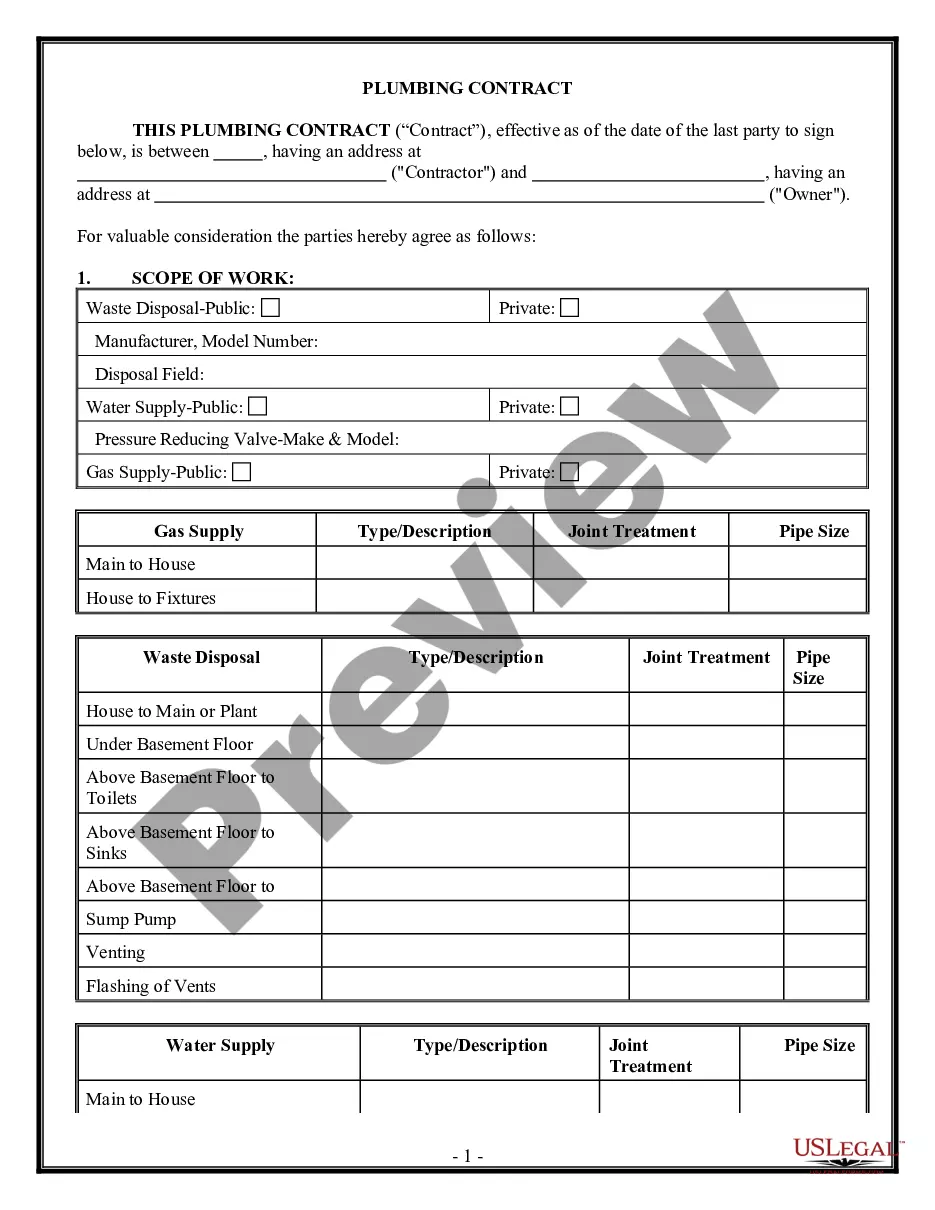

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!