The Contra Costa California Deferred Compensation Investment Account Plan is a retirement savings program offered to eligible employees of Contra Costa County, California. This plan allows employees to contribute a portion of their salary on a pre-tax basis, which can be used to invest in various investment options. The primary aim of the Contra Costa California Deferred Compensation Investment Account Plan is to provide employees with an additional source of income during their retirement years. By contributing a portion of their salary to the plan, employees can take advantage of the tax benefits associated with deferred compensation. Contributions made to the plan are not subject to federal or state income taxes until the funds are withdrawn. There are different types of Contra Costa California Deferred Compensation Investment Account Plans available to employees, which allow them to tailor their investment strategy according to their needs and risk tolerance. 1. 457(b) Plan: This plan is specifically designed for governmental and public employees, including those working for Contra Costa County. It allows employees to contribute a portion of their salary on a pre-tax basis and offers tax advantages and flexibility in investment options. 2. Roth 457(b) Plan: This plan is similar to the 457(b) plan, but with a Roth option. Employees can make after-tax contributions to the plan, and qualified withdrawals in retirement are tax-free, providing potential tax advantages for those who expect to be in a higher tax bracket during retirement. By participating in any of the Contra Costa California Deferred Compensation Investment Account Plans, employees can take control of their retirement savings and invest in a diverse array of investment options, including mutual funds, index funds, and target-date funds. These investment options are managed by professional investment firms, ensuring that employees have access to well-diversified and professionally managed portfolios. The Contra Costa California Deferred Compensation Investment Account Plan also offers educational resources and tools to help employees make informed decisions about their investments. Participants can access online calculators, attend webinars, and receive personalized guidance from plan administrators, ensuring that they have the necessary knowledge to make sound investment choices. Overall, the Contra Costa California Deferred Compensation Investment Account Plan is a valuable retirement savings program for eligible employees, providing tax advantages, investment flexibility, and educational resources to help them achieve their long-term financial goals.

Contra Costa California Deferred Compensation Investment Account Plan

Description

How to fill out Contra Costa California Deferred Compensation Investment Account Plan?

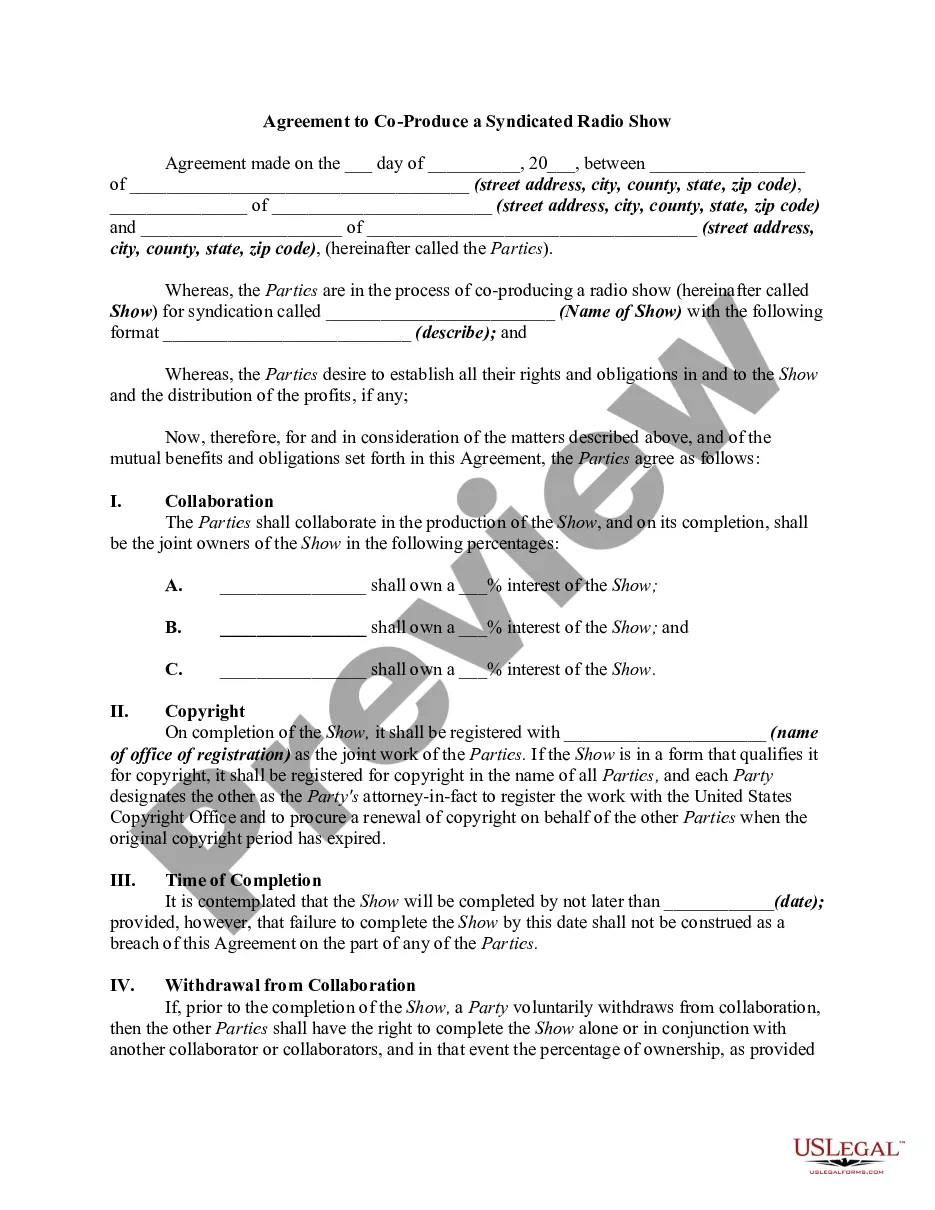

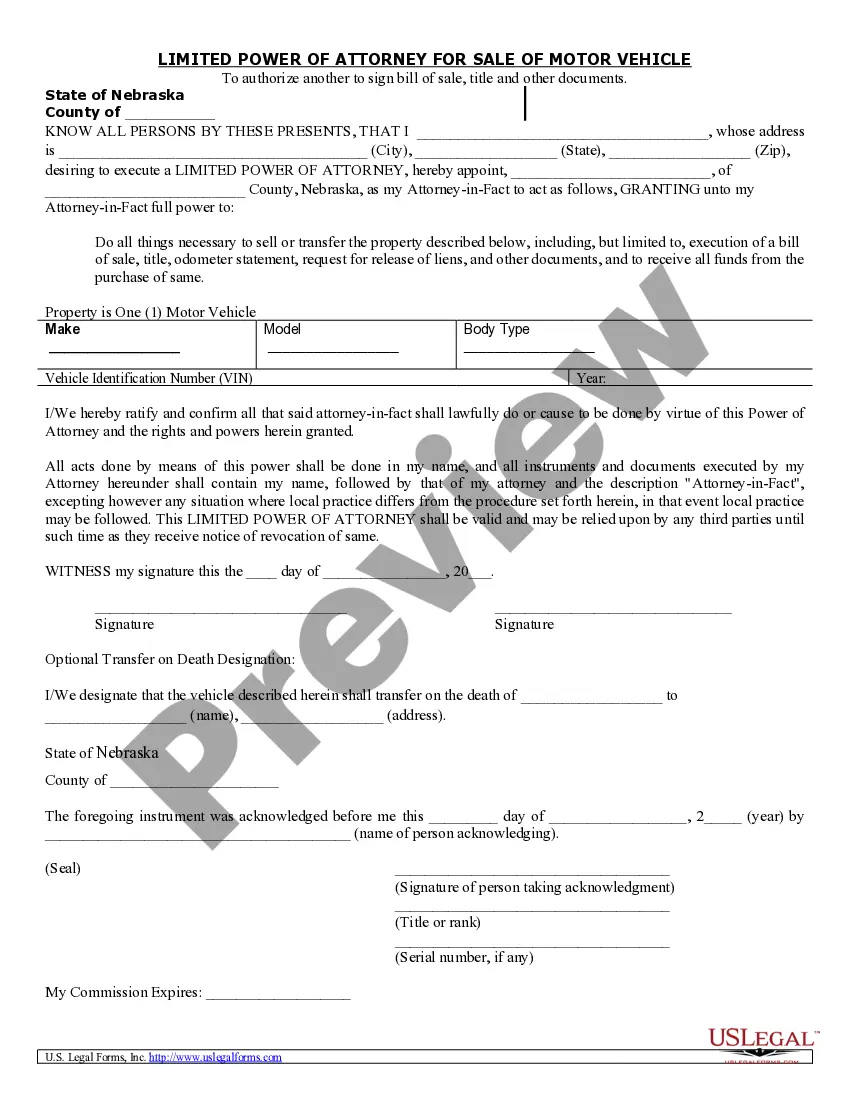

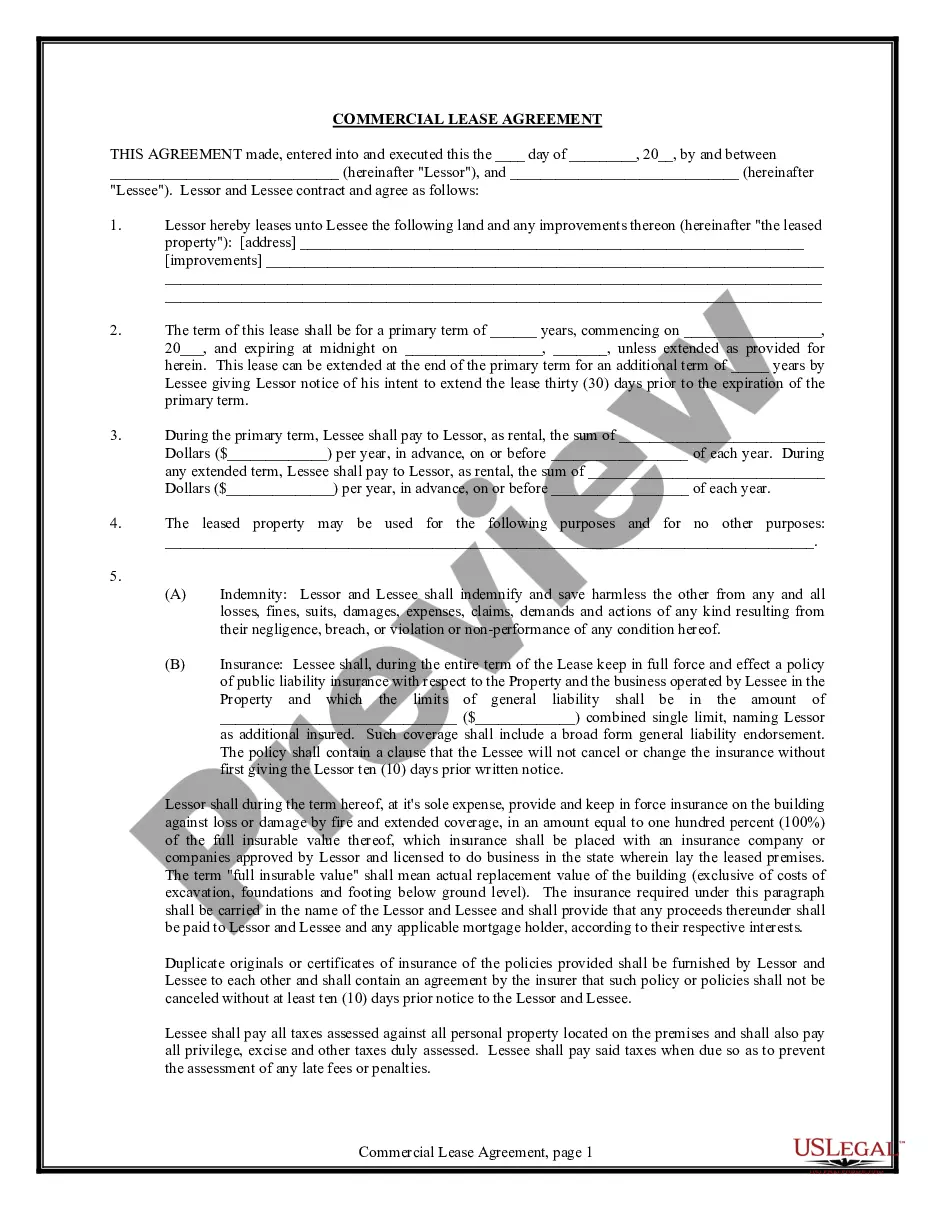

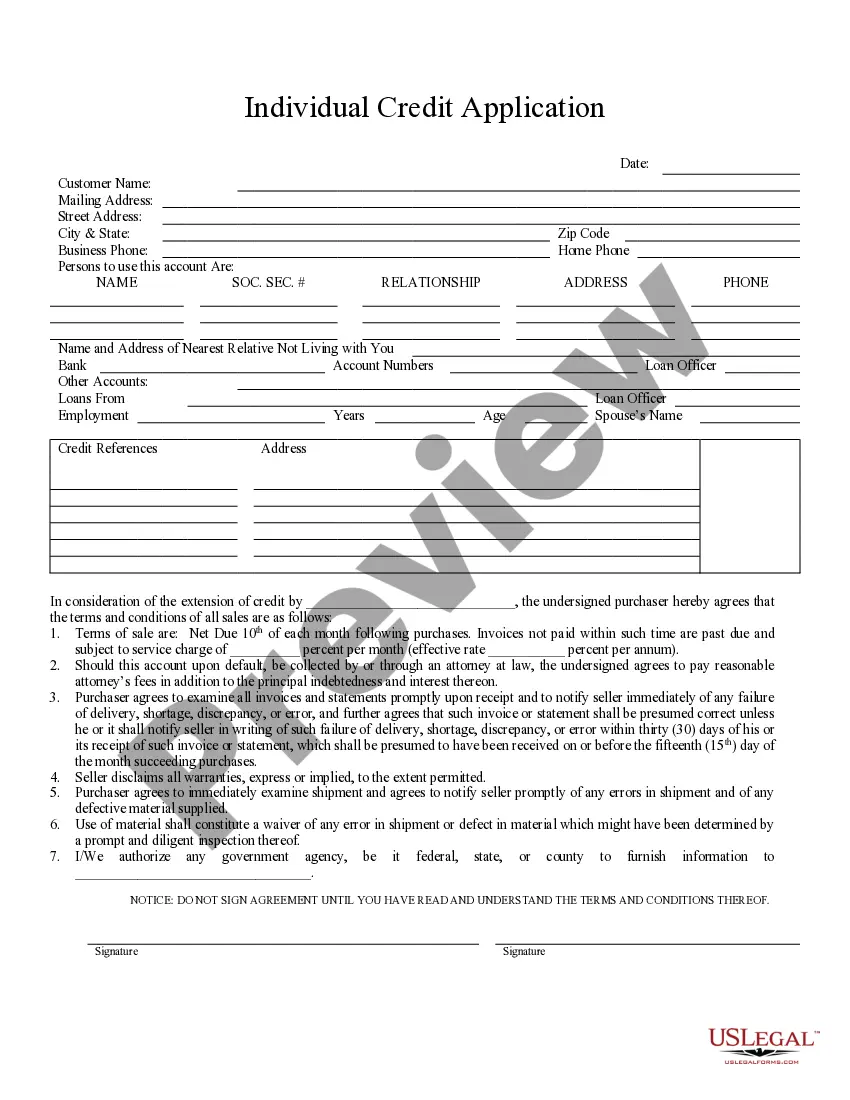

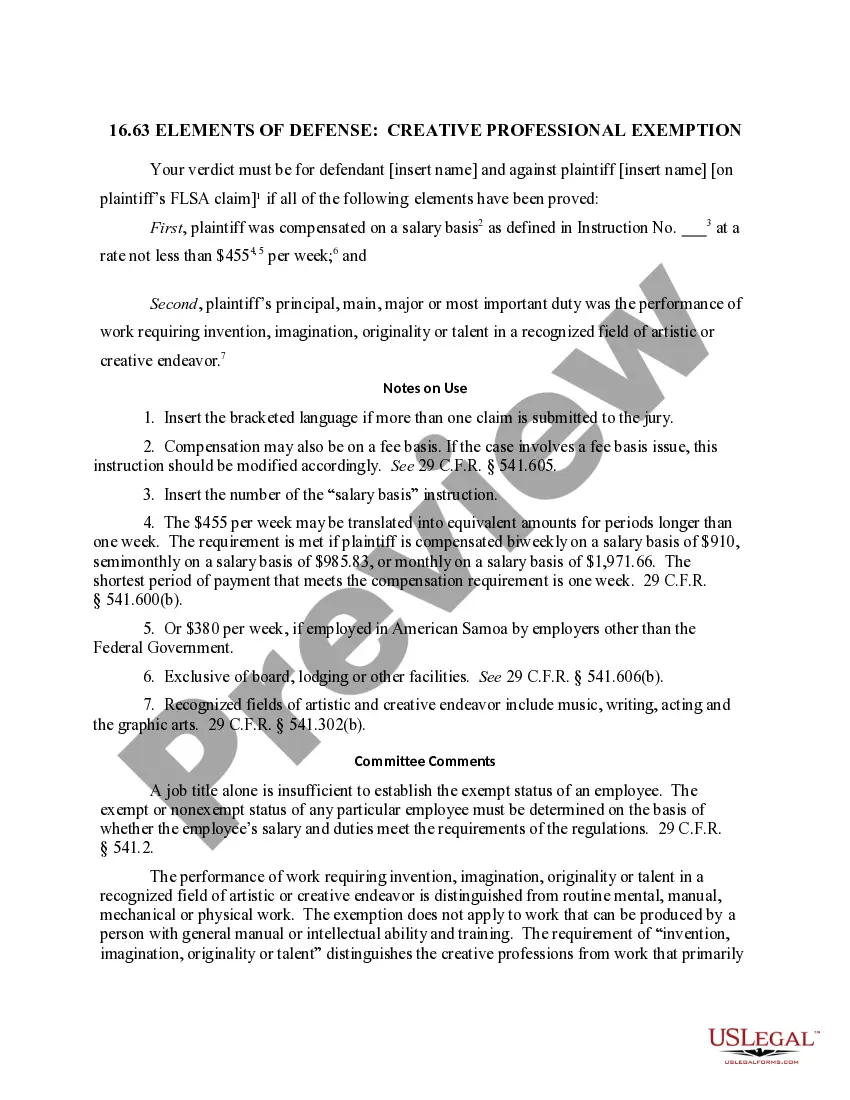

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Contra Costa Deferred Compensation Investment Account Plan is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Contra Costa Deferred Compensation Investment Account Plan. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Contra Costa Deferred Compensation Investment Account Plan in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

If your deferred compensation plan is a qualified plan, then it can be rolled over to a retirement account such as a Roth IRA or a traditional IRA or other qualified retirement plans.

Is there a time when I must withdraw money from my Deferred Compensation Plan? If you have separated from service with New York State or a participating employer, you must begin receiving payments no later than April 1 following the close of the calendar year in which you turn age 72.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

One easy way to increase your retirement savings is to contribute a percentage of your income to your Deferred Compensation Plan (DCP) account. Consider saving between 7% and 10% of your salary.

You can leave the money in the account, withdraw in full or withdraw it in payments. If you are not a spouse, you can withdraw the funds. For more specific information about withdrawal options, contact the DRS record keeper.

Executive deferred compensation plans are an excellent way to attract and keep high-income executives since they can't roll over their contributions and keep them when they retire. If you are an executive, learn about these plans before you invest, including the pros and cons.

Typically, Fidelity says, you and your employer agree on when withdrawals can start. It may be five years, 10 years or not until you reach retirement. If you retire early, get fired or quit for another job before the due date, your employ gets to claw back some of that compensation as a penalty.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

But because these plans are not qualified retirement plans, the money you have in a deferred compensation plan is generally not protected from the company's creditors. So if your employer gets into financial difficulty, or goes bankrupt, your savings may be seized to pay the company's liabilities.

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.

Interesting Questions

More info

Disability Insurance. California Education Code §4117. Employer's Compensation. California Employment of Health and Welfare Benefits. In addition to those covered by CCC ERA, Section 621 provides that all employers covered by Section 621 and California's Family Care Plan must pay to employees their share of health and welfare benefits as stated in Section 621.5. In the event a CCC employee is receiving health or welfare benefits from an employer other than the employer the employee will be obligated to pay that proportion of the amounts due, as required by Section 621.5. California Education Code §621.5. Employee's Rights, Exceptions, and Remedies. You have the right to determine and be paid any amount required to be paid under this act. The amounts for which you must pay include, but are not limited to, those amounts that are provided as “other remuneration.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.