Dallas Texas Deferred Compensation Investment Account Plan is a retirement savings plan offered to employees of the city of Dallas, Texas. This plan allows participants to defer a portion of their income into a tax-deferred investment account, providing them with an opportunity to save for retirement while potentially lowering their current taxable income. The Dallas Texas Deferred Compensation Investment Account Plan offers various investment options to cater to the diverse needs and risk tolerance levels of its participants. These investment options may include mutual funds, stocks, bonds, and other investment vehicles. Participants can select from a range of investment options based on their individual financial goals and objectives. One type of Dallas Texas Deferred Compensation Investment Account Plan is the Defined Contribution Plan. Under this plan, participants contribute a portion of their pre-tax income into their investment account, and the invested funds grow tax-deferred until retirement. The eventual retirement income is based on the contributions made, investment returns, and other factors, such as the participant's age at retirement. Another type of plan available is the Roth Deferred Compensation Plan. Unlike the traditional pre-tax contribution plan, participants contribute after-tax income into their investment account. While participants do not receive an immediate tax benefit, the funds grow tax-free, and qualified withdrawals made during retirement can be tax-free as well. The Dallas Texas Deferred Compensation Investment Account Plan also offers a range of additional features and benefits to participants. These may include employer match or contribution, allowing employees to receive additional funds to boost their retirement savings. Participants may also have access to educational resources, tools, and seminars to help them make informed investment decisions. The plan provides flexibility in terms of contributions, allowing participants to change their contribution amount or investment allocation as needed. It also offers convenient online access, allowing participants to manage their investments, view account balances, and monitor performance anytime, anywhere. Overall, the Dallas Texas Deferred Compensation Investment Account Plan serves as a valuable retirement savings tool for employees of the city of Dallas. It offers a range of investment options, tax advantages, and flexibility to help participants plan for a secure and comfortable retirement.

Dallas Texas Deferred Compensation Investment Account Plan

Description

How to fill out Dallas Texas Deferred Compensation Investment Account Plan?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Dallas Deferred Compensation Investment Account Plan.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Dallas Deferred Compensation Investment Account Plan will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Dallas Deferred Compensation Investment Account Plan:

- Ensure you have opened the correct page with your regional form.

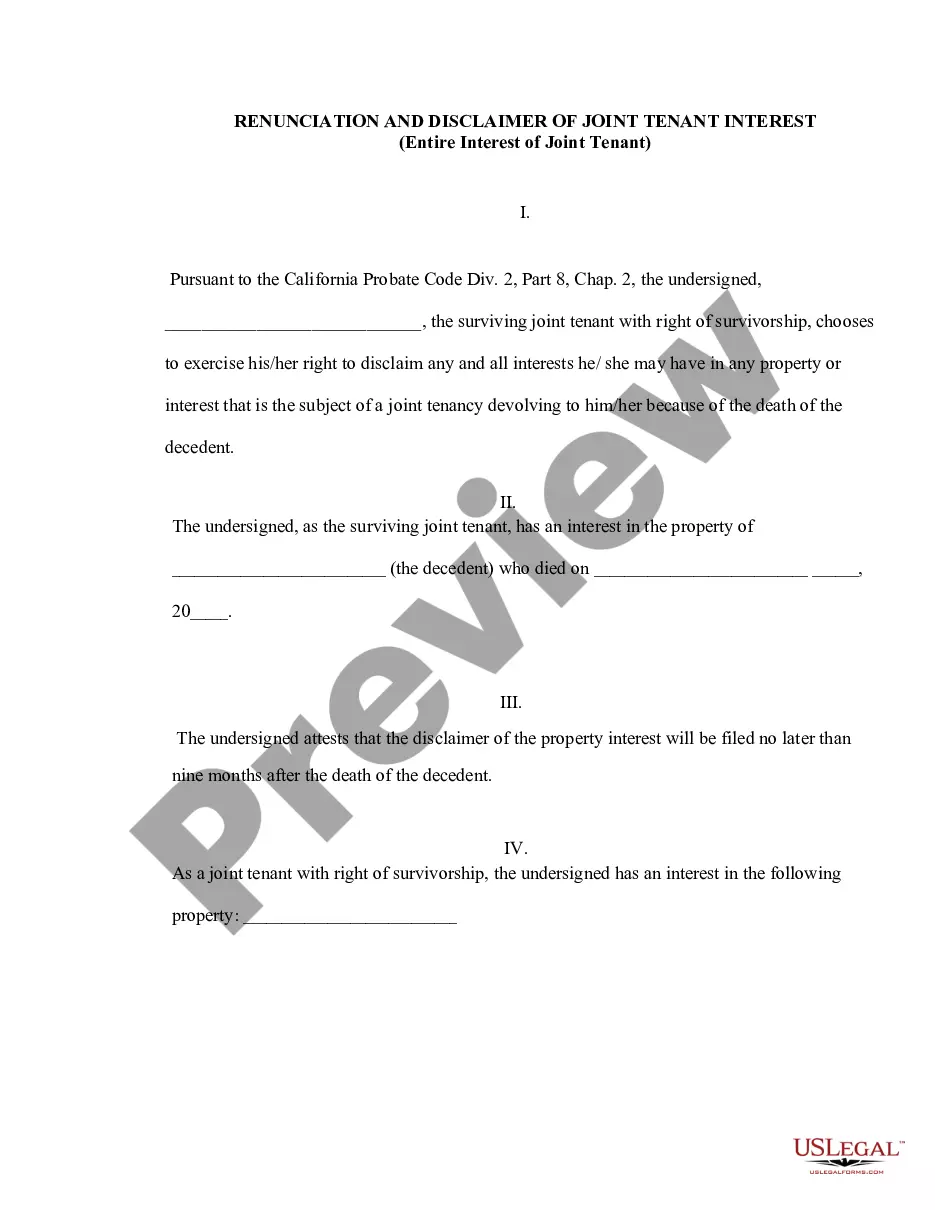

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Dallas Deferred Compensation Investment Account Plan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!