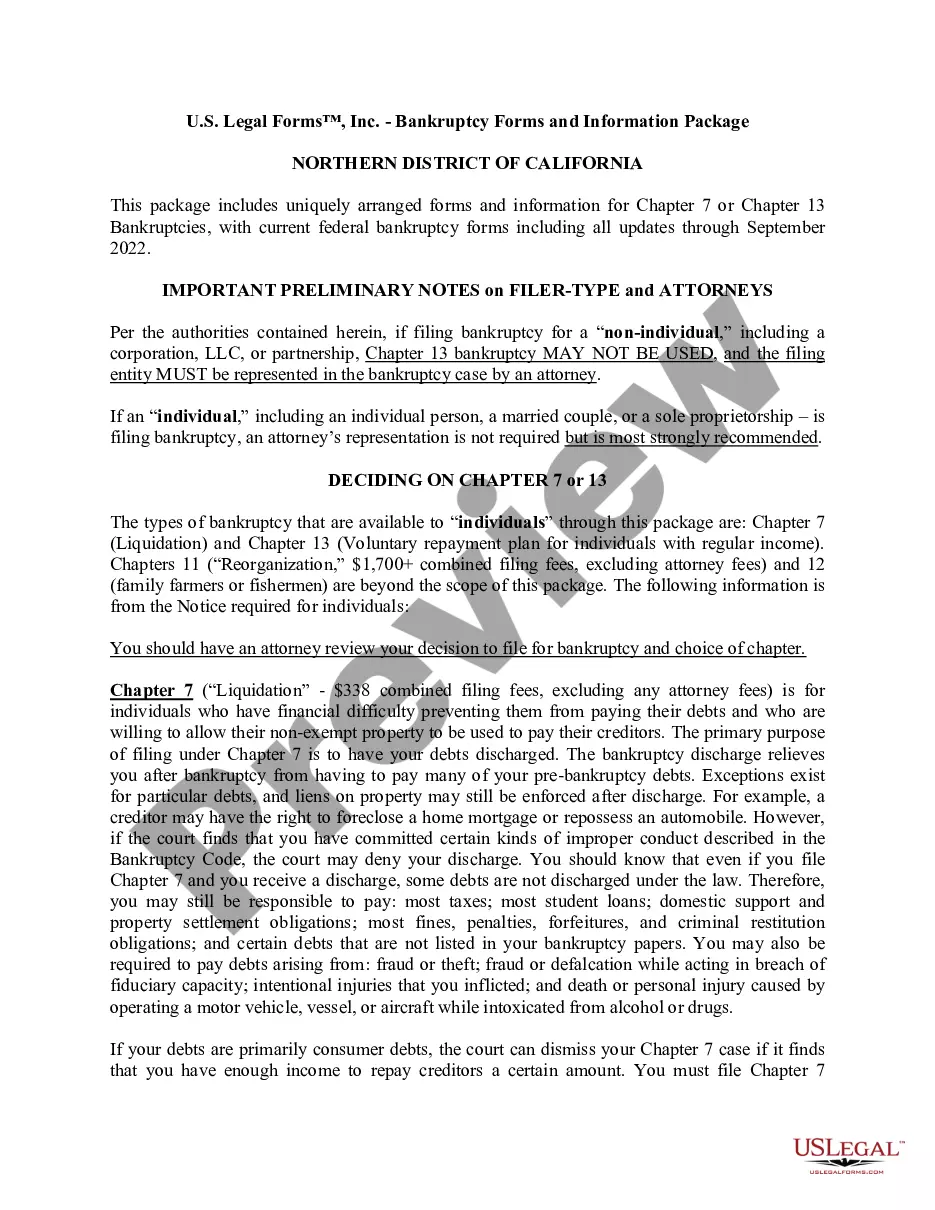

Kings New York Deferred Compensation Investment Account Plan is a retirement savings program designed specifically for Kings County employees in the state of New York. This plan allows eligible employees to defer a portion of their salary on a pre-tax basis, thereby reducing their current taxable income. The Kings New York Deferred Compensation Investment Account Plan offers various investment options, allowing participants to tailor their investment strategy based on their risk tolerance and financial goals. These investment options may include stocks, bonds, mutual funds, and other investment vehicles. One noteworthy feature of this plan is that contributions made by employees are deducted directly from their paycheck, making it an easy and convenient way to save for retirement. Participants can contribute up to a certain percentage of their salary or a specific dollar amount, depending on the plan's guidelines. Employees who contribute to the Kings New York Deferred Compensation Investment Account Plan can also benefit from potential employer matching contributions. These matching contributions, if available, can either be provided as a set percentage of the employee's contribution or based on a specific formula set by the employer. In addition to the standard Kings New York Deferred Compensation Investment Account Plan, there might be other variations or sub-plans available to eligible employees. These variations could include options like a Roth 457 plan, which allows participants to make after-tax contributions that can potentially be withdrawn tax-free during retirement. The Kings New York Deferred Compensation Investment Account Plan is an excellent opportunity for Kings County employees to save for retirement in a tax-efficient manner. By taking advantage of this plan, employees can secure their financial future and ensure a comfortable retirement while benefiting from potential employer matching contributions and a range of investment options. Keywords: Kings New York Deferred Compensation Investment Account Plan, retirement savings program, Kings County employees, New York, pre-tax basis, taxable income, investment options, stocks, bonds, mutual funds, investment vehicles, contributions, paycheck deduction, retirement, employer matching contributions, Roth 457 plan, tax-efficient, financial future.

Kings New York Deferred Compensation Investment Account Plan

Description

How to fill out Kings New York Deferred Compensation Investment Account Plan?

If you need to get a trustworthy legal document provider to get the Kings Deferred Compensation Investment Account Plan, look no further than US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support team make it easy to get and execute various papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Kings Deferred Compensation Investment Account Plan, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Kings Deferred Compensation Investment Account Plan template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less pricey and more affordable. Create your first company, organize your advance care planning, create a real estate contract, or execute the Kings Deferred Compensation Investment Account Plan - all from the comfort of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

First, in order for you not to be taxed, you had to accept a "substantial risk of forfeiture." Basically, the amounts deferred are considered assets of the employer and potentially subject to creditors of the employer. Second, you cannot alter the timing of the payments to you unless the plan allows such changes.

How deferred compensation is taxed. Generally speaking, the tax treatment of deferred compensation is simple: Employees pay taxes on the money when they receive it, not necessarily when they earn it. For example, say your employer provides you $80,000 a year in salary and $20,000 a year in deferred compensation.

Deferred compensation is typically not considered earned, taxable income until you receive the deferred payment in a future tax year. The use of Roth 401(k)s as deferred compensation, for example, is an exception, requiring you to pay taxes on income when it is earned.

A deferred compensation plan allows employees to place income into a retirement account where it sits untaxed until they withdraw the funds. After withdrawal, the funds become subject to taxes, although this is usually much less if payment is deferred until retirement.

You generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach age 72 (70 ½ if you reach 70 ½ before January 1, 2020).

On the company balance sheet, the accounting for deferred compensation appears on the left or assets side as salaries expense, and on the right or liabilities side as salaries payable.

Generally, your deferred compensation (commonly referred to as elective contributions) isn't subject to income tax withholding at the time of deferral, and you don't report it as wages on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors, because it isn't included in box 1 wages

Record the journal entry upon disbursement of cash to the employee. In 2020, the deferred compensation plan matures and the employee is paid. The journal entry is simple. Debit Deferred Compensation Liability for $100,000 (this will zero out the account balance), and credit Cash for $100,000.

Is deferred compensation considered earned income? Deferred compensation is typically not considered earned, taxable income until you receive the deferred payment in a future tax year. The use of Roth 401(k)s as deferred compensation, for example, is an exception, requiring you to pay taxes on income when it is earned.

1. Wait for the W-2 sent by your employer's deferred compensation plan administrator. The W-2 has several boxes. Box 1 lists the compensation paid to you from the deferred compensation plan. Boxes 2, 3 and 4 list the amount of federal, Social Security wages and Social Security taxes withheld from the compensation.