The Maricopa Arizona Deferred Compensation Investment Account Plan, commonly known as the Maricopa AZD CIA Plan, is a retirement savings program designed exclusively for employees of the city of Maricopa, Arizona. This employer-sponsored plan allows participants to defer a portion of their salary into an investment account, which can grow tax-deferred until withdrawal during retirement. The Plan is governed by the Arizona State Retirement System (ASKS), ensuring the highest level of fiduciary standards and investment options. One of the key benefits of the Maricopa AZD CIA Plan is its flexibility, allowing participants to choose their contribution level, investment options, and beneficiary designations. This plan offers a diverse selection of investment options to meet various risk tolerances and investment goals. Participants can allocate their contributions across options such as stocks, bonds, mutual funds, and target-date retirement funds. The Maricopa AZD CIA Plan also provides eligible employees with a generous employer match contribution. This match incentivizes employees to save for their retirement and can significantly boost their account balances over time. The exact match percentage and contribution limits may vary depending on employment terms and agreements with the city. In addition to the standard Maricopa AZD CIA Plan, there might be variations or additional plans available, including 457(b) and Roth 457(b) options. The 457(b) plan allows participants to make pre-tax contributions, reducing their taxable income for both federal and state tax purposes. On the other hand, the Roth 457(b) plan enables after-tax contributions, providing potential tax-free withdrawals during retirement. It's important to note that the Maricopa AZD CIA Plan is a long-term retirement savings vehicle, subject to specific eligibility and withdrawal rules. Participants should consult the Plan's official documentation, their financial advisors, or the ASKS for complete information regarding contributions, vesting, investment options, and distribution requirements. In summary, the Maricopa AZ Deferred Compensation Investment Account Plan is a valuable retirement savings program available to employees of the city of Maricopa, Arizona. It offers flexibility in contribution levels, investment options, and employer match contributions. Potential variations of the plan may include the 457(b) and Roth 457(b) options, providing additional tax advantages. Participants are encouraged to thoroughly understand the Plan's provisions and consult with experts to make the most informed decisions regarding their retirement savings.

Maricopa Arizona Deferred Compensation Investment Account Plan

Description

How to fill out Maricopa Arizona Deferred Compensation Investment Account Plan?

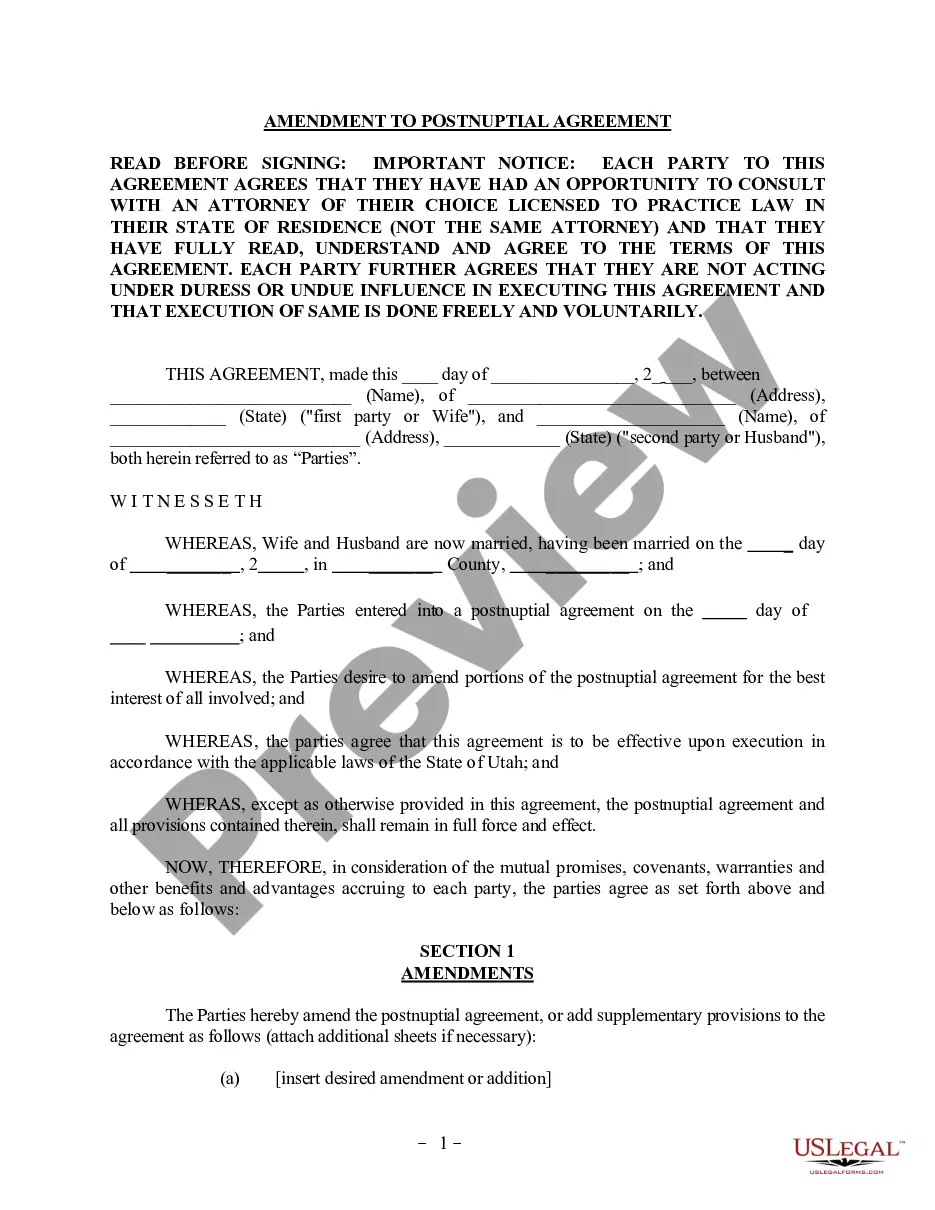

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Maricopa Deferred Compensation Investment Account Plan, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Consequently, if you need the current version of the Maricopa Deferred Compensation Investment Account Plan, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Deferred Compensation Investment Account Plan:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Maricopa Deferred Compensation Investment Account Plan and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!