The San Antonio Texas Deferred Compensation Investment Account Plan is a retirement savings program offered to employees of the City of San Antonio. This plan allows participants to contribute a portion of their pre-tax income into a tax-deferred investment account, helping them secure their financial future during retirement. The San Antonio Texas Deferred Compensation Investment Account Plan offers several investment options to suit the diverse needs and risk tolerance of its participants. These investment options include stocks, bonds, mutual funds, and other investment vehicles. Participants have the flexibility to choose the allocation of their contributions to match their investment preferences. One type of San Antonio Texas Deferred Compensation Investment Account Plan is the Traditional Deferred Compensation Plan. This plan allows participants to defer a portion of their compensation until retirement, reducing their current taxable income and potentially lowering their tax liabilities. The contributions made into this plan grow on a tax-deferred basis until participants withdraw the funds during retirement or termination of employment. Another type of San Antonio Texas Deferred Compensation Investment Account Plan is the Roth Deferred Compensation Plan. This plan allows participants to contribute a portion of their after-tax income into the investment account, potentially offering tax-free withdrawals during retirement. By choosing the Roth option, participants can avoid paying taxes on the earnings and investment gains when they withdraw funds in retirement. Participants in the San Antonio Texas Deferred Compensation Investment Account Plan can benefit from the convenience of payroll deductions, making it easier for them to save for retirement. The plan also provides educational resources and tools to help participants make informed investment decisions and plan for their retirement goals. It's important to note that the San Antonio Texas Deferred Compensation Investment Account Plan is subject to certain rules and regulations set by the Internal Revenue Service (IRS) to maintain its tax-advantaged status. Participants may have restrictions on the amount they can contribute annually, and there may be penalties for early withdrawals before reaching the age of 59 ½. Overall, the San Antonio Texas Deferred Compensation Investment Account Plan offers employees of the City of San Antonio a valuable opportunity to save for retirement with potential tax advantages. By taking advantage of this retirement savings program, participants can build a strong financial foundation for their future while enjoying the peace of mind that comes with secure retirement planning.

San Antonio Texas Deferred Compensation Investment Account Plan

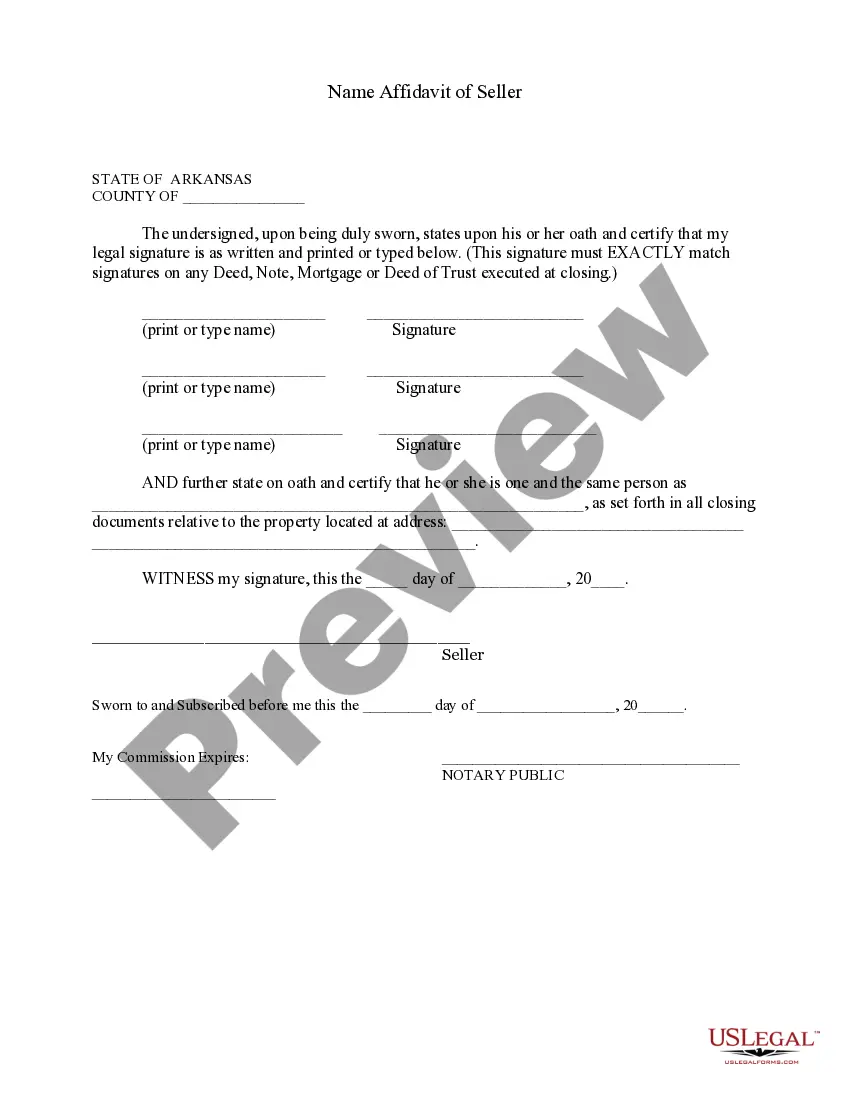

Description

How to fill out San Antonio Texas Deferred Compensation Investment Account Plan?

Draftwing forms, like San Antonio Deferred Compensation Investment Account Plan, to take care of your legal affairs is a challenging and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for various cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the San Antonio Deferred Compensation Investment Account Plan form. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before getting San Antonio Deferred Compensation Investment Account Plan:

- Make sure that your form is specific to your state/county since the regulations for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the San Antonio Deferred Compensation Investment Account Plan isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start using our website and download the document.

- Everything looks great on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is good to go. You can try and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!