Travis Texas Sustained Profit Growth Plan

Description

How to fill out Sustained Profit Growth Plan?

Laws and statutes in every domain differ across the nation.

If you're not an attorney, it's simple to become confused in numerous regulations when it comes to preparing legal documents.

To steer clear of expensive legal fees while formulating the Travis Sustained Profit Growth Plan, you require a certified template applicable to your jurisdiction.

This is the most straightforward and economical method to obtain modern templates for any legal situations. Discover them all in just a few clicks and maintain your paperwork systematically with the US Legal Forms!

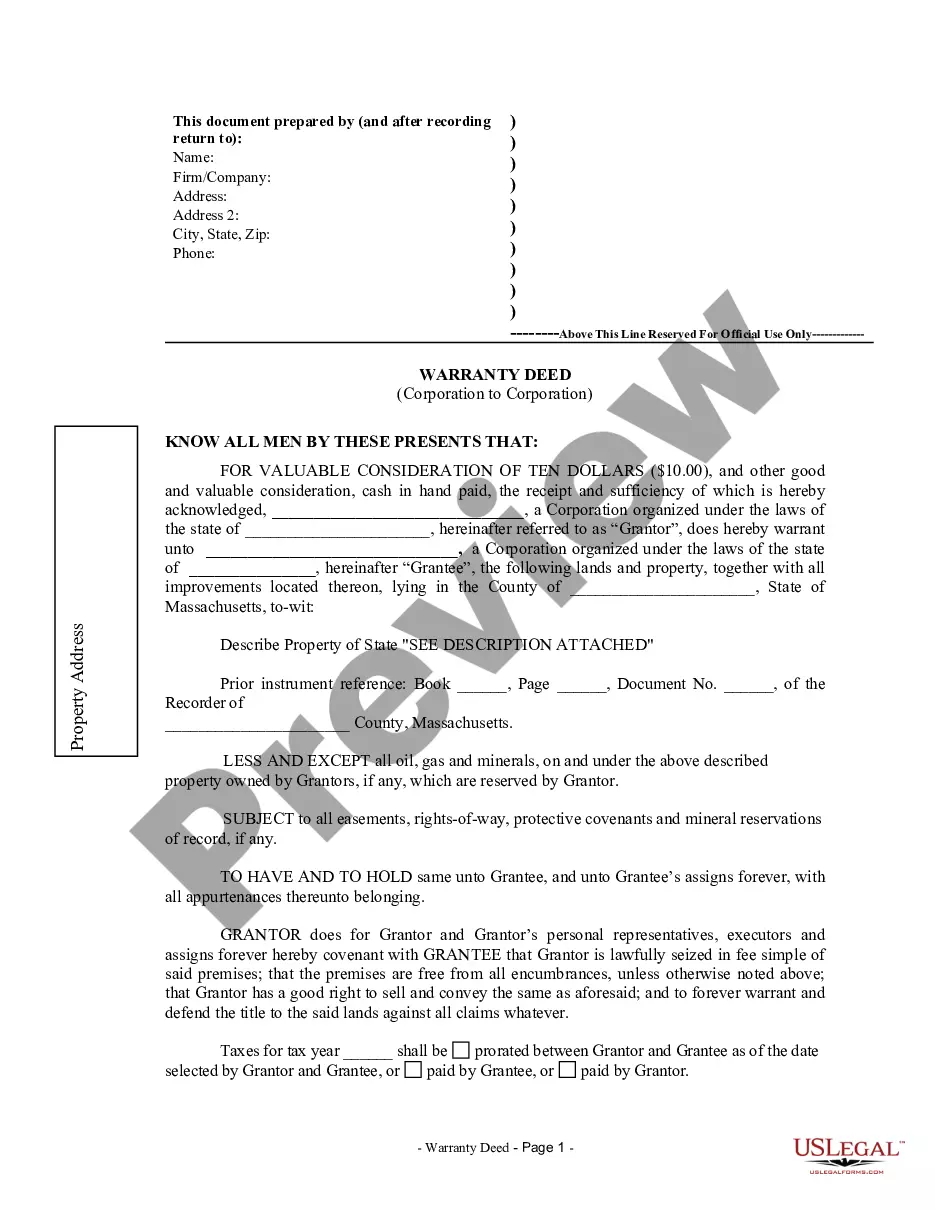

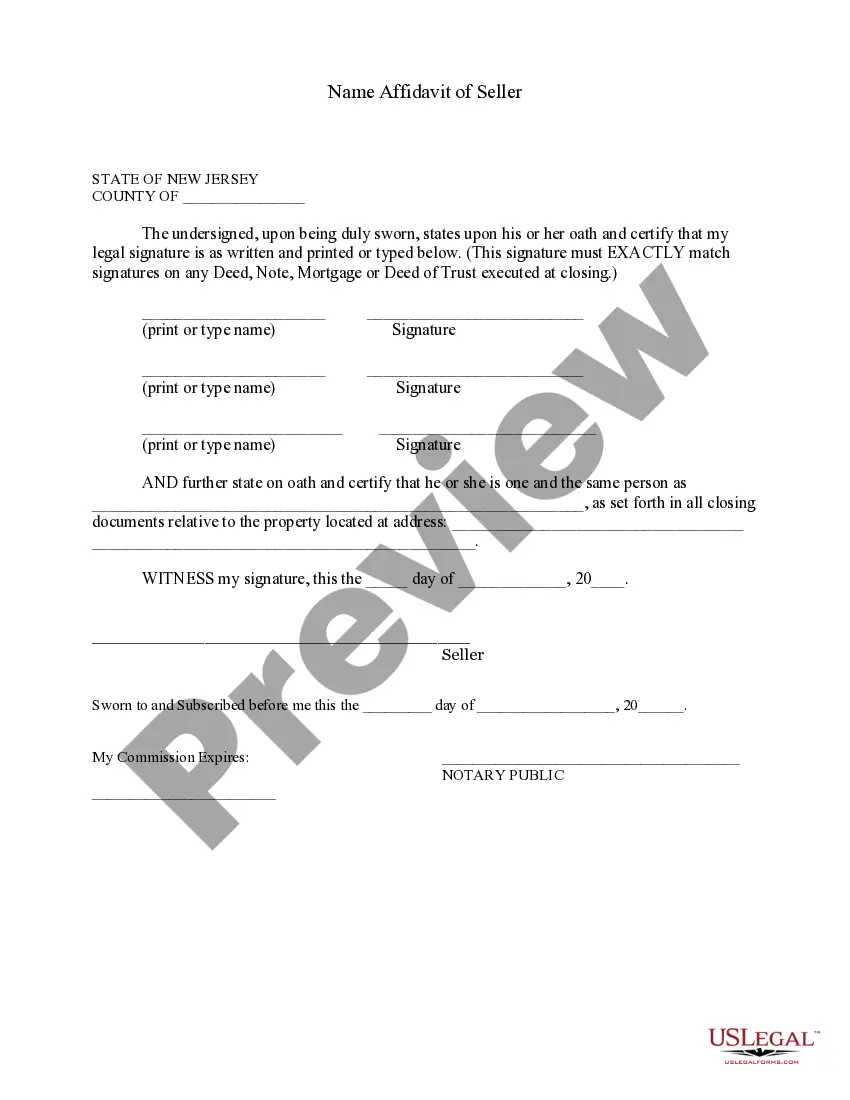

- Examine the page content to ensure you have located the correct sample.

- Use the Preview option or review the form description if provided.

- Look for another document if there are discrepancies with any of your specifications.

- Click the Buy Now button to acquire the template when you find the suitable one.

- Select one of the subscription plans and Log In or create an account.

- Choose your preferred method of payment for your subscription (with a credit card or PayPal).

- Select the format you wish to save the file in and click Download.

- Fill out and sign the template on paper after printing it or handle everything electronically.

Form popularity

FAQ

To calculate actual growth in sales, the analyst would find the percentage increase from one year to the next....Example The Dividend Ratio for 2014 is 40%, so the Retention Ratio is 60%. For that year the ROA would be 7.49%, or (5.25% × . 793 × 1.8). The Sustainable Growth Rate would be 4.49%, or (. 6 × 7.49%).

IGR = (Retained Earnings ÷ Net Income) × (Net Income ÷ Total Assets) IGR = Retention Ratio × ROA.

Sustainable growth rate is basically a link between the nature of the current operations of a firm and its future valuation. Example: To understand the concept of sustainable growth rate better, let's have a look at an example. Let's say that a company pays out 40% of its earnings as dividends each year.

Finally, the sustainable growth rate (SGR) can be calculated by multiplying the retention ratio by the ROE. Sustainable Growth Rate (SGR) = 50% × 25% SGR = 12.5%

5 Effective Strategies for Achieving Sustainable Growth Get More Customers. This is the most well-known sustainable growth strategy to allow your enterprise to expand.Increase Sales From Existing Customers.Sell Something New.Expand to a New Market.Try a New Distribution Channel.

By using the return on equity and dividend payout ratio, the SGR then enables firms to forecast future equity and develop optimal growth rates.

You calculate the sustainable growth rate by taking the company's return on equity times the result of 1 minus the dividend payout ratio. Another way to calculate it is to multiply the retention rate by the return on equity.

Calculate the sustainable growth rate (SGR) The SGR can be calculated using the sustainable growth rate formula: SGR = retention ratio ROE . Hence, Company Alpha's SGR is 50% 20% = 10% . Remember that you can always use our sustainable growth rate calculator to quickly obtain the same result.

The sustainable growth rate is calculated by multiplying the company's earnings retention rate by its return on equity. The formula to calculate the sustainable growth rate is: Where: Retention Rate (Net Income Dividends) / Net Income) .

Which of the following is an advantage of using the sustainable growth rate (SGR)? Firms avoid more equity offering. You just studied 24 terms!