Dallas, Texas is a vibrant city located in the southern region of the United States. Known for its rich history, diverse culture, and booming economy, Dallas offers a range of opportunities for residents and visitors alike. First Florida Bank, Inc., a prominent financial institution operating in Dallas, has proposed an innovative compensation plan called the Dallas Texas Proposed Book Value Phantom Stock Plan. This plan aims to reward and motivate employees by providing them with phantom stocks based on the bank's book value. The plan is designed to create a sense of ownership within the bank and align the interests of its employees with the institution's growth and success. The Dallas Texas Proposed Book Value Phantom Stock Plan includes various appendices that outline the specific details and terms of the program. These appendices provide comprehensive information regarding the eligibility criteria, vesting schedule, valuation method, and distribution process of the phantom stocks. The plan also includes different types of phantom stock options based on tenure and performance levels. These options include: 1. Tiered Phantom Stock: This type of phantom stock is awarded based on an employee's tenure with the bank. As employees reach specific milestones, they become eligible for an increased number of phantom stocks, providing a valuable long-term incentive. 2. Performance-based Phantom Stock: This type of phantom stock is awarded based on an employee's individual performance and contribution to the bank. It encourages high-performance individuals to strive for excellence and directly links their efforts to financial benefits. 3. Departmental Phantom Stock: This type of phantom stock is awarded based on the overall performance of the department in which an employee works. It encourages collaboration and teamwork within the bank, as employees collectively work towards achieving departmental goals. The appendices of the Dallas Texas Proposed Book Value Phantom Stock Plan provide detailed explanations of each type of phantom stock and the criteria for their allocation. These appendices also outline the process for annual re-evaluation and adjustment of the plan to ensure its effectiveness and fairness. By implementing the Dallas Texas Proposed Book Value Phantom Stock Plan, First Florida Bank, Inc. aims to attract, retain, and motivate talented individuals within its workforce. The plan's comprehensive appendices and different types of phantom stock options enable the bank to tailor incentives to individual and departmental performance, creating a win-win scenario for both the institution and its employees.

Dallas Texas Proposed book value phantom stock plan with appendices for First Florida Bank, Inc.

Description

How to fill out Dallas Texas Proposed Book Value Phantom Stock Plan With Appendices For First Florida Bank, Inc.?

Creating forms, like Dallas Proposed book value phantom stock plan with appendices for First Florida Bank, Inc., to take care of your legal affairs is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for a variety of cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Dallas Proposed book value phantom stock plan with appendices for First Florida Bank, Inc. template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before downloading Dallas Proposed book value phantom stock plan with appendices for First Florida Bank, Inc.:

- Make sure that your form is specific to your state/county since the regulations for writing legal paperwork may differ from one state another.

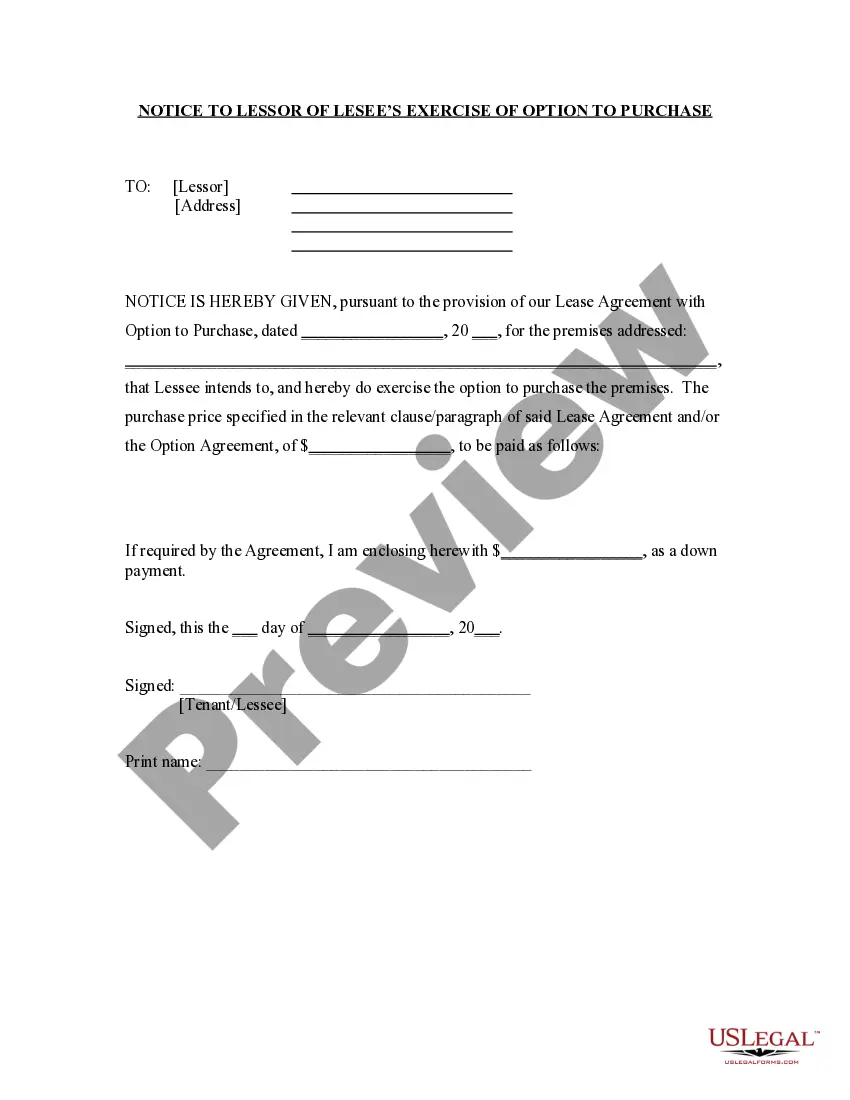

- Discover more information about the form by previewing it or reading a brief description. If the Dallas Proposed book value phantom stock plan with appendices for First Florida Bank, Inc. isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin utilizing our website and download the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!