Title: Santa Clara California Proposed Book Value Phantom Stock Plan with Appendices for First Florida Bank, Inc. Keywords: Santa Clara California, Proposed Book Value Phantom Stock Plan, Appendices, First Florida Bank, Inc. Introduction: The Santa Clara California Proposed Book Value Phantom Stock Plan is a comprehensive and innovative proposal designed specifically for First Florida Bank, Inc. It aims to create a mechanism to reward and motivate employees through a unique stock ownership plan. This detailed description will provide insights into the plan structure and its various appendices, highlighting its benefits for the bank and its employees. 1. Plan Overview: The Santa Clara California Proposed Book Value Phantom Stock Plan harmonizes the concept of stock ownership with the bank's overall growth strategy. By creating fictional phantom stocks, this plan replicates the economic benefits of traditional stock options, positively impacting employee engagement and productivity. 2. Key Elements of the Plan: a) Stock Allocation: This section outlines how phantom stocks will be granted to eligible employees, considering factors such as tenure, job performance, and organizational impact. b) Vesting Schedule: The proposed plan includes a vesting schedule indicating how the phantom stocks will be distributed over a specific time period, ensuring alignment with long-term employee commitment. c) Calculation of Book Value: This section explains the methodology for calculating the book value of First Florida Bank, Inc. applicable for determining the value of phantom stocks. d) Performance Metrics: The plan includes predefined performance metrics to assess employee contributions and tie them to the potential value growth of the phantom stocks. e) Dividend and Voting Rights: The plan addresses the distribution of dividends and the employee's rights (if any) associated with voting. 3. Appendices: a) Sample Phantom Stock Agreement: This appendix provides a template agreement describing the terms and conditions of the phantom stock allocation, including vesting periods, restriction, and potential liquidity events. b) Accounting Treatment Guidelines: This appendix explains the recommended financial reporting and accounting treatment of the phantom stock program. c) Tax Implications: Detailed information on the potential tax implications for both employees and the bank is outlined in this appendix, ensuring compliance with local regulations and guidance. d) Communication Strategy: To ensure effective implementation, a communication strategy appendix outlines how the bank will inform and educate employees about the proposed plan, generating a sense of enthusiasm and understanding. e) Employee Education: This appendix suggests educational resources, such as training sessions or workshops, to help employees gain a better understanding of phantom stocks, their benefits, and the long-term impact on their finances. f) Legal and Regulatory Compliance: This appendix emphasizes the importance of adhering to all relevant legal and regulatory requirements to ensure the plan is compliant and legally defensible. Conclusion: The Santa Clara California Proposed Book Value Phantom Stock Plan with Appendices offers a structured and well-defined framework for employee stock ownership within First Florida Bank, Inc. Implementing this plan can potentially foster greater employee loyalty, improve performance, and drive long-term value creation. Its various appendices provide detailed guidance on the plan's execution and compliance requirements, ensuring a smooth and transparent implementation process.

Santa Clara California Proposed book value phantom stock plan with appendices for First Florida Bank, Inc.

Description

How to fill out Santa Clara California Proposed Book Value Phantom Stock Plan With Appendices For First Florida Bank, Inc.?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Santa Clara Proposed book value phantom stock plan with appendices for First Florida Bank, Inc., you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Santa Clara Proposed book value phantom stock plan with appendices for First Florida Bank, Inc. from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Santa Clara Proposed book value phantom stock plan with appendices for First Florida Bank, Inc.:

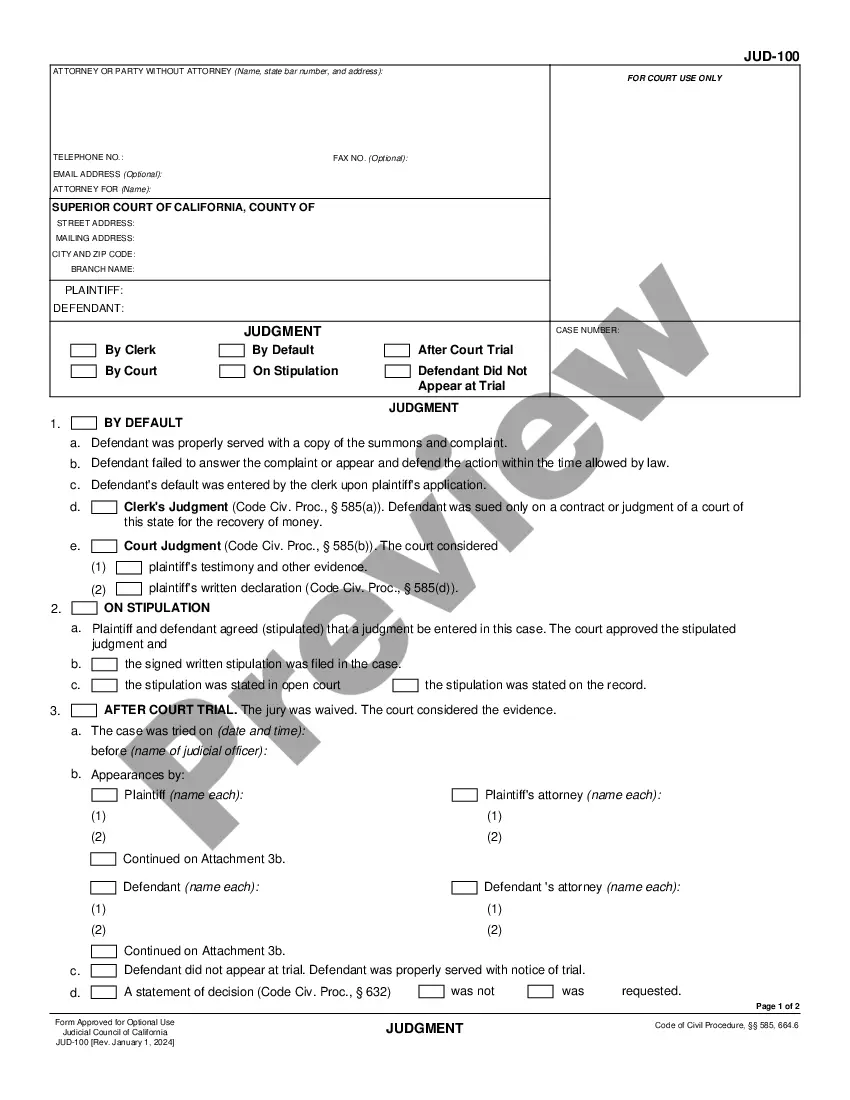

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!