The Wayne, Michigan Proposed Book Value Phantom Stock Plan with Appendices for First Florida Bank, Inc. is a comprehensive compensation plan designed to incentivize and reward employees of the bank. This plan aims to provide a financial tool that mirrors the performance of the bank's stock without actually granting ownership rights to the employees. The Wayne, Michigan Proposed Book Value Phantom Stock Plan is structured to align the interests of employees with the growth and success of First Florida Bank, Inc. The plan allows participants to benefit from the increase in the bank's book value, encouraging them to contribute their best efforts towards its growth and financial performance. Under this proposed plan, employees are provided with hypothetical phantom stock units that are allocated based on certain criteria such as years of service, position, and performance. These phantom stock units do not represent actual shares but provide economic rights equivalent to the increase in the bank's book value over a specified period. The Wayne, Michigan Proposed Book Value Phantom Stock Plan offers various focal points in its appendices to ensure clarity and comprehensiveness. These appendices include: 1. Plan Structure and Eligibility: This section outlines the structure of the phantom stock plan and defines the eligibility criteria for participation. It specifies the categories of employees who can take part in the plan and the conditions for eligibility. 2. Allocation Methodology: The appendices provide a detailed explanation of how the phantom stock units are allocated to employees. It describes the formula used to determine the allocation and the factors considered, such as tenure, position, and performance. 3. Vesting and Distribution: This section outlines the vesting schedule for the phantom stock units and how they will be distributed to employees. It may include provisions for staggered vesting to incentivize long-term commitment and retention. 4. Valuation and Payout: The appendices discuss the methodology used to determine the value of the phantom stock units. It explains how the book value of First Florida Bank, Inc. is calculated and how the payout will be determined based on the increase in book value over the specified period. 5. Tax Implications: This section provides a brief overview of the potential tax implications for employees participating in the phantom stock plan. It may offer general advice or refer to relevant tax authorities for detailed guidance. In summary, the Wayne, Michigan Proposed Book Value Phantom Stock Plan with Appendices for First Florida Bank, Inc. is a comprehensive compensation plan designed to motivate and reward employees based on the bank's book value. It offers phantom stock units to employees, providing them with economic rights without actual ownership. The appendices provide additional details on eligibility, allocation, vesting, distribution, valuation, payout, and tax implications.

Wayne Michigan Proposed book value phantom stock plan with appendices for First Florida Bank, Inc.

Description

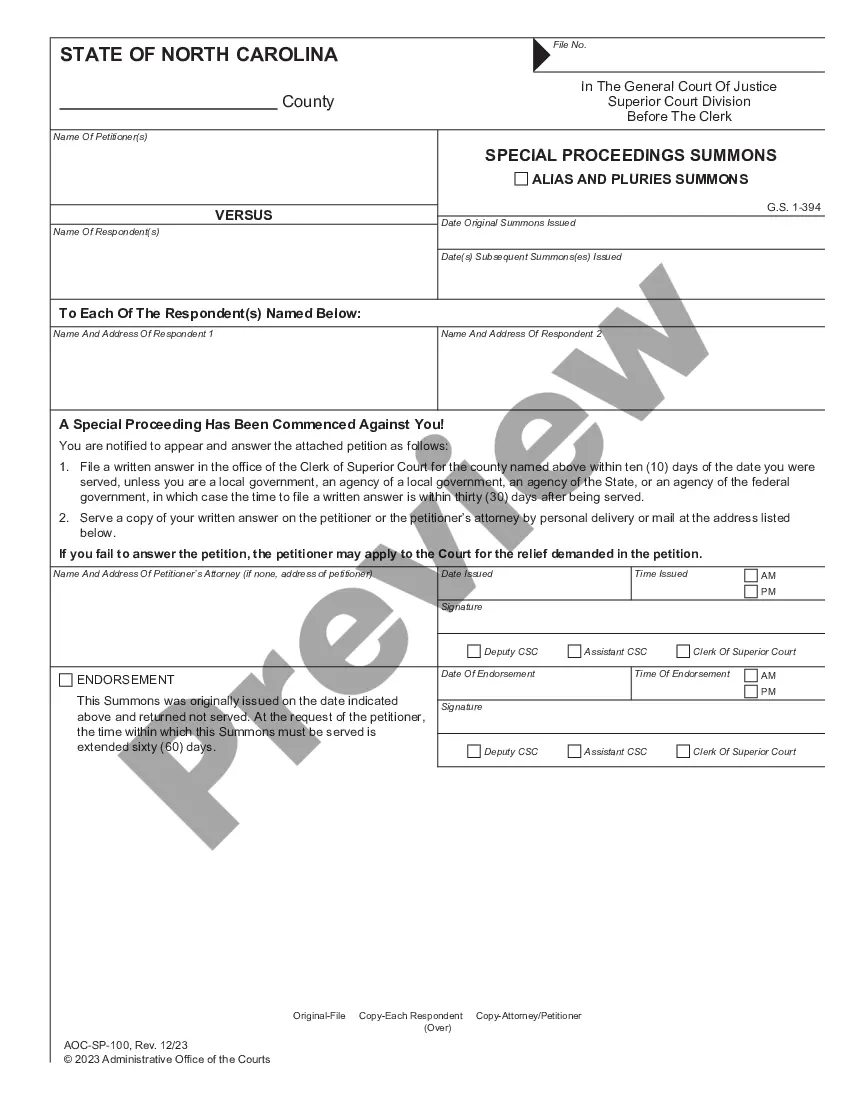

How to fill out Wayne Michigan Proposed Book Value Phantom Stock Plan With Appendices For First Florida Bank, Inc.?

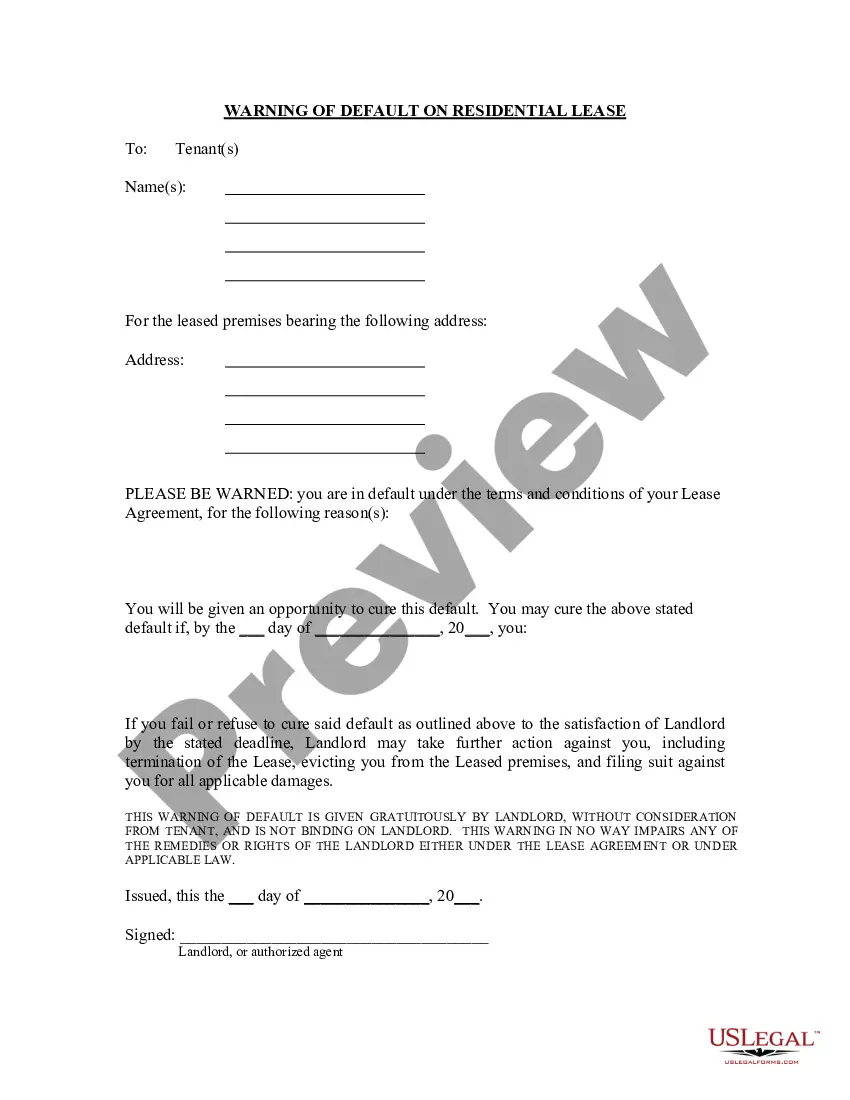

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Wayne Proposed book value phantom stock plan with appendices for First Florida Bank, Inc., you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Wayne Proposed book value phantom stock plan with appendices for First Florida Bank, Inc. from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Wayne Proposed book value phantom stock plan with appendices for First Florida Bank, Inc.:

- Take a look at the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

The answer involves two variables: (a) the presumed value of the company, and (b) the number of shares to be used in the plan. Once these two answers are known, the phantom share price is calculated as the former (the value) divided by the latter (the number of shares).

A phantom stock plan is a deferred compensation plan that awards the employee a unit measured by the value of a share of a company's common stock, or, in the case of a limited liability company, by the value of an LLC unit. However, unlike actual stock, the award does not confer equity ownership in the company.

The answer involves two variables: (a) the presumed value of the company, and (b) the number of shares to be used in the plan. Once these two answers are known, the phantom share price is calculated as the former (the value) divided by the latter (the number of shares).

Phantom options are designed to mirror traditional share options but with the gain to the employee being paid in cash. The intention behind a phantom option is similar to a share option in that the option holder is motivated to grow the value of the underlying shares that are subject to the phantom option.

A phantom stock plan is a deferred compensation plan that awards the employee a unit measured by the value of a share of a company's common stock, or, in the case of a limited liability company, by the value of an LLC unit. However, unlike actual stock, the award does not confer equity ownership in the company.

Phantom stock is an employee benefit where selected employees receive benefits of stock ownership without the company giving them actual stock. It is worth money just like real stock, and its value rises and falls with the company's actual stock (or what the company is valued at, if it's not a publicly traded company).

Phantom stock plans can be a valuable method for companies that seek to tie incentive compensation to increases or decreases in company value without awarding actual shares of company stock.

The phantom stock becomes a liability that the company must eventually convert to either cash or company stock. In privately held businesses, company stock is rarely an option. employees like these plans as any phantom stock they receive is not taxable until converted into cash by the company.

Phantom stock, also known as synthetic equity, has no inherent requirements or restrictions regarding its use, allowing the organization to use it however it chooses.

Phantom stock is not a good idea if the company is planning on issuing them to most or all employees, especially if the shares will be paid out when the employee leaves the company or retires. In that case, phantom shares may be ruled illegal because of the Employee Retirement Income and Security Act (ERISA).