The Clark Nevada Book Value Phantom Stock Plan is a compensation program offered by First Florida Banks, Inc. that allows employees to participate in the company's growth and success. This plan is designed to provide employees with potential financial benefits while also aligning their interests with the long-term goals of the organization. With the Clark Nevada Book Value Phantom Stock Plan, employees are granted virtual shares of company stock, known as phantom stock units. These units track the book value of the bank, representing a hypothetical ownership interest. Unlike traditional stock options, participants do not actually own shares of stock; instead, they receive cash value based on the increase in the bank's book value over time. This plan serves as an incentive for employees to contribute to the bank's growth and profitability. By tying compensation to the company's overall financial performance, it promotes a sense of ownership and encourages employees to make decisions in the best interest of the organization and its shareholders. There are different types of Clark Nevada Book Value Phantom Stock Plans available to employees based on their level of participation or eligibility: 1. Standard Employee Plan: This is the basic version of the plan and is open to all eligible employees. It allows employees to earn phantom stock units based on the bank's book value growth, which can be redeemed for cash or other benefits upon certain triggering events like retirement, resignation, or at predetermined dates. 2. Executive Deferred Compensation Plan: This plan is designed specifically for key executives within First Florida Banks, Inc. It offers additional benefits and options for executives to further enhance their compensation. The plan typically includes features like accelerated vesting schedules, more generous redemption options, and the ability to defer taxation on the phantom stock units until a later date. 3. Management Incentive Plan: This plan is tailored for high-performing managers who hold critical positions within the organization. It offers additional incentives and rewards tied to specific performance metrics, such as departmental or individual goals. The management incentive plan may provide increased allocations of phantom stock units or accelerated payout schedules for achieving or surpassing performance targets. It's worth noting that each Clark Nevada Book Value Phantom Stock Plan may have specific eligibility criteria, vesting schedules, and redemption rules. Participants should carefully review the terms and conditions of their specific plan to fully understand the benefits, rights, and obligations associated with their participation. In conclusion, the Clark Nevada Book Value Phantom Stock Plan of First Florida Banks, Inc. is a robust compensation program that enables employees to share in the bank's success. By offering phantom stock units tied to the company's book value, employees are motivated to contribute to the bank's growth and align their interests with shareholders. With different plans available for employees at various levels, the program offers flexibility and tailored benefits based on individual or managerial roles.

Clark Nevada Book Value Phantom Stock Plan of First Florida Banks, Inc.

Description

How to fill out Clark Nevada Book Value Phantom Stock Plan Of First Florida Banks, Inc.?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

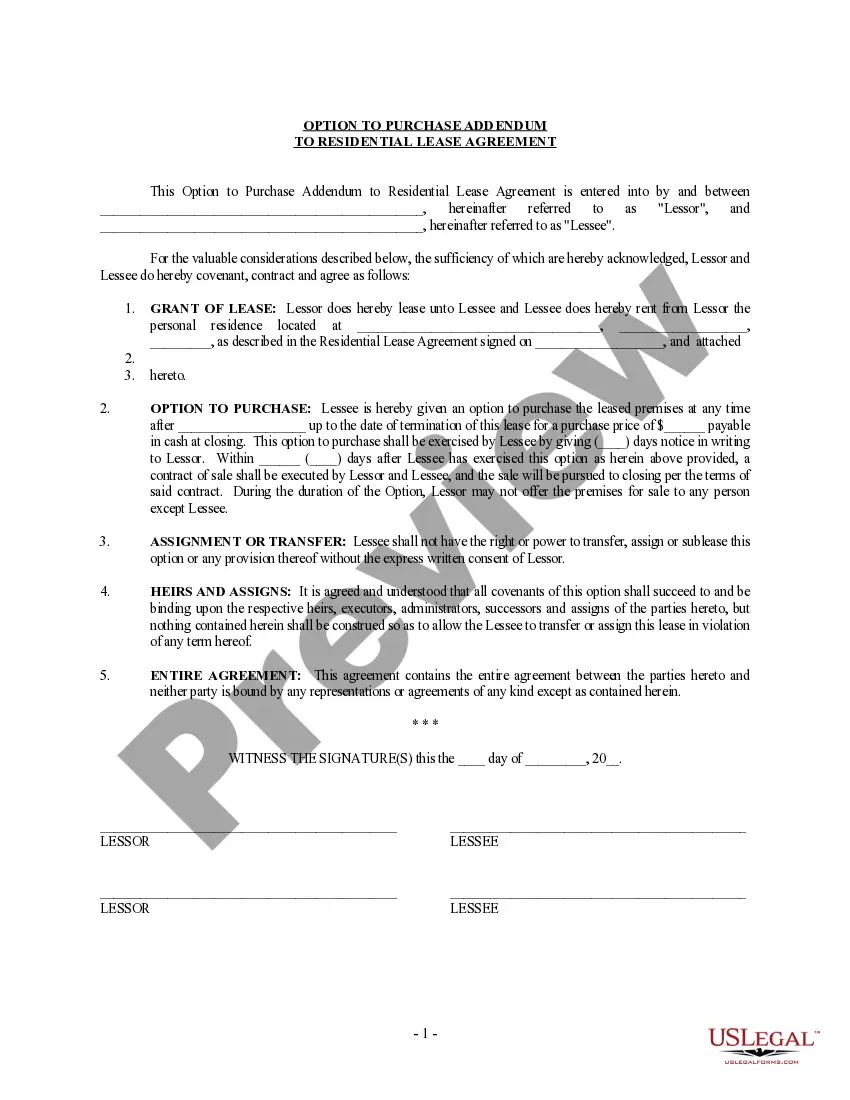

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business objective utilized in your region, including the Clark Book Value Phantom Stock Plan of First Florida Banks, Inc..

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Clark Book Value Phantom Stock Plan of First Florida Banks, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Clark Book Value Phantom Stock Plan of First Florida Banks, Inc.:

- Ensure you have opened the right page with your localised form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Clark Book Value Phantom Stock Plan of First Florida Banks, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!