Cuyahoga Ohio Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees is a specialized compensation plan designed to provide financial security and incentivize key employees of the bank. This agreement aims to offer an attractive benefit package to retain and reward valuable employees who play a crucial role in the success and growth of the institution. Under the Cuyahoga Ohio Deferred Compensation Agreement, eligible key employees have the opportunity to defer a portion of their salary, bonuses, or other forms of compensation. This deferred amount is then invested over time, allowing it to grow on a tax-deferred basis until distribution at retirement, termination, or another agreed-upon event. By participating in this agreement, key employees can accumulate funds for future financial needs, such as retirement or education expenses. The plan offers flexibility in investment options, enabling participants to choose from a variety of vehicles, including stocks, bonds, mutual funds, or other investment instruments. The personalized investment strategy allows employees to align their investment choices with their risk tolerance and long-term financial goals. In addition to the tax advantages and investment flexibility, the Cuyahoga Ohio Deferred Compensation Agreement may also include additional benefits, such as a company matching contribution or profit-sharing component. These features further incentivize key employees to participate and contribute to the bank's overall success. It's important to note that there may be different variations of the Cuyahoga Ohio Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees, tailored to the specific needs and preferences of different employee groups. These variations could include different contribution rates, vesting schedules, investment options, and payout options, among others. By customizing the agreement to meet the unique requirements of various key employee segments, the bank strives to ensure maximum participation and satisfaction. In summary, the Cuyahoga Ohio Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees is a comprehensive and flexible compensation plan designed to reward and retain key employees. It offers a range of benefits, including tax-deferred growth, investment customization, possible matching contributions, and various payout options. By implementing this agreement, the bank demonstrates its commitment to attracting and retaining talented individuals who contribute significantly to its ongoing success.

Cuyahoga Ohio Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees

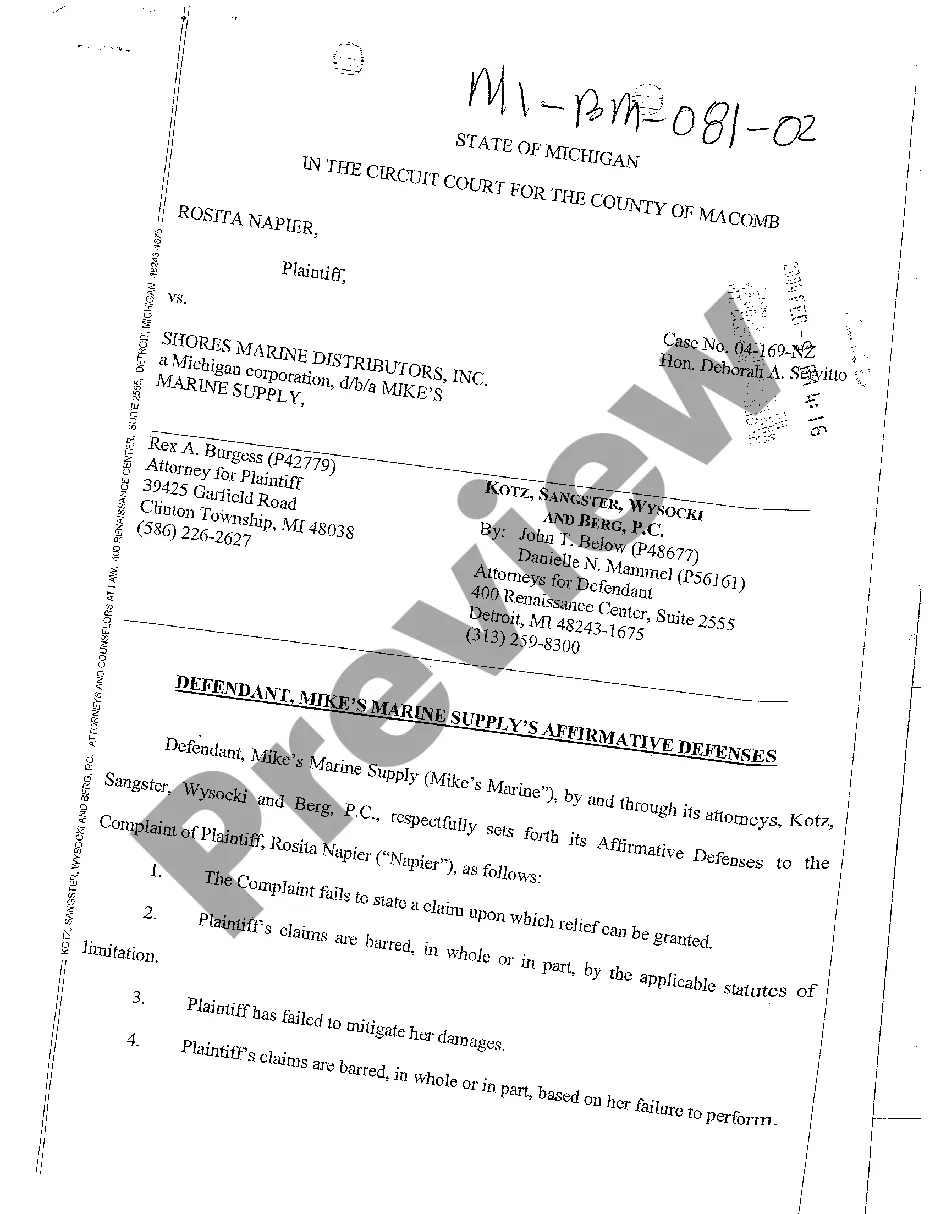

Description

How to fill out Cuyahoga Ohio Deferred Compensation Agreement By First Florida Bank, Inc. For Key Employees?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life situation, finding a Cuyahoga Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Cuyahoga Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Cuyahoga Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cuyahoga Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

You can leave the money in the account, withdraw in full or withdraw it in payments. If you are not a spouse, you can withdraw the funds. For more specific information about withdrawal options, contact the DRS record keeper.

Examples of deferred compensation include retirement, pension, deferred savings and stock-option plans offered by employers. In many cases, you do not pay any taxes on the deferred income until you receive it as payment. Deferred compensation plans come in two types qualified and non-qualified.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

The Florida Deferred Compensation Plan is a supplemental retirement plan for employees of the State of Florida, including OPS employees and employees of the State University System, State Board of Administration, Division of Rehab and Liquidation, Special Districts, and Water Management Districts established under

Deferred compensation plans can be a great savings vehicle, especially for employees who are maximizing their 401(k) contributions and have additional savings for investment, but they also come with lots of strings attached.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

You can continue to invest with the Program when you leave your public employer and throughout retirement. Under this option, you can withdraw money without penalty, regardless of your age (all withdrawals are subject to ordinary income taxes).

If you are eligible to withdraw, you may: Leave the value of your account in the Program until you reach age 70 ½. At 70 ½, you will be required to withdraw a minimum distribution each year.

Typically, Fidelity says, you and your employer agree on when withdrawals can start. It may be five years, 10 years or not until you reach retirement. If you retire early, get fired or quit for another job before the due date, your employ gets to claw back some of that compensation as a penalty.