San Antonio Texas Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees is a specialized financial arrangement offered to key employees of the bank, based in San Antonio, Texas. This agreement allows eligible key employees to defer a portion of their compensation for a future date, typically during retirement, while also taking advantage of potential tax benefits and earnings growth. The San Antonio Texas Deferred Compensation Agreement is a structured plan designed to help key employees enhance their overall compensation package and provide them with financial security in the long term. By deferring a portion of their income, employees can delay receipt of taxable income, potentially reducing their current tax liability. This arrangement also allows for investment opportunities to grow the deferred amounts, providing potentially higher returns compared to traditional savings or retirement plans. First Florida Bank, Inc. offers different variations of the San Antonio Texas Deferred Compensation Agreement to cater to the unique needs of their key employees. These variations may include: 1. Defined Contribution Plan: This type of deferred compensation agreement offers employees the opportunity to contribute a specific percentage or dollar amount of their salary into a tax-advantaged account. First Florida Bank, Inc. may also contribute to the plan based on employee tenure or performance. 2. Supplemental Executive Retirement Plan (SERP): The SERP is a specialized deferred compensation plan tailored for executives and high-level key employees. It allows them to accumulate additional retirement benefits beyond what is provided by the standard retirement plans. The SERP typically involves a promise from the employer to pay specific financial benefits at retirement, based on a predetermined formula. 3. Stock Options or Restricted Stock Units (RSS): In some cases, the deferred compensation agreement may offer key employees the opportunity to receive company stock options or RSS as part of their compensation package. These equity-based incentives align the employees' interests with the company's performance and long-term growth, fostering a sense of ownership and commitment. It is important for key employees in San Antonio, Texas, to thoroughly review the terms and conditions of the Deferred Compensation Agreement to understand how it may affect their overall financial situation, retirement plans, and tax obligations. Consulting with a financial advisor or tax professional can provide additional clarity and guidance regarding these agreements and their implications.

San Antonio Texas Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees

Description

How to fill out San Antonio Texas Deferred Compensation Agreement By First Florida Bank, Inc. For Key Employees?

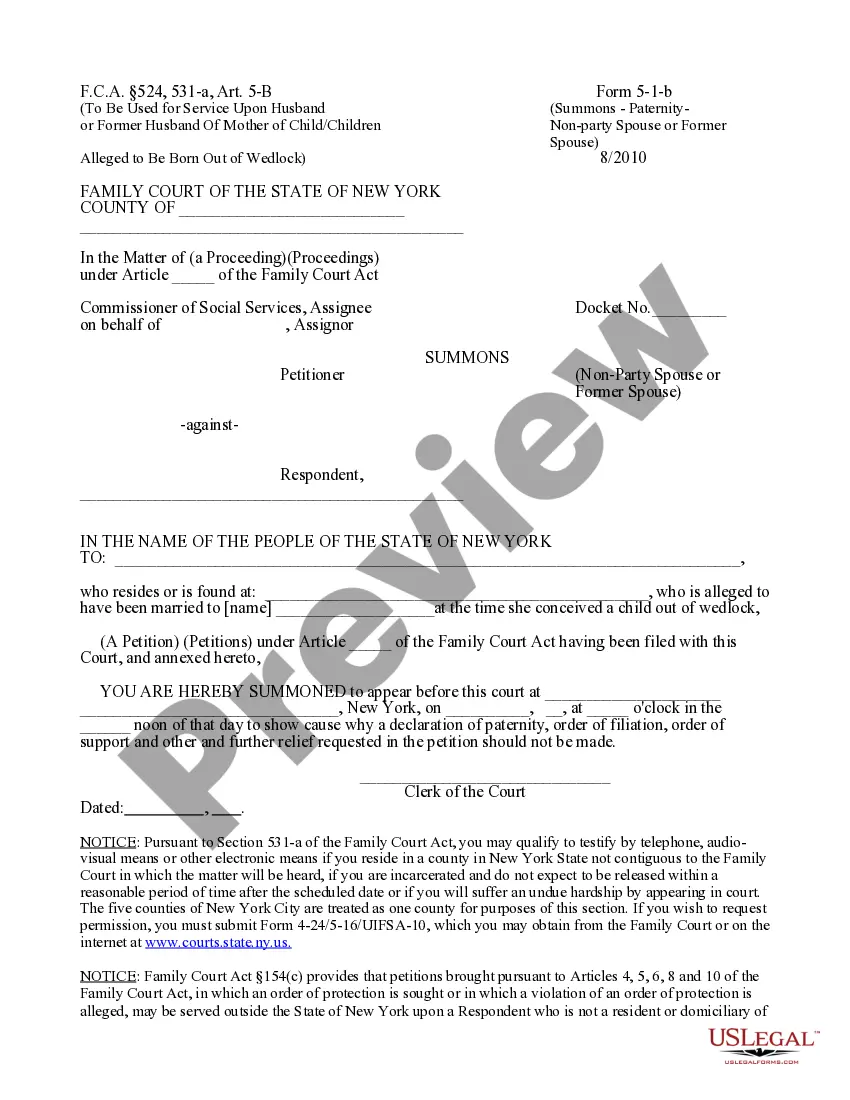

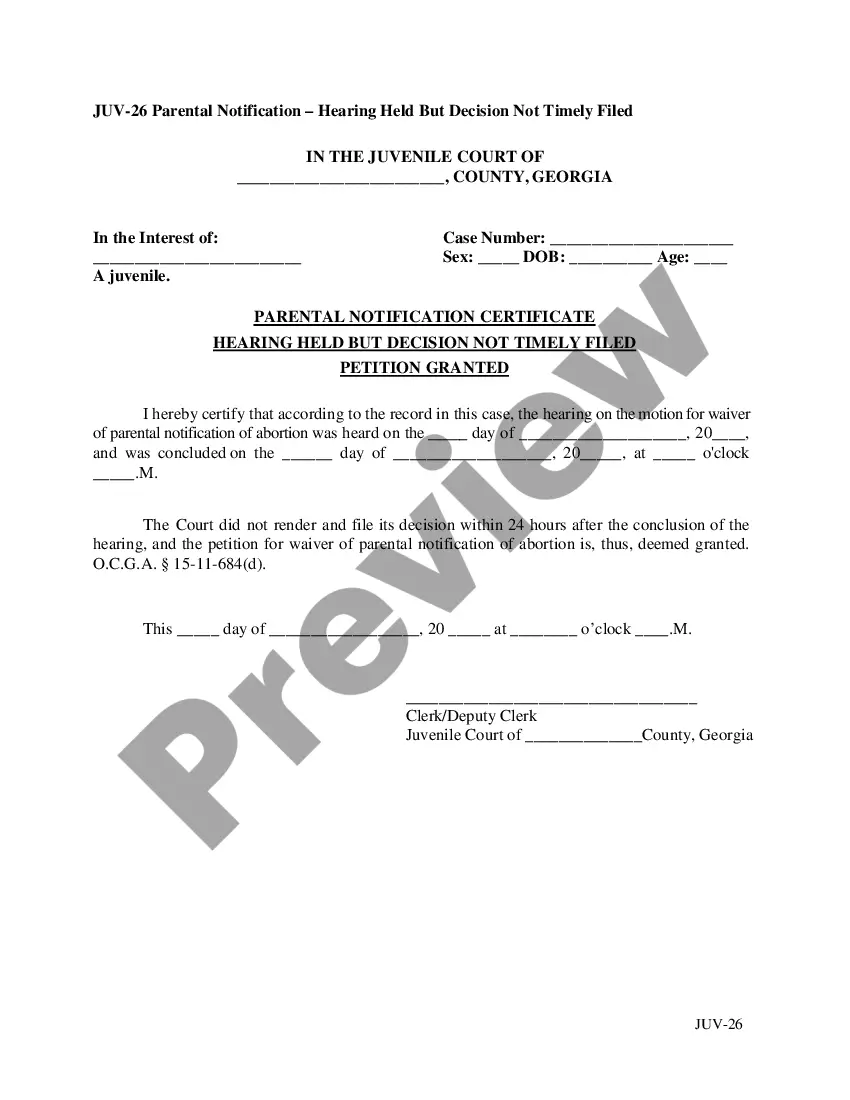

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including San Antonio Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any tasks associated with document execution straightforward.

Here's how you can purchase and download San Antonio Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees.

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the validity of some documents.

- Examine the related document templates or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and buy San Antonio Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed San Antonio Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional completely. If you need to deal with an exceptionally challenging case, we recommend using the services of a lawyer to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!

Form popularity

FAQ

Examples of deferred compensation include retirement, pension, deferred savings and stock-option plans offered by employers. In many cases, you do not pay any taxes on the deferred income until you receive it as payment. Deferred compensation plans come in two types qualified and non-qualified.

You can take the distribution in a lump sum or regular installments, paying tax when you receive the income. You can also arrange to withdraw some of it when you anticipate a need, such as paying for your kids' college tuition. While the IRS has few restrictions, your employer will probably have their own rules.

The Florida Deferred Compensation Plan is a supplemental retirement plan for employees of the State of Florida, including OPS employees and employees of the State University System, State Board of Administration, Division of Rehab and Liquidation, Special Districts, and Water Management Districts established under

Governmental 457 plans are subject to a separate contribution limit that is the same as qualified plans, even though these limits are not cumulative. However, if you roll over money from a 457(b) plan to a 401(k) plan, you can't take out money penalty-free before age 59 1/2 anymore.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

When it comes to withdrawals, 457(b) plans have a big advantage over 403(b)s and 401(k)s. They do not come with early withdrawal penalties if you leave your job. So if you need to tap into your 457(b) contributions before you reach age 59.5 and you've left the job that provided you with the 457(b), don't fret.

You can transfer or roll over assets tax-free from your 457 plan to a traditional IRA as often as you want after you leave your job. However, your plan may require you to move your balance to your new employer's 457 if you change jobs.

The 457 plan is a retirement savings plan and you generally cannot withdraw money while you are still employed. When you leave employment, you may withdraw funds; leave them in place; transfer them to a 457, 403(b) or 401(k) of a new employer; or roll them into an Individual Retirement Account (IRA).

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.

Key Takeaways. If you are a government or non-profit employee, you may have a 457(b). In this case, your savings in this plan can be rolled over, like assets in a 401(k). There is no penalty for early withdrawals but you must take a minimum distribution from age 72.